The Impact of COVID-19 on the South Korea Hotel Industry

HVS has conducted a survey about the COVID-10 pandemic and its unprecedented impact on the South Korea hotel market. The survey is divided in two sections, how the properties in South Korea is reacting in response to drop of overall demands throughout contingency plans and viewpoint of how experts in the hotel operations are recognizing sign of recovery of pandemic as well as their outlook of the market in the future.

Survey Questions

Contingency Plans

- The level of effectiveness for each contingency measure

- Other contingency measures being undertaken

- Contingency measures being undertaken from the Corporate Office to support Hotel Owners

- The period of implementing the contingency measure

- Implementing promotions to drive Rooms & F&B sales

- Implementing new F&B business models

- Experience of increase in staycation business

Sign of Recovery & Market Outlook

- An indication to sign of recovery

- A recovery period by each market segment

- Group booking status

- A recovery period by each source market

- The market's dynamic between pre- and post-COVID-19

Key Takeaways

- Almost 80% of the sample hotels are fully opened

- Contingency measures are planned for an average of 6.4 months. Most respondents answered 6 months.

- 50% of respondents'' corporate offices offer to defer FF&E programs and PIPs

- Designing room package for staycation driving sales for both rooms and F&B was found most effective among initiatives properties are currently implementing.

- Most hoteliers believe that a travel ban lift is a priority to welcome new and return business.

- Leisure demand is expected to partially recover the fastest in less than four months in comparison to other segments. 85% respondents expected the full recovery of leisure demand to be achieved in less than 12 months.

- 65% of properties witnessed cancellations of group bookings due to COVID-19.

- Most respondents' outlook for the Domestic market is a fast recovery within 6 months, followed by short haul market including China.

- As a direct impact of COVID-19, lower performance in both occupancy and average rate is expected by most of respondents.

Respondents

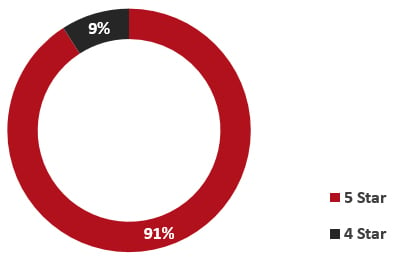

Respondents by Hotel Positioning

Over 90% of the properties in the survey sample are in the 5-star positionings.

Respondents by its Opening Status

It is found that almost 80% of the survey sample are fully opened for operation. Almost 35% of the properties responded to the survey are located within Seoul and over 70% of the properties responded to the survey are in Seoul and its metro area. All hotels in the sample survey are branded hotels.

Contingency Plans

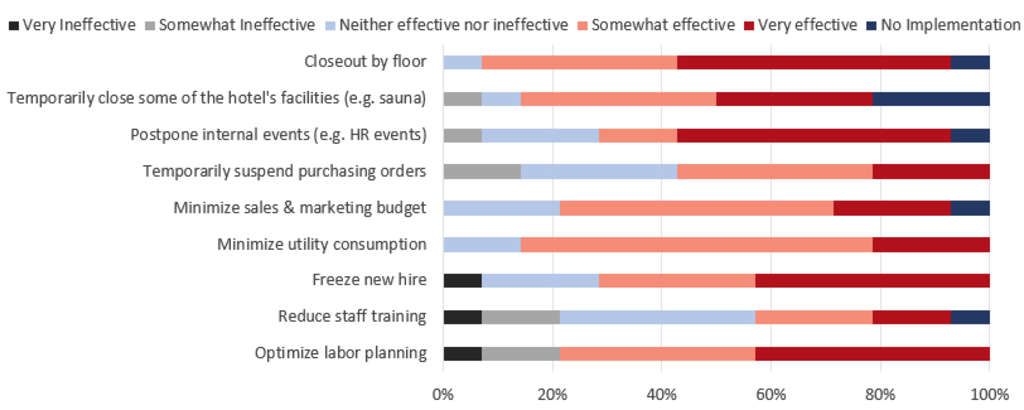

What is level of effectiveness for each measure?

We found that properties' contingency measures are planned in average for 6.4 months and most of respondents answered for 6 months. Out of the result, a reduction in staff training is deemed least effective and controlling room inventory by closing out by floor as most the effective contingency measure. Other effective measures provided by respondents are the shortening F&B operation hours, maintaining minimum roster for government subsidy, and cross training.

