The Energy Price Threats to Hotel Demand

During periods of elevated energy prices concerns about leisure and business travel stagnation become real. Travel requiring overnight accommodations is highly and predominantly discretionary. Leisure travel expenditures give way to necessities when energy prices spike.

“The price at which demand destruction kicks in can be fiendishly difficult to estimate.” Morgan Stanley

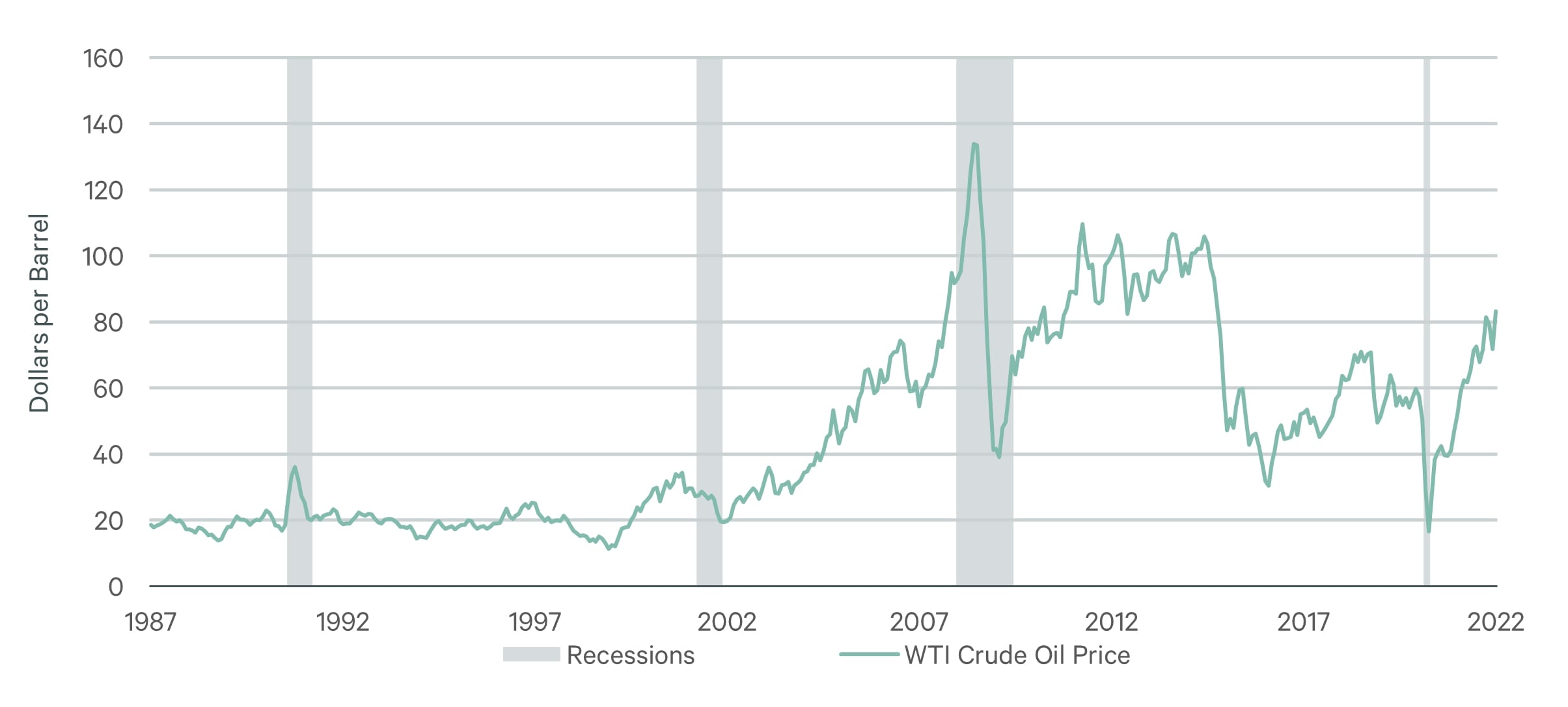

As sudden as the appearance of a late afternoon thunderstorm, rising energy prices became a credible threat again to future travel and hotel demand in the U.S. Figure 1 shows that the daily price of West Texas Intermediate (WTI) oil elevated to nearly $140/barrel during the 2008-‘09 recessionary period, flirted with $120/barrel in the post-recession period last decade, and recently climbed to comparable levels. The charts for regular gas prices and jet fuel look similar even with the lag between changes in the prices of crude oil and refined products.

