COVID-19 Impact On US Waterparks And Waterpark Resorts

Due to COVID-19, many outdoor waterparks delayed their season openings while others have decided, or were mandated, not to open at all in 2020. Many resorts with waterparks and standalone indoor waterparks were forced to close for several months, and some

Due to COVID-19, many outdoor waterparks delayed their season openings while others have decided, or were mandated, not to open at all in 2020. Many resorts with waterparks and standalone indoor waterparks were forced to close for several months, and some have yet to reopen.

With the largest database of waterparks and waterpark resorts across North America, H&LA has tracked the openings and closings of standalone waterparks and resorts with waterparks in 2020. Our data has been confirmed via online or property-level sources and is the latest data available as of the date of publication. With this data, we were able to estimate the total losses in revenue and attendance to the U.S. waterpark industry.

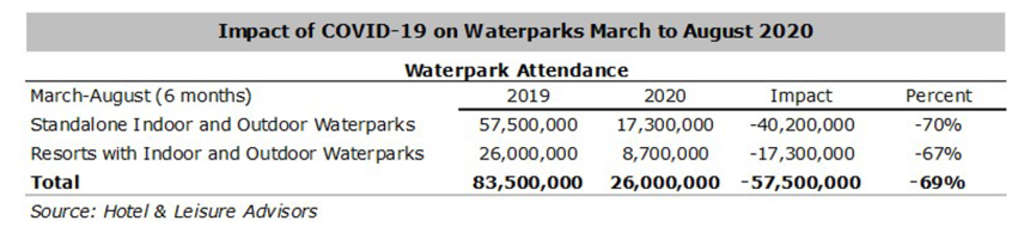

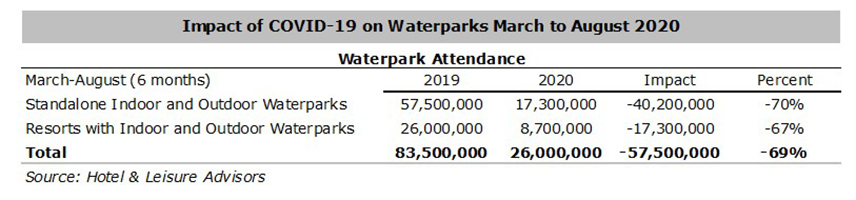

H&LA estimates an overall impact of $2.9 billion in lost revenue and 57.5 million in lost attendance for all outdoor waterparks, resorts with outdoor waterparks, standalone indoor waterparks, and indoor waterpark resorts in the United States between March and August 2020. Standalone indoor and outdoor waterparks account for $1.2 billion in lost revenue and 40.2 million in lost attendance, while resorts with an indoor or outdoor waterparks account for $1.7 billion in lost revenue and 17.3 million in lost attendance. Attendance was down 69% from 2019 at U.S. waterparks due to the closures and mandates associated with COVID-19.

Methodology

We analyzed waterparks by type (outdoor vs. indoor, resorts vs. standalone) and grouped them by size and operating status (open vs. closed). We estimated attendance and per capita spending for each group based on our waterpark financial and attendance database, interviews with various parks, industry publications, SEC filings, and other industry sources. We also considered whether the waterparks are private or municipally owned. We then estimated impact from COVID-19 for each of the groups based on the number of days open and potential impact from reduced demand and limited capacity. For resort properties with waterparks, our analysis focused on leisure guests that utilize the waterpark and did not estimate impact on the resort from lost group and commercial guests.

For the six-month period of March through August 2019, we estimate the industry attracted approximately 83.5 million attendees. When comparing that to the same six-month period in 2020, the industry saw only 26 million attendees, for a negative impact of 69%. Waterpark resorts had a larger total revenue impact than standalone properties because of their size and numerous departments such as rooms, food and beverage, spa, etc. that exist. The following table shows standalone and outdoor waterparks had a slightly higher percentage of impact than resorts with waterparks.