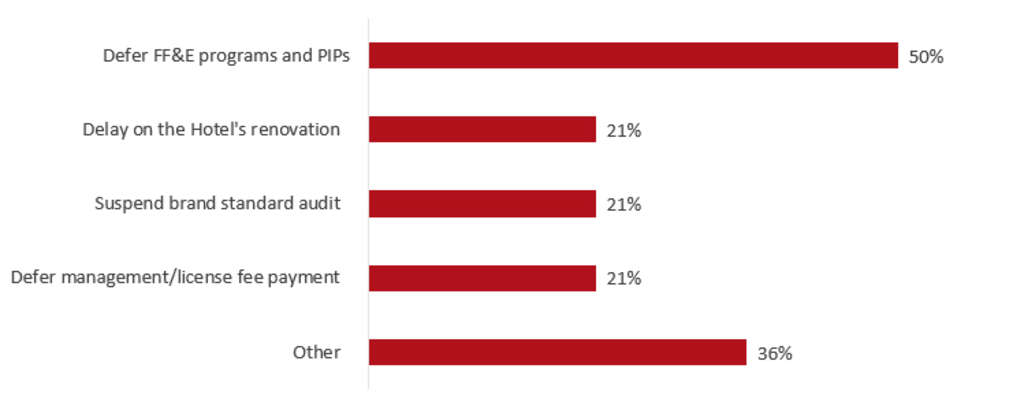

Which relevant measures were undertaken from the Corporate level to Hotel Owners?

For the measures undertaken from the Corporate level to Hotel Owners, 50% of respondents' corporate offices offered to defer FF&E programs and PIPs. Other measures include payroll reduction, mandatory leave, expense audits and savings in revenue management fee.

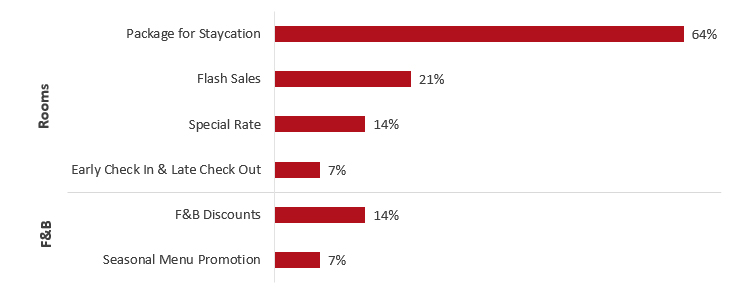

What are the room and F&B promotions that the properties are currently implementing?

Designing room packages for staycation in driving sales for both rooms and F&B was found to be the most common initiative properties are currently implementing. There were also some properties succeeded by providing room discounts through flash sales and constrained special rates. For F&B, discounts and seasonal menu promotion were adopted to drive F&B business.

Staycation Business and F&B

Signs of Recovery & Market Outlook

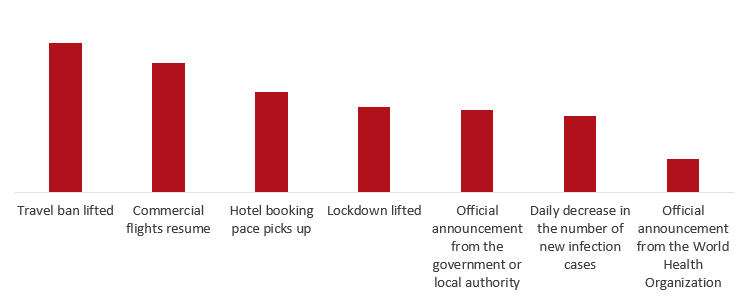

Which of the following would indicate a sign of recovery?

Most hoteliers believe that a travel ban lift is the priority to welcome new and return business. It is found that hoteliers perceive an official announcement from the government or local authority as more important than official announcement from the World Health Organization.

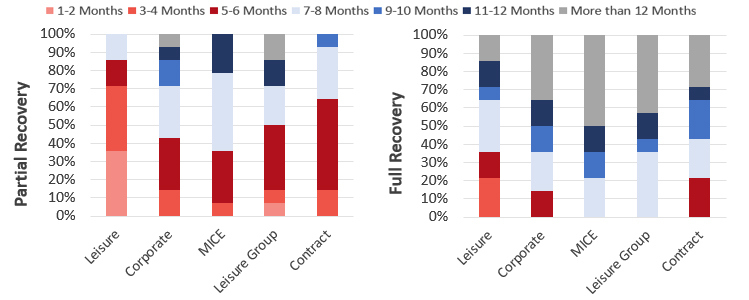

How many months would each market segments take to recover?

Hoteliers have responded that leisure demand is expected to initially recover the fastest in less than four months. 85% of respondents expect the full recovery of leisure demand to be achieved in less than 12 months. MICE and leisure group demand are expected to initially recover faster than corporate demands, however full recovery for both are expected to take longer than corporate demand. All respondents expect contract demand to initially recover within ten months, and 28% expect it to fully recover only after 12 months.

