What was the impact of regulation on short-term rental markets in 2025?

Over the past few years, the rapid growth of short-term rentals has prompted city level and national governments to introduce more regulatory frameworks.

These measures are typically designed to address specific, locally defined pressures. These include the availability of long-term housing, the concentration of tourist accommodation in residential neighborhoods, tax leakage, and the need for clearer oversight of safety and quality standards.

Rather than taking a single form, short-term rental regulation spans a wide spectrum, with rules ranging from simple registration and licensing to activity caps, primary residence restrictions, and digital enforcement.

However, it is also crucial to recognize that short-term rental performance is simultaneously influenced by a range of macro-level factors that extend beyond regulation. These include changes in travel demand, economic conditions, airline capacity, major events, seasonality, and shifts in traveler behavior.

In this analysis, we examine short-term rental performance in markets where regulations are already in place, using Lighthouse data to provide a data-backed view of how regulated short-term rental markets are currently performing in regulated environments today.

New York City

Short-term rental regulation in New York City

New York’s Local Law 18, enforced from September 2023, is one of the strictest short-term rental frameworks globally.

- Rentals under 30 days are only allowed if the host is present during the stay, with a maximum of two guests.

- Hosts must register with the city

- Platforms are prohibited from processing bookings for unregistered listings.

The intent is to eliminate unhosted, apartment-style short-term rentals and return housing stock to the long-term market.

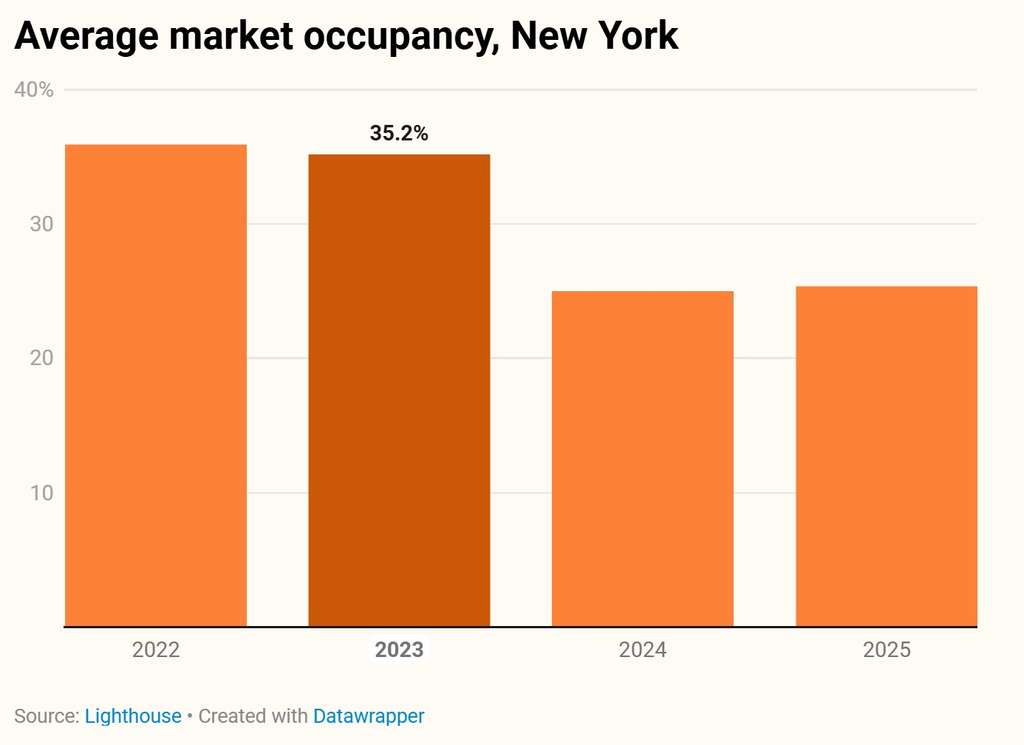

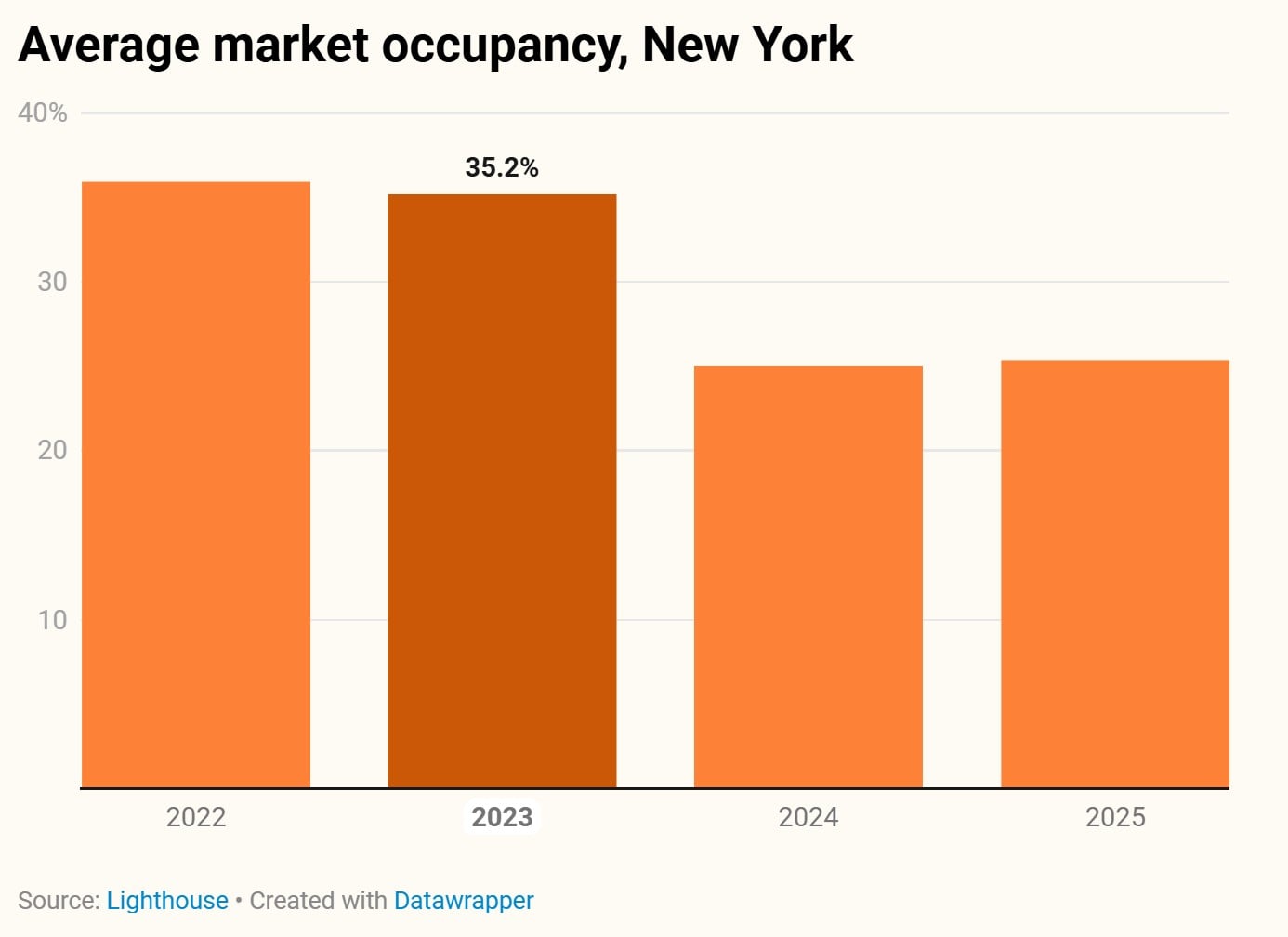

Market performance snapshot

Average citywide occupancy shows a clear step down beginning in 2024, following enforcement in late 2023. However, occupancy has since stabilized, with 2025 tracking slightly above 2024 levels.

