Milan Hotel Market Spotlight YE SEP 2024

OVERVIEW

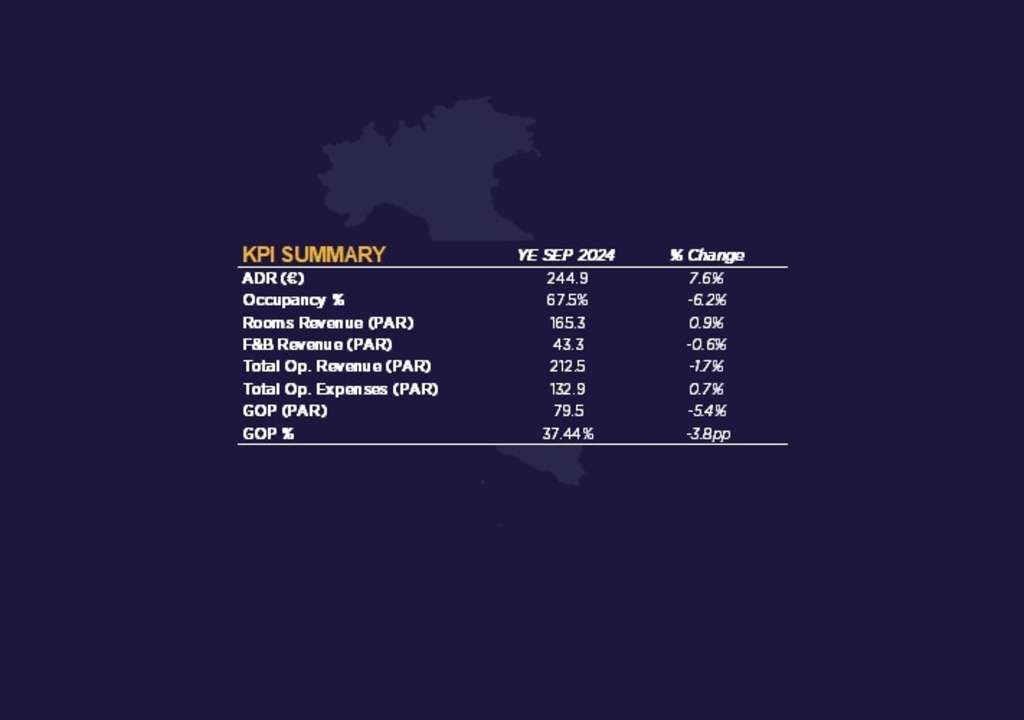

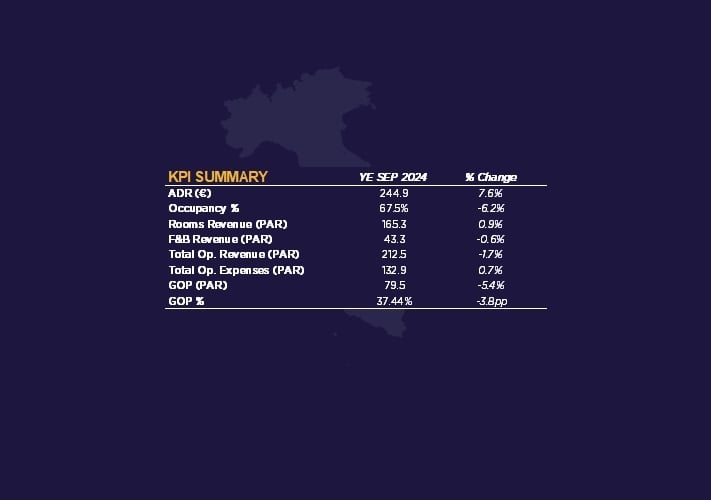

- The sample of branded full-service hotels in Milan recorded a decrease in profit during the 12 months running to September 2024. The GOP per available room (PAR) decreased by -5.4% due to a 1.7% revenue decrease and a marginal rise in expenses (+0.7%).

- Rooms Revenue recorded a modest increase of 0.9%, due to a 7.6% growth in ADR and despite a 6.2% decline in occupancy. F&B revenue decreased by 0.6%, reaching €64 per occupied room (POR). Additionally, Other & Minor Operated revenues dropped significantly by -62.2%.

- Occupancy rates in 2024 were significantly impacted by the slow months of June, August, and September, each facing a decline compared to last year (-11.2%, -10% and -11.1%, respectively). This was partially due to the opening of 481 new rooms during YE September 2024, which resulted in a 1.8% increase in total supply.

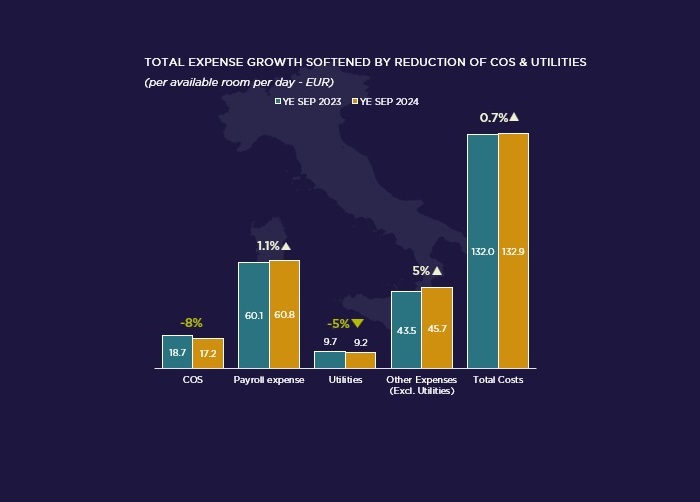

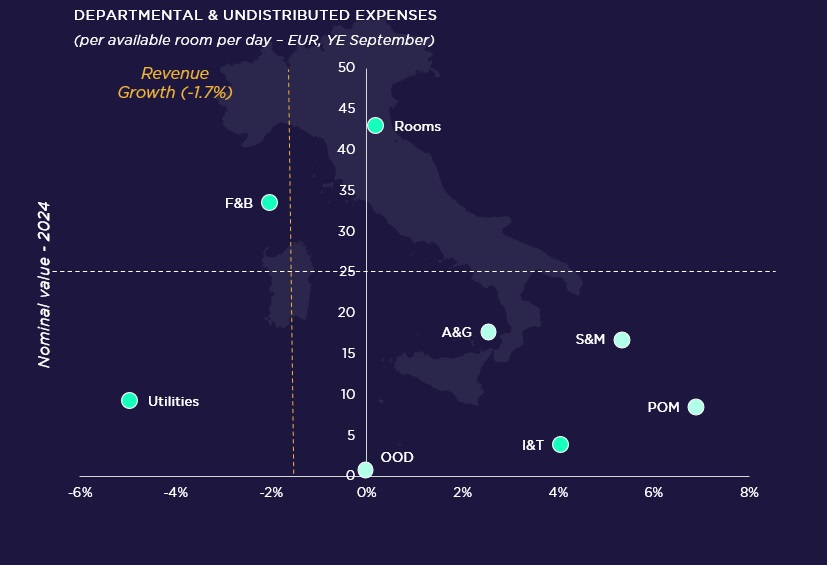

- The primary driver of expense growth was the Other Expenses department (+€2.2 PAR), followed by Payroll (+€0.7 PAR). However, this growth was partially offset by a decline in Cost of Sales (COS) by €1.5 PAR and a reduction in Utilities expenses of €0.48 PAR.

- The declining revenue, combined with rising expenses, decreased the GOP margin from 38.9% in YE Sep 2023 to 37.4% in YE Sep 2024.

COST OF SALES

- Total cost of sales recorded a drop by -8%, from €19 to €17 PAR, driven by Rooms and F&B departments (-8.1% and -8.2%, respectively).

PAYROLL COSTS

- Total payroll costs registered a slight growth compared to last year (+1.1%), increasing from €60 to €61 PAR. This was driven by the S&M department, where labor cost increased by €0.85 PAR, followed by a €0.55 PAR increase in the POM department.

UTILITIES COSTS

- The data indicates a small decline in utility costs by €0.48 PAR. This was mainly driven by the lower cost of electricity (-10.3%) and gas (-19.5%). However, there is a reported increase in other fuels (+27.3%).

OTHER EXPENSES

- Other Expenses saw the highest growth compared to last year, rising by 5% from €44 to €46 PAR. This increase was driven by a €0.87 PAR rise in Other Expenses within the S&M department and €0.73 PAR rise in Contract Services within the Rooms department.

Francesco Calia

International Partner - Head of Hospitality Italy

Cushman & Wakefield