HVS: Paris Profile – Exploring How the City Will Recover from the COVID-19 Lockdown

The restrictions imposed by the COVID-19 pandemic have severely hit the hospitality industry worldwide. In Paris, a small proportion of all hotels currently remain in operation, and the occupancy levels for these opened hotels is currently in single digits.

As of early May, France has begun a phased easing of the strict coronavirus lockdown measures imposed on 17 March. The gradual 'deconfinement' plan started last Monday 11 May and is expected to last until 24 July. Hotels - as well as restaurants, cafés and bars - may start reopening from 2 June. However, this date is not set in stone, as the government plans to reassess if conditions are met for reopening at the end of May.

The evolution of the pandemic and the related government regulations will certainly play a role in determining the pace of recovery of the country in general, and the hospitality industry in particular. The degree of travel restrictions within and outside the country when the summer holiday period arrives, too soon to be stipulated now according to the French government, can have a huge impact on this year's results for hotels. Measures such as France's exemption of the municipal tourist tax during 2020 are expected to help the industry when demand does return.

While regulations will frame recovery, they will represent just one of the factors in the rebound equation. The characteristics of the market, from its demand sources to the destination's transport links or its supply dynamics, will play a significant role in the recovery of the hospitality industry once travel resumes. Our thoughts on the outlook for Paris are as follows.

