Top 3 Hotel Operators Post-COVID and Why?

It's been a few months where hospitality, entertainment, and leisure venues shut their doors in the UK and most part of the world. However, in July 2020, UK, European & global hotel, and hospitality had started planning for a 'new normal' reopening of their businesses.

According to Boutique hotelier research in April 2020, it claimed that UK hotels to bounce back strongly once economy restarts and travel restrictions are lifted post the COVID-19, and anticipated to be willfully recovered by Q4 2021. Moreover, Top hotel news May 2020 claimed that amidst COVID-19, a total of 188 hotels openings took place in May 2020 totaling 41,445 keys globally. 72 of these projects will be in the luxury 5-star section while the remaining 116 will be 4-star hotels. This evidently shows that the pandemic does not stop the confidence of the travel industry where hoteliers, developer and investors are implementing the opportunity for a change to develop new models for more flexible developments with post-COVID-19 measures of strict health and safety protocols for the wellbeing of guests and employees to ensure a positive and safe experience at their hotels.

The question is, which hotel operators can hold up and doing their best despite the COVID-19 pandemic. The main factors to considered are number of rooms in operation, profitability, and business value.

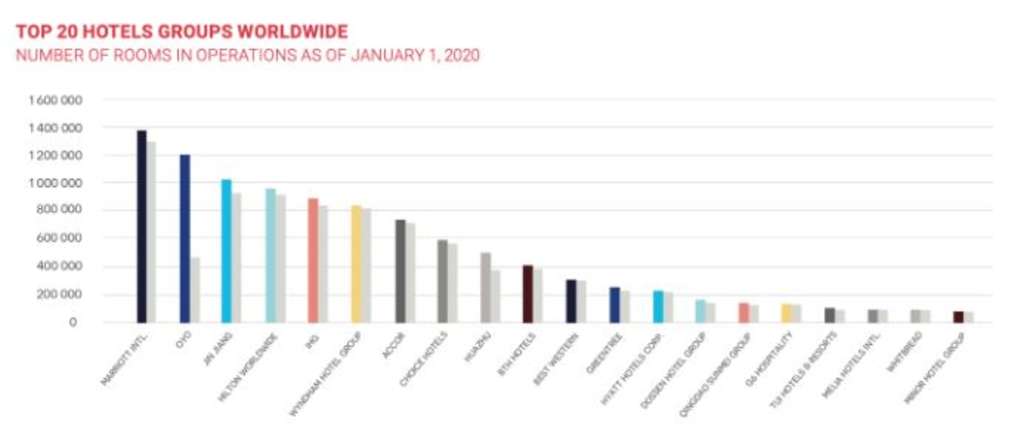

1. Number of Rooms

From the graph above, it is clear that The American group Marriott International remain strong and is the true champion in this hotel sector with more than 1.3 million rooms worldwide in Jan 2020. Follow by India's Oyo, a sharp increased from roughly 400,000 rooms in 2019 to well over 1.2million rooms in 2020. This make the group the fastest growing hospitality chain only founded in 2013 which entered top 10 in 2019 due to its development model with strongly based on digital tools. Continued with the Jin Jiang International which has recently increased ranking of the room supply after its acquisition of Radisson Blu Hotel. This shown the rise of hotel group based in Asian are currently growing at the rapid pace supporting that Thai's minor hotel group is also entered the world top 20 hotel in 2020.