- 2022: 35.91%

- 2023: 35.17%

- 2024: 24.98%

- 2025 (Jan-Oct): 25.34%

New York remains one of the highest-priced short-term rental markets. In 2024, booked prices climbed throughout the year, reaching $664.20 in October, $610.00 in November, and peaking at $696.40 in December.

In 2025, average booked prices (Jan-Oct) fell significantly. The average booked price is 24.89% lower than its 2024 peak, standing at $442.87 year to date (YTD). While lower than last year’s highs, pricing remains elevated relative to many other urban markets.

Amsterdam

Short-term rental regulation in Amsterdam

Amsterdam has regulated short-term rentals since January 2019, when the city tightened its rules:

- It forced the annual cap on entire-home rentals down from 60 nights to 30 nights per year.

- Hosts are required to register their property with the municipality and report each rental period in advance.

- The city has introduced neighborhood-specific bans in areas experiencing high levels of nuisance and housing pressure.

Market performance snapshot

Short-term rental supply in Amsterdam has increased over the past three years.

- Jan 2023 - 6,015 properties

- Jan 2024 - 7,725 properties

- Jan 2025 - 8,199 properties although peaked in August 2025 with 8,559 properties

Amsterdam continues to record some of the highest occupancy levels among major European cities, with strong seasonality.

Average annual occupancy shows:

- 2022: 52.19%

- 2023: 60.33%

- 2024: 53.28%

- 2025 (Jan-Oct): 50.45%

Despite a historical trend of 60%+ occupancy in late summer and early autumn, April was the sole month to reach that level in 2025.

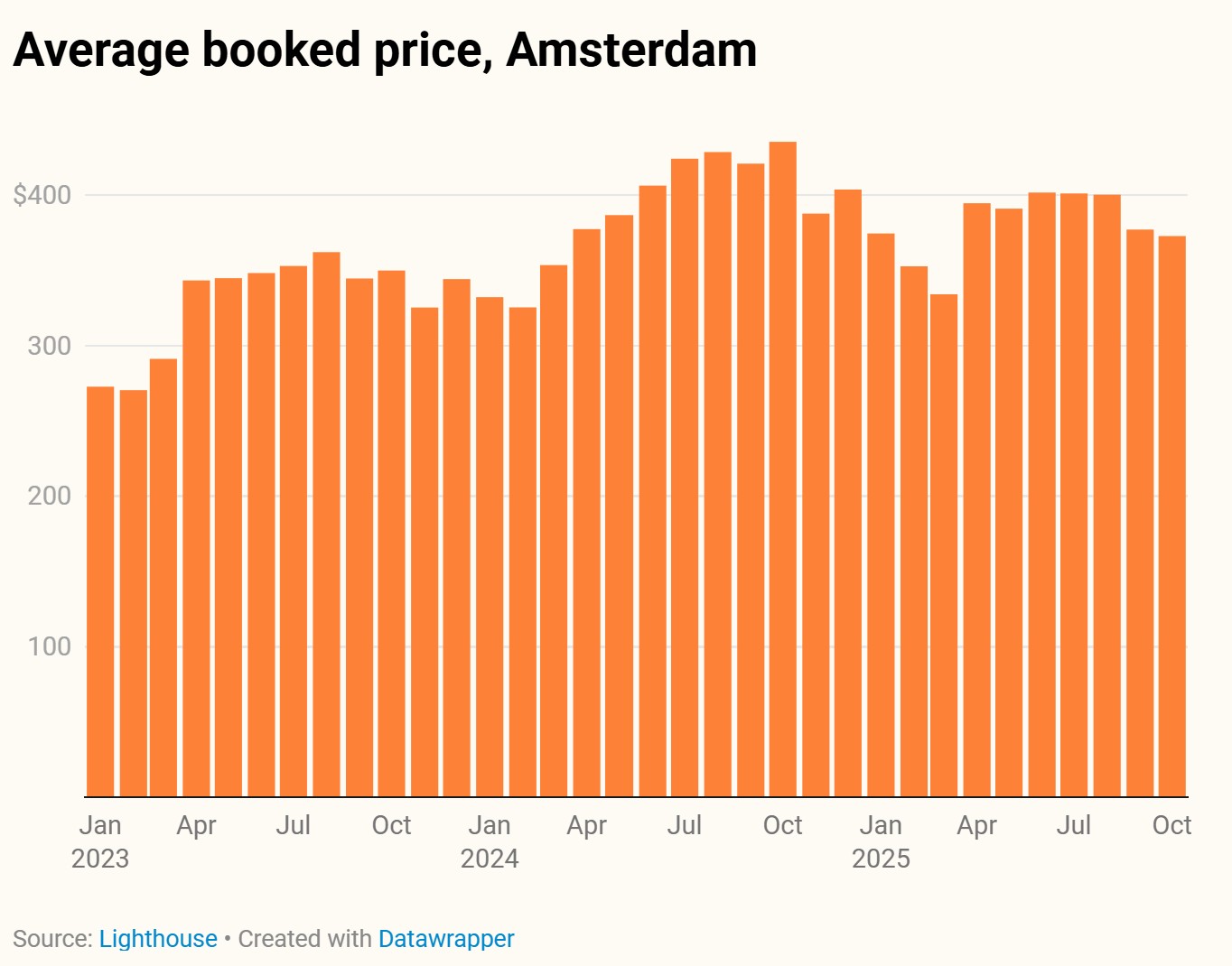

Over the longer term, booked prices have risen substantially year over year, particularly during peak travel months.

- 2022 peak booked prices: generally in the $290–$305 range

- 2024 peak booked prices: exceeded $430, with an October 2024 peak of $435.50

- 2025 peak booked prices: around $400 during summer months

Compared year over year, peak booked prices in 2025 are lower than 2024 highs, but remain well above previous years.

Barcelona

Short-term rental regulation in Barcelona

Barcelona has one of the most interventionist approaches to short-term rental regulation in Europe.

- In August 2021, the city banned short-term rentals of private rooms, restricting legal STR activity primarily to licensed tourist apartments.

- More recently, the city announced plans to scrap all existing short-term rental licenses by November 2028, effectively phasing out tourist apartments by 2029.

- The stated policy objectives are to address housing availability and reduce tourism pressure in residential neighborhoods.

Market performance snapshot

Barcelona’s supply increased steadily across 2023–2025, reaching a high of 21,815 listings in June 2025.

