The New Normal for the Way Ahead

As the 2022 budget season progresses, CBRE’s Hotels Advisory professionals surveyed 130 industry leaders around the U.S. regarding concerns facing the hotel industry.

As hotel operators and owners prepare for 2022 and beyond, numerous questions come to mind. How will the lodging sector perform during the 4th quarter of 2021? Will there continue to be operational, financial and investment challenges during 2022? What will drive those challenges and how will the lodging industry face and perform against those challenges?

As many in the industry have witnessed, hotels remain resilient throughout economic cycles. Savvy managers and owners are adept in meeting operational and financial challenges. CBRE is committed to providing thoughtful insight along with a wealth of data, research and consulting services to owners and operators in an effort to afford the industry a clearer picture into the future.

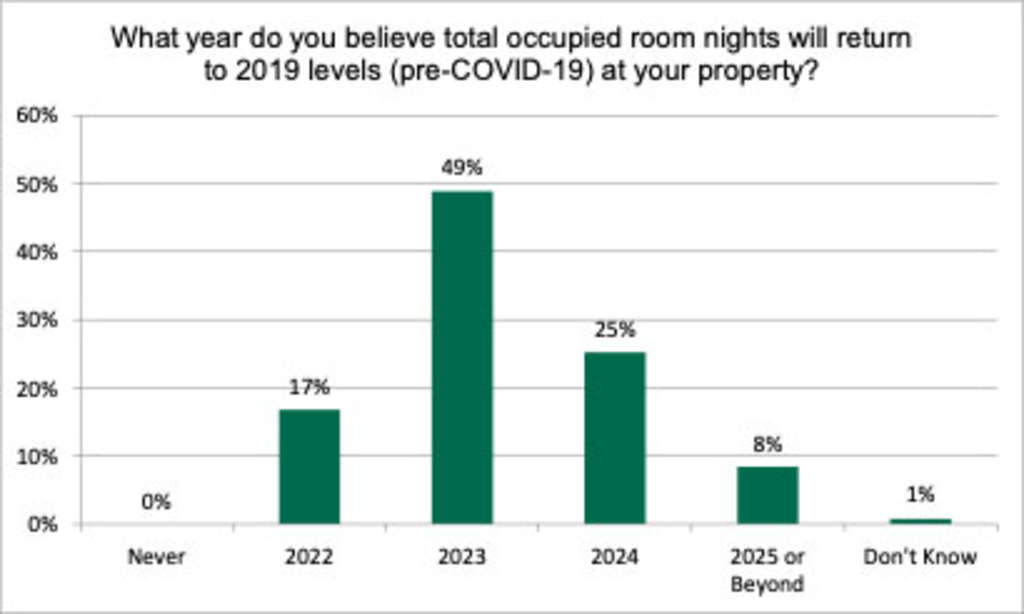

As the 2022 budget season progresses, CBRE’s Hotels Advisory professionals surveyed 130 industry leaders around the U.S. regarding concerns facing the hotel industry. A particularly insightful metric examines at what point the hotel industry will return to pre-pandemic performance levels. The broad spectrum of hotels (geographic location, chain scale positioning, branding/non branding, age of the hotel, market orientation) all present challenges in determining the return to 2019 levels of operation. This is most likely due to the influence that each of these factors possesses in determining market and hotel performance. Nonetheless, we set out to ask hoteliers, “When do you think your hotel(s) will return to pre-pandemic levels, most notably the 2019 levels of performance?” When asked this question, nearly 75% of the respondents indicated either 2023 or 2024 with most indicating 2023.

FIGURE 1:

This is particularly interesting as the CBRE national economists have indicated that based on the anticipated growth in gross domestic product (GDP), anticipated employment and unemployment levels, discretionary spending levels and other minor economic indicators, that the U.S. lodging sector RevPAR is anticipated to return to 2019 levels by 2025. Some markets, such as leisure destinations, will return sooner and other markets, such as downtown urban core group meeting destinations, will lag.

