The Impact of COVID-19 On Hotels Across Gateway Cities in Europe?

The world is now facing the unprecedented situation of the new Coronavirus, COVID-19, a "public health emergency of international concern and pandemic" according to the World Health Organisation. The effects, actual and projected, of COVID-19 are evident across the globe and are changing in real time. Global coronavirus cases has exceeded 380,000 and total death toll has passed 16,000 as of 24 March 2020.

COVID-19 is often compared to the SARS outbreak of 2002 to 2003. During that time, the virus spread to over 8,000 people worldwide and killed almost 800. But, COVID-19 seems much more contagious and easily spread. It proved that SARS can be contained but seems gradually unlikely that COVID-19 will be contained as of now. It spread in many countries and resulting in more people infected and dead compared to the SARS epidemic. The impact of SARS was comparatively short lived. According to STR research, it shows that in impacted areas hotel occupancy dropped to nearly 10% but only for a month. The peak was May 2003 and by July occupancy already had recovered strongly (Source: Hotel analyst March 2020).

Not only causing people to be frightened, the outbreak of COVID-19 also has impact on the global economy. This crisis will affect every hotel operation in the world. The COVID-19 outbreak and government advice from UK and across Europe resulted in significantly lower demand across all segments and hit all hotel departments. People are going to stop traveling for the foreseeable future. Hotel industry is usually the first in the front-line to take a hit when there is a global crisis. Health scares tend to frighten people, and frightened people are likely to refrain from getting on planes and staying at hotels.

It is estimated that the total damage to European business travel will be USD 110 billion, according to the Global Business Travel Association. This calculation is based on the cancellation of 8% of forecast travel in 2020. Before the pandemic is contained, it is likely that significantly more travel will be cancelled. On 27th February 2020, Marriott International Inc. CEO, Mr. Arne Sorenson said. "We would expect this will be messy for the next few weeks, if not maybe the next few months,". Marriott shares dropped 24% over the past month and over the same period, Hilton and Hyatt Hotels Corp. also continued falling sharply. The S&P 500 has also declined 11% in line with its competitors.

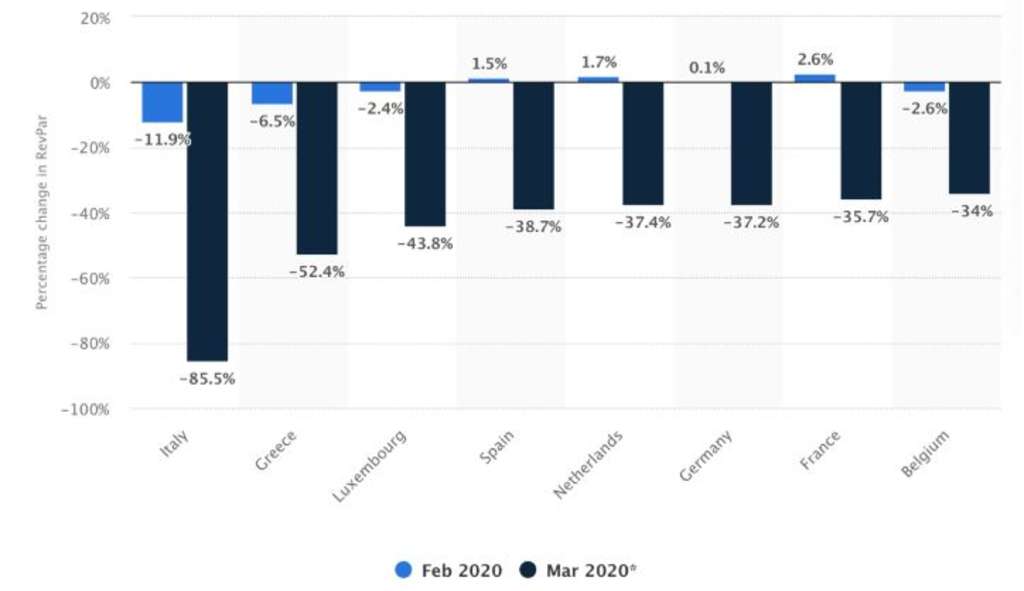

Percentage change in revenue per available room (RevPar) of hotels in selected European countries from February to March 2020

Since the first confirmed case of coronavirus on 24th January in France, the COVID-19 pandemic is having a damaging impact on the hotel industry across Europe. With the exception of Italy where the number of cases grew rapidly, in February, the impact on revenues per available room (RevPar) was still quite small. By March, the implementation of lockdowns and restrictions on unnecessary travel resulted in negative results across the region. In March, Italy experienced a dramatic 85% drop in RevPar, while hotels in Greece recorded a 52.4% drop. Swiss hotel industry is affected by the shutdown of Chinese tourists. Chinese tourism is concentrated in specific regions of Switzerland, which could worsen the situation even further. The hotel industry in Canton Lucerne, for instance, should expect, in the worst-case scenario, a drop of roughly 20% in occupancy rate.

Below are STR KPI data comparison in London:

February preliminary data (compared with February 2019)

- Occupancy: -2.3% to 76.3%

- Average daily rate (ADR): +0.3% to GBP133.57

- Revenue per available room (RevPAR): -2.1% to GBP101.91

1-8 March preliminary data (compared with corresponding week in 2019)

- Occupancy: -21.0% to 65.5%

- ADR: -8.5% to GPB128.39

- RevPAR: -27.7% to GPB84.14

The COVID-19 epidemic has had an undeniable impact on international travel and the hospitality industry. Analysts at Bernstein have tried to anticipate the effect upon the global hotel industry for 2020 estimating a profit (EBITDA) decline of 11-29% year-on-year (Source: Skift). Economy will be in recession, but hotel owners should prepare for the bounce back. The hospitality industry is resilient and, once the situation improves and the pandemic is contained globally, the return of demand is an inevitability.

In conclusion, the crisis is ongoing situation that is changing by hour. Predicting what will happen next is difficult and limited with every country acting different towards coronavirus. But the underlying similarity is that Occupancy, ADR and RevPar have dropped significantly across Europe. The hospitality industry has clearly been hit hard by the COVID-19 pandemic. However, according to some experts the scenario includes "a near complete bounce back in 2021", once again showing the flexibility of the hospitality industry. As soon as the outbreak ends, when consumers and investors regain confidence. Travel will come back, and it will come back fairly quickly.

Korosh Farazad

Founder and Chairman of Farazad Group of Companies

Farazad Group Ltd.