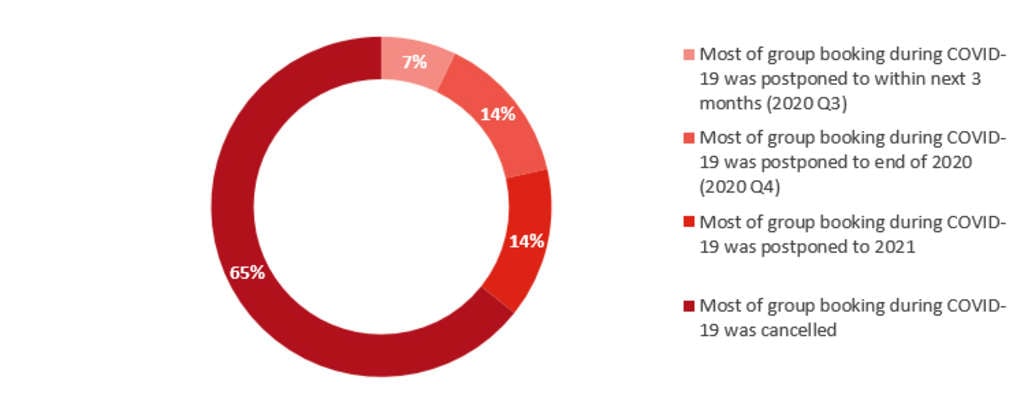

The hotel's group booking status during COVID-19.

We found that 65% of properties witnessed cancellation of group bookings due to COVID-19. Hoteliers responded that postponed group bookings could overlap to future group bookings for the same dates. There are also issues that the postponed group bookings can be further postponed or be cancelled entirely should the COVID-19 situation worsen at a future point.

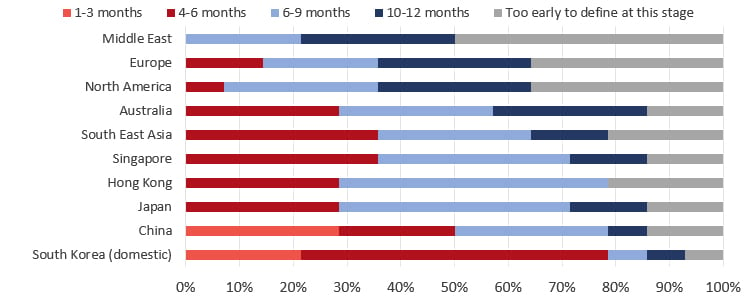

How many months would each source market take to recover?

Most respondents expect the Domestic market to show a fast recovery within six months, followed by the short haul markets including China. Most source markets is expected to recover in between four to nine months. Exception are the long-haul markets of North America, Europe and Middle East which are expected to recover by mid-2021.

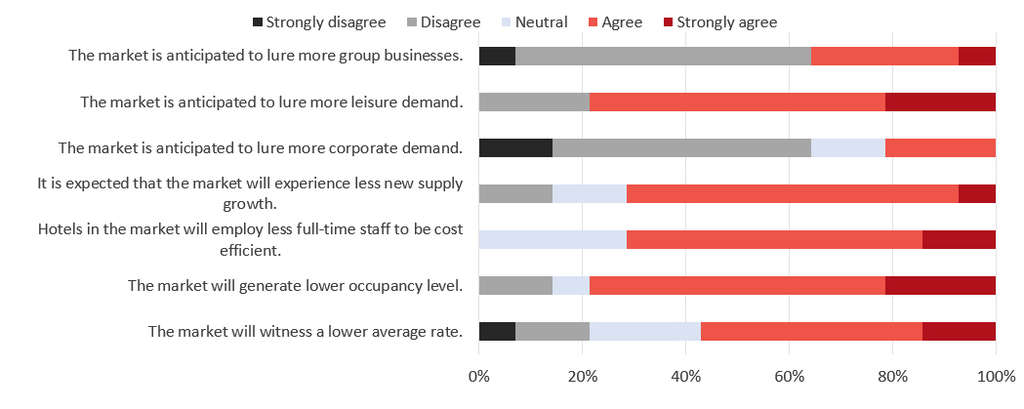

Assuming that the market will be recovered by Q2 2021, how would the market perform in comparison to the pre-COVID-19 period?

Respondents had viewpoint of future as due to direct impact of COVID-19, lower performance in both occupancy and average rate is expected by most of respondents. They believe that it is difficult to capture new business from corporate and group segments and the focus is firmly on leisure demand. With the uncertainty in the market, 71% expect that the industry will experience less supply growth, 14% think the opposite.