Hotel Guest Satisfaction: Do you understand who loves what and why?

Examining gender, age and income differences

George Santayana, the philosopher and poet, once said, "When men and women agree, it is only in their conclusions; their reasons are always different."

The question of how much demographics play a role in the way people evaluate personal experiences is one that customer satisfaction researchers have asked for years. Are men tougher to please than women? Who is easier to satisfy? Younger people or mature people with more life experience? Are those with a higher income more demanding customers? Or are those to whom money is a more precious commodity more rigorous in their evaluations?

Hotels direct their offerings to a wide variety of customers. Some target younger guests; others pursue business travelers; still others go after families on leisure vacations. Hotels are designed to reflect value propositions based on the traveler's budget, as well as preferences for amenities. While hotel categories can be expanded further, there are four broad types of offerings: budget, midscale, upscale, and luxury.

To better understand the various categories of hotel guests, Maritz Research investigated guest satisfaction scores as part of a larger cross-sector benchmarking effort, CEBenchmarks™. Many of the findings were unexpected. The data underscore that sometimes guest demographics have a significant impact, while in other cases, the impact is minimal. While budget hotels receive the lowest ratings by all demographic groups, men appear to be much more tolerant of the shortcomings sometimes associated with budget properties than are women. Basically, most men want a clean, comfortable place to sleep, regardless of the amenities. The majority of women want more from hotel properties.

The opposite is true of luxury properties. Men do not seem to perceive added value from luxury hotels beyond what they experience at upscale properties. Women, however, do appreciate the extras a bit more. Clearly, the luxury segment needs to direct more marketing efforts, especially about extra amenities, toward women.

There is a relationship between age and satisfaction ratings, with younger guests – those 25-34 years old – giving the most critical ratings. This segment is especially difficult to please across all property levels. Those targeting lifestyle brands to this age group will have to work hard to secure their loyalty. In contrast, guests age 55 and older tend to be more pleased by hotels than their younger counterparts.

It should not be a surprise that the wealthiest guests are the most critical hotel visitors, particularly when evaluating budget properties. What perhaps is more surprising is income seems to have less impact than one might expect on evaluations of midscale and upscale properties. The implication is that midscale and upscale properties have a wider range of prospective guests who might find their properties appealing.

Across various demographic categories, Maritz Research's data shows a fairly wide rating gap between midscale and budget properties, with midscale properties being rated much higher. There is a narrower gap between midscale and upscale properties, and even less of a gap among upscale and luxury properties. This demonstrates the midscale hotel's opportunity to draw customers that usually stay in upscale hotels, as well as the upscale hotel's opportunity to draw from the luxury segment. Implicit in this, is the luxury segment's continued challenge to have a differentiated offering for which guests are willing to pay a premium rate.

The key takeaway, of course, is that hotels need to understand their value proposition and market their properties to the most appropriate guest segments. Their best customers may or may not be the most affluent, or the youngest, but there is still a good chance to foster guest loyalty among large segments of the traveler population simply by knowing core guests and what they value.

The CEBenchmarks™ Study

Nearly all hotels offer some type of guest satisfaction survey for guests to rate their experiences and provide feedback. A question that is always asked is, 'How does my score compare to others?' Another question is, 'What is a reasonable expectation for a high performing hotel in my category?' While the answer will largely depend on market dynamics, it is fair to assume a budget hotel will never be rated as high as a luxury hotel, even if it is the best hotel in its category.

Hotel managers are often compensated for achieving a certain level of guest satisfaction. Targets are usually set based on some kind of comparative standard, whether it is to historical performance, or to the performance of other properties in the chain. However, sometimes managers complain their hotels attract harder-to-please guests than others. While these assertions are difficult to support, if differences exist between how various categorical groups evaluate their stay experiences, then hotel guest composition will potentially influence ratings, and manager compensation.

As part of CEBenchmarks™, Maritz Research examined more than 9,000 recent hotel guests across the four broad categories of properties: budget, midscale, upscale, and luxury. CEBenchmarks™, which will eventually be published to include a full year of data, currently includes guest stay data collected from February 24, 2011 through September 30, 2011. The hotel participants were recruited based on a self-reported stay at any type of hotel one month prior to taking the survey. If a person reported multiple hotel stays within the past month, one stay was randomly selected for evaluation. Guests were asked to rate a range of attributes related to their stay, but their overall satisfaction rating was the main subject of our analysis.

Rating differences were tracked across three key demographics: gender, age, and income. Analysts examined whether demographic rating differences are consistent across the various hotel tiers, or whether the type of hotel has an interactive influence on rating patterns.

