Tourism After Lockdown: Hotel Guests Expect Normal in the New Normal

The Delta variant continues to disrupt the reopening of economies in many parts of the world and, indeed, some countries are grappling with previously unseen levels of infections. Consequently, a challenge with tourism right now is responding to the evolving needs of consumers. Vaccination progress has enabled international travel to restart in some countries, and after months of restrictions, many consumers have dusted off their passports to enjoy an eagerly awaited break. However, a key question remains: what are the needs and expectations of travelers as we adapt to coexisting with the virus?

July 2021 research among a sample of global consumers has uncovered negative sentiment toward travel, and despite decreasing government barriers and restrictions, many consumers have put off traveling due to lingering anxieties around factors such as infection and complicated and costly testing requirements.

Let’s now examine views and attitudes toward accommodation experiences and compare findings with our previous results. Are the consumers of today and tomorrow similar to or different from those in the pre-pandemic travel market?

Choose location, decide price, and read reviews

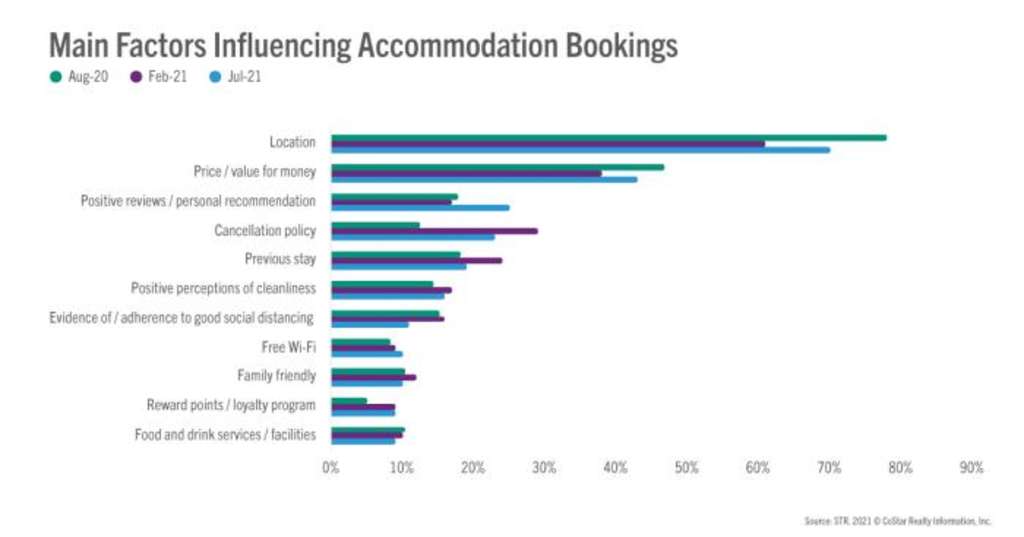

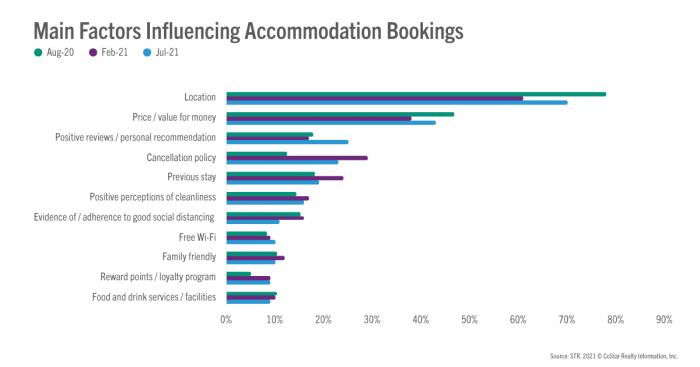

Earlier in the year, we highlighted the increasing importance of cancellation policies as ever-changing travel guidance and personal circumstances precipitated the need for more flexibility. The latest data shows that cancellation policies are still important. However, location, price and reviews are now the three key determinants when choosing accommodation. This suggests increased confidence in travel and hints at a return to a pre-pandemic rationale.

