Vienna Hotel Market Spotlight YE June 2025

OVERVIEW

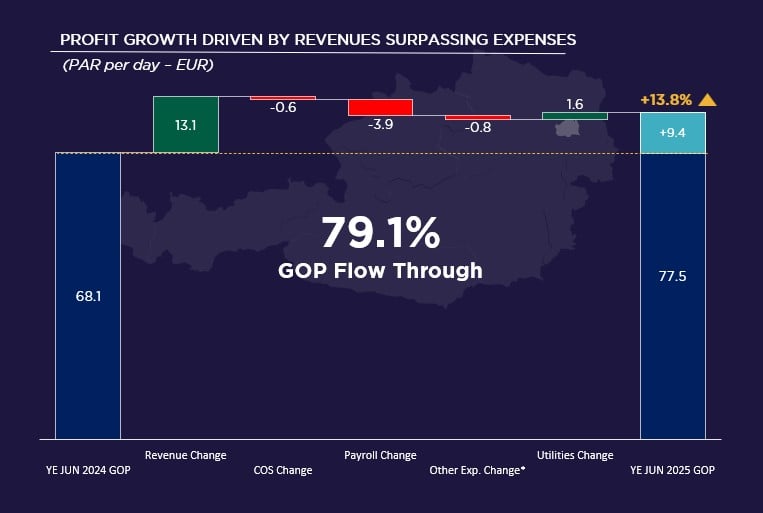

- The sample of branded full-service hotels in Vienna recorded a notable increase in profit during the 12 months ending in June 2025. The GOP per available room (GOP PAR) increased by 13.8% (YoY), driven by a 6.1% revenue rise that outpaced the 2.5% increase in expenses. While revenue growth slowed to 5.4% in H1 2025, it still surpassed expenses (+4.0%), leading to an 8.8% GOP PAR increase.

- Rooms revenue PAR grew by 7.3% (YoY), due to ADR increasing by 6.2% and supported by a 1.1% increase in occupancy. The ADR reached €211, and the F&B revenue increased by 2.5%, reaching €76 per occupied room POR (YE June 2025).

- Occupancy reached 76.8% during the 12 months ending June 2025, representing 1.1% increase. In H1 2025, the occupancy declined to 70.7% (-0.9 pp. YoY). There was a notable decline of occupancy in March (-11.6%) and growth in April (+8.0%) due to the shift of Easter holidays.