The sample for this study was recruited through an online panel provider. With the exception of the luxury category, which contained a large number of unbranded boutique hotels, the data was weighted to represent the incidence of people who reported staying at the various major brands, rather than simply considering the brands the survey respondents rated. This provides a more accurate, representative benchmark rating for the broader marketplace.

The focus is not on the demographic proportions themselves, but rather on the response patterns within the various demographic categories.

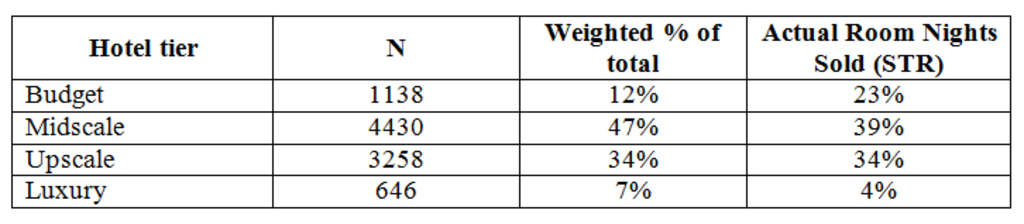

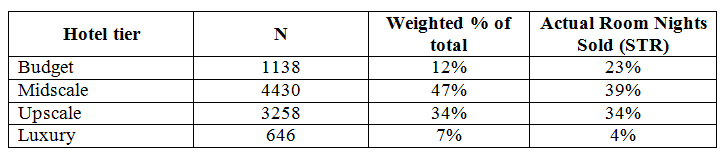

Sample breakdown by tier

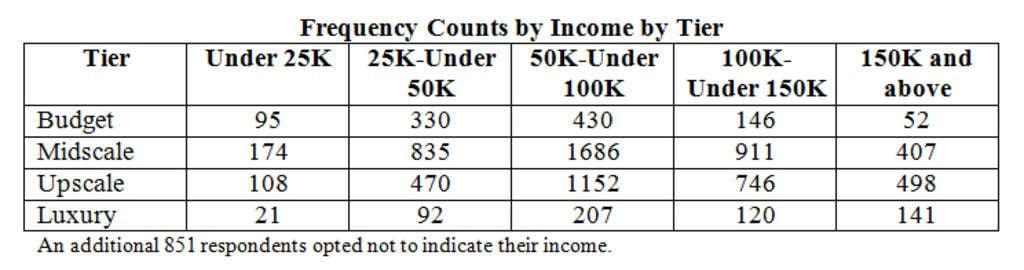

The 2011 sample leans heavily toward midscale property representation, and lighter on budget property representation, when compared to actual room nights sold, as measured by Smith Travel Research (STR). Below is a table showing the sample composition, and a comparison of percentages of room nights sold for hotel chains, excluding independents.

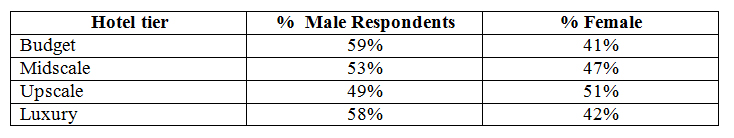

Who is easier to satisfy: Men or women?

While CEBenchmarks™ sought to achieve an equal mix of men and women, males were generally more likely to report a hotel stay within the past month. The gap was particularly large for guests who reported a stay at either a budget or luxury property.

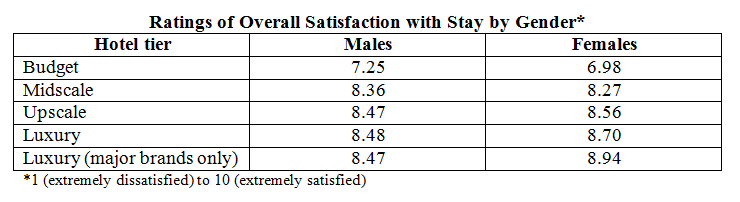

The question of whether men or women are easier or more difficult to satisfy is dependent on the type of hotel at which they stay. Men rate budget hotels significantly higher than females. At the same time, there is close rating parity in the midscale and upscale segments, indicating that gender does not play a significant role in guest satisfaction at either of these hotel types.

A particularly interesting finding is that males rate their experiences at upscale and luxury hotels virtually the same. This suggests that men who stay at luxury properties do not recognize much additional value from the higher-end accommodations and amenities in the same manner as females. Females rate luxury properties much higher than men. The difference is even greater when considering only major branded luxury hotels (e.g. Ritz-Carlton, Four Seasons, Mandarin Oriental, etc.), which women tend to rate even higher.

Do hotel guests mellow with age?