Impact

With the mandated closures, limited capacities, and travel restrictions, the waterpark industry has been one of the industries hardest hit in the midst of the COVID-19 pandemic. Unlike other recreation businesses that are open year-round, outdoor waterparks have a short operating season, and closing for even a week has a substantial impact on the bottom line for these properties. Most resorts with indoor or outdoor waterparks were closed starting in mid-March and did not start reopening until May or June. Some are still closed and may not reopen until 2021. The uncertainty, drastic decreases in tourism numbers, and government restrictions resulted in huge economic loss for waterparks across the United States. Some waterparks have been impacted significantly, and our research indicates that they may not rebound from the economic downturn.

We project these negative impacts to continue in 2021 until an effective vaccine or treatment for COVID-19 is developed. Our estimate of an overall impact of $2.9 billion in lost revenue for the waterpark industry does not include the impact on manufacturers, suppliers, and other businesses that cater to the waterpark industry. If capacity limits continue in 2021, waterpark operators will have to re-think their operating season schedule, operating hours, ticket and season pass pricing, and amenities offered in their parks and resorts.

Outdoor Waterparks:

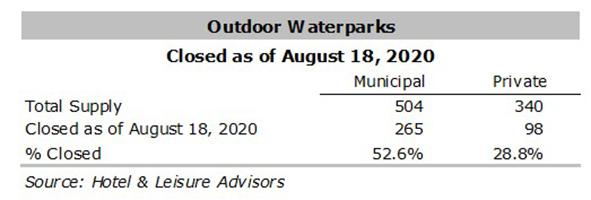

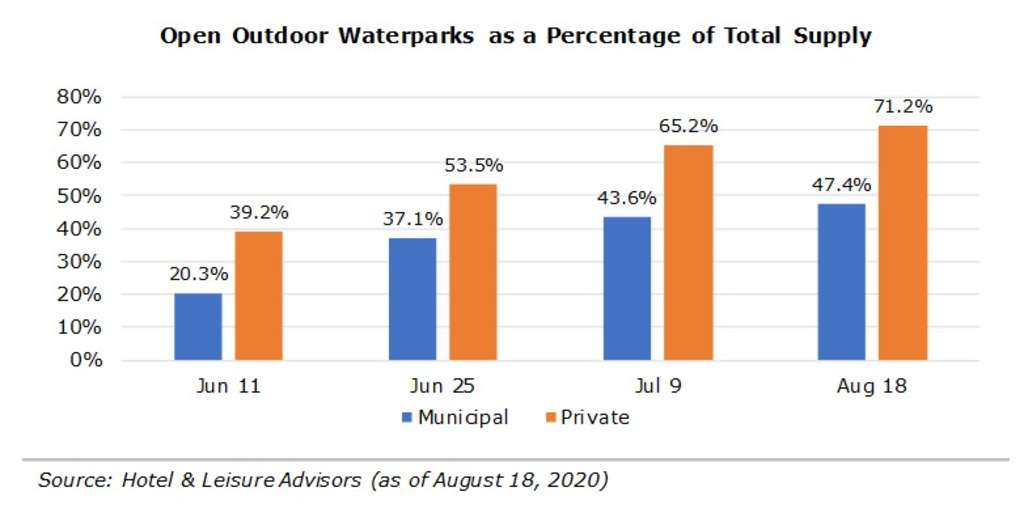

For most outdoor waterparks, the season typically begins around Memorial Day and ends between mid-August and Labor Day. For resorts with outdoor waterparks, although the resorts are open year-round, their waterparks may be seasonal, except in Florida, where some of the waterparks are open year-round. As the 2020 waterpark season kicked off, the vast majority of waterparks decided to delay opening or were mandated not to open, while some decided to remain closed for the entire 2020 season. In June 2020, one month into the waterpark season, 70% of outdoor waterparks remained closed with a sizable number of municipal waterparks deciding to close for all of 2020. As of mid-August, towards the end of the waterpark season, 43% of the outdoor waterparks in the United States had not opened for most or all of the 2020 season. A number of waterparks that opened in June had to close again due to government mandates.

The following table provides our estimates for the 2020 season operating status for standalone outdoor waterparks and resorts with outdoor waterparks in the United States.