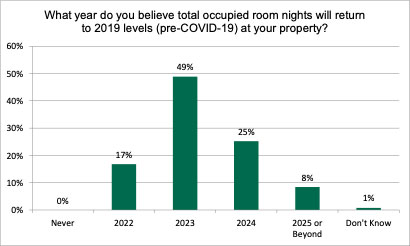

Recent performance, as reported by Kalibri Labs, indicates that markets with high leisure demand have outperformed other markets in the U.S., particularly markets that have high regional “drive” business. Markets such as Jacksonville, Savannah, Charleston, San Diego, Fort Lauderdale, and Virginia Beach achieved some of the highest occupancy levels during the summer of 2021 and typify this trend. Make no mistake, lodging business is down almost everywhere in the U.S., however, leisure markets have experienced a lesser decline. Supporting this thesis is the fact that over 48% of the survey respondents perceive that leisure travel is the main demand driver for their hotel in 2022. Another 32% of respondents indicated that some combination of leisure, corporate or group meeting demand will be the main demand driver in 2022.

FIGURE 2:

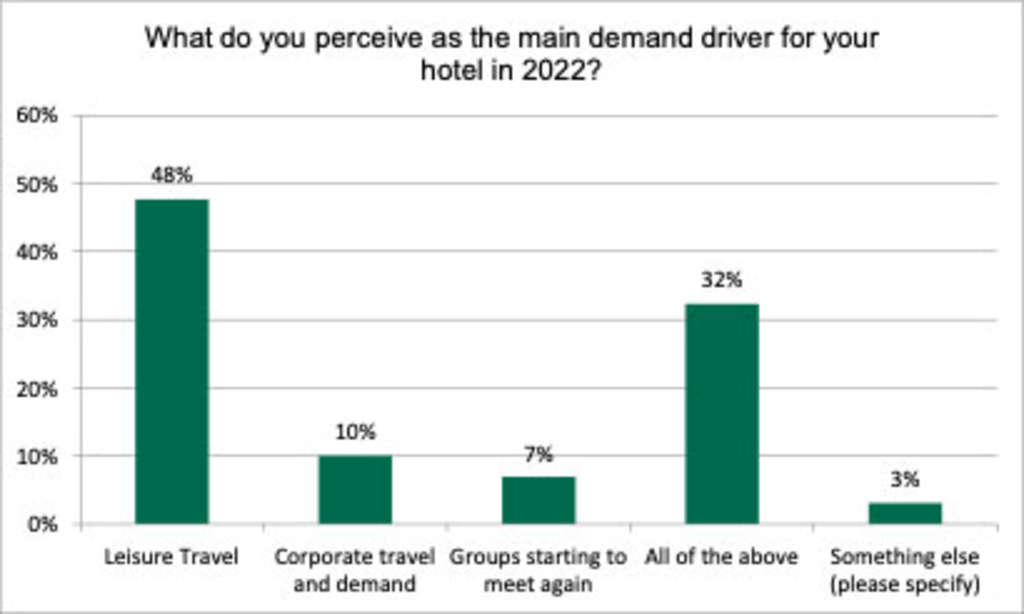

While our research did not seek to specify what kinds of groups (corporate, association, large, small, regional, leisure) are making reservations for 2022, the research did indicate that 83% of the respondents stated that they are receiving group reservations for 2022. This was somewhat surprising considering the continuous outbreaks of variants to the COVID-19 virus. Follow up conversations with participants found that many groups are booking and making plans for 2022. It remains tentative and tenuous if these bookings actualize.

As an industry, we have noticed collectively that group business continues to be tentative and taking a “wait and see” posture. We are confident that as more protocols around the virus are developed, and as groups adapt and adopt policies for their own meetings, events will return. Again, follow up conversations with participants indicated that corporate groups and associations want and need to “gather” for annual functions and general business meetings. Interestingly, municipalities have influenced the group meeting activity through local ordinances and restrictions placed on meeting size. Hotels that have maintained food and beverage operations, and those that also accommodate groups, have fared better than the industry in total.

