The Impact of Brexit on Hotel Industry and 2020 Outlook

As soon as the referendum result regarding UK's exit from the EU hit the news, concern and uncertainty sparked among many in the UK, especially within the hospitality and tourism industry, which is the fourth largest in Britain.

The greatest cause of worry is found around the amount of employees that the hospitality industry attracts from European migrants. Hotel, restaurants, leisure and entertainment businesses employ over 400.000 migrant workers. Pre-Brexit, EU nationals -many of whom are employed in hospitality- were free to enter the UK without a work permit or visa, which is about to change in a post-Brexit reality. Pre-Settlement, Settlement and other classifications around the residency and corresponding rights mean that EU nationals will find themselves doubting if they will manage to remain or they will be put off upon their arrival to the UK.

As with many industries and the whole British economy, hotel industry is prone to the pound weakness that took place after the Brexit vote. The decrease in the value of the pound has led to increased costs for imported goods. On the other side of the coin, the weakness of Britain's currency has sparked a Brexit bounce with an increasing number of overseas visitors, looking for a bargain.

From a macroeconomic point of view, a synchronised global slowdown and a continuation of Brexit related uncertainty means that the UK economy's loss of momentum will persist during 2020. The forecasts suggest a 0.8% GDP growth in 2020 but the annual average figure hides the fact that the quarterly rate is expected to pick up form Q2 2020 once a Brexit agreement is reached. That means a potential 1% yoy growth for Q4 2020, ahead of the Q4 2019 corresponding figure. Additionally, following the general election, investment is likely to pick up. However, the main driver will be the concerns about the future trade relationship with the EU and labour availability, which will continue to undermine confidence and delay investment decisions in the UK. This relationship is expected to carry on until the trading relationship with the EU becomes more transparent. On one hand, professional and administrative services, and technology-related jobs, continue to be the strongest sectors. These jobs will contribute to further office-based employment growth in 2020, growing faster than total jobs. Overall, office-based jobs growth will follow a similar trend to that of 2019, with London growing slightly faster than elsewhere. On the other hand, sterling's depreciation since the Brexit referendum will further support tourism and continue to encourage staycations for UK residents, driving spend on home soil. However, we expect to see some appreciation of the pound in 2020 as the UK-EU relationship and trade agreements become clearer. Similarly, UK assets that are trading at a discount are relatively attractive to foreign investors.

Operational Real Estate sectors, which include Student Housing, Data Centres, Healthcare, Pubs, Leisure, and Hotels, are property types, which have historically been regarded as complex, illiquid and at some extend opportunistic. However, the continued slow down of the traditional real estate sector performance in combination with the challenging environment around the real estate capital allocation will continue to drive capital towards new sectors and towards non-core real estate.

Real estate fundamentals are driving institutional owners towards operational exposure but also giving them more options as to how they can access operational markets. Real estate investors are not as reliant on big brand operators as they were in the past. In the UK hotel market, for example, the big four international hotel companies now only control 39% of their branded room supply. With growing competition from white-label managers and other formats, brands have become much more focused on protecting their loyal customer base and market share of physical product. Schroders' acquisition of European hotel management firm Algonquin is an example of the bricks (the real estate owner) and the brains (the operator or brand) coming back together. With direct access to the consumer, and growing expertise in the sector, more investors will aim to minimise income leakage by developing their own brands or operating independently. Considering the broader UK landscape, a new trend that can potentially emerge through 2020 is that of larger pub companies to develop their offering of overnight accommodation through hotel acquisitions.

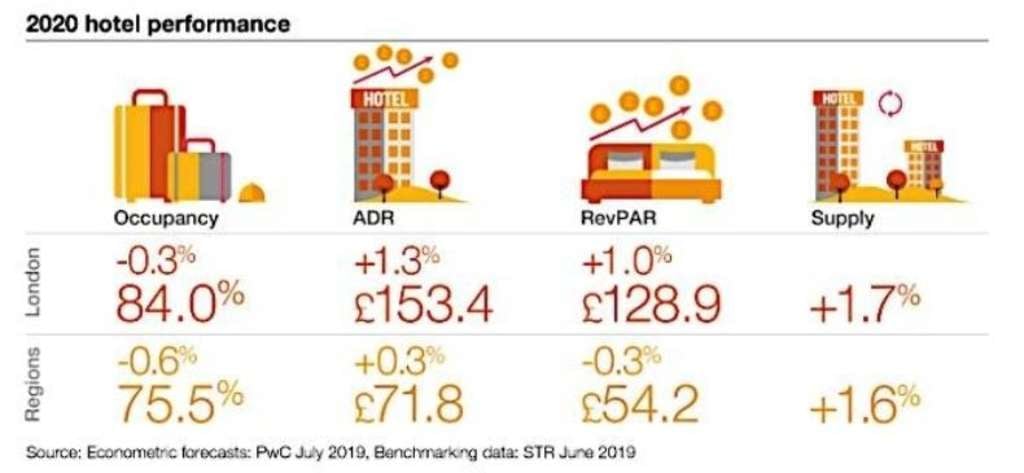

According to PwC an unceasingly intense supply of rooms will make it challenging to preserve the growth figures of 2019, which were boosted by international tourism due to the weakness of the British currency. Occupancy rate is forecasted to slip by 0.3% in 2020 and ADR to experience a slight around 1.3%. Furthermore, Revenue per available Room (RevPAR) growth is forecasted to increase by 1% in 2020 and reach £128.9.

The demand related to the one-off cricket world cup managed to prevent the regional decline in the summer. However, it wasn't sufficient to outweigh the decline in the regional market and stop the decrease in RevPAR for the second consecutive quarter of 2019. Regional hotel market conditions are expected to get tougher due to the reliance on UK GDP developments. According to PwC's forecasts for 2020, Britain will experience a regional decline of 0.6% in occupancy rate, a slight increase in ADR but a drop in RevPAR of 0.3% and therefore it is safe to conclude that Brexit will affect hotels' revenues but not at a large extent.

To sum up, Brexit will create a domino effect. It will create challenges for the EU nationals to enter the country and subsequently less migrants will be employed by the hospitality industry. From a macroeconomic perspective, investments will be stipulated and the pound is expected to rise again once the relationships between Britain and the EU become more transparent. Finally, hotels' revenues will be affected due to the excessive supply of rooms and a decline in occupancy rate, which cannot be outweighed by the increase in the average daily rate.

Korosh Farazad

Founder and Chairman of Farazad Group of Companies

Farazad Group Ltd.