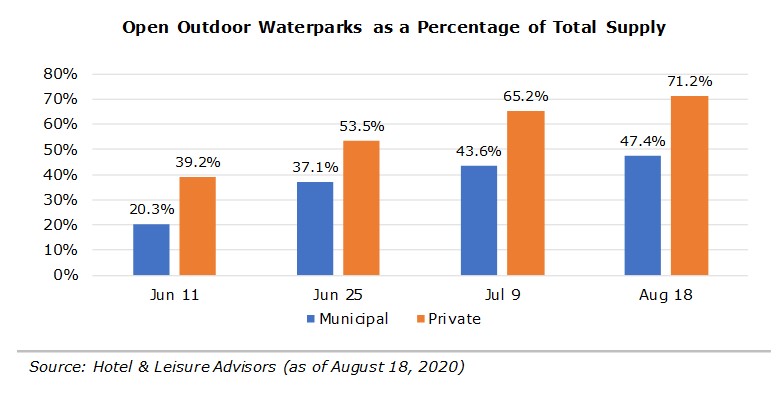

The following graph provides statistical data between June and August concerning the percentage of outdoor waterparks that were open. It indicates that privately operated outdoor waterparks were more likely to open than municipal properties.

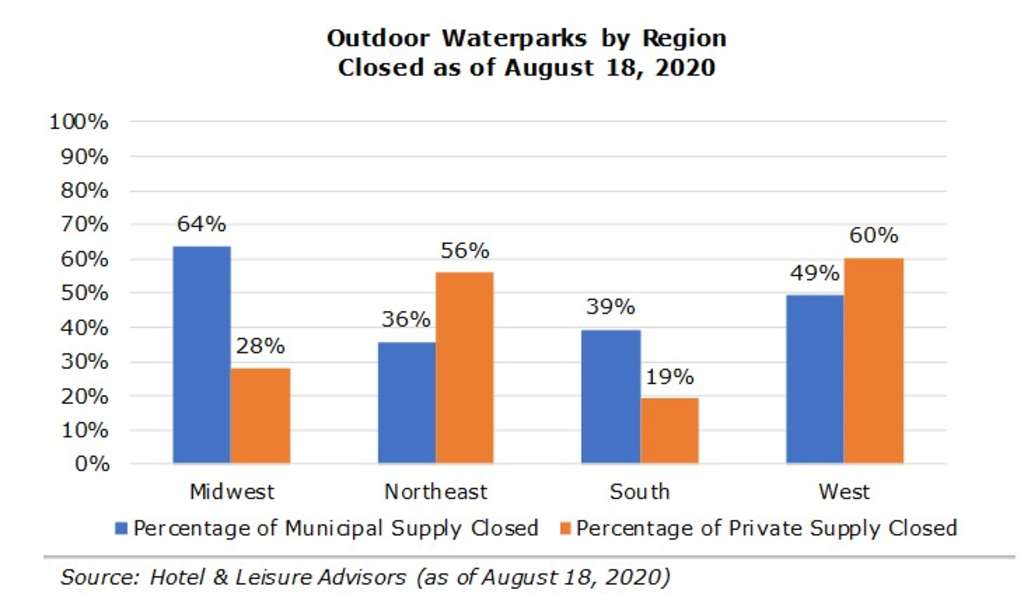

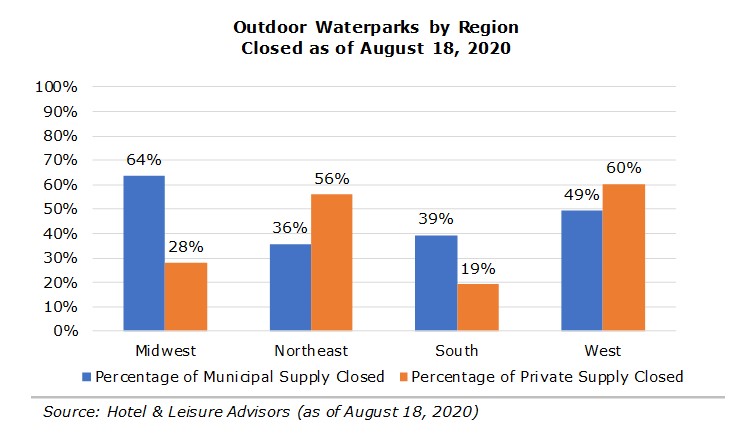

The following graph indicates the different regions of the United States and where outdoor waterparks are more likely to have been closed due to the pandemic.