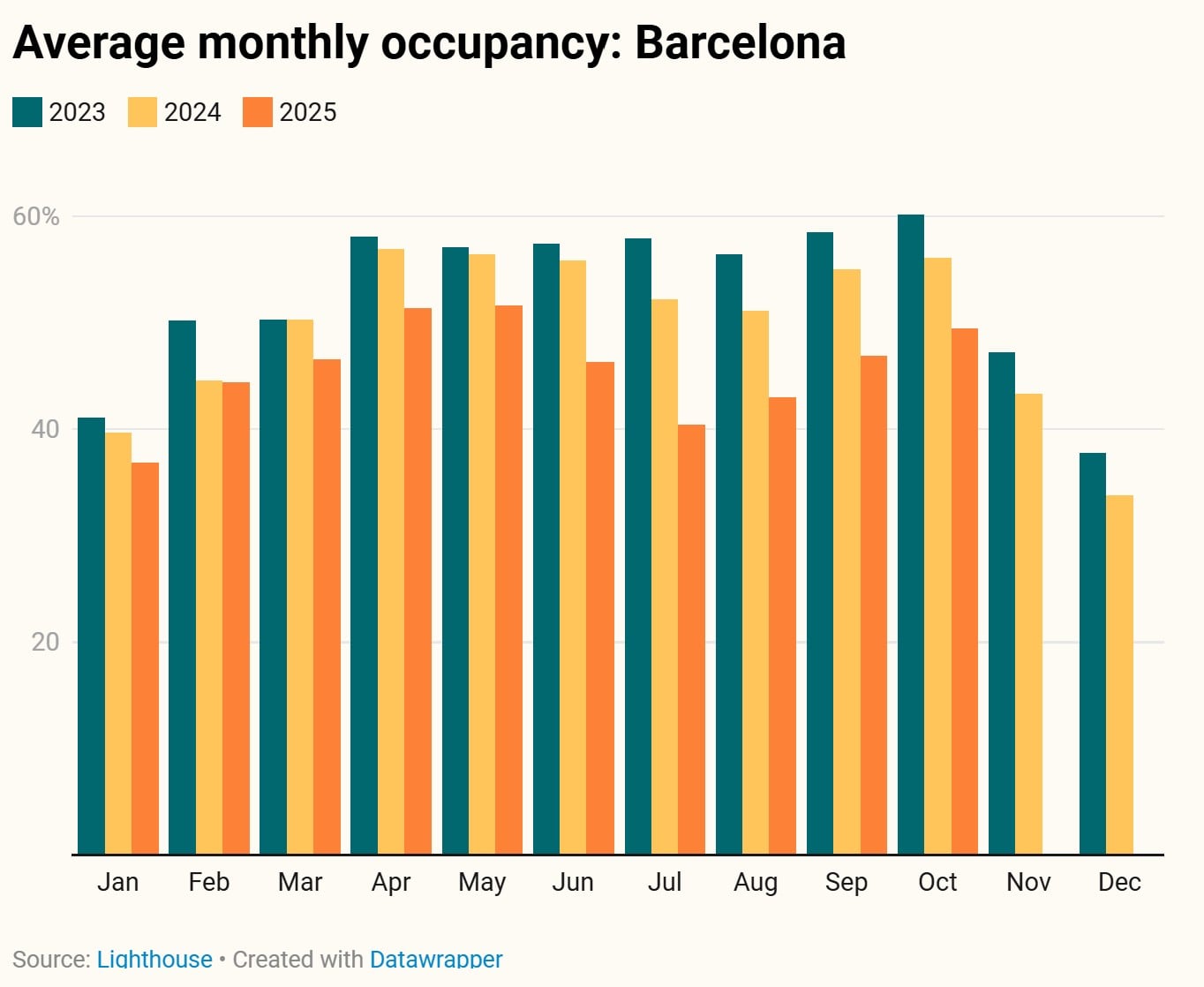

That being said, average market occupancy was also down 4 percentage points compared to 2024, and 7 points down on 2023, with the 2025 peak season dragging down the average for the year.

In fact, in previous years, peak monthly market occupancy regularly exceeded 55% but this has moderated in 2025.

Booked prices increased materially between 2022 and 2024, particularly during peak travel periods.

- 2022 peak booked prices: generally between $260–$270

- 2023 peak booked prices: generally between $340–$360

- 2024 peak booked prices: exceeded $400, with a high of $408.80 in August 2024

- 2025 peak booked prices: approximately $350 during the summer months and overall down 5.4% YoY through the end of October 2025.

Compared year over year, peak booked prices in 2025 are lower than 2024 highs, but are still higher than 2022 and early 2023.

Istanbul

Short-term rental regulation in Istanbul

Turkey introduced a national framework for short-term rentals on January 1, 2024 under the Law on Leasing of Residential Properties for Tourism Purposes.

- The regulation requires hosts to obtain a government permit, display an official plaque at the property entrance,

- Comply with a maximum rental limit of 100 days per year.

- A key provision is that permit approval requires the unanimous consent of all neighbors in the building, creating a high administrative threshold for legal operation.

- The regulation applies nationwide and is enforced through licensing and platform compliance.