FIGURE 3:

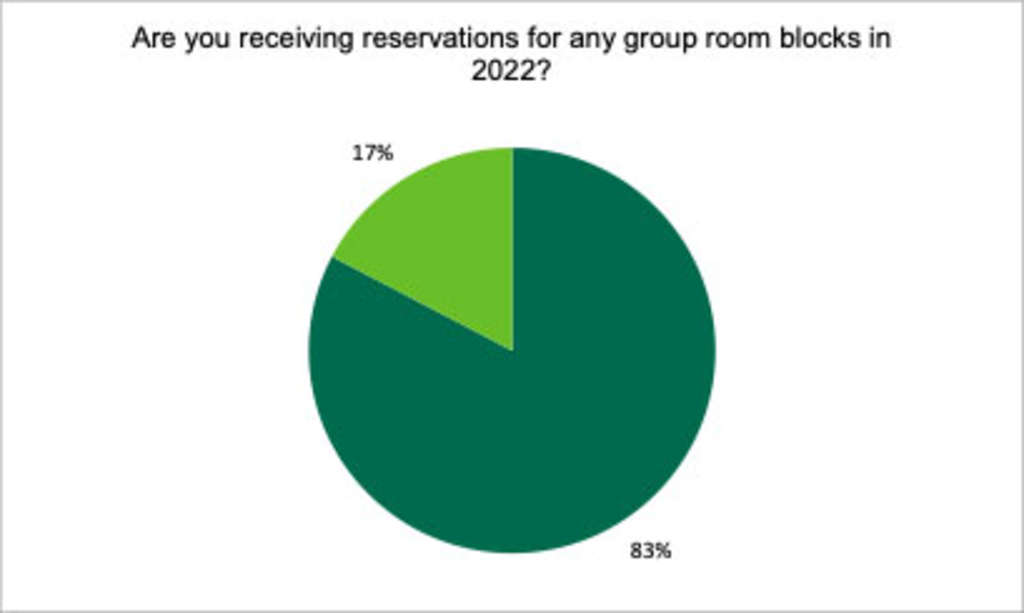

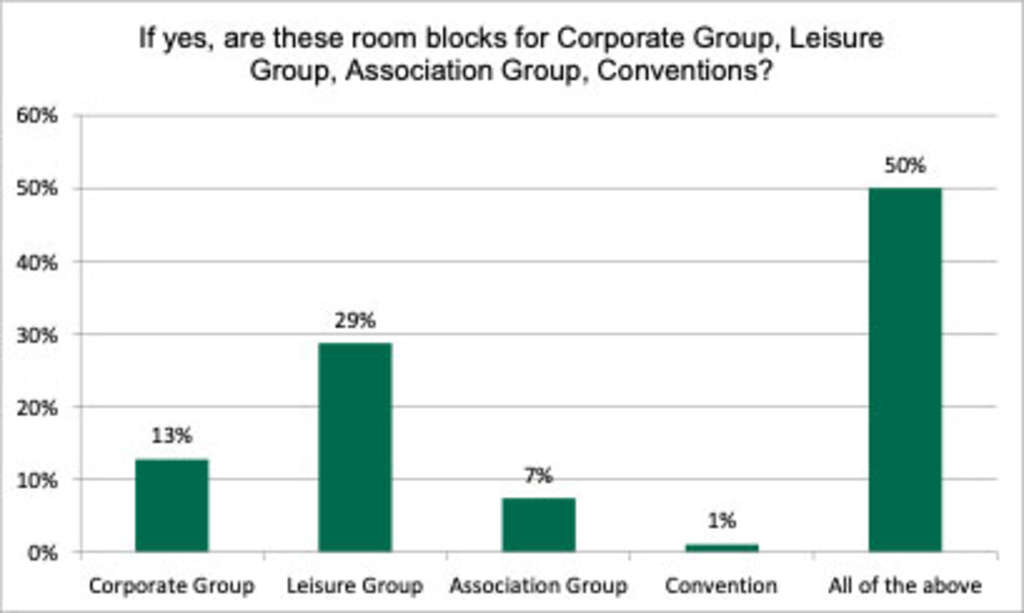

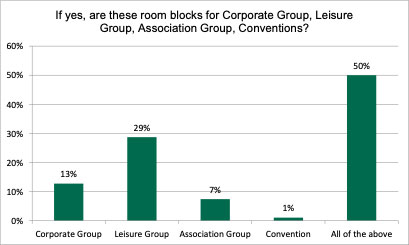

Of those surveyed who responded “yes” when asked if they were receiving group reservations for 2022, leisure groups comprised the largest (29%) slice of the group meeting pie. Second was corporate group at 13%. Association group was last and only 1% indicated convention business was booking in 2022.

