Hoteliers Beat Budgeted Revenues and Control Costs

Hotel managers achieved the winning formula in 2015 – they exceeded their budgeted revenue projections while concurrently spending less than expected to operate their hotels. The result was a 2.2 percent profit surplus compared to budget.

As general managers, controllers, and directors of sales prepare their budgets and marketing plans for 2017, we present the results of our most recent look at the budgeting accuracy of U.S. hotel operators. From CBRE Hotel's Americas Research's Trends® in the Hotel Industry database, we identified 400 operating statements that contained both actual and budgeted data for 2015. Using these statements, we compared the revenues and expenses projected for 2015 with what was actually earned and spent during the year.

Budget Accuracy Continues

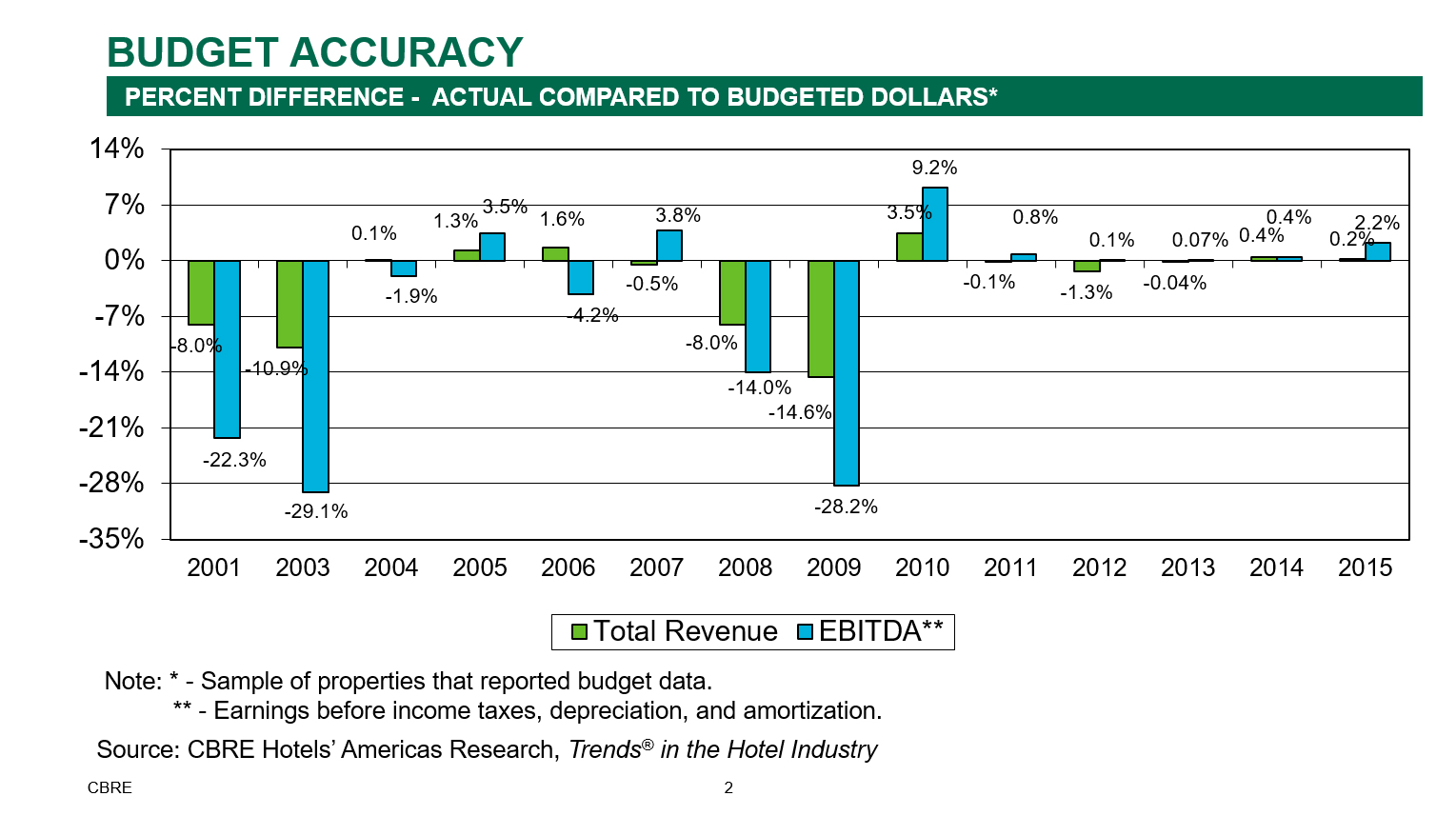

Since 2001, CBRE Hotels' Americas Research has assessed the accuracy of hotel budgets. Over the past 15 years, one trend has become very predictable. During times of industry prosperity, hotel budgets are extremely accurate.

During the depths of the 2001 and 2009 industry recessions, hotel managers underestimated their revenue levels by an average of 10.4 percent, while the profit deficits averaged 23.4 percent. Conversely, when the industry has been in periods of growth, the budget variance for revenues has been a positive 0.5 percent on average, while profit goals were exceeded by 1.4 percent. For the purpose of this analysis, profits are defined as earnings before income taxes, depreciation and amortization (EBITDA).

This trend of budget accuracy during periods of prosperity was demonstrated once again in 2015, another year of growth for U.S. hoteliers. Comparing 2015 budgeted to actual performance, hotel managers surpassed their total revenue goal by 0.2 percent, and beat their profit targets by 2.2 percent.

Occupancy Overcomes ADR

Since the depth of the industry recession in 2009 through 2015, our firm's Hotel Horizons

® forecasts have, in general, underestimated occupancy growth and overestimated changes in average daily rate (ADR). In 2014, it appears that hotel managers analyzed the history of these forecasts and made their own adjustments when preparing their 2015 budgets. Unlike our published forecasts, hotel managers overestimated their potential growth in occupied rooms for 2015, but surpassed their projections for growth in ADR.