Fewer respondents compared with our February 2021 and August 2020 studies stated that COVID-19 protocols, such as effective social distancing, swayed their accommodation booking (11% versus 16% and 15%, respectively). This finding strengthens the view that consumers are now more accepting of the virus, most likely due to vaccination, compared with earlier in the pandemic.

The new normal: more space and better WiFi?

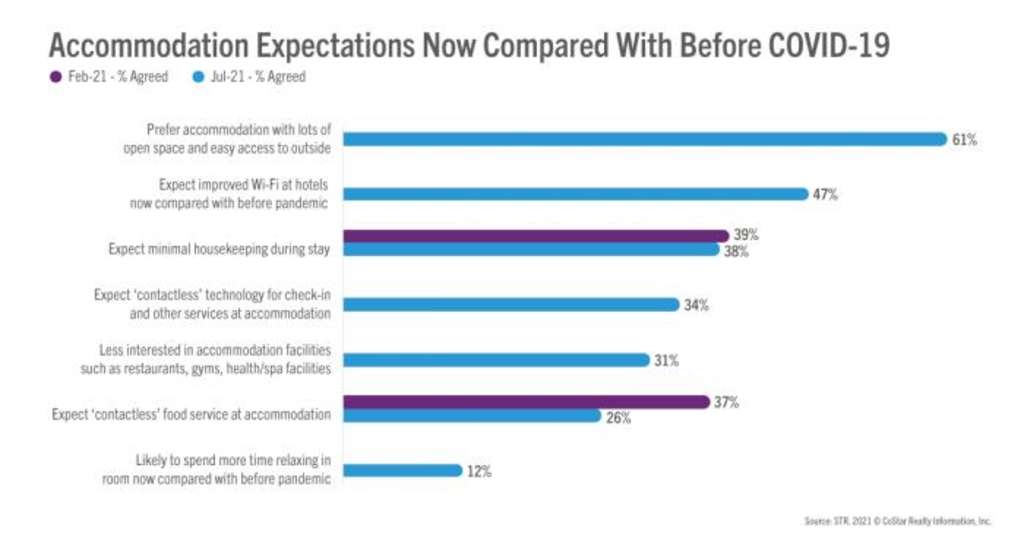

Minimalism design was a trend before the pandemic as many hotel brands decluttered rooms and communal areas to bring down costs and adapt to consumer preference. The evidence suggests that more open spaces and better use of outdoor areas will be well received by consumers today and into the future. More than 60% of respondents agreed that they preferred accommodation with these features. There was little variation in opinion by age, which suggests universal interest in more space and better access to the outside.

Working from home may have contributed to raised expectations for hotel Wi-Fi services going forward. Nearly 50% of travelers expect improved Wi-Fi now than compared with before the pandemic. Frequent business travelers placed even greater emphasis with more than 60% expecting an improvement.

Meanwhile, minimal housekeeping and contactless services, two concepts many hoteliers thought might be here to stay due to COVID, are of less interest for consumers.

Fewer than 40% of respondents agreed with statements relating to these aspects. Contactless food service, where guests order and pay without interacting with servers or touching shared public services, is one aspect which has fallen out of favour in recent months perhaps due to increased confidence in hotels.

The pandemic has forced many hotels to develop their in-room offering and services. However, there is little to suggest that consumers will want to spend more time in their room going forward – just 12% agreed that they would spend more time relaxing in their room compared with before the pandemic.

Overall, the findings suggest most consumers are seeking a resumption to normality in their hotel experiences. This will come as good news not just for revenue managers but for all hotel departments in their efforts to recover and grow beyond pre-pandemic levels.

A new focus on sustainability?