Market performance snapshot

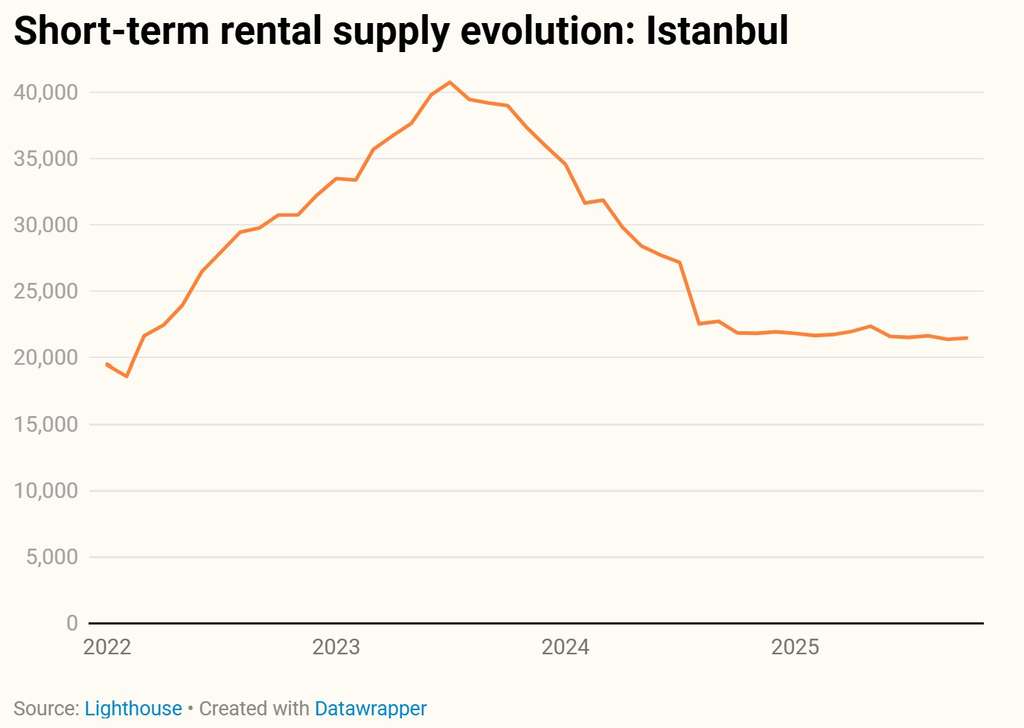

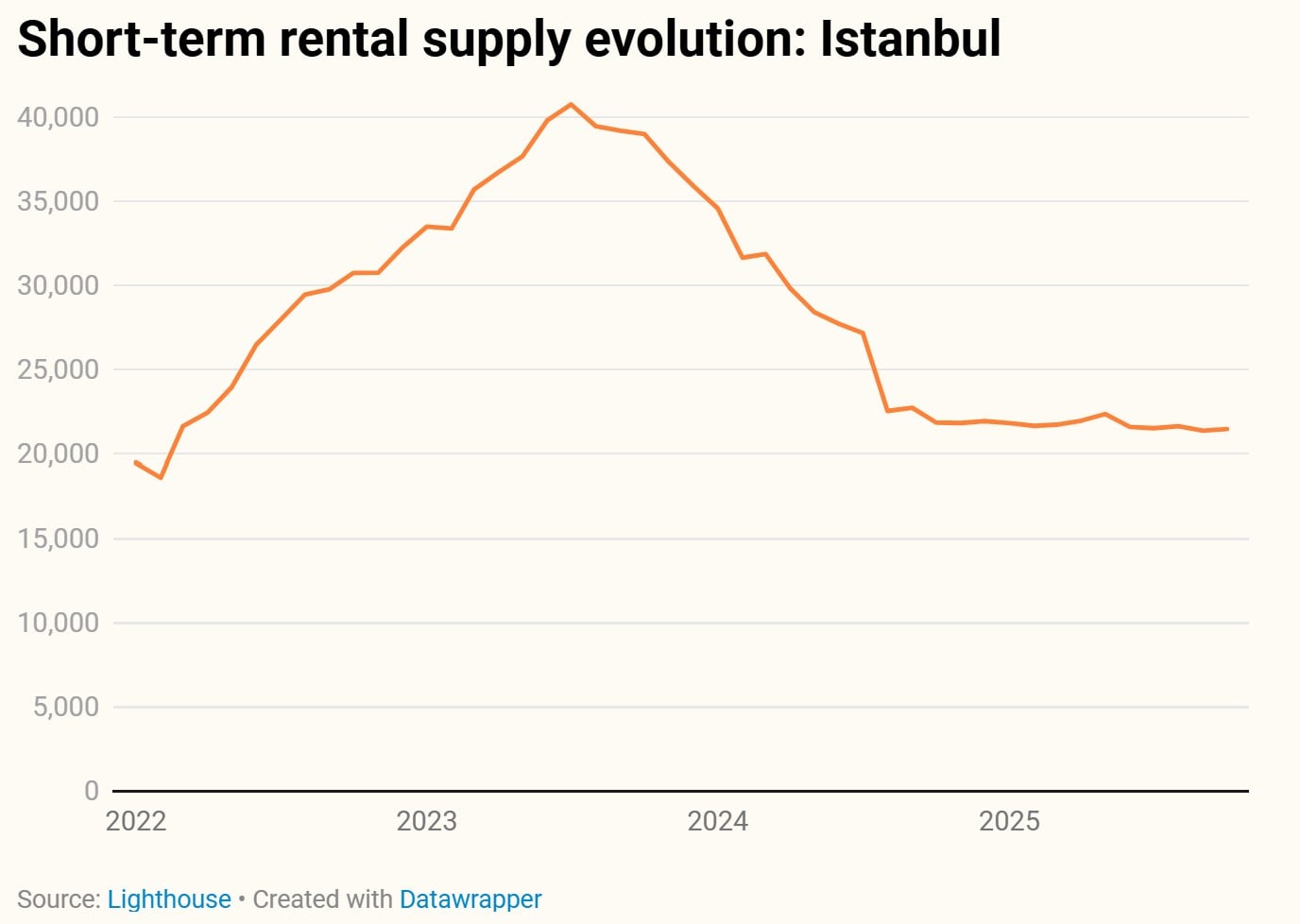

Istanbul’s short-term rental supply declined following the introduction of the national licensing framework.

- January 2024: 34,576 listings

- October 2025: 21,469 listings

This is a reduction of approximately 37.9% in supply over the period.

Istanbul's average occupancy is lower compared to most other European destinations, characterized by significant seasonality and weaker results outside of peak season.

Average annual occupancy in Istanbul has trended lower since 2022, with a partial recovery visible in 2025.

- 2022: 25.33%

- 2023: 19.96%

- 2024: 17.38%

- 2025 (Jan-Oct): 20.21%

The market maintains clear seasonality, peaking in the summer and early autumn. Despite 2024 recording the lowest annual average in the series, 2025 is currently outperforming the prior year on a YTD basis.

On the pricing front, average booked prices in 2025, through October, are $122.28, compared to 2024’s full year average of $117.62.

During the busier months, prices peaked at $138.30, while in 2025, the peak booked prices were generally in the $130–133 range.

Florence

Short-term rental regulation in Florence

In June 2023, Florence announced a ban on new short-term rental licenses within the historic city center, a UNESCO World Heritage site.

- The regulation was introduced to manage overtourism and protect residential housing in the city’s core.

- Existing short-term rentals were allowed to continue operating under 'grandfathering provisions' while the restriction applies only to new licenses within the designated zone.

Market performance snapshot

At a city level, short-term rental supply has continued to increase since the regulation was introduced, growing by 23.3% through to October 2025.

- June 2023: 12,520 properties

- October 2025: 15,431 properties

While showing strong seasonality, Florence continues to drive high demand, with occupancy during peak spring and autumn months regularly exceeding 70%.

In 2025, peak occupancy has moderated compared to prior years, contributing to a lower annual average, down 2 percentage points over 2024.

