Hotel Bookings Reach Near-2019 Levels after UK & US Reopen

Swift vaccination distribution and partial reopenings in the US and UK have triggered a significant spike in hotel bookings to near-2019 levels.

With the vaccine rollout well underway, the UK has commenced phase one in the roadmap to reopening the nation's economy. As reported by the BBC, schools, and colleges reopened on March 8th. There may be up to 10,000 people permitted in stadiums by May 17th, while the target date for life back to normal (including nightclubs!) is June 21st.

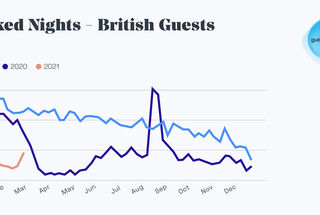

This has not only led to a massive increase in airline bookings, but Market Data published in the March 2021 edition of The Hotelier PULSE Report also shows a major increase in hotel bookings from British guests. On February 23rd, one day after British Prime Minister, Boris Johnson announced the UK roadmap to reopening the economy, hotel bookings spiked to reach 76% of bookings over the same period in 2020.

In addition, vaccination in the US is progressing at a good pace, and bookings from US guests are already very close to 2019 pre-pandemic levels. In the second week of March 2021, hotel bookings in the US increased significantly, exceeding 2020 values and comprising nearly 95% of bookings over the same period in 2019.

However, Hoteliers worldwide remain concerned with flight capacity and the impact on hotel bookings. According to Aviation & Tourism Expert, Gavin Eccles, air capacity will be plenty if demand is consistent.

Addressing the issue in the March 2021 #hotelierPULSE COLLECTIVE panel, co-hosted by Techtalk.travel, Guestcentric, and Great Hotels of the World, he said:

"If the demand is there, then the aircraft will be ready. What will be interesting is that airlines have now had to implement a short-term planning model. If we were living in normal times, airlines should really be planning for summer 2022 right now. However, the industry is planning for summer 2021, which is just 3 months away. Goes without saying that the pandemic has driven airlines and airports to ramp up their flexibility to respond to rapid market changes."

He continued, "Airlines are ready to go. Where we have a problem at the moment is with the demand. Most consumers are hesitant to take the leap of faith to book at the moment because they don't know what might be available. But as we've seen after the UK plan to reopen the economy, with a little bit of positivity and confidence, the market is booming."

Also speaking at the event, CEO of Guestcentric and Great Hotels of the World, Pedro Colaco, added: "These signals indicate that consumers are ready and eager to travel again. It seems that a little bit of good news goes a long way to instill confidence and get consumers back in the air and into hotels."

"Recovery depends on an array of factors from the number of new cases to how quickly we can achieve mass vaccination. Of course, there is still a long way to go until the whole world reaches 'Life back to Normal', but the light at the end of the tunnel is shining a little brighter each day," he concluded.

To Receive Crucial Market Data next Month, Click Here to Take the Hotelier PULSE Survey

Watch the Hotelier PULSE Highlights from our February 2021 Survey

About the Hotelier PULSE Report

Since the launch of The Hotelier PULSE Report series in April 2020, Guestcentric has surveyed hundreds of Hoteliers on key issues that remain top-of-mind since the start of the Covid-19 crisis, such as occupancy, ADR, financial recovery, Health & Safety, and redefining Sales & Marketing strategies for the future.

For the 12th Edition of The Hotelier PULSE Report, we surveyed 106 key decision-makers at hotels. General Managers represent the majority of our respondents at 34.0%, followed by Group CEOs/ Property Managers at 32.1%. The remaining respondents include Front Oce Managers (13.2%), followed by Sales Directors (9.4%), Revenue Managers (6.6%), Marketing Directors & Managers (3.7%), and IT Managers (0.9%). The overwhelming majority of our respondents come from Europe (84.9%); followed by North America (7.6%), South America and Asia (both at 2.8%), and Africa (1.9%). The 'City Center Hotel' segment is where most of our respondents come from at 45.3%, followed by Resorts (29.3%), and Bed & Breakfasts (25.5%).

Melissa Rodrigues

Content Manager

+35 196 157 3854