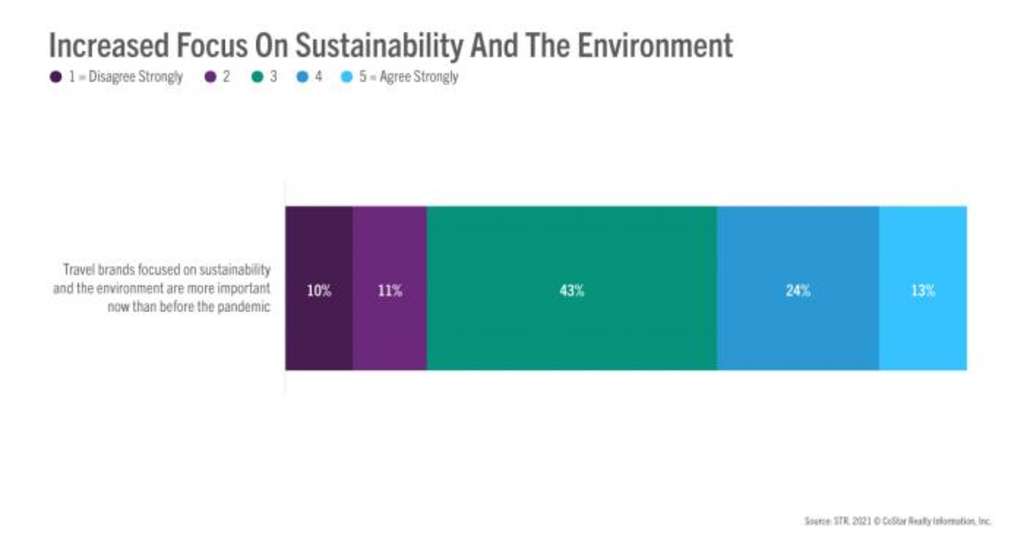

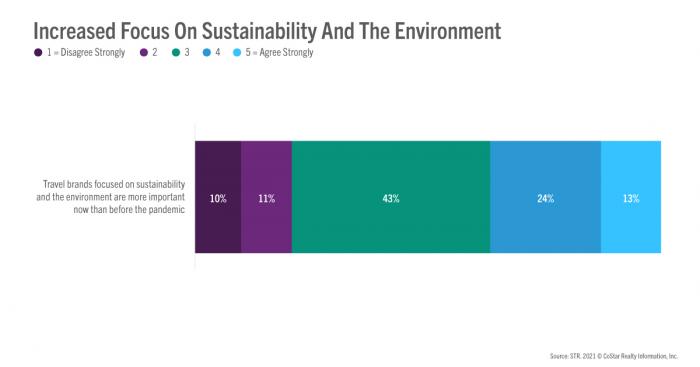

Findings thus far suggest travelers want to get back to enjoying and experiencing hospitality in the same ways as before COVID-19. The pandemic has helped shed a new light on our environment and the practices and behavior of brands. This has resulted in increased focus on sustainability and the environment in tourism. Nearly 40% of respondents agreed that eco-conscious brands are more important now. Meanwhile, for the remainder, just over 60%, there was a view that sustainability is as important now as before the pandemic.

Actions can speak louder than words so it will be interesting to monitor how the industry responds to calls for increased sustainability alongside growing demand and, for many companies, the needs to recoup losses fast due to COVID-19. The outcomes of COP-26, the UN climate change conference soon to take place in Glasgow, will have ramifications for the industry too. Developing more sustainable practices and raising awareness of these efforts is likely to be an increasingly important part of the recovery for many businesses.

If you would like to find out more about how STR can help you get closer to your customers during these volatile and uncertain times, see what we are doing with consumer research.

About STR

STR provides premium data benchmarking, analytics and marketplace insights for the global hospitality industry. Founded in 1985, STR maintains a presence in 15 countries with a corporate North American headquarters in Hendersonville, Tennessee, an international headquarters in London, and an Asia Pacific headquarters in Singapore. STR was acquired in October 2019 by CoStar Group, Inc. (NASDAQ: CSGP), the leading provider of commercial real estate information, analytics and online marketplaces. For more information, please visit str.com and costargroup.com.