Tourism After Lockdown: Guest Expectations Today and Tomorrow

As vaccine programs continue across the world and we see warming attitudes toward travel alongside increased accommodation bookings, it is important to take stock and assess how the pandemic, and it’s resultant impact on consumer behavior, may leave an indelible mark on hospitality.

COVID-19 has forced us to see the world differently. Previously the hustle and bustle of busy destinations sparked excitement for many travelers, but during the crisis, personal safety concerns and social distancing led to radically different perceptions of these types of destinations and experiences. The extent to which traveler perceptions and behavior will return to pre-pandemic levels remains unknown and continues to be a fascinating subplot of the recovery.

In this blog, based on research we conducted in February 2021, we look at the experiences of travelers this year and examine attitudes about the future of hospitality.

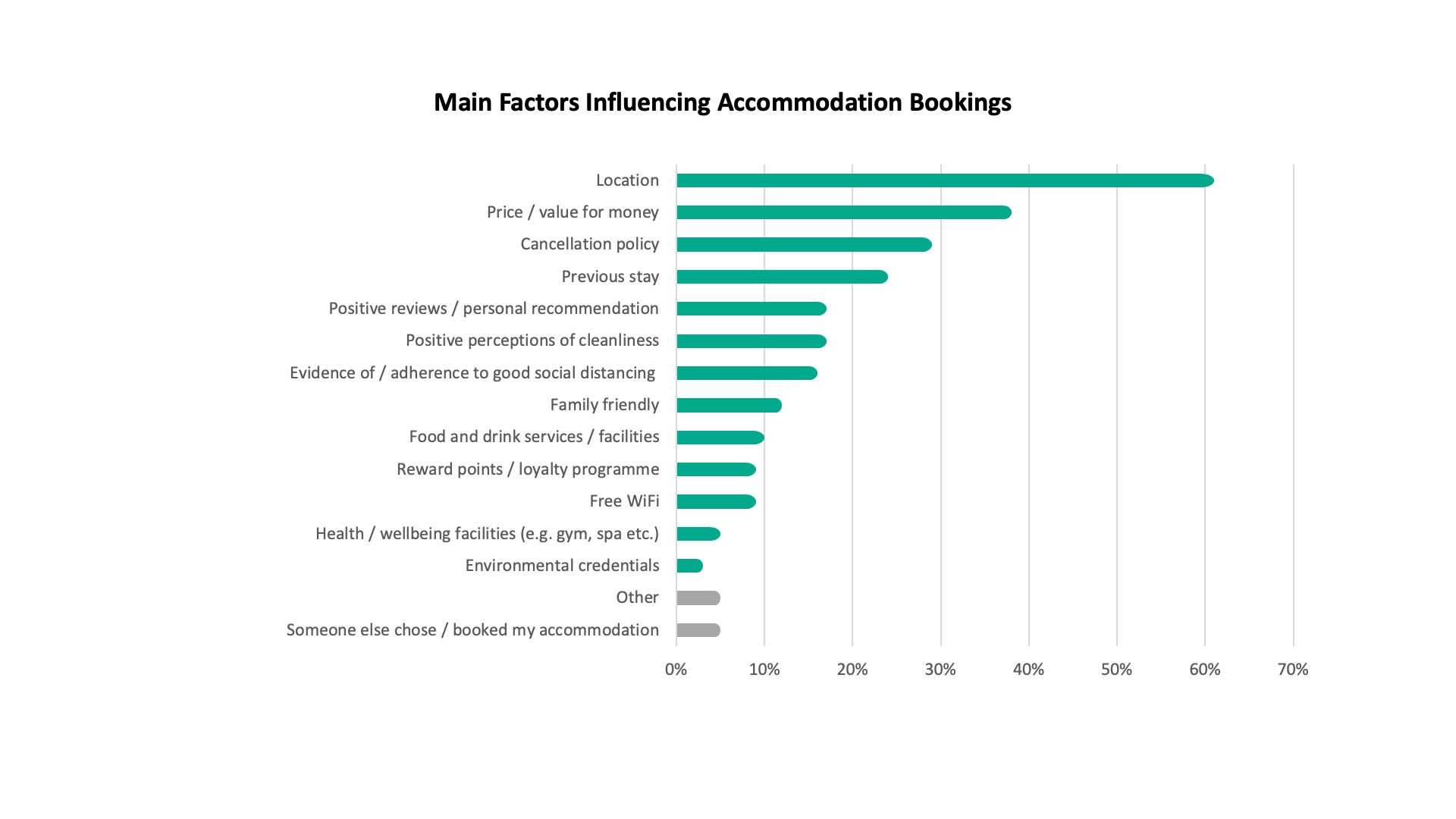

Location, price and cancellation policy

Traditional determinants of location and value for money continue to be key reasons influencing accommodation choice. This is an encouraging finding, which provides reassurance that what was relevant before COVID-19 continues to be relevant during recovery and perhaps beyond.

