Insights from Our 2023-2024 Hotel Management Sentiment Survey

With the first quarter of the year behind us, our recent sentiment survey provides a snapshot of the current state of the hotel industry and a glimpse into what 2024 might hold. Benefiting from insights from hotel managers across various regions, the survey sheds light on performance expectations, operational challenges, and future forecasts.

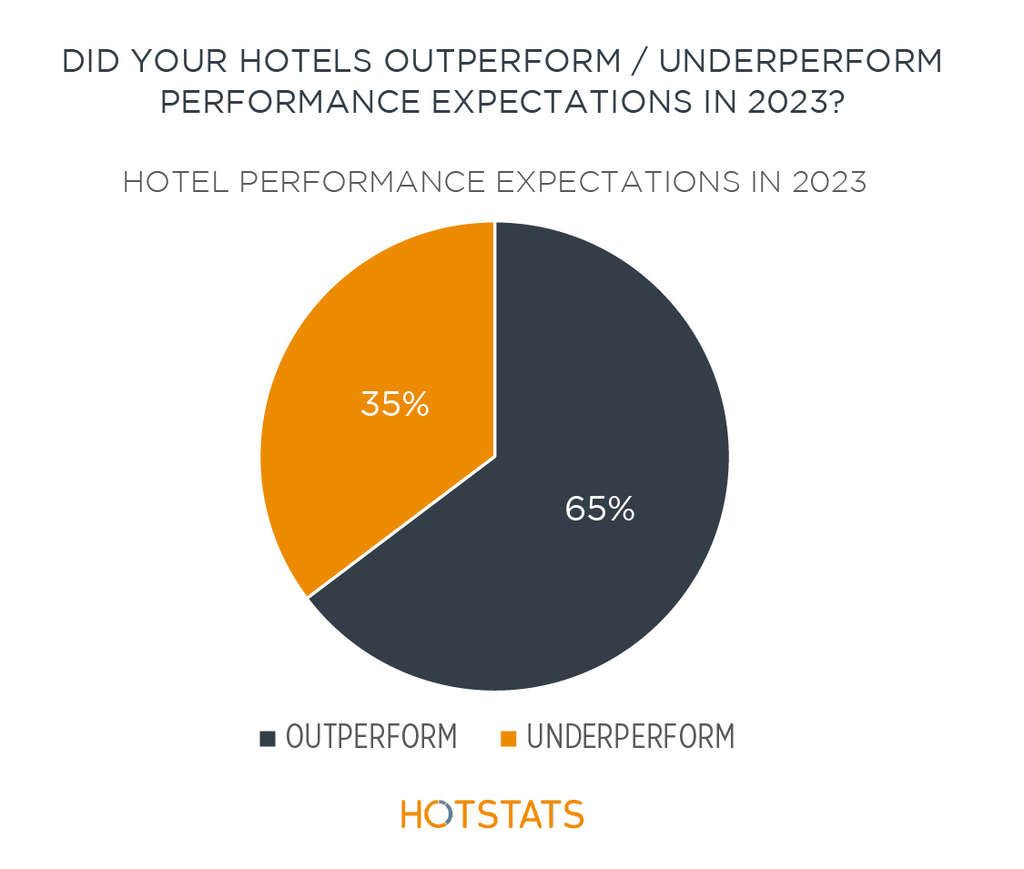

Although respondents to our 2023-24 sentiment survey painted a diverse picture of the hotel industry's performance, a general pattern of optimism emerged. The majority of hoteliers (65%) felt that they outperformed their expectations last year whereas only 35% felt that they fell short. This disparity highlights the uneven impact of global economic conditions, with some regions and hotel classes maneuvering more adeptly than others.

Even more optimism boosted their outlook for 2024, with most respondents expecting higher gross operating profits than in 2023. Conversely, hoteliers are becoming less worried about costs.