FIGURE 1: Daily Price of WTI Crude Oil, 1986 Through March 7, 2022

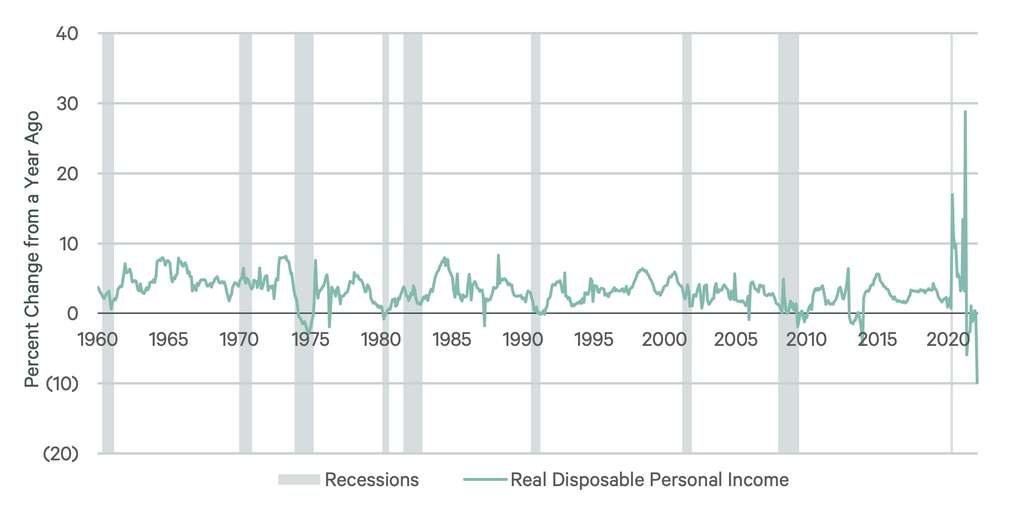

During periods of elevated energy prices concerns about leisure and business travel stagnation become real. Travel requiring overnight accommodations is highly and predominantly discretionary. Leisure travel expenditures give way to necessities when energy prices spike. Figure 2 indicates that disposable income began to revert in late 2021 following historic increases due to fiscal stimulus. Leisure travelers will lose confidence should the reversion overshoot the mean. Recent advancements in telecommunications technology make the already weak business travel more substitutable than ever.

FIGURE 2: Monthly Year-Over-Year Percent Changes in U.S. Disposable Income, 1960 Through January 2022

Like Malcolm Gladwell’s tipping point there might be a ‘moment of critical mass’ when energy prices rise to a level at which travel becomes costly enough to begin destructing hotel demand. The term ‘demand destruction’ recently entered the business news vernacular in reference to the energy price spike. The term refers to a permanent change in consumer behavior.

Should the recent trend of escalating oil and gas prices continue, economists at CBRE Hotels Research will launch empirical studies detailing how oil prices will influence future U.S. hotel performance. But for now, advanced planning by hotel owners and management may benefit from incorporating what was learned during historical periods of high prices about the relationships between oil/gasoline price and hotel demand.

Two Channels of Possible Pain

One obvious path to travel impairment mapped to high oil prices comes from elevated air fares as airlines attempt to pass on increases in fuel costs. The price elasticity of air travel is a complicated topic in that the magnitude depends on many factors such as purpose of trip, profile of traveler, distance traveled, and even short-run versus long-run sensitivities. Further complications arise from modeling variable lag times linking oil prices, refined jet fuel prices, and air fare effects. Air travel was found to be elastic and sometimes inelastic, but generally a statistically significant negative number (See Brons, et. al., 2002 for a review)[1]. Similarly, the percent change in auto travel relative to the percent change in gasoline tends to be inelastic again based on idiosyncratic factors and also statistically significant (See Graham and Glaister, 2002 for a review).[2]

The second path detrimental to travel is economic recession triggered by high energy prices. Significant downturns in the national and local economies that negatively affect hotel revenues in the past have been tied, albeit indirectly, to high energy prices. The precise connection between recessions and energy price shocks is another complicated topic. Hundreds of studies address this subject. Here are a couple of highlights:

· Some but not all recessions are preceded by energy price spikes. One (2008-2009) of the past two recessions as shown in Figure 1 followed from continuous prior annual increased oil prices. Research findings confirm that these run-ups are associated with recessions along with other factors (see L. Killian, 2008 and L. Kilian and R. J. Vigfusson 2014).

· Recessions (e.g., 1981-‘82) often follow sharply higher energy prices (e.g., 1979), but major economic expansions do not usually follow sharply lower energy prices (e.g., 1986).

Direct Effects of Energy Prices on Hotel Demand: What Do We Know?