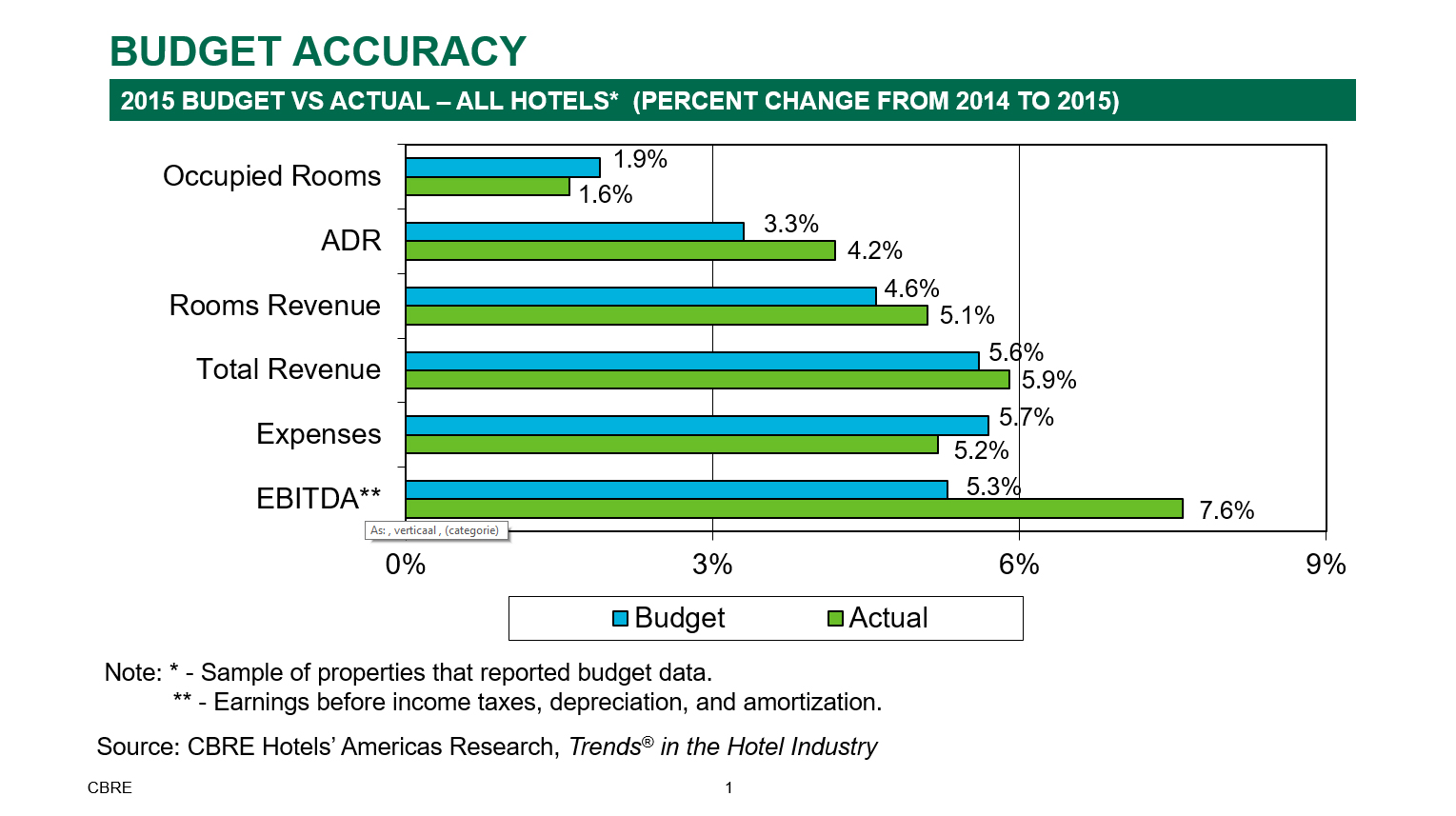

For 2015, hotel managers estimated a 1.9 percent increase in the number of occupied rooms. By year-end, that actual growth in occupancy was 1.6 percent. Conversely, ADR was budgeted to grow by 3.3 percent. However, hotel managers were able to beat that mark and achieve a 4.2 percent increase in ADR.

Given the record high levels of occupancy achieved by most hotels in the U.S. it is not a surprise that hotel occupancy growth is slowing down. Given the daily and seasonal demand patterns most operators have to deal with, it is unrealistic for most hotels to continue accommodate significantly greater numbers of guests. On the other hand, it appears that hotel managers took advantage of the high occupancy levels and pushed room rates to a greater degree than anticipated.

The net result was a rooms revenue (RevPAR) excess of 0.5 percent compared to budget. Concurrently, total hotel revenue exceeded budget by 0.2 percent. This implies that the combined growth in revenue from food and beverage, other operated departments, and miscellaneous income lagged the budget.

Less Occupancy, Fewer Expenses

By accommodating fewer rooms than budgeted, the hotels in our sample incurred less expense growth than planned. During 2015, expenses at the properties in the study sample increased by 5.2 percent. This is 0.5 percentage points less than the budgeted expense growth rate of 5.7 percent.

Fortunately for hotel operators, and their owners, the combination of greater than expected revenue growth, and less than projected expense growth resulted in a substantial budget surplus on the bottom-line. On average, the hotels in our sample exceeded their 2015 budgeted EBITDA goals by 2.2 percent.

What To Budget for 2017

According to the September 2016 edition of Hotel Horizons

®, CBRE Hotels' Americas Research is projecting that a 3.9 percent increase in RevPAR will lead to a 4.3 percent gain in total hotel revenues for 2017. Concurrently, operating expenses are forecast to rise by 3.9 percent. This should result in an improvement in profits of roughly 5.2 percent.

Given this positive market forecast, historical trends indicate that the odds are favorable for U.S. hotels to achieve their budgeted targets once again in 2017. For participants in the lodging industry, accurate budgets and forecasts provide predictability. For investors and lenders, predictability implies less risk. For owners, predictability leads to better management of cash flows and investments. For operators, predictability (in theory) means fewer headaches.

Robert Mandelbaum

Director of Research Information Services

CBRE Hotels