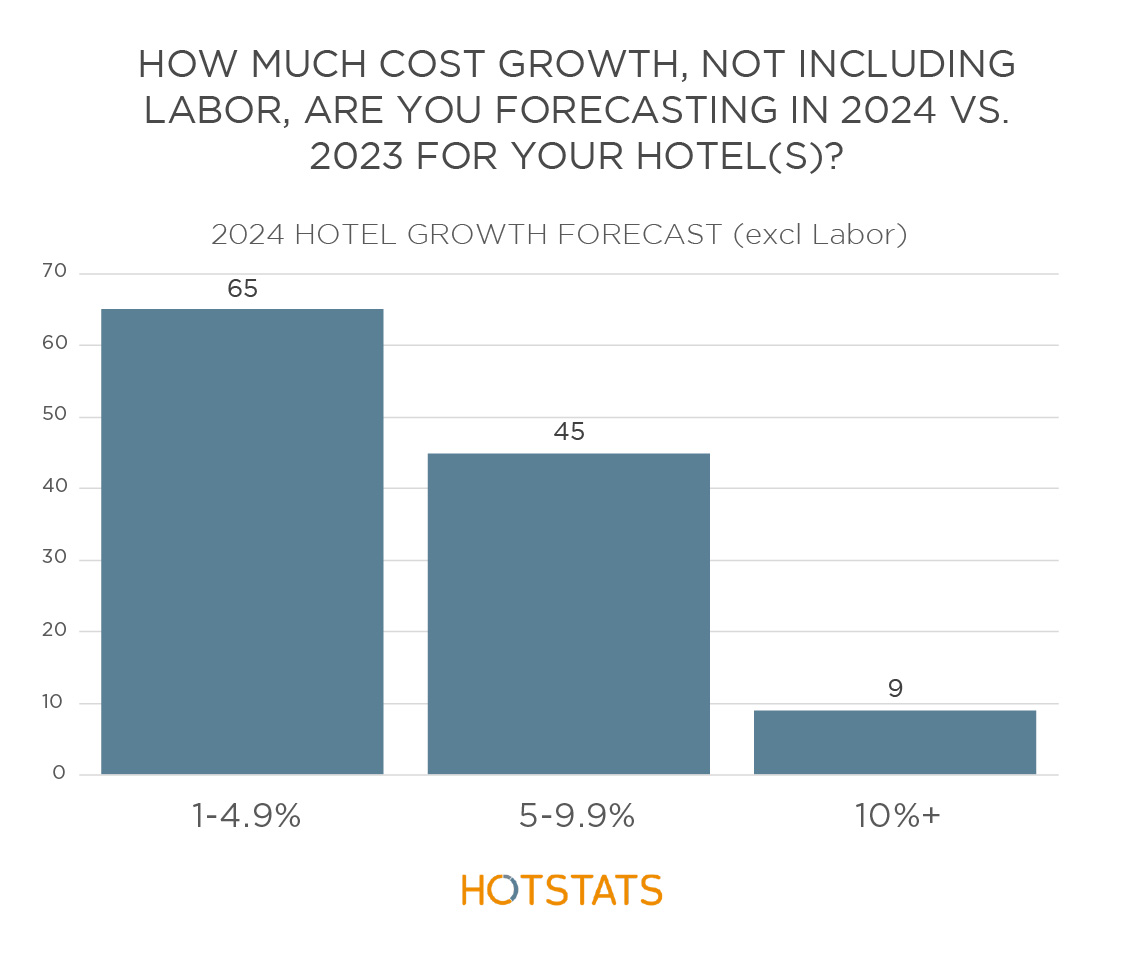

Other than labor costs, most respondents (55%) believed that 2024 would only see growth of 1-4.9% in general expenses. Only 38% of hoteliers expected costs to increase by 5-9.9%, and very few, just 7% of respondents, believe that costs will rise above 10%.