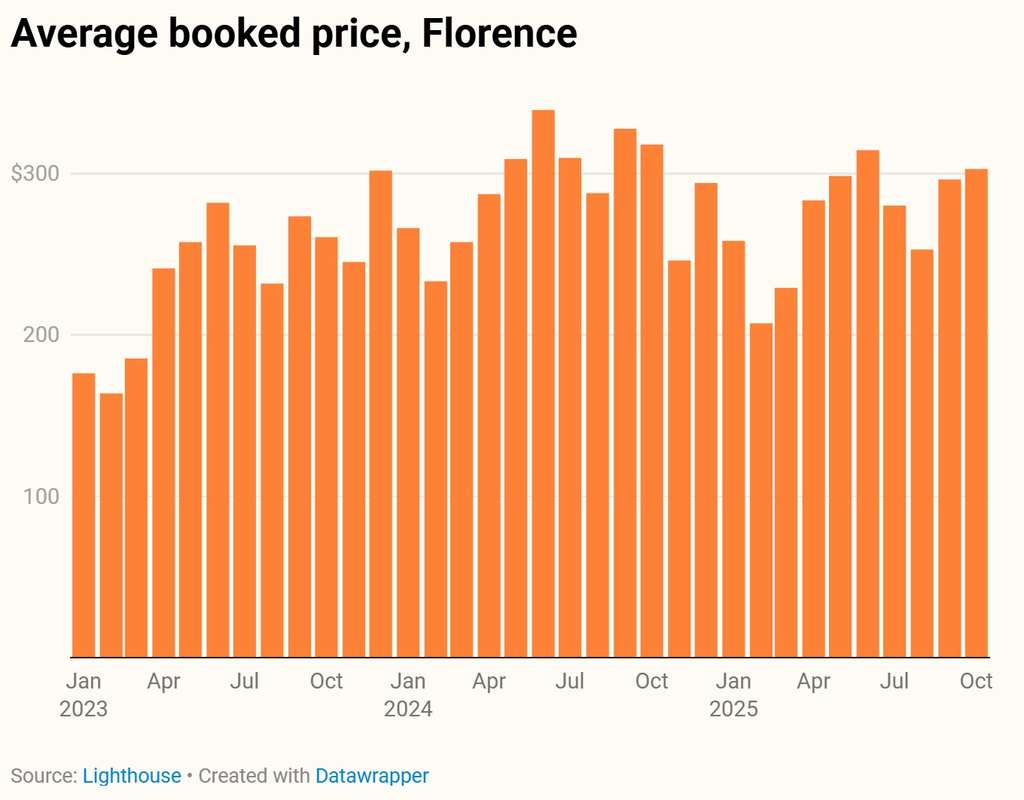

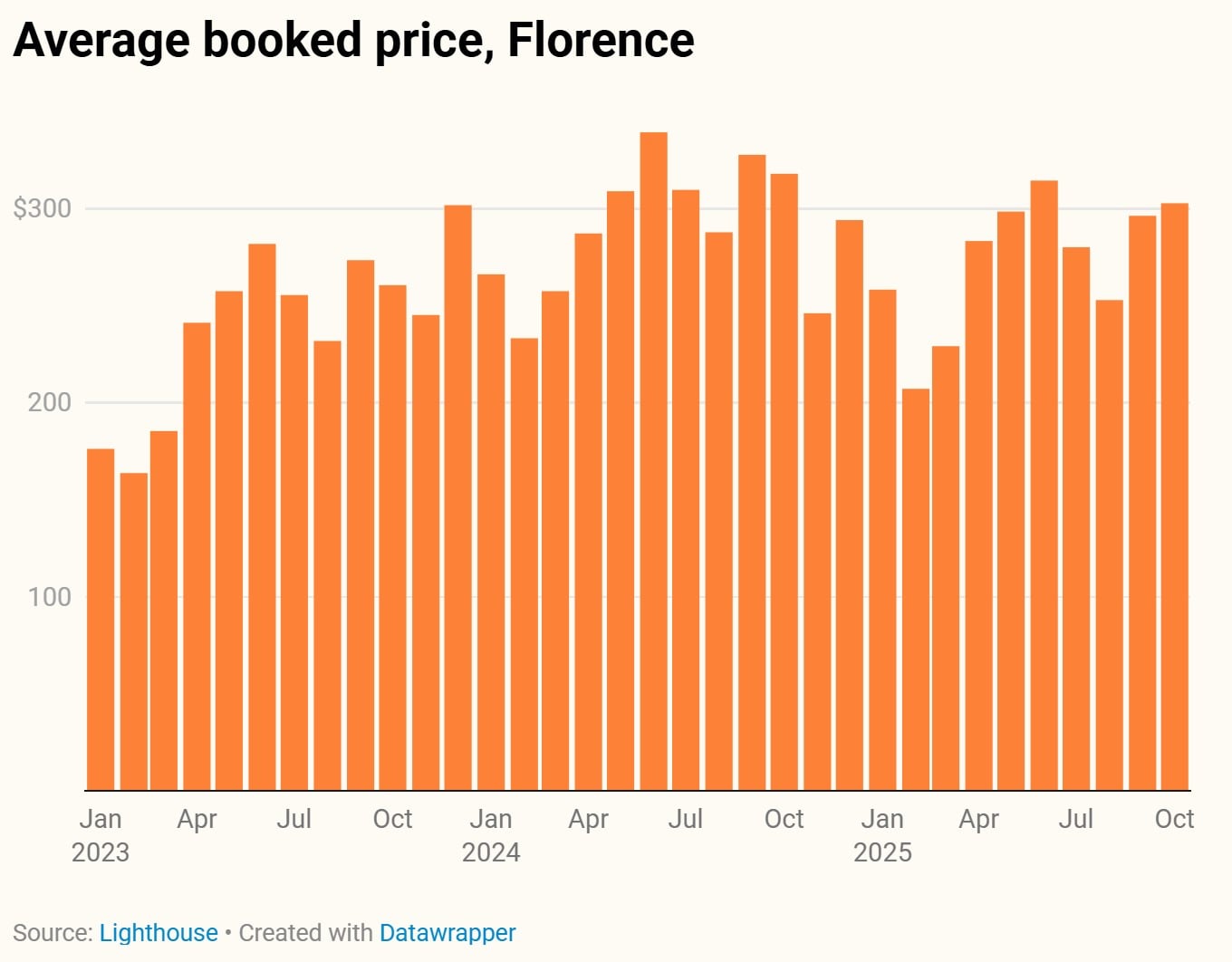

Meanwhile, booked prices continue to grow, particularly during the peak travel months.

Through October, the 2025 average of $272.35 represented a 6% decline from the 2024 average of $289.73. This contraction was driven primarily by a reduction in peak pricing; whereas 2024 monthly averages frequently exceeded $300 -reaching highs of $339 - 2025 prices surpassed that threshold only twice, in June ($314.60) and October ($302.90).

Despite this, prices remain elevated relative to earlier years.

Vancouver

Short-term rental regulation in Vancouver

Vancouver has restricted short-term rentals to primary residences, with the aim of removing investor-owned units from the market.

- Short-term rentals are limited to a host’s principal residence or a secondary suite on the same property.

- In May 2024, British Columbia strengthened enforcement, effectively banning “investment condos” from operating as STRs.

- The framework applies across the province, including Vancouver and Victoria.

Market performance snapshot

Following the tightening of provincial enforcement, Vancouver’s short-term rental supply has declined modestly.

Total listings fell from 3,427 in May 2024 to 2,965 by October 2025, a reduction of approximately 13.5%, indicating a smaller but still active market.

Occupancy in Vancouver remains highly seasonal, with occupancy building into summer and softening through late autumn and winter.

Average annual occupancy has stepped down each year in the series:

- 2022: 48.07%

- 2023: 44.98%

- 2024: 40.45%

- 2025 (Jan-Oct): 36.32%

Peak summer occupancy remained relatively high but was lower year over year in 2025:

- July: 49.3% (2024) compared to 44.6% (2025) (-4.7 pts)

- August: 49.4% (2024) compared to 45.1% (2025) (-4.3 pts)