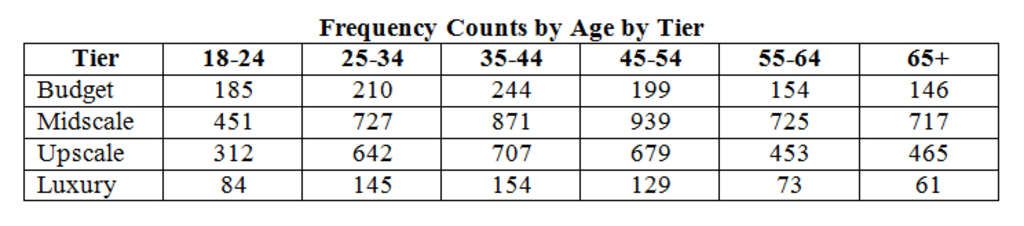

There's been much discussion in the industry around studying inter-generational differences. 'Generation Y', the youngest group of travelers, represents an attractive target since many Baby Boomers will soon retire and may travel less. For CEBenchmarks™, the age categories were broken out even more discreetly than the broad generational categories. The frequency counts by age group by tier, is shown below.

Older people are easier to satisfy

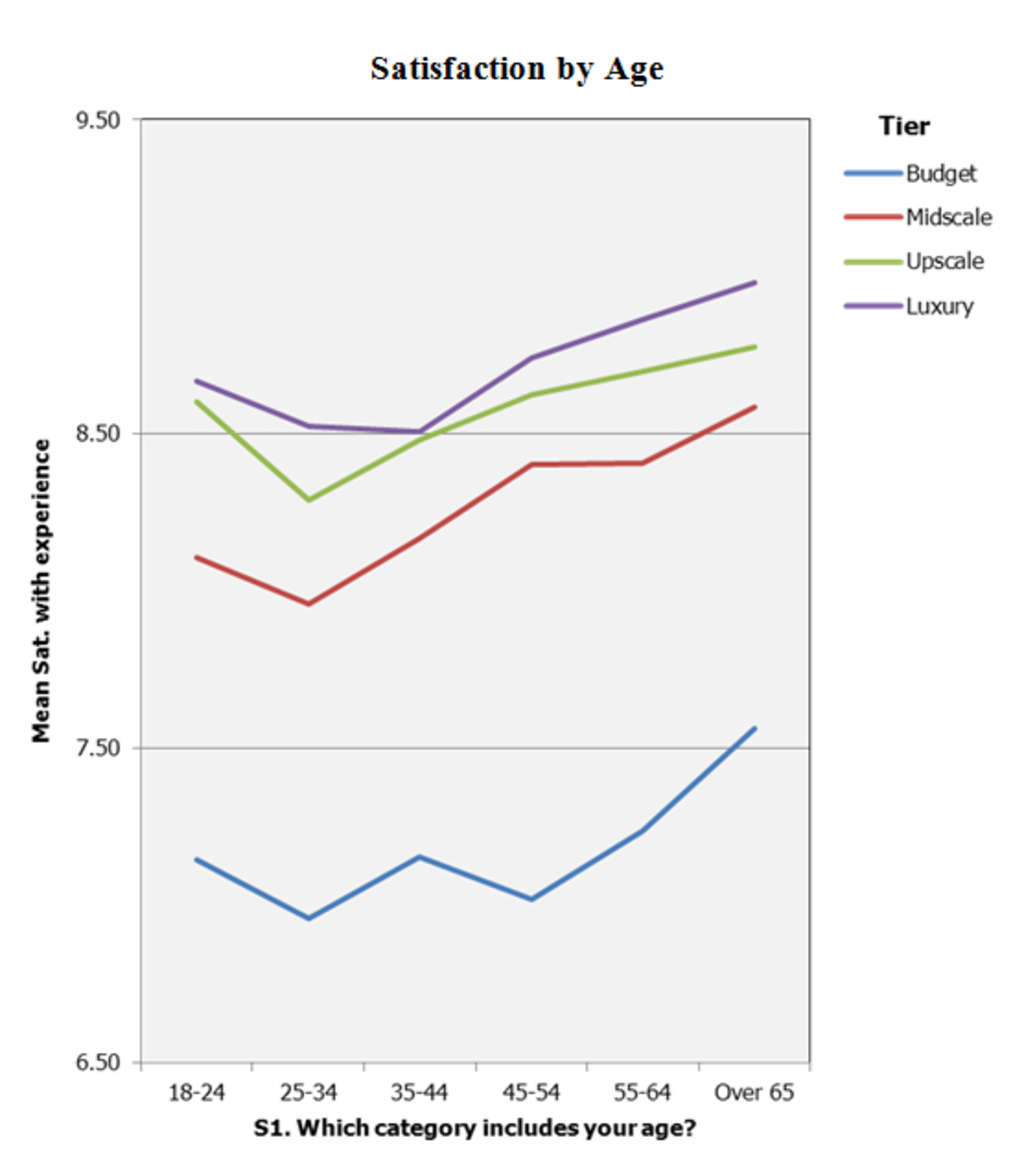

The chart "Satisfaction by Age" shows that, regardless of tier, older travelers are much more generous in their stay evaluations than younger travelers. However, generally, the most critical group is 25-34 year old guests. This is true in all categories, although in the luxury category, 35-44 year old guests are just as critical.