However, reflecting the volatile and unpredictable nature of travel in recent months, cancellation policies have become much more important than before COVID-19. Some 30% of respondents in our research stated that the accommodation provider’s cancellation policy was a main factor that influenced the booking. This was much higher than recorded in similar research we conducted in 2020. Whilst there is an expectation that travel plans will be less prone to change as we move through the recovery, increased flexibility is likely to continue to appeal to consumers going forward.

Scrambling for breakfast

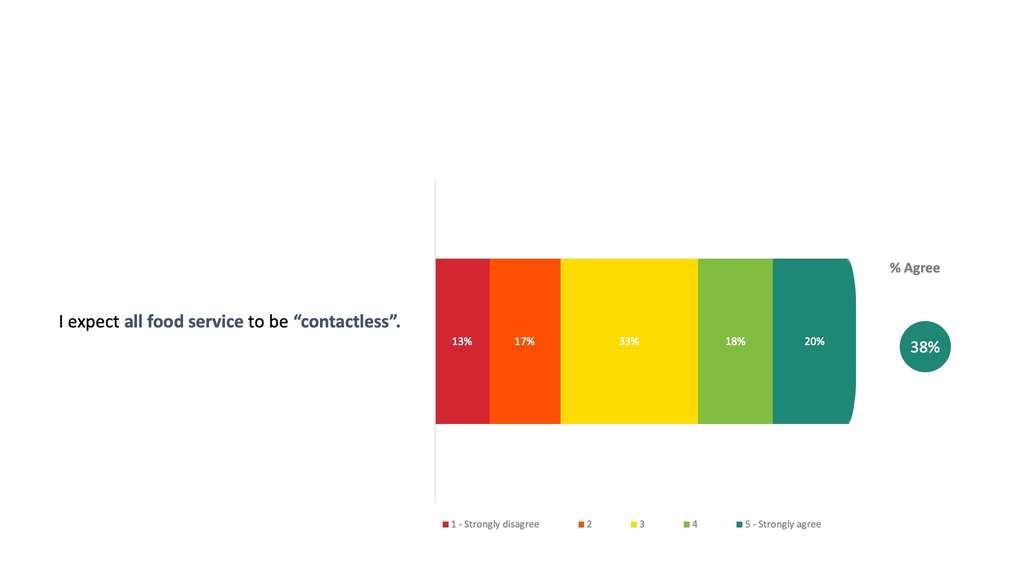

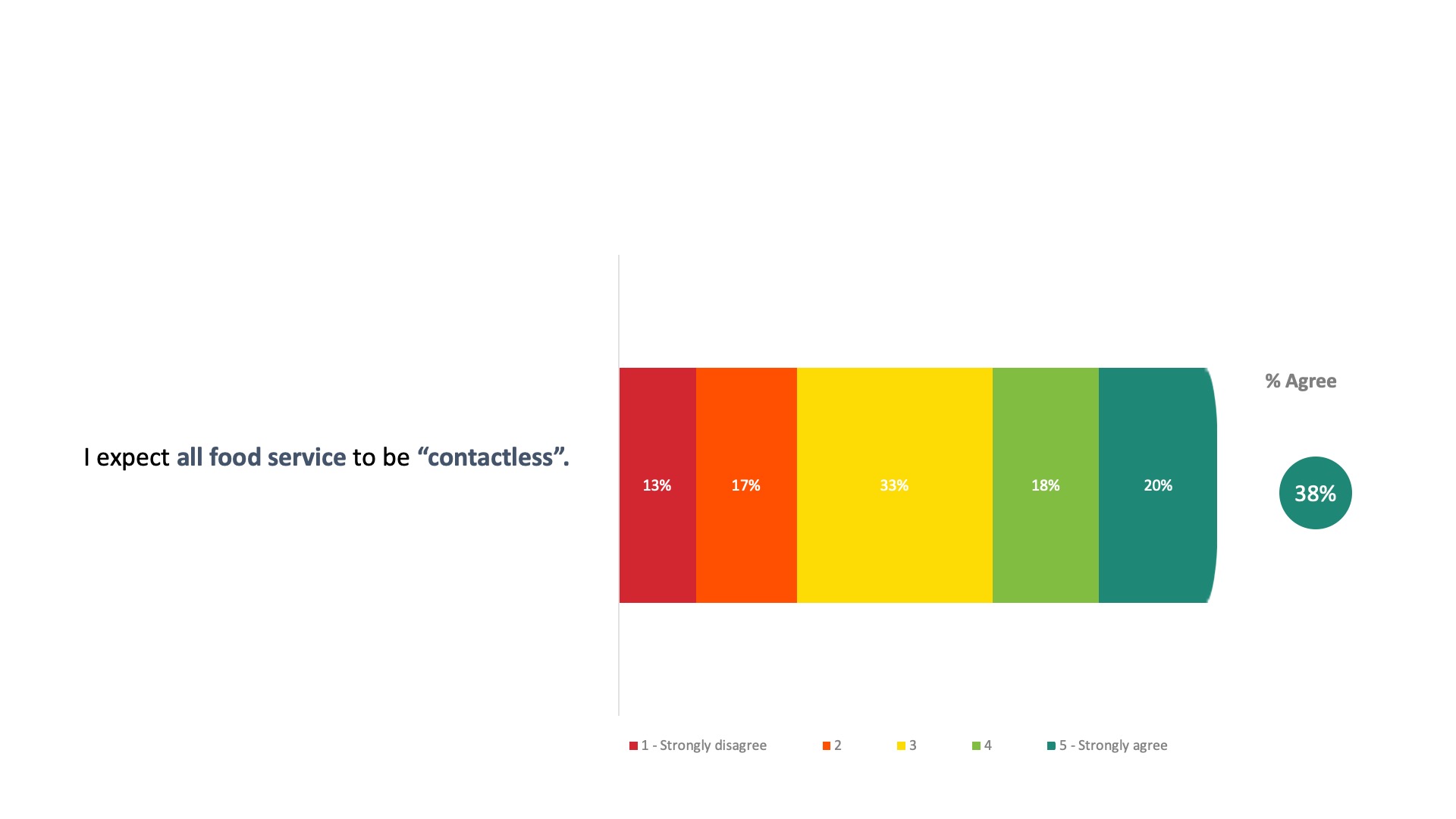

One of the many ways that COVID-19 has upended hospitality is by impacting food & beverage service. For most hotel operators, buffet breakfasts have been replaced with grab-and-go or a la carte services to minimize infection risks. But, how do consumers feel about this change?

As we see below, there is weak overall support for a completely contactless food service in hotels where guests order and pay without interacting with servers or touching shared public services.

Among North Americans, the concept has slightly higher appeal. This is likely due to a greater prevalence of limited interactions when it comes to eating and drinking among these travelers already. Increased convenience is a trend, which in recent years has contributed to the growth in morning snacks from a broader consumer perspective. So, whilst COVID-19 has forced many operators to reduce their food service offerings, it may be that for some travelers, contactless food service was already preferable before the pandemic.