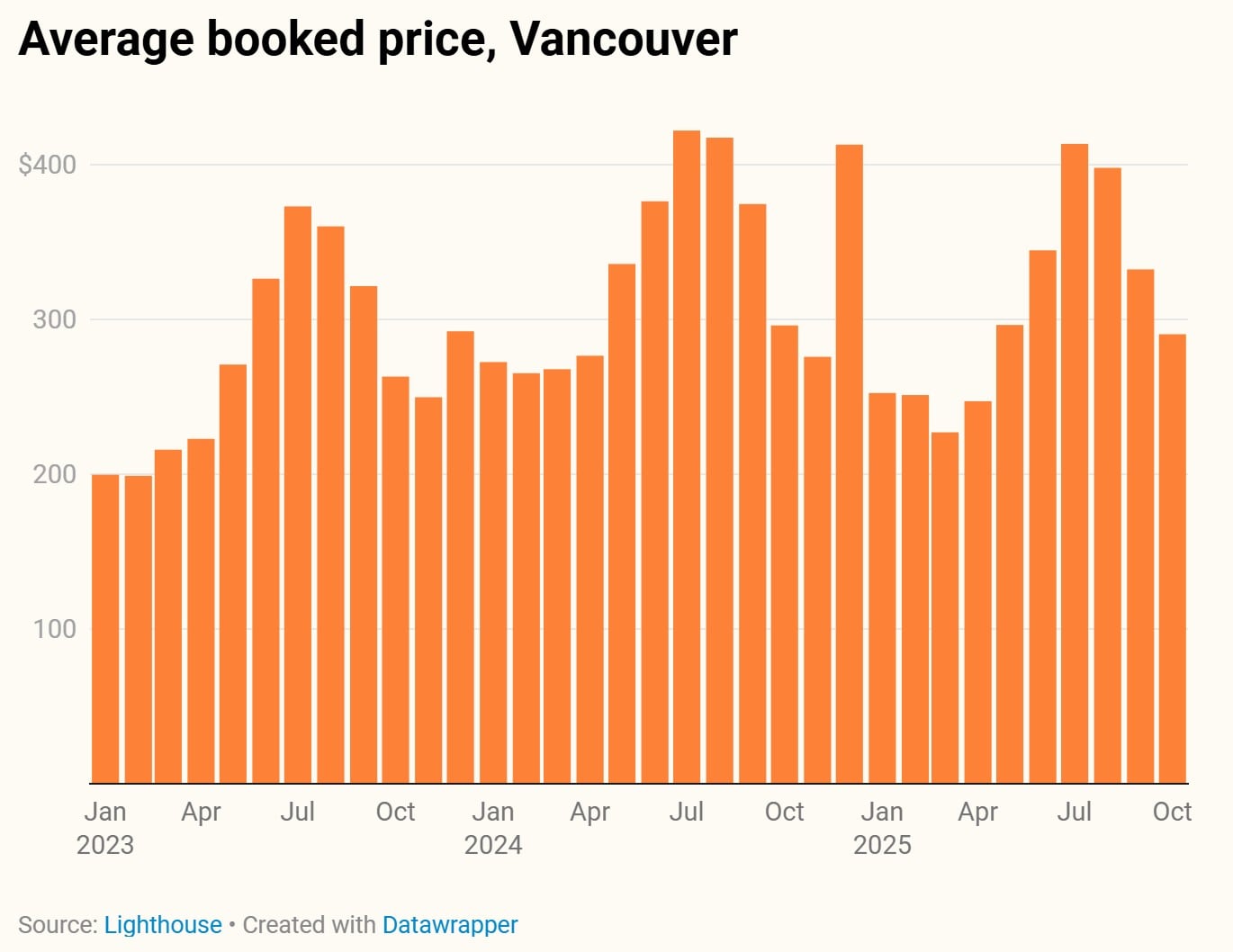

Booked prices in Vancouver are highly seasonal, rising sharply through peak summer demand and easing into shoulder and winter periods.

Vancouver’s peak booked price in 2024 occurred in July ($422.10), with August also above $400 ($417.50).

In 2025, summer peaks were slightly lower: $413.50 in July and $398.00 in August.

Year over year, peak-month pricing moderated:

- July: $422.10 (2024) to $413.50 (2025) (-2.0%)

- August: $417.50 (2024) to $398.00 (2025) (-4.7%)

Dubai

Short-term rental regulation in Dubai

Dubai regulates short-term rentals through a mandatory registration and permitting system overseen by the Department of Economy and Tourism (DET).

- All holiday homes must be licensed, and operators are required to comply with property standards and registration rules.

- In 2025, enforcement was tightened, with increased scrutiny of unlicensed listings, updated registration fees, and stricter requirements around permit and QR code display at the property level.

- The regulatory framework focuses on formal registration and compliance rather than limiting the number of short-term rentals or imposing usage caps.

Market performance snapshot

- Despite tighter enforcement in 2025, Dubai continues to operate at scale as a short-term rental market.

- At the start of January 2025, Dubai recorded 40,464 active listings. By October 2025, supply stood at 39,176 listings, representing a decline of 3.2% over that period, while still retaining a huge supply of short-term rentals, relative to other markets with restrictions.

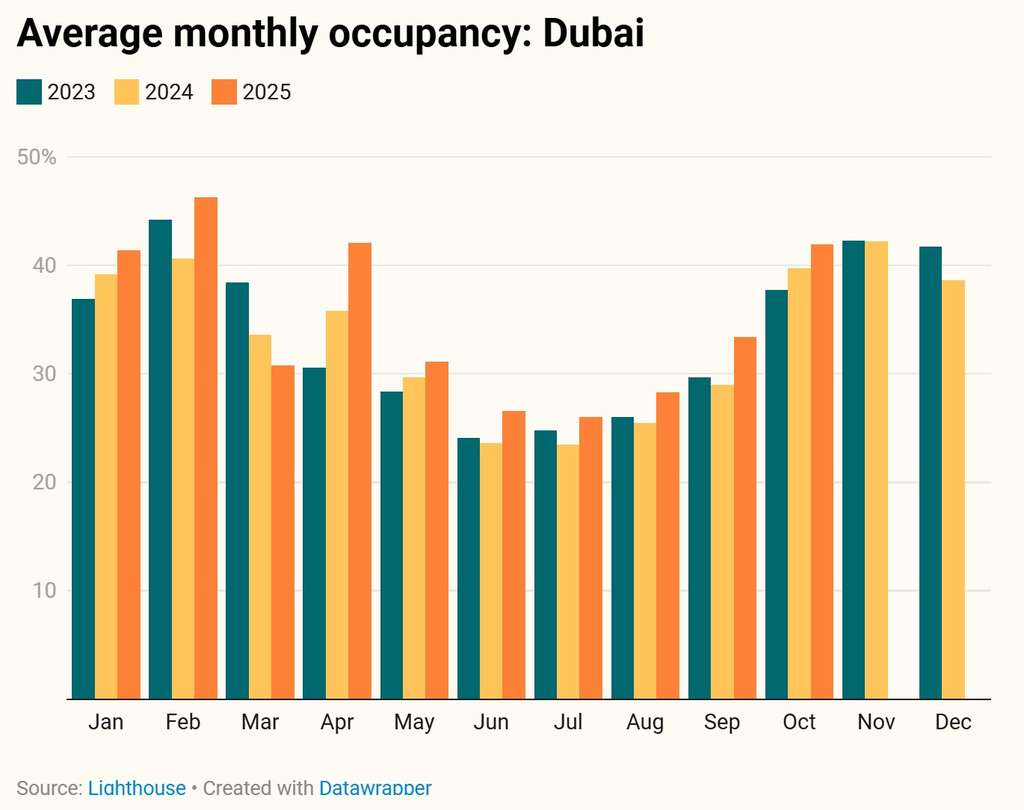

- Occupancy in Dubai is strongly seasonal, with performance closely tied to climate-driven travel patterns.

- Winter demand saw a notable uptick in 2025, with February occupancy rising to 46.3% from 40.6% the previous year. Despite this improvement, the market remains heavily seasonal; summer occupancy persists at much lower levels, down roughly 20 points from the winter peak.

- Booked prices follow a similar seasonal pattern. During the 2024 winter peak, booked prices reached $457.80 in December, while winter pricing in early 2025 peaked at $382.10 in January, representing a decline from the prior year’s highs.

- In the summer months, booked prices declined sharply, with August 2025 averaging $182.90, while in August 2024, the average booked price was $228.50.

- The data shows a market characterized by large supply, stronger winter occupancy, and pronounced seasonal swings in both occupancy and pricing, with modest supply contraction following tighter enforcement in 2025.

Los Angeles

Short-term rental regulation in Los Angeles

Los Angeles regulates short-term rentals through a home-sharing framework that is designed to restrict STR activity primarily to primary residences rather than large-scale commercial inventory.

- In addition to the City of Los Angeles rules, Los Angeles County introduced a separate short-term rental ordinance for unincorporated areas, which took full effect on October 7, 2024.

- That county-level layer includes an annual registration requirement, limits on unhosted stays, and restrictions on certain unit types (like ADUs or “granny flats"), adding a stricter compliance burden in the parts of the market it governs.

Market performance snapshot

Los Angeles remains a large STR market in absolute terms, but Lighthouse shows a clear change in the supply trajectory between 2022–2024 growth and a softer 2025.

From January 2022 (25,604 listings) to October 2025 (34,966 listings), supply increased by 36.6%, reflecting significant market expansion, has been flatter to slightly down more recently: October 2024 recorded 35,679 listings vs 34,966 in October 2025 (-2.0%).

In 2025, supply has eroded from its high point in January of 36,043 properties to 34,966 by October.

