New emerging trend, or a slow market reorganisation?

Previous articles by M. Ratkai, Professor of Hospitality Business and ESG at the Hotelschool The Hague, have addressed the ever-changing landscape of corporate disclosures, including the EU’s Corporate Social Responsibility Directive (CSRD) and ongoing negotiations of the Omnibus proposal. To obtain effective corporate reporting and governance practices, it is essential to have a strong institutional, legal, and regulatory framework. In 2023–2024, nearly two-thirds of the countries revised their governance frameworks, and 73% of the analysed countries issued national reports on companies’ compliance. Most of these reports cover all listed firms.

In 2024, around 44,000 companies were publicly listed across the globe, representing a total market value of EUR 100+trillion. Since 2022, their combined market capitalisation has grown by 28%. Since 2005, however, over 35,000 companies have exited public stock exchanges worldwide.

The OECD study shows that sustainability-related disclosure is required by law or regulations in 79% of jurisdictions, and 65% name multiple stakeholders (including shareholders) as the primary users of sustainability disclosures. Additionally, 62% require transition planning. Regarding the reliability of sustainability-related information, 60% of the countries have established requirements for the assurance of such information (mainly limited or reasonable assurance), and an additional 17% are considering it. Different approaches exist regarding the types of entities allowed to provide sustainability assurance, including statutory auditors and other assurance service providers.

Do increasing responsibilities and legal accountability influence listed companies’ behaviour? Apart from the obvious, there is another noticeable trend. In both the USA and Europe, delistings have outpaced new listings, resulting in a net decline in the number of listed companies. Approximately 12,000 companies delisted in Europe (about one-third of the total) and 5,000 in the USA. Also, initial public offering activity has weakened across most regions. The exception has been Asia (excluding China and Japan), where net listings have continued to rise and remained positive over 2022-24.

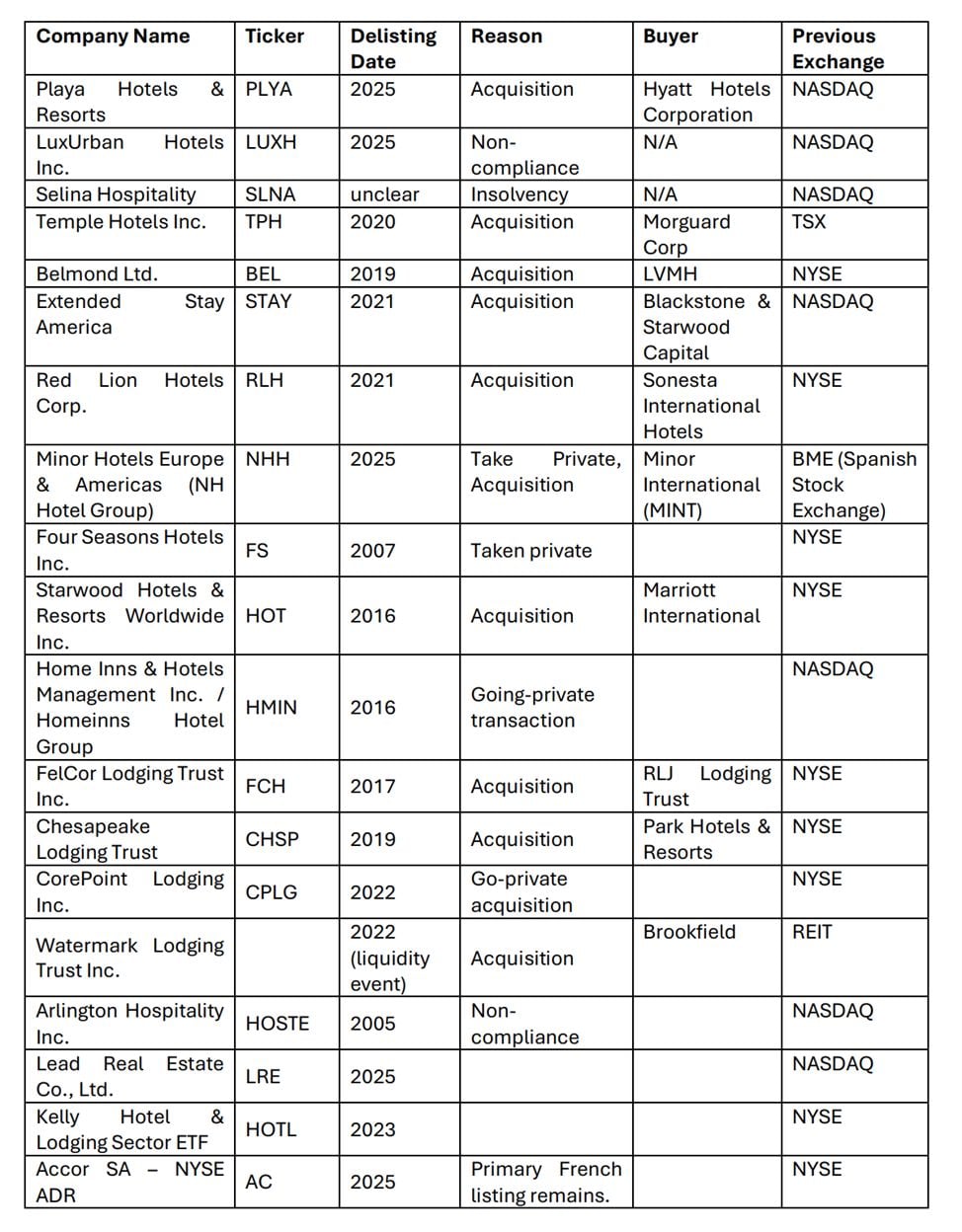

What insights has the Chair of Hospitality Business and ESG at Hotelschool The Hague uncovered regarding the accommodation and lodging sector? They found that many delistings took place in our sector as well, see the list below from the past years.

Note: The information in the table is provided as is and may contain inaccuracies. Users are advised to verify critical details independently.

Conclusion

There are a few conclusions that can be drawn from the above: there were many acquisitions, but also many non-compliance issues. The question arises automatically: whether the new ownership structure is the only reason behind the delistings? Or maybe, because of the increasing expectations for transparency and accountability? Or maybe we can witness a slow market reorganisation? What do you think? Do you have an opinion?

Source:

- OECD (2025), OECD Corporate Governance Factbook 2025, OECD Publishing, Paris, https://doi.org/10.1787/f4f43735-en.

- Investing.com. 2025, January 16. Luxurban Hotels to be delisted from Nasdaq for noncompliance. Retrieved from https://www.investing.com/news/sec-filings/luxurban-hotels-to-be-delisted-from-nasdaq-for-noncompliance-93CH-3815772

- HFTP. (2025, July 25). Minor Hotels Europe & Americas to delist from the stock exchange by the first half of 2025. Hospitality Financial and Technology Professionals (HFTP). https://www.hftp.org/news/4128304/minor-hotels-europe-americas-to-delist-from-the-stock-exchange-by-the-first-half-of-2025