Hotel Insurance Costs on the Rise

As of the writing of this article we are in the early stages of evaluating the impact of the COVID-19 virus on the U.S. lodging industry. Owners and operators are discussing the potential use of business interruption insurance (BI) to cover expected losses in profits. Business interruption insurance covers the loss of income that a business suffers after a disaster. It is designed to put a business in the same financial position it would have been in if no loss had occurred. Owners and operators are encouraged to review their BI policies to determine if their businesses are covered from any losses attributable to the COVID-19 virus.

Per the 11th edition of the Uniform System of Accounts for the Lodging Industry (USALI), the cost of BI is recorded as building and contents insurance, along with the costs to insure damage from fire, weather and terrorism. In addition to building and contents insurance, the overall insurance expense category includes the costs for liability insurance and deductible payments.

Hotel insurance costs have historically been characterized as a "fixed charge." Insurance premiums are contractually fixed and do not vary with the volume of business activity. However, the annual changes in hotel insurance premiums can vary greatly from year to year.

>To determine historical movements in hotel insurance costs, CBRE Hotels Research analyzed the operating statements of 3,987 U.S. hotels that participated in the firm's Trends® in the Hotel Industry survey each year from 2015 through 2019 (estimate). The following paragraphs summarize our analysis.

A Minor Expense

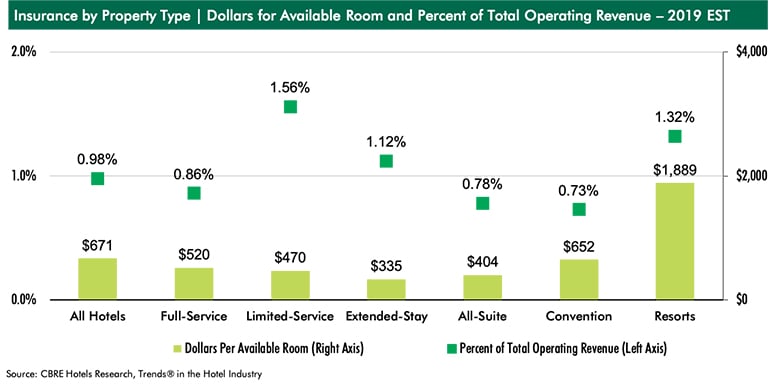

In 2019, the properties in the sample averaged 170 rooms and achieved an occupancy of 74.4 percent and an average daily rate (ADR) of $174.96. During the year, insurance expenses averaged approximately 1.0 percent of total revenue, or $671 per available room (PAR).

Among the different property types, the cost of insurance is most expensive for resort hotels. During 2019, the resort properties averaged insurance payments of $1,889 PAR, or 1.3 percent of revenue. At the other end of the spectrum, insurance for extended-stay hotels averaged just $335 PAR. For limited-service hotels, insurance PAR averaged a relatively limited $470, but due to low revenue levels represented 1.6 percent of total revenue, the greatest percentage of all property types.