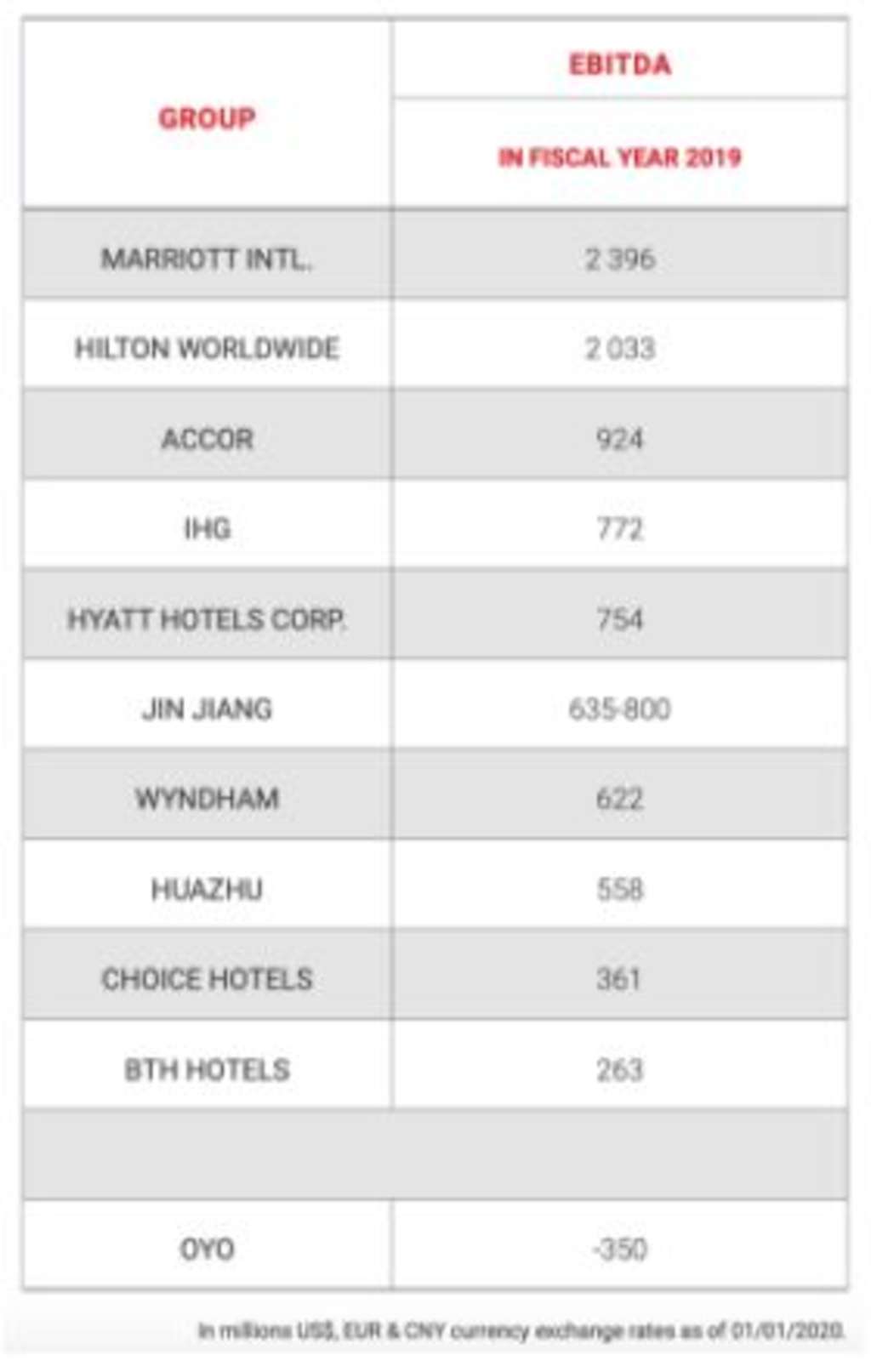

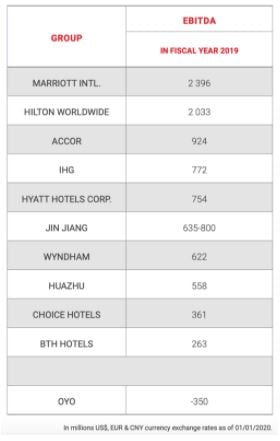

2. Profitability

As expected, Marriot is ranked as the number one world leader in term of number of rooms, profitability, and business value with EBITDA 2019 of US$ 2,396 million. Followed closely by Hilton with EBITDA slightly less of US$2,033 million. Number 3 in term of EBITDA is Accor, a French multinational hospitality company. It is the largest hospitality company in Europe. As illustrated in the graph above, it is ranked 7 in terms of number of rooms nonetheless in term of profitability and performance is doing very well and remain competitive just behind Marriot and Hilton with EBITDA 2019 of US$924 million. Accor is ahead of another European player, InterContinental Hotels or IHG, a British multinational hospitality company which is the 4th in the world profitability. Speaking of the size that OYO has made a big improvement and rose up to second place in term of number of rooms, but the situation is different in term of profitability where its EBITDA is negative of US$350million

3. Value

Top 10 Most valuable Brands

According to Brand Finance 2020. The study shown that hospitality industry is drastically impacted by COVID-19, brands could possibly lose up to 20% of cumulative brand value, approximately to US$14 billion. Nonetheless, their analysis illustrated that Hilton remains the world's most valuable hotel brand, recorded a remarkable growth of 35% in brand value from US$8 billion in 2019 to US$ 10.8 billion in 2020 based on the enterprise value. The brand's year on year success is due to strong revenue growth and a solid reputation, making Hilton a one of the guest's beloved destination around the world.

Saviod D'Souza, the Valuation Director of Brand Finance said that "Unsurprisingly, the COVID-19 pandemic is going to hit the hotels sector hard as holidays are cancelled and people work from home. While Brand Finance has predicted that hotel brands could face an average 20% loss of brand value, the brands that will be less impacted will be properties with strong brands where social distancing protocols will be easier such as resorts and extended stay properties. Unsurprisingly, brands with a larger exposure to primary markets will be impacted more than secondary and tertiary markets as customers move their preference to properties within "drive-to" markets."

In conclusion, the top 3 hotel operators post COVID-19 are Marriot, Hilton and Accor which is proven by size, profitability, and their brand value. They are established respectful multinational companies with strong brand, solid reputation and notable history that resonate worldwide with business and leisure customers. They have exceptional customers experience while rebuilding consumer confidence during COVID-19 pandemic that will protecting their future revenues and growth.

Korosh Farazad

Founder and Chairman of Farazad Group of Companies

Farazad Group Ltd.