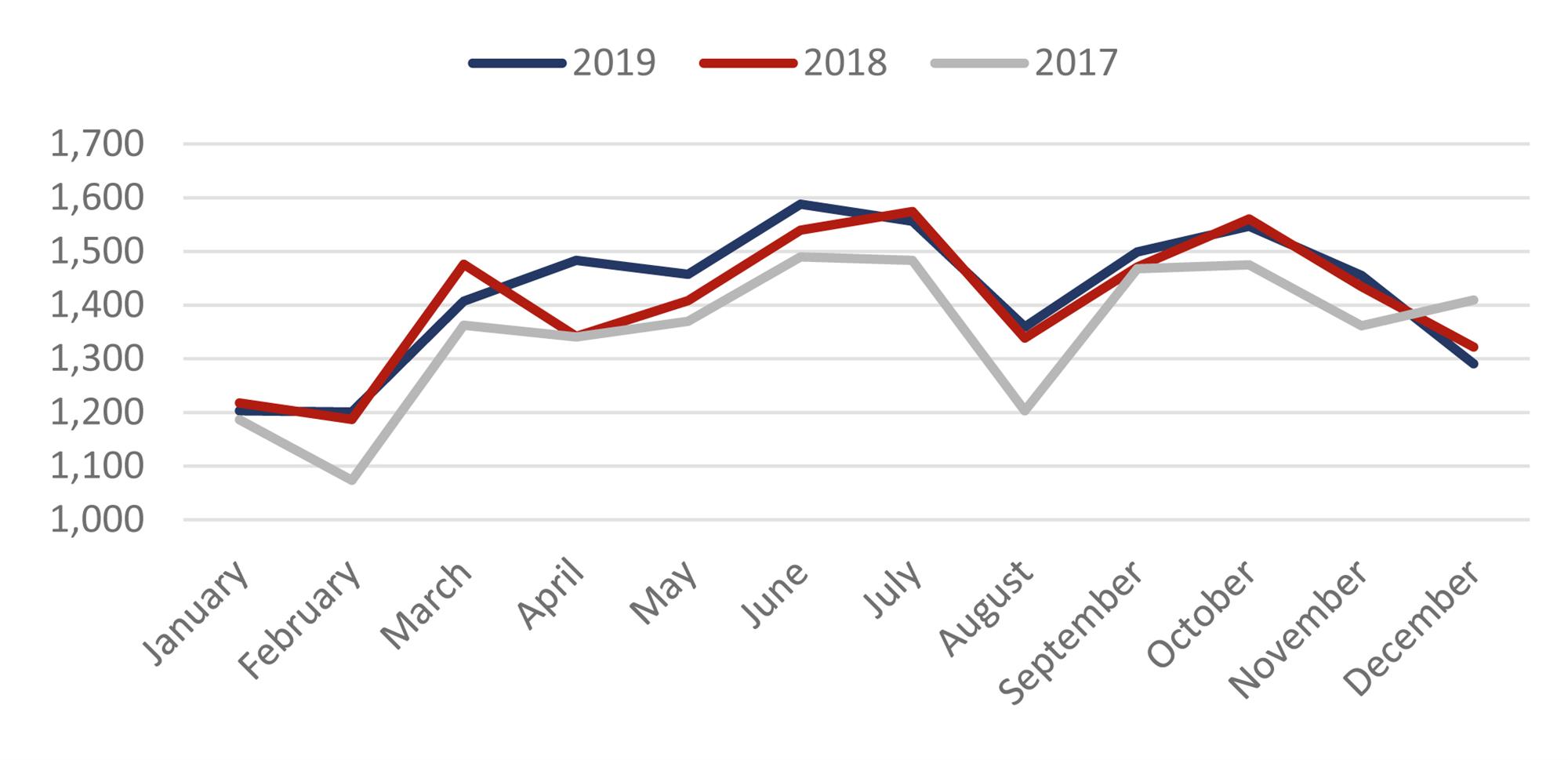

- As we pointed out in our recent Market Pulse in August 2019, Paris enjoys an exceptionally well-balanced mix of business and leisure demand, which allows the City of Lights to have both a broad seasonality, as shown in the chart below, and strong average rate. Year-round destinations such as Paris will have the advantage of being able to capture demand at whatever point activity returns. The same is not true for season-dependent beach or ski resorts. Strong average rates can act as a double-edged sword: high rates might provide operators with room to manoeuvre, to some extent, to offer tactical discounts in order to attract demand upon reopening. However, Paris is likely to lose out to leisure travellers on a reduced budget, which might instead opt for less expensive destinations in the short term.

Seasonality - Total Arrivals (000s)