A Growing Expense

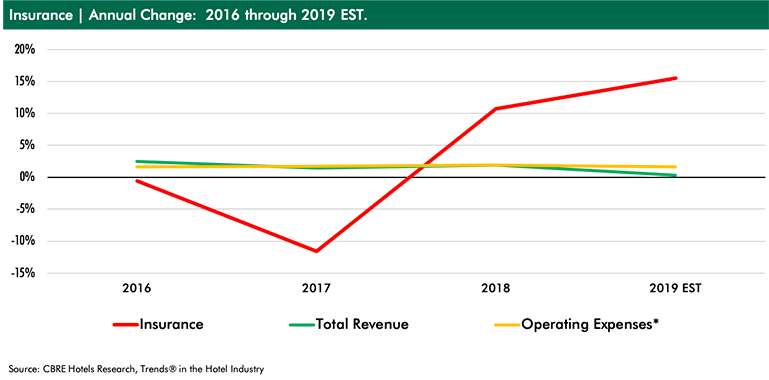

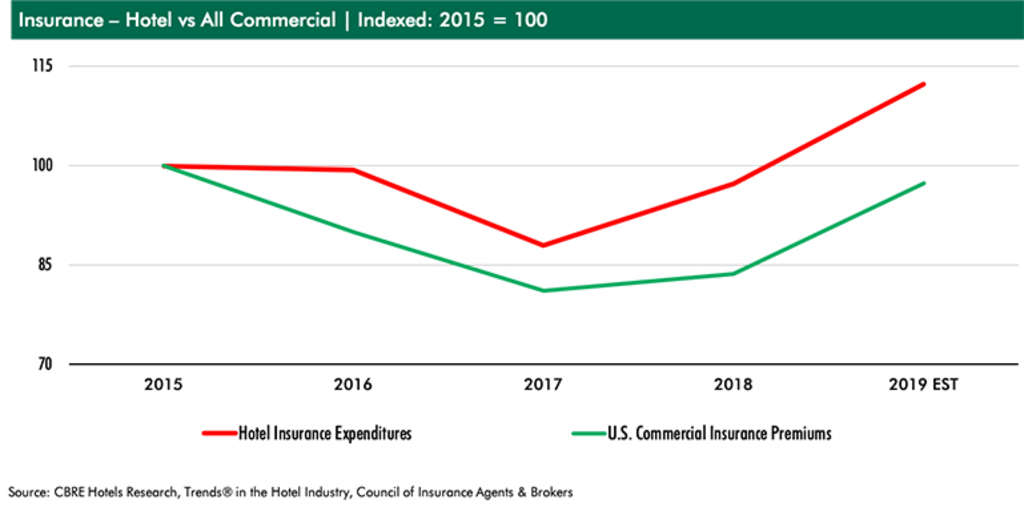

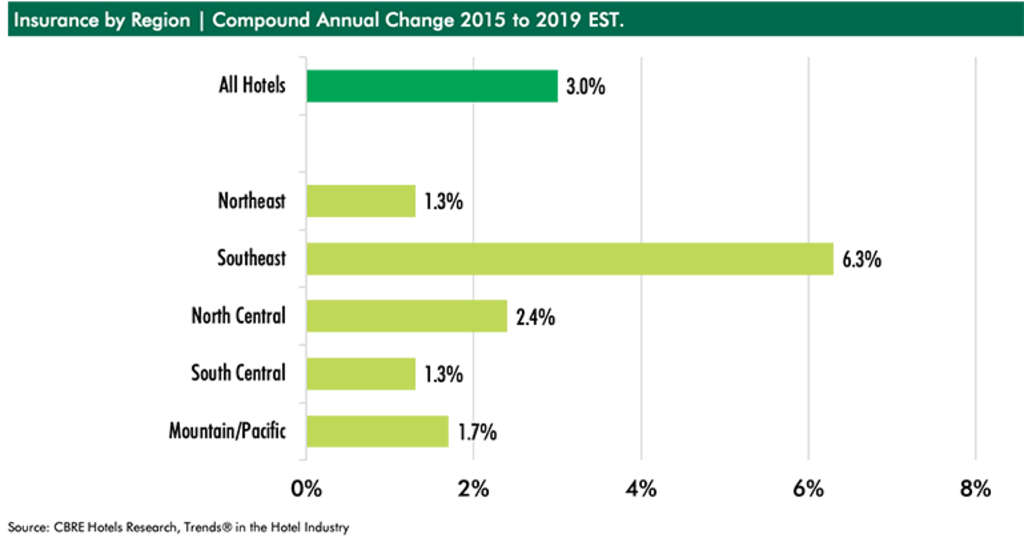

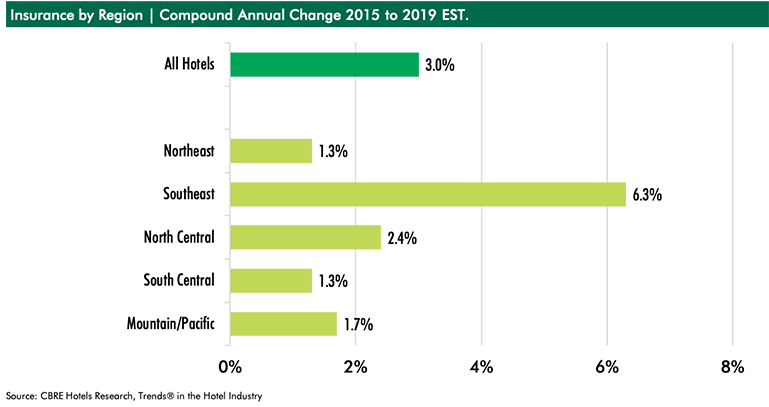

From 2015 through 2019E, the cost of hotel insurance for the hotels in the study sample increased at a compound annual growth rate (CAGR) of 3.0 percent. This is greater than the 1.7 percent CAGR for total operating expenses during the same period. The 3.0 percent CAGR for hotel insurance also compares unfavorably to the 0.7 percent CAGR decline averaged by all forms of commercial insurance from 2015 through 2019E.Within the hotel industry, catastrophic events have historically caused insurance premiums to rise. To compound the negative impact of the increase in insurance costs, these historic catastrophic events have concurrently triggered a decline in hotel revenues. After the 9/11 terrorist events in 2001, hotel insurance costs rose by 20 to 30 percent the following two years. Following Hurricane Katrina in 2005, hotel insurance expenses increased by 9.5 percent during 2006.

Reviewing the annual changes in hotel insurance costs during recent history, we find that weather has been the biggest influence. On average, hotel insurance costs declined by 0.6 percent in 2016, and another 11.6 percent in 2017. Unfortunately, since then hotel insurance expenses have been on a sharp upward trajectory. In 2018, hotel insurance costs increased 10.7 percent, followed by an estimated 15.5 percent rise in 2019.

Analyzing the data by property type and geographic region, it is evident that hurricanes Harvey, Irma and Maria significantly contributed to the recent surge in insurance expenses. From 2015 through 2019E, hotels in the resort location category and properties in the southeast experienced the greatest increases in insurance costs.

Insurance in 2021

The degree to which COVID-19 will impact the U.S. lodging industry during 2020 is far from being determined. However, as of mid-March 2020, it appears the declines in revenues and profits for the year will be significant. If history repeats itself, the extent to which insurance companies will have to cover losses in 2020 will result in additional insurance premiums for hotels in 2021. Fortunately, if the disease can be contained in 2020, hotel revenues should rise in 2021.Robert Mandelbaum

Director of Research Information Services

CBRE Hotels