FIGURE 4:

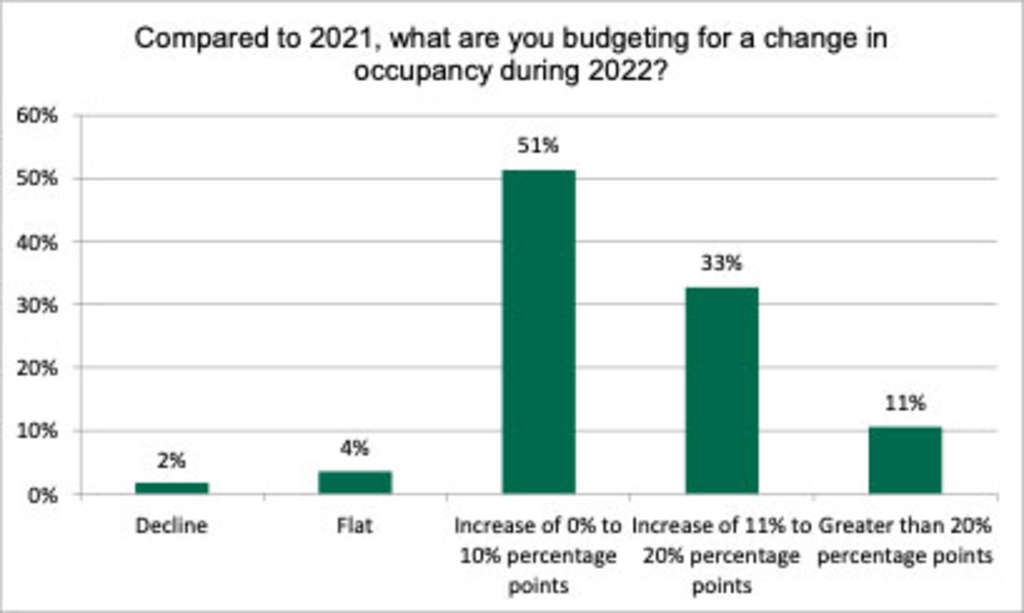

We also surveyed participants to gauge their plans for increases to occupancy and ADR. Over 51% of the respondents indicated that they anticipate increasing occupancy in their 2022 budgets by anywhere from 0 to 10 percentage points.

FIGURE 5:

FIGURE 6:

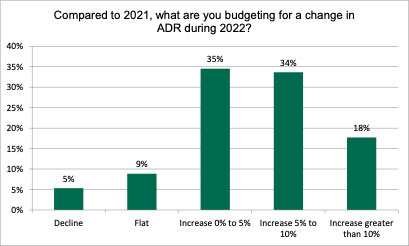

For ADR, nearly 70% of the respondents are budgeting increases ranging from 9 to 10% in 2022. This is not surprising considering the ADR gains observed in 2021.

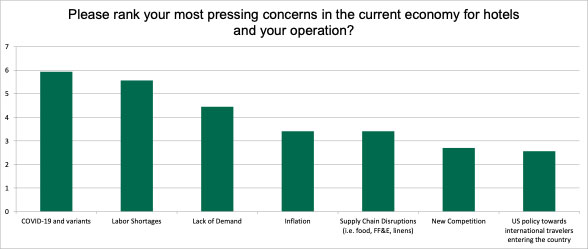

Finally, the operational challenges facing owners today seem more severe than almost any other period in our recorded lodging history. While we are confident that the hotel industry will persevere, the COVID-19 pandemic is cited as causing the most concern amongst hotel owners and operations. The second greatest challenge for U.S. hoteliers is the challenge to secure adequate labor. Unfortunately, during the downturn, many hotel employees left the industry for work in other businesses. While this does not bode well for the industry during the short term, it certainly motivates owners and operators to find creative solutions in providing service and amenities that are congruent with the relationship between price and value.

FIGURE 7:

In conclusion, optimism remains prevalent in the industry. Investment sales continue and that may be the greatest indicator that seasoned investors and new entrants into the lodging sector see value. As 2022 approaches, hoteliers are faced with challenges once again as they were in 2001 and 2008 and arguably many times prior. We have confidence that operators and investors will move forward with resolve in finding that very fine balance between the price of a guest room, the cost of a guest room, and the cost of providing services in 2022 and beyond.

*This article was published in the November/December 2021 edition of Hotels magazine.