The finding that younger consumers are more critical is replicated in other sectors as well. Other Maritz research has shown very little loyalty among Gen-Yers, or Millennials, as they are sometimes called. Hotels targeting their offerings to this generation of travelers have their work cut out for them. They must find ways to connect with these guests on an emotional level, which isn't easy. Hotels have creatively sought to initiate this level of identification through affiliation with social causes important to this generation of travelers, as well as to design hotel experiences to resonate with shared values. However, as the data show, they've only been moderately successful at pleasing these younger customers.

How do guests view value?

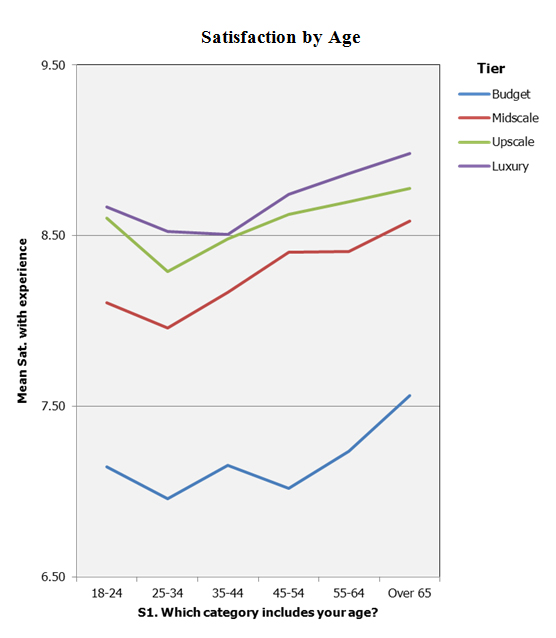

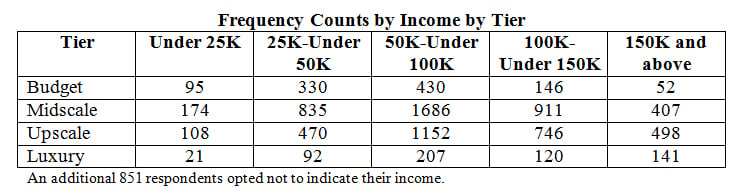

One might presume the more affluent the traveler, the more critical they will be. Another assumption may be the less affluent the traveler, the more value they demand for the money. The following table represents the frequency breakdown of income by hotel tier.