An exhaustive search for research related to the correlation in high energy prices and hotel demand resulted in finding only one published study this century. This paper by Canina et. al. (2003) reports an industry-wide elasticity of -1.74 indicating that if there is a 1 percent annual increase in the price of gas then a 1.74 percent annual decline in the number of rooms sold (i.e., demand) results. Ignoring the drawbacks of this study, one of which is that it uses data from just 12 annual periods, reasonable explanations for this elastic finding using data for all hotels come when the authors disaggregate the hotel market into locations and chain scales. Specifically, the sensitivity was found to be pronounced for hotels in suburban and highway locations and the two lower end chain scales – economy and midscale. These hotels constitute the majority of traditional lodging establishments in the U.S. The energy price elasticities for urban and the higher end of the chain scale spectrum were less than 1.0 (i.e., inelastic).

Energy Price-Associated Recessions and Hotel Demand: What Do We Know?

This literature search also generated only one related study. In 2010 hotel and short-term rental professional Jamie Lane and I (Corgel and Lane, 2011) ran three Moody’s Analytics oil price-based economic scenarios through the hotel market forecasting models operated by the predecessor to CBRE Hotels Research. Returning to Exhibit 1, oil prices were on a steady rise again (i.e., following a steep decline in 2009) toward $100/barrel in 2010 giving justification for Moody’s to create baseline macroeconomic scenarios with a $98/barrel oil price, a $125/barrel scenario, and a mild recession scenario at $150/ barrel.

The focus of our analysis was revenue per available room (RevPAR) growth. With the baseline scenario, RevPAR continued a path of slow and steady growth through 2013. For both the $125/barrel and $150/barrel scenarios, RevPAR growth initially declined by about one-third. All hotels’ RevPAR growth declined to almost zero by 2012 using the $150/barrel scenario. The disaggregate forecasting for locations using the $150/barrel scenario inputs found that RevPAR growth for suburban and interstate hotels declined by about 50 percent from the current forecast published at that time, but resort hotels would experience RevPAR growth of approximately one-quarter of the projected growth. Our result for resorts contrasts with Canina et. al. (2003) who found a non-negative sensitivity to gas price shocks for resorts.

Observations

Three observations emerge. I hesitate to label them conclusions given the thin set of findings now available about the relationships between energy price shocks, travel, and hotel financial performance in the U.S.

First, travel and hotel demand growth will sustain (recover) at the current pace if oil prices remain below $125/barrel and gasoline prices remain below about $4.50/gallon. At oil price levels above $120/barrel, ‘consumer destruction’ sets in according to the president and CEO of an energy company recently interviewed on a financial network. It coincides with the Moody’s $125/barrel scenario.

Second, the U.S. paid accommodations market is populated with many different hotels and short-term rental options. Aggregation bias across locations and chain scales is a research concern. Each type of accommodation has different sensitivities to energy price shocks. The overnight accommodations demand mix between leisure, business, and group decidedly shifted to leisure and away from business and group during the pandemic period. Changes in telecommunications technology may result in some variation of this demand mix shift continuing. Similar to different locations and chain scales, these demand segments have different sensitivities to the two travel costs related to gas and jet fuel price generated air fare increases.

Third, consideration of lags is important for estimating the effects of energy price spikes on travel demand. Consumers selecting air travel respond to changes in airfares, not directly to changes in either oil prices or jet fuel. Figure 3 presents data on the lag between airfares and oil prices. A relatively strong correlation exists between oil price changes three months prior to air fare increases and declines.

FIGURE 3: With a 3 month lag the change in Airfare and change in Oil are 60% correlated

References

- Brons, M., E. Pels, P. Nijkamp, and P. Rieveld. 2002. “Price Elasticities of Demand for Passenger Air Travel: A Meta-Analysis.” Journal of Air Transport Management 8: 165–175.

- Canina, L, K Walsh, and C. A. Enz. 2003. “The Effects of Gasoline-Price Changes on Room

- Demand: A Study of Branded Hotels from 1988 through 2000. Cornell Hotel and Restaurant Administration Quarterly 44(4), 29-37

- Corgel J. B. and J. Lane. 2011. “Oil Prices and Lodging Risk.” Cornell Hospitality Quarterly 52(3): 228–231.

- Graham, D. T. and S. Glaister. 2002. “The Demand for Automobile Fuel: A Survey of Elasticities.” Journal of Transport Economics and Policy 36(1): 1-25.

- Kilian, L. 2008. “The Economic Effects of Energy Price Shocks” Journal of Economic Perspectives. 46(4):871-909.

- Kilian, L. and Robert J. Vigfusson. 2014. “The Role of Oil Price Shocks in Causing U.S. Recessions” Board of Governors of the Federal Reserve System, International Finance Discussion Papers (August).

- [1] For those without an economics background this price elasticity number = % change in trips divided by % change in price. Price ‘elastic’ means the calculated result is > 1 and ‘inelastic’ < 1.

- [2] Note these reviews were prepared early in this century. Studies since that time tend to be targeted at specific conditions in various countries and in different market settings. Recent findings coincide with the earlier reviews.