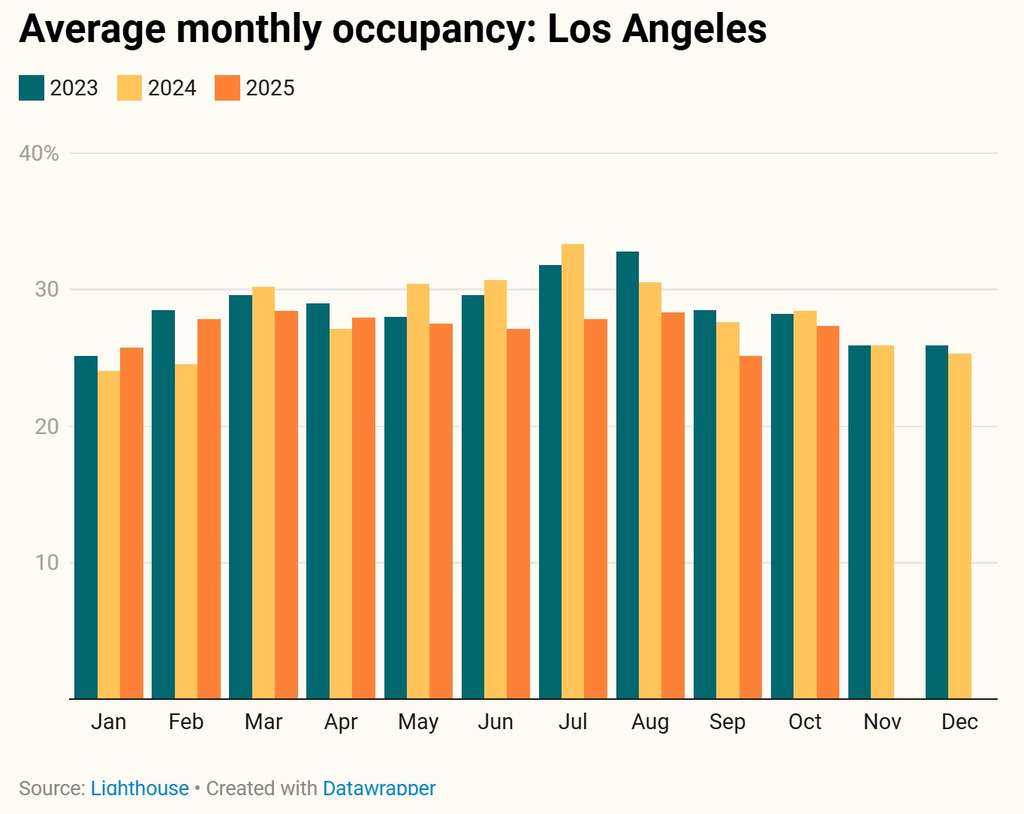

Short-term rental occupancy in Los Angeles is relatively stable, with some seasonality showing a lift in occupancy in the spring and summer months.

The monthly range tightened in 2025 versus prior years: occupancy ran from 25.1% (September) to 28.4% (March) in 2025, compared with wider seasonal highs in 2023–2024 (for example, 32.8% in August 2023 and 33.3% in July 2024).

Average booked price increased meaningfully into 2024, then eased in 2025:

- 2023 average booked price: $407.27

- 2024 average booked price: $470.83 (+15.6% vs 2023)

- 2025 (Jan-Oct) average booked price: $413.24 (-12.2% vs 2024)

Peak pricing was strongest in 2024, with the high at $550.30 (July 2024) and $521.70 (August 2024). In 2025 Jan-Oct, the highest month was $468.50 (January 2025), while the lowest was $367.60 (September 2025).

France

Short-term rental regulation in France

France strengthened its national short-term rental framework in late 2024 through La Loi Le Meur.

- The law allows municipalities to reduce the annual cap on primary residence rentals from 120 nights to 90 nights.

- It also introduces stricter energy efficiency requirements and reduces the tax allowances applied to short-term rental income.

- These measures add regulatory and financial constraints but stop short of enacting a nationwide ban on short-term rentals.

Market performance snapshot

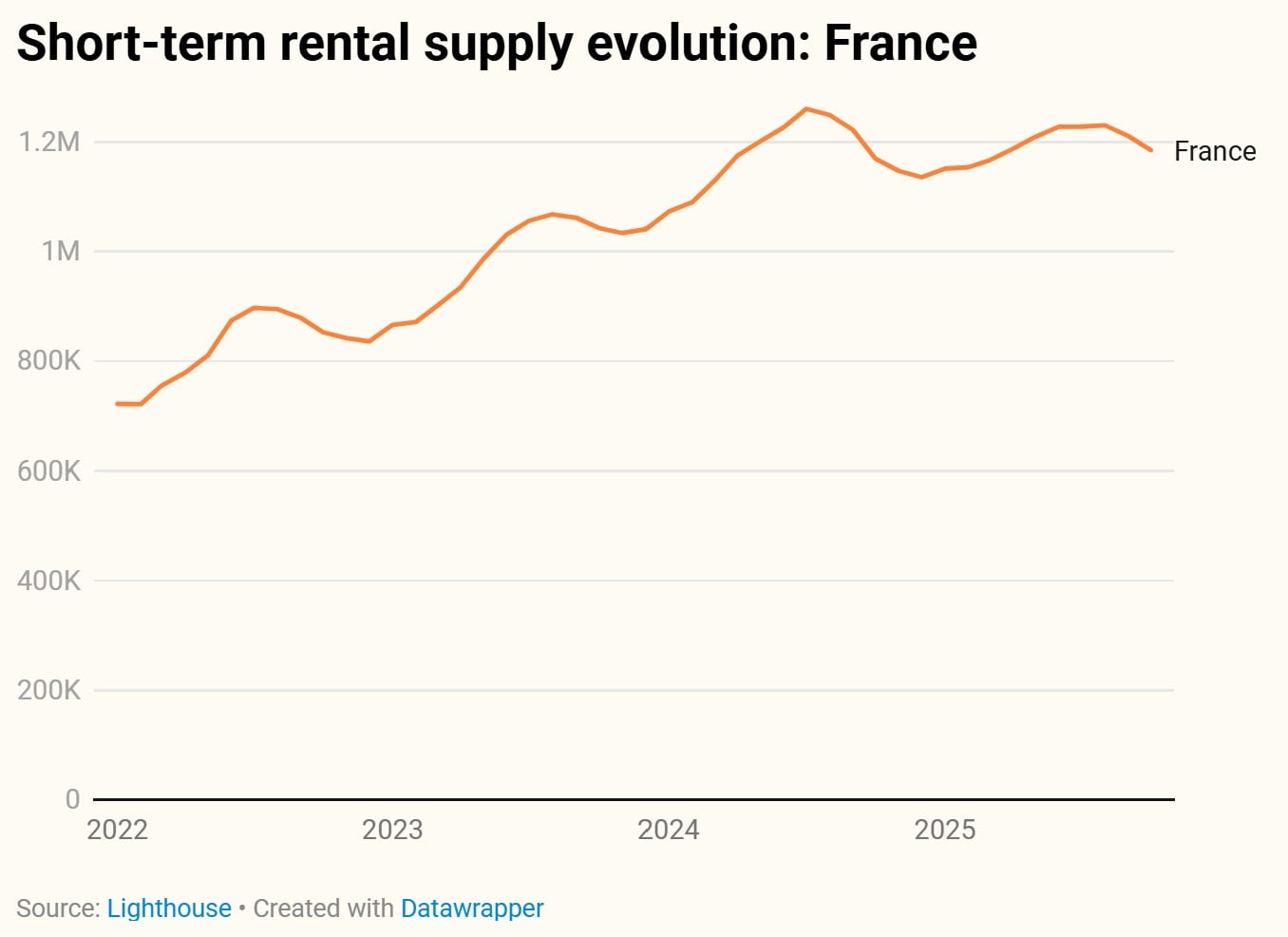

With 1,184,868 properties, France remains one of the largest short-term rental markets globally.