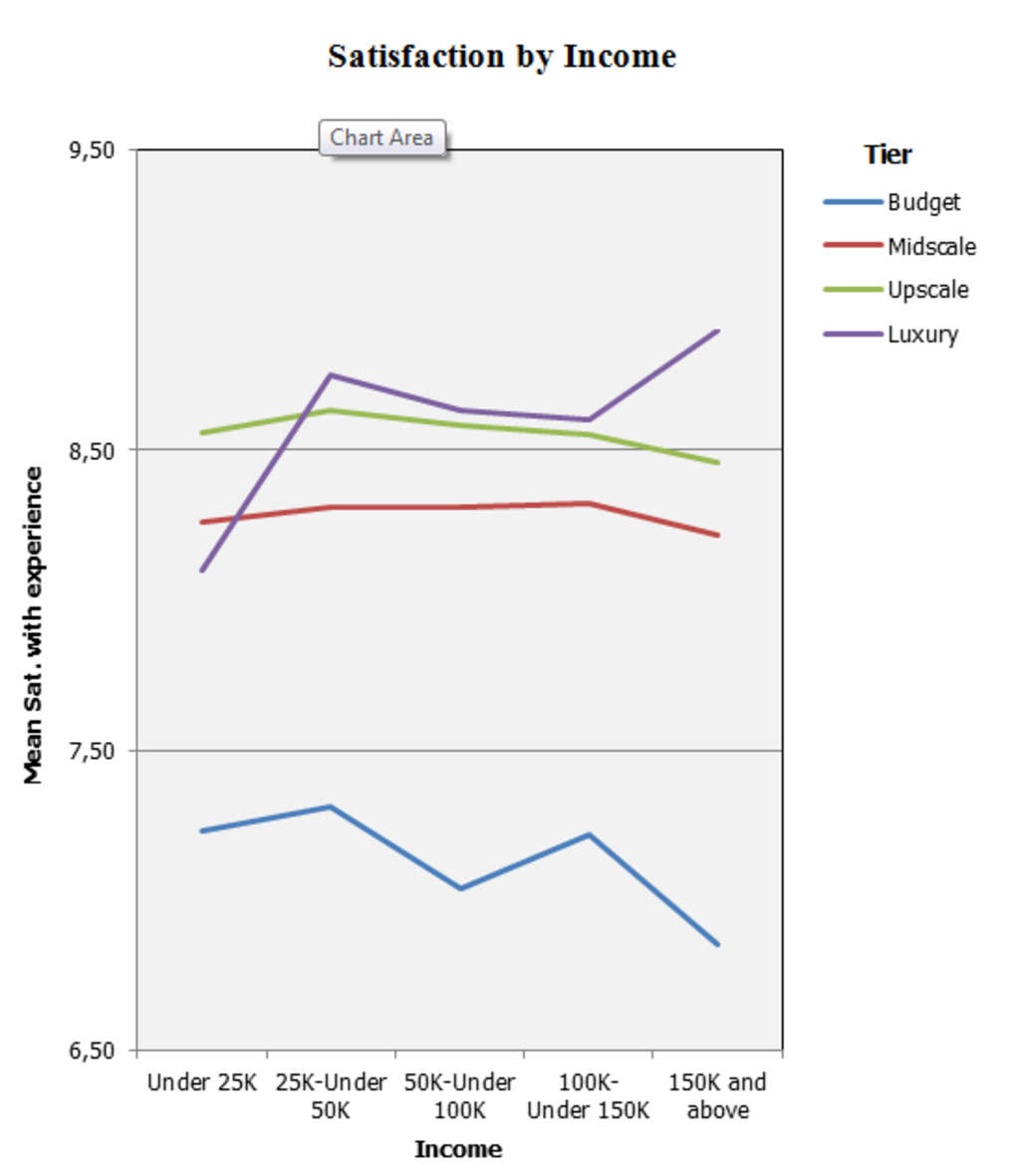

Wealthy guests are usually the tougher graders

The data show those making less than $50,000 per year are the most satisfied guests at budget hotels. This is understandable, because these hotels are designed for the budget-conscious traveler. However, there is less relationship between income levels and satisfaction levels for midscale and upscale hotels. The exception is that the highest earners are generally the most critical guests for both tiers of hotels, even though the rating differences are not as steep as in the budget segment.

The luxury segment is harder to assess. There is a large jump in satisfaction between the lowest earners (under $25,000) and those making between $25,000 and $50,000 per year. For the lowest earners, luxury hotels may cost too much to enjoy. For those with higher, but still relatively modest incomes, luxury hotels may represent a rare, but more enjoyable experience. Satisfaction then dips again in the next income categories, but rises sharply with the highest earners. This seems appropriate because luxury properties were designed with the most affluent guests in mind. It is most likely these are the guests who will appreciate the unique value proposition offered by luxury hotels.

As often found in service industries, hospitality guests are not a homogenous group, even in the various tiers of hotels. Hotel brands should continue to differentiate and fine-tune their positions with the groups that not only appreciate their offerings, but are also in a position to value these offerings appropriately.

At the same time, recognize it may take a little extra to satisfy guests who aren't necessarily the best match for your hotel. If you run a budget hotel, consider giving extra care or benefits to your female travelers. Similarly, if you have a guest between the ages of 25-34, understand this guest may need additional attention.

By knowing who your best guests are, you'll be more able to offer the services that give them the most satisfaction. It's a bet on customer loyalty that's sure to pay off.

By Rick Garlick, Ph.D. Senior Director of Consulting and Strategic Implementation, Maritz Research Hospitality Group

About Maritz Research

As one of the world's largest marketing research firms, Maritz Research, a unit of Maritz, helps many of today's most successful companies improve performance through an actionable understanding of their customers, employees, and channel partners. Founded in 1973, Maritz Research offers a range of strategic and tactical solutions concentrating primarily in the automotive, financial services, hospitality, telecommunications and technology and retail industries. The company has achieved ISO:2 0252 registration, the international symbol of quality. Maritz Research is a member of CASRO and official sponsor of the American Marketing Association.