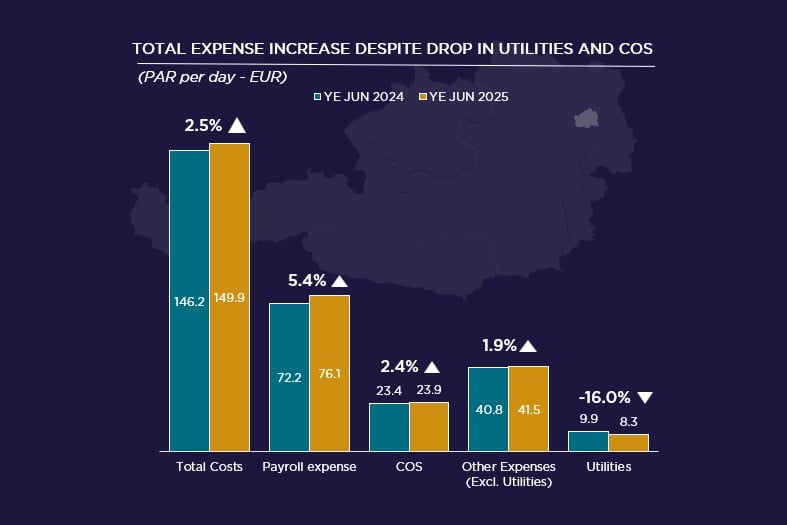

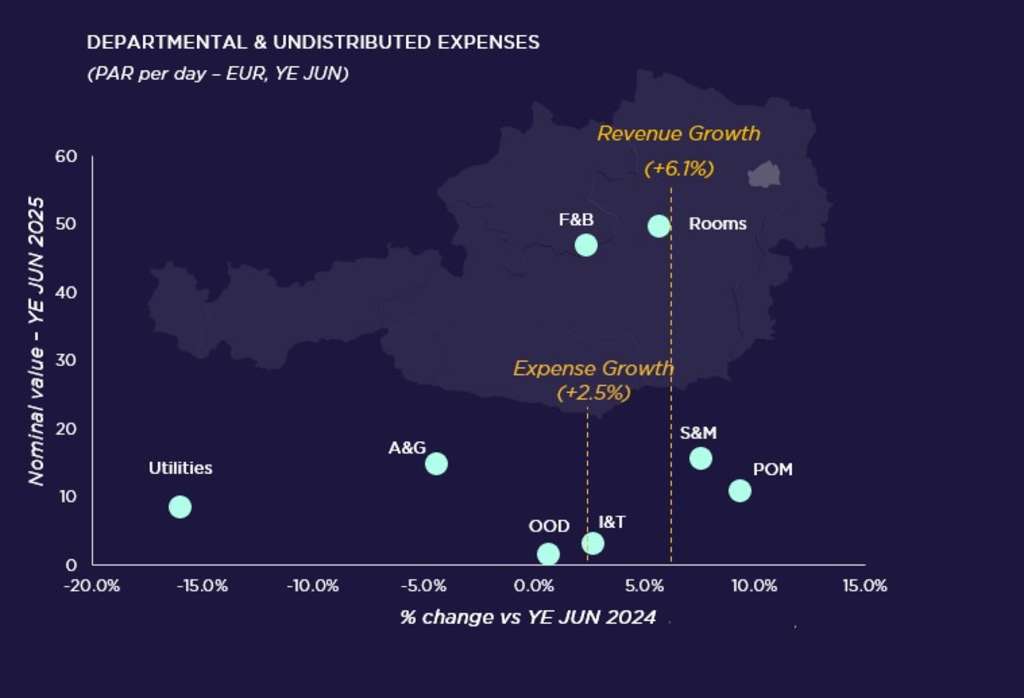

- Total expenses increased by €3.7 PAR (+2.5% YoY), driven by Payroll (+€3.9, +5.4%), meanwhile the decline in Utilities (-€1.6, -16.0%) slowed down the expense growth.

- During the period, there were four new hotel openings in Vienna and no reported closures. The total supply increased by 522 rooms (+6.5%, weighted by opening date).

- Except for Payroll, the major expense lines were constrained during the period, resulting in 71.9% of the additional revenue flowing through to the bottom line. As a result, the GOP reached €77.5 (+€9.4, +13.8%), and the GOP margin increased by 2.3 percentage points to 34.1%.

SUPPLY

- During YE Jun 2025, there were four hotel openings in Vienna, increasing the total supply by 522 rooms, representing a room supply growth of 6.5% (weighted by opening date).

- The majority of the new rooms (77.0%) opened in the central area of Vienna, albeit only Astoria Curio Collection could be considered as being in the downtown Vienna. The only hotel opening in the surroundings of Vienna was B&B Hotel Heiligenstadt, accounting for 23.0% of the new supply.

- All the new openings were branded hotels. Two hotels were within the Upper Upscale (46.9% of the new supply), one in the Upscale (30.1%), and one in the Economy (23.0%) classes.

- No major hotel closures were announced during the period.

- Anantara Palais Hansen underwent refurbishment during the period with multiple partial closures. The brand announced the project’s completion at the beginning of May 2025.

PAYROLL COSTS

- The labour expenses reached €76.1 PAR (+€3.9, +5.4%). The Rooms department led the growth, with payroll rising by €2.0 PAR (+7.6%), followed by the F&B department (+€0.9, +3.1%). In H1 2025, the Payroll costs increased by €4.6 (+6.4%, YoY), driven by the Rooms (+€2.0, +7.5%) and the F&B (+€1.4, 4.7%) departments.

COST OF SALES

- Total COS increased by €0.6 PAR (+2.4%), primarily within the F&B (+€0.4 PAR, +3.2%). In H1 2025, COS increased by €0.8 PAR (+3.9% YoY), driven by the F&B department at €12.4 (+€0.7, +5.6%).

OTHER EXPENSES (excl. Utilities)

- Other expenses increased by €0.8 (+1.9%) to €41.5 PAR, driven by higher other costs within POM (+€0.9 PAR) and Rooms (+€0.6 PAR) departments. The overall cost increase was partially offset by a €0.9 PAR reduction in the A&G department.

UTILITY COSTS

- Utility costs decreased by €1.6 PAR (-16.0%), mainly driven by electricity costs declining by €1.0.