Indoor Waterpark Resorts and Standalone Indoor Waterparks:

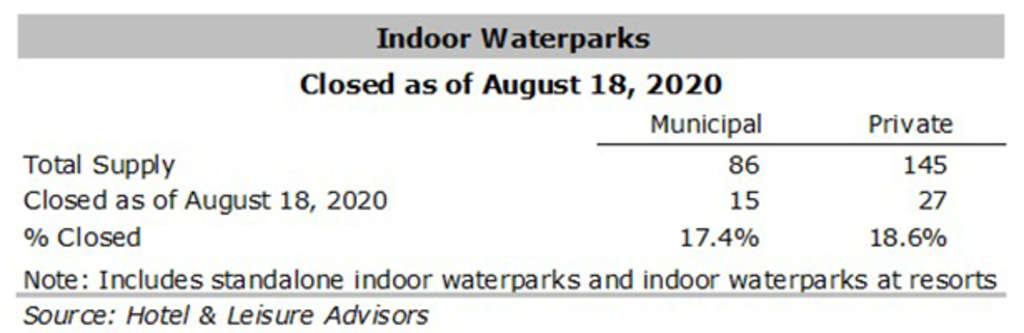

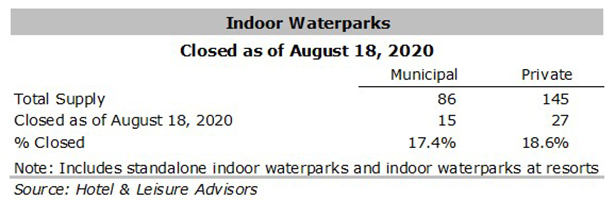

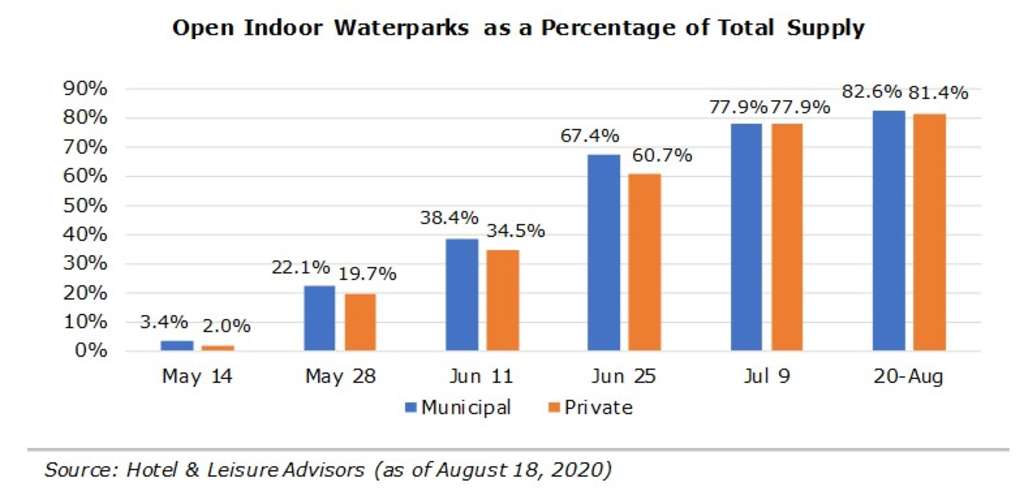

Unlike most outdoor waterparks, indoor waterpark resorts and standalone indoor waterparks are open on a year-round basis. However, due to travel restrictions and government mandates, many indoor waterparks were forced to close in March and April 2020. By the end of May, approximately 80% of the indoor waterparks in the United States remained closed. As travel restrictions started lifting, indoor waterparks (resorts and standalone) opened with limited capacity. Some indoor waterpark resorts remained open for lodging, but their waterparks were closed. For our analysis, we considered these properties as closed. By the end of June, as restrictions eased further, approximately 36% of the indoor waterparks (resorts and standalone) remained closed. Our research indicates that as of mid-August 2020, 18% of the indoor waterparks in the United States remain closed.

The following graph indicates the change in the number of indoor waterparks open between May and August 2020.