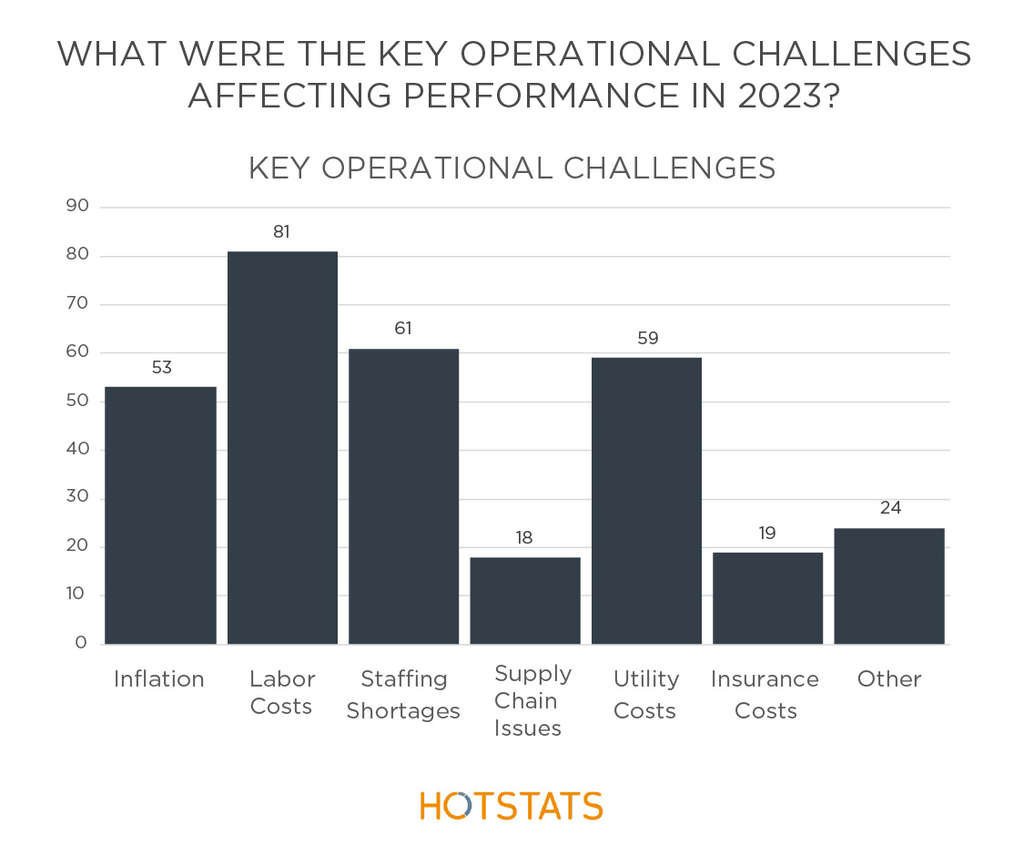

Despite the positive sentiment and unexpectedly high trading performance, broader economic trends are putting pressure on the hospitality industry. Challenges loom large, as inflation, utility costs, and staffing shortages joined labor costs to be among the top operational challenges looking back on 2023. Hoteliers generally believe that an uphill battle continues, with most forecasting labor costs to be the fastest-growing expense. A sizeable minority believe it could increase past 10%. The strain on operational capabilities emphasizes the ongoing need for strategic planning and innovation in resource management.

As we look forward into 2024, several potential challenges were highlighted that could shape the industry's trajectory. Key among these are labor costs and staffing shortages, utility costs, inflation, exchange rate fluctuations, and the looming issue of an oversupply of rooms in certain markets. Additionally, the costs associated with technological updates and geopolitical instability are expected to impact operational dynamics and strategic decision-making.

The findings of our 2023-24 sentiment survey underline the importance of adapting and innovating which will be crucial in navigating the complexities of a rapidly changing economic landscape.

For hotel managers and industry stakeholders, understanding these trends and preparing for the challenges ahead will be key to ensuring sustainable growth and profitability in 2024 and beyond.

About HotStats

HotStats provides monthly P&L benchmarking and market insight for the global hotel industry, collecting monthly detailed financial data from more than 8,500 hotels worldwide and over 100 different brands and independent hotels. HotStats provides more than 550 different KPIs covering all operating revenues, payroll, expenses, cost of sales and departmental and total hotel profitability.