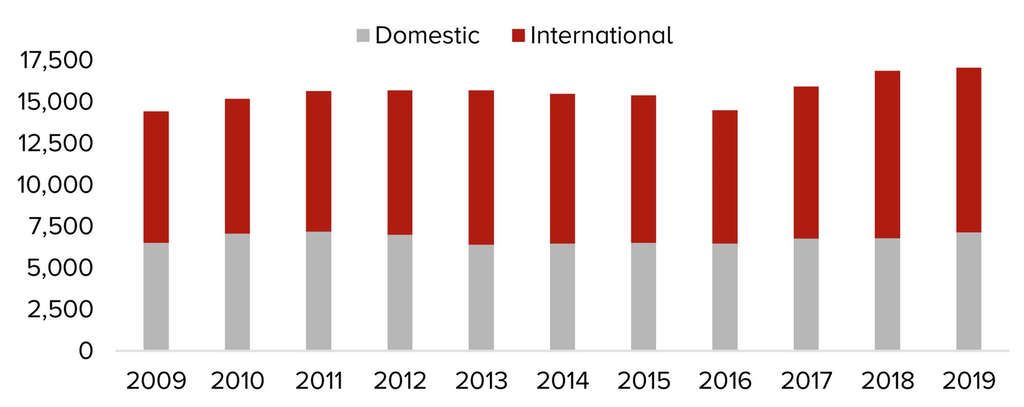

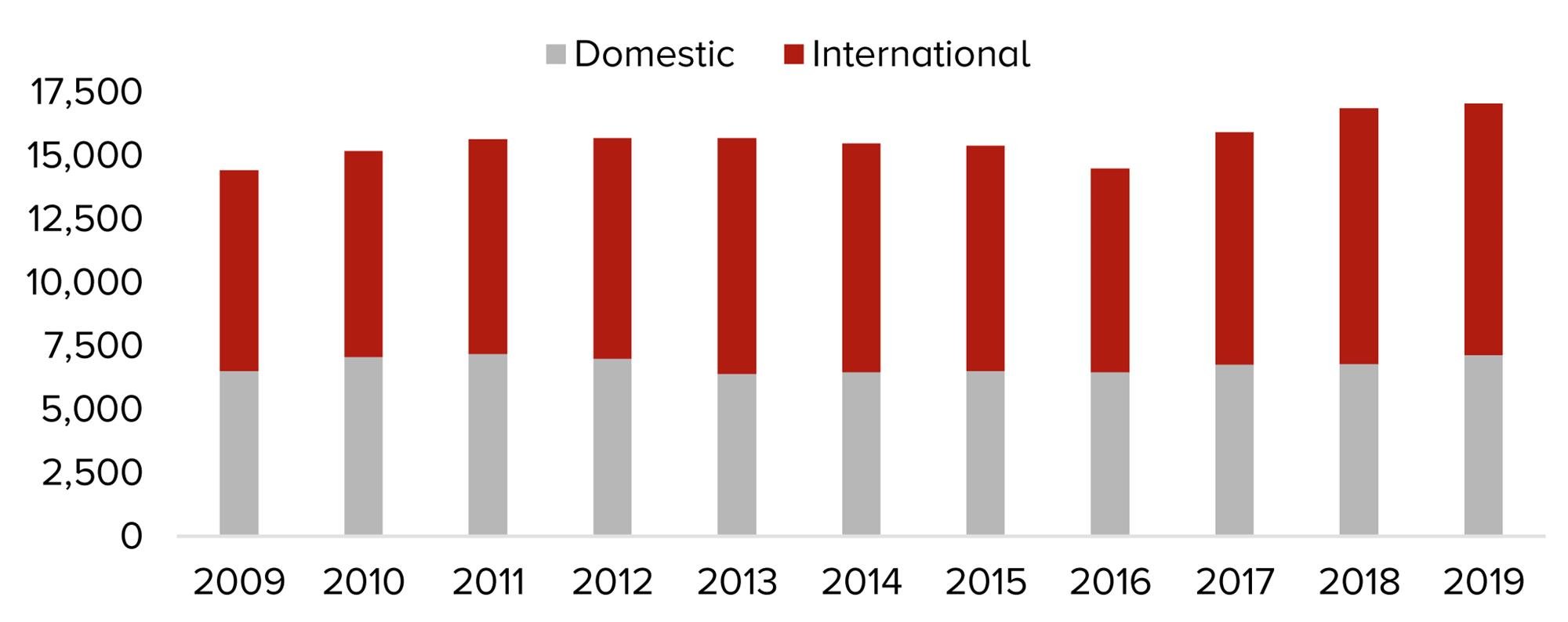

- Paris, one of the world's major global cities, received more than 17 million visitors in 2019. International visitors were almost 10 million, making Paris the sixth largest city by volume of international visitors in the world, and the second largest in Europe, behind London. And 2019, it is worth remembering, was not an ideal year for Paris owing to the Yellow Vest movement that deterred tourists from visiting the city.