National supply continued to grow through 2024, peaking at 1.26 million listings in July 2024 (during the Paris Olympics), before trending lower through 2025.

Occupancy follows a strong seasonal pattern, driven by summer travel demand.

Average annual occupancy peaked in 2023 (38.4%), before moderating slightly in 2024 (34.5%) and 2025 Jan-Oct (29.0%), reflecting a softer 2025 peak season relative to prior years.

Booked prices increased materially between 2022 and 2024, particularly during summer months.

- 2023 peak booked price: $205.70 (August)

- 2024 peak booked prices: $241.90 (August)

- 2025 peak booked prices: $216.30 (August)

Saudi Arabia

Short-term rental regulation in Saudi Arabia

As part of its tourism strategy, Saudi Arabia has implemented a strict licensing framework.

- Hosts are required to obtain a Tourism License through the official government portal to operate legally.

- In March 2025, the Ministry of Tourism intensified enforcement, requiring digital platforms like Airbnb and Booking.com to remove listings that did not display a valid license number.

- This "clean-up" was designed to ensure quality standards and bring the sector under the oversight of the new Tourism Law.

Market performance snapshot

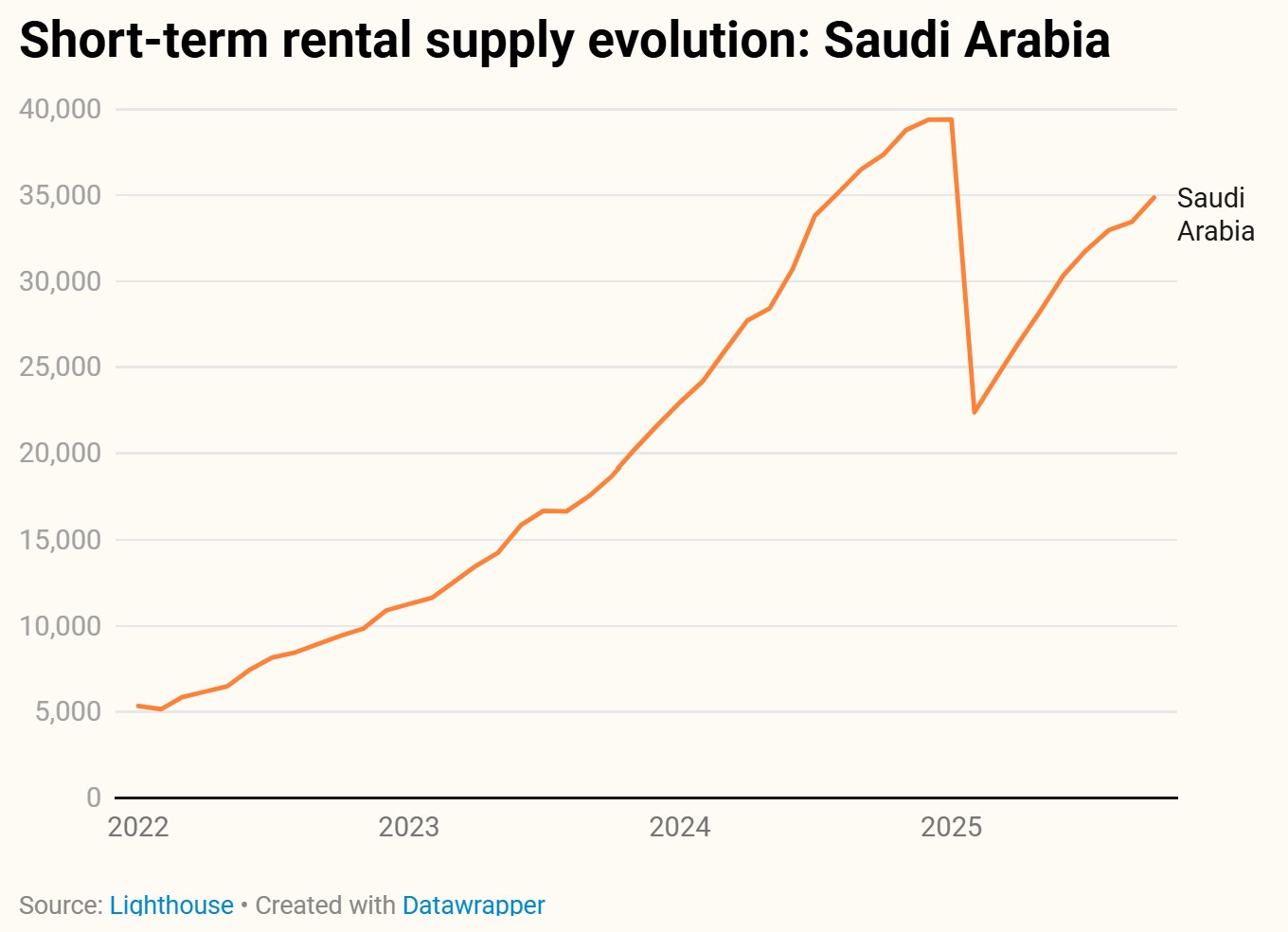

The impact of the March 2025 enforcement is visible in the supply data.

Supply peaked at 39,401 listings in January 2025. Following the crackdown, it dropped sharply to a low of 22,369 in February/March before gradually recovering.

However, as of October 2025, supply had climbed back to 34,865 listings.

Occupancy remains low relative to the other markets we analyzed, reflecting a developing sector where supply currently exceeds demand.

Average market occupancy has hovered between 11% and 19% throughout most of 2023–2025.

Booked pricing shows a seasonal element, peaking in March and April.

However, yearly average prices show a softening of prices too.

- 2025 (Jan-Oct) average booked price: $191.29

- 2024 average booked price: $196.45

- 2023 average booked price: $235.19

Closing thoughts

Across the cities and countries analysed, short-term rentals continue to operate under a wide range of regulatory frameworks. However, the data shows that regulated markets are not uniform in their outcomes, with supply, occupancy, and pricing evolving differently across locations.

In many cases, short-term rental supply has adjusted rather than disappeared, while occupancy and pricing trends remain closely tied to seasonality, destination profile, and broader travel demand.

Notably, 2025 data indicates a moderation in pricing and peak occupancy across several major markets compared to 2024, though high-demand destinations continue to command premium rates.

These patterns also reflect market behavior within regulated environments, not just the impact of the rules themselves. Macroeconomic conditions, shifting travel patterns, and local dynamics remain powerful drivers of performance.

For operators, this makes market-level visibility essential. Actively tracking market dynamics provides the practical baseline needed to set rates, plan availability, and benchmark performance.

Lighthouse’s data solutions support this by providing consistent visibility into these core indicators across markets, allowing operators to assess current conditions, track change over time, and make decisions based on market behaviour.

Managing a short-term rental business, regardless of size, requires the right data to ensure you're always competitive and can navigate the future of short-term rentals with confidence.

About Lighthouse

Lighthouse is the leading commercial platform for the travel & hospitality industry.

We transform complexity into confidence by providing actionable market insights, business intelligence, and pricing tools that maximize revenue growth.

We continually innovate to deliver the best platform for hospitality professionals to price more effectively, measure performance more efficiently, and understand the market in new ways.

Trusted by over 70,000 hotels in 185 countries, Lighthouse is the only solution that provides real-time hotel and short-term rental data in a single platform. We strive to deliver the best possible experience with unmatched customer service. We consider our clients as true partners—their success is our success.

For more information about Lighthouse, please visit: https://www.mylighthouse.com.