What Is Hotel Feasibility Analysis?

Hotel Feasibility Studies

Feasibility studies are conducted by developers to analyze and confirm the optimal product to maximize market penetration, performance and the internal rate of return on investment (ROI) for the product's intended holding period. It is generally undertaken to provide objective and reliable information for the decision whether or not to pursue the project.

Developers undertake feasibility studies to determine the cost of projects, justify the investment of resources, and establish the approach to maximize profit until project exit. Separate analyses are frequently undertaken by lenders, operators and investors.

For the developer, a successful project is one that satisfies the developer's explicit objectives. A feasible project is generally one with a projected economic value greater than its cost and that will provide the required return on investment (ROI).

Feasibility studies for hotel projects call for the analysis of the demographic, geographic, economic, market and financial factors:

- Analysis of the area, demographic, and neighborhood to evaluate the local economy;

- Review of the site size, access and visibility, topography, availability of utilities and other site-related attributes;

- Review of the plans for the facility, the scope of the project, and the projected costs;

- Market analysis of the data gathered in the local and regional market;

- Estimate of project performance by projecting the occupancy rate (OCC), average daily rate (ADR), and revenue per available room (RevPAR);

- Estimate of the annual operating results by analyzing the project's scope and characteristics compared with comparable properties; and

- Calculation of the economic value through discounted cash flow or direct capitalization analysis.

They are typically conducted by independent third-party consultants who specialize in hotel projects.

Feasibility studies are conducted for various stakeholders, often with conflicting objectives, for different purposes with varying degree of detail, and for different stages of project development. For sustainable development, it must consider the interests of all project stakeholders.

Prefeasibility Studies

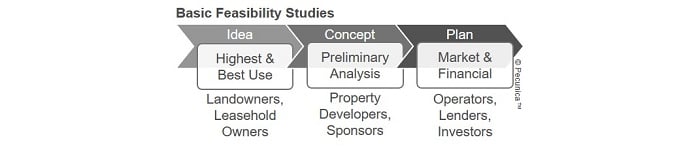

All investment projects start with opportunity definition - the exploration and identification of the project opportunity. An opportunity is typically analyzed first in a prefeasibility study to justify the investment of resources in pursuit of the project and the cost of a comprehensive feasibility analysis.

To determine the most appropriate use of vacant land or an improved property, a landowner or leasehold owner may conduct a highest and best-use study (HBU study). The purpose of an HBU study is to establish what property development is physically possible, financially feasible, maximally productive, and legally permitted.

After project concept refinement, the preliminary feasibility analysis is commonly conducted by the developer for the "go/no-go" decision and to serve as the basis for the business case. This high-level market research and analysis and investment appraisal is generally based on secondary data that can be easily collected and worked out.

A preliminary feasibility study enables exploration of potentially interesting options before deciding to proceed with the project and for preparation of the preliminary business case. It assesses the basic conceptual, economic and financial viability of the proposed project chiefly to identify the costs and benefits of each opportunity and to eliminate those opportunities that are unsuitable.

If the prefeasibility study shows that the intended project to be promising, the developer can decide to study the investment opportunity in more detail and establish the scope of the study. The prefeasibility study must be conducted before the project's design to reveal the areas that require more attention in the comprehensive feasibility study.

For the feasibility study of sustainable development projects, the developer must ensure that sustainable development principles are applied throughout the extended project life cycle. The costs and benefits of the development project to all stakeholders must be assessed during every phase of the property's life, including product disposal.

Comprehensive Feasibility Studies

A comprehensive feasibility study is an all-inclusive feasibility study that takes into consideration all aspects of a development project that can impact its success. It includes different types of studies that depend on the project's purpose and participants, any one of which could be the analyst's sole assignment in a particular situation:

- Strategy study - Analysis of the project and the development objectives, policies, plans and decision criteria;

- Legal study - Determination of the legal and political constraints and problems that may affect the project, including title, zoning and building code;

- Compatibility study - Assessment of the suitability of the development project to surrounding land uses, municipal master plans, public policies, and environmental standards;

- Architectural and engineering study - Evaluation of alternative land-use plans, structure and design alternatives, soil analysis, utility availability, etc.;

- Location and market analysis - The study of the economic base and local market or related aggregate data to determine the general suitability of the location and market for the business;

- Merchandising study - Analysis of the marketing factors for a product, such as consumers, competitive properties, sales and marketing, pricing, and absorption rate;

- Market feasibility study (MFS) - Conducted to assess or reconfirm whether or not a development concept is supported by current and future market dynamics;

- Financial-economic study - Financial analysis of the project, including cash-flow forecasts, tax and tax shelter planning, rate-of-return analysis, analysis of financing alternatives, capital budgeting analysis, cost-benefit analyses, and holding-period analysis.

The feasibility of a development project can be determined only in terms of specified constraints and given resources. The consultant reaches a conclusion on whether or not a development project is feasible based on criteria provided by the developer.

When evaluated in terms of sustainability, the comprehensive feasibility study considers all significant environmental, social and economic factors. However, the feasibility criteria vary for each stakeholder.

Copyright © 2020 Pecunica LLC. All rights reserved.