Visitation in Paris, 2009 to 2019 Evolution

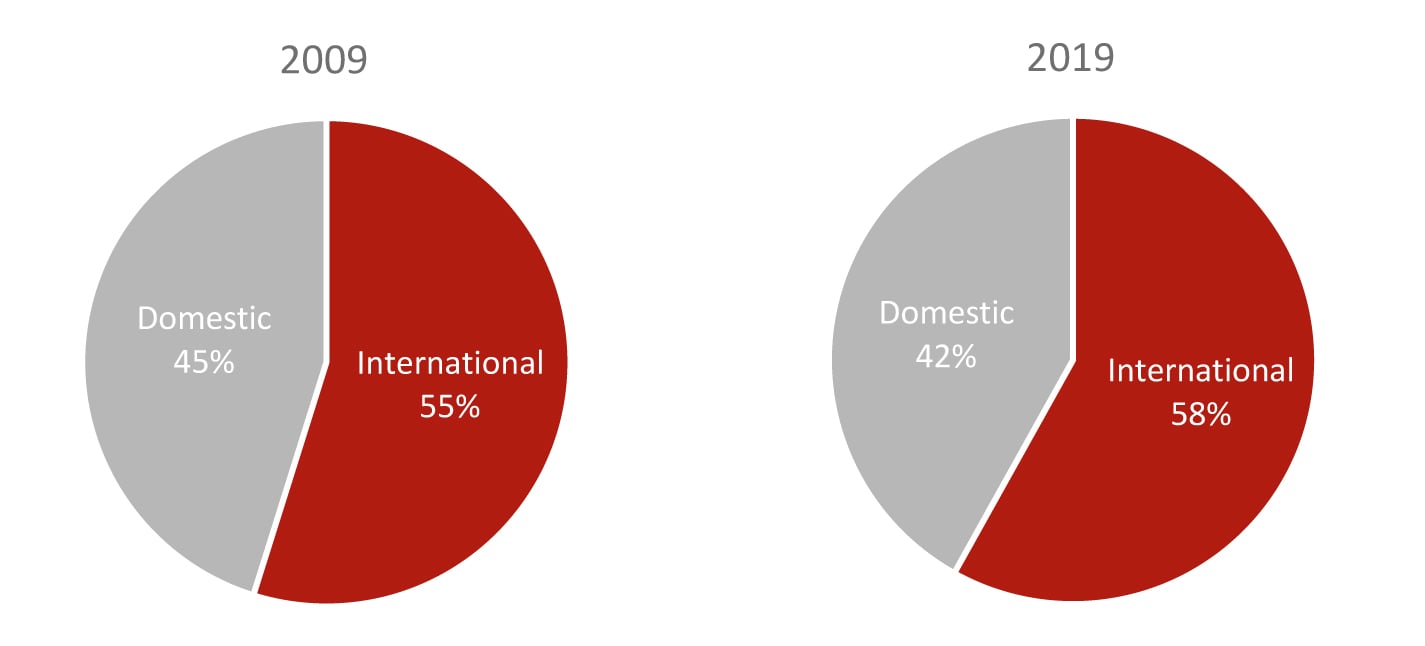

The proportion of international visitation in Paris has remained quite stable over the past decade, increasing from 55% in 2009 to 58% in 2019. Given the existing and expected restrictions on international travel, we expect domestic demand to recover faster, shifting the balance in the short term and presenting a challenge for this market until international visitation recovers. Notwithstanding, domestic visitation historically represents more than 40% of total visitation, and we expect the international tourism gap to be partly filled with an increase in national demand as 'staycations' become a preferred short-term option. Furthermore, with Europeans representing more than half of total foreign visitors, we expect Paris's exceptional transport links to foster a rapid demand recovery once international movements resume.

International and Domestic Visitation in Paris, 2009 vs 2019

- We expect that it will take much longer for MICE and group business demand to return. According to ICCA, Paris ranked first in the world by number of meetings held in 2018, and second in terms of MICE participants, behind Barcelona. In addition to large conventions and exhibitions handled by the city's main convention centres, some of the key events significantly influencing the hotel market in Paris are the Roland Garros Tennis Open, the biennial Air Show at Le Bourget Airport and the world-famous fashion shows Haute Couture and Prêt-à-Porter. The latest news indicates that events of more than 5,000 attendees will have to wait until September. A similar timeline is expected for professional sports. However, such events need far more time to plan and we consider it will be well into 2021 before such events are realistically able to resume.

- While we expect hotel activity to slowly make its return over the near term, the longer-term future looks very promising. The organisation of the Olympic Games in 2024 will surely benefit the rebound of tourism, and the €2 billion investment plan to revitalise Disneyland Paris is still expected to go ahead, albeit perhaps delayed.

- Going forward, Paris has a pipeline of more than 4,000 rooms (5% of existing supply) expected to enter the market by 2022, of which around 1,500 relate to projects in the planning phase. Hotels currently under construction expected to open this year include the 149-room Kimpton Paris and the 123-room Canopy by Hilton Paris Trocadero, both to become the first of their brand in France. We expect the current situation to delay the construction and opening of hotels, while some projects in the planning phase will be cancelled. As a result, a more limited pipeline entering the market will benefit the existing hotel supply. Moreover, there may also be some hotels, currently closed, which might never reopen.

Paris has remained one of the most attractive hotel markets over the past decade, both for visitors and investors and, following a paced return once demand can resume, the City of Lights should continue to be one of the top tourism destinations worldwide.

Sophie Perret

Associate Director

+44 20 7878 7722

HVS