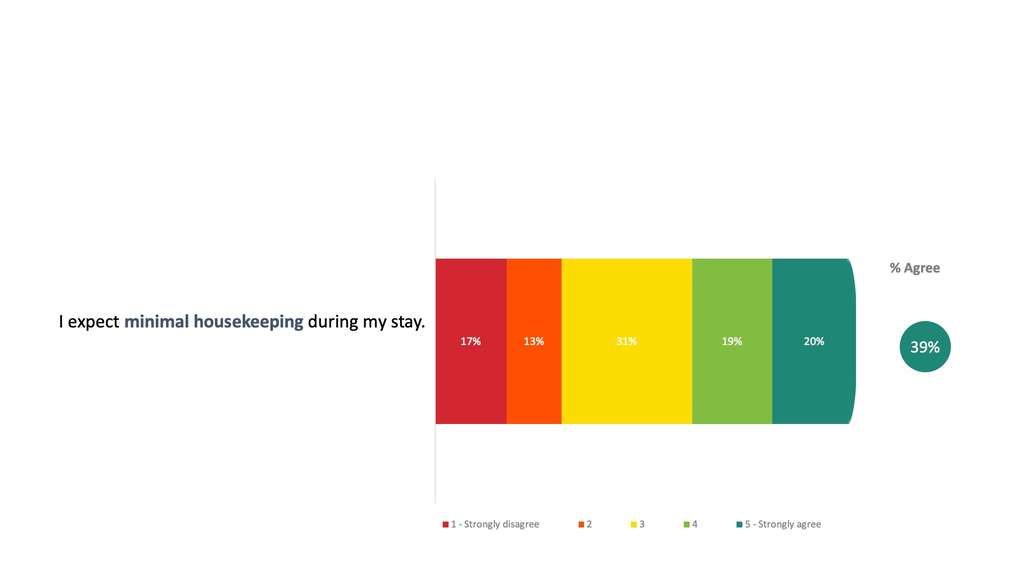

Do not disturb

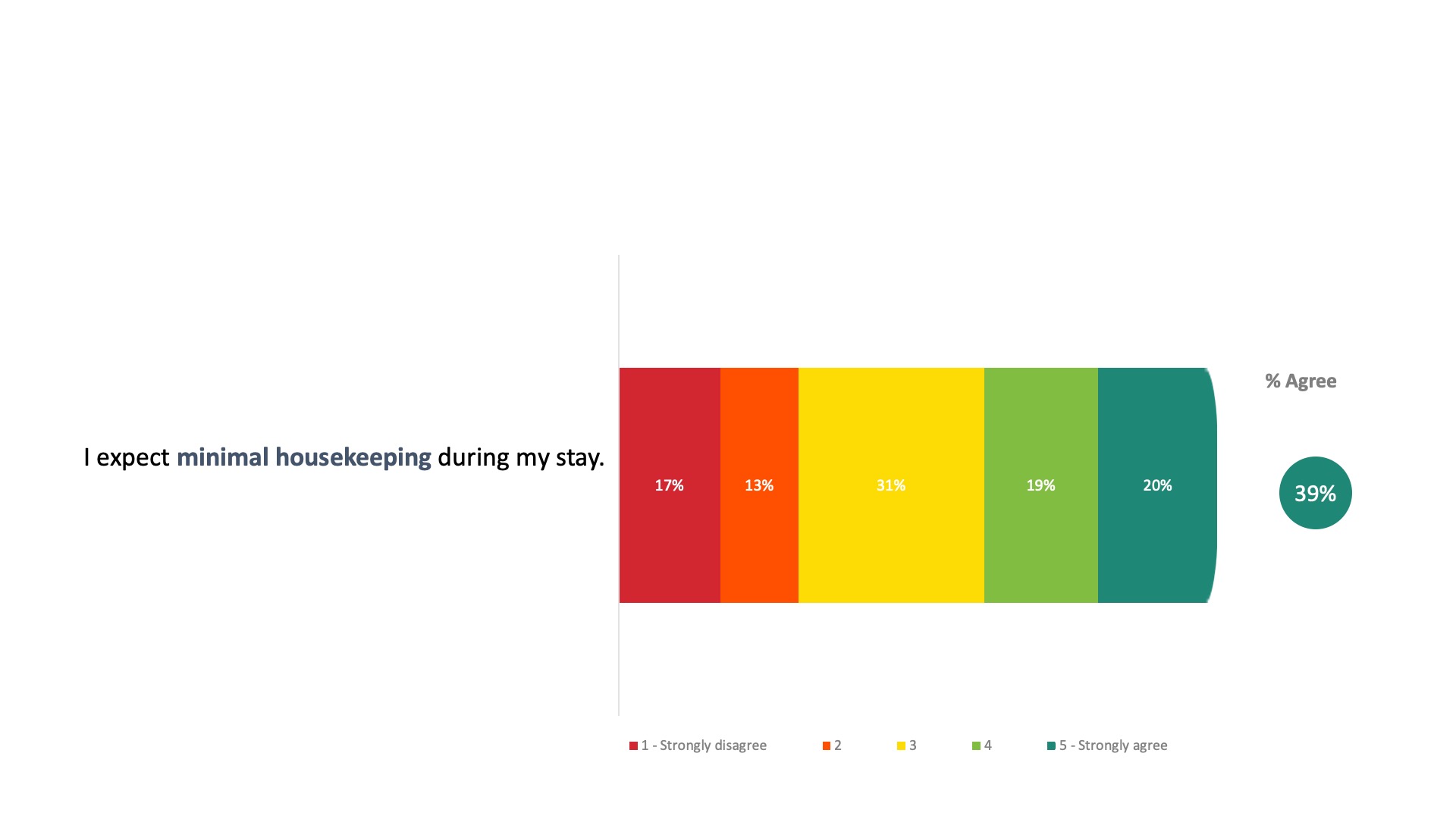

Housekeeping is another department of hospitality that has been fundamentally impacted by the pandemic. Pre-COVID-19, there was an expectation of regular and attentive room cleaning services, but concerns around infections have swayed views on the importance and necessity of fastidious housekeeping.

There is little evidence of strong support for minimal housekeeping. Around 40% of travelers agreed that they expected minimal housekeeping in the current situation. However, signaling polarized views among travelers, 30% disagreed with the statement and the remainder (31%) did not express a preference one way or the other.

What’s next?

Housekeeping and food services are just a few of many hotel operations that have been heavily influenced by COVID-19. In the current environment, some travelers seek and expect services that reduce risk and offer increased personal safety. As vaccination progress continues, it remains to be seen how hardened these expectations remain. However, there is a sense that hotel services, which require guest and staff interactions, will continue to be fundamental to hospitality experiences going forward.

If you would like to find out more about how STR can help you get closer to your customers during these volatile and uncertain times, please click here.

We were excited to share more in-depth findings during our recent Hotel Data Conference: Global Edition, which was a 13-hour event that covered APAC, Middle East & Africa, Europe, Central & South America, and North America. Purchase access to the Attendee Hub to watch more than 50 sessions and view PDFs of the presentations here. All recordings will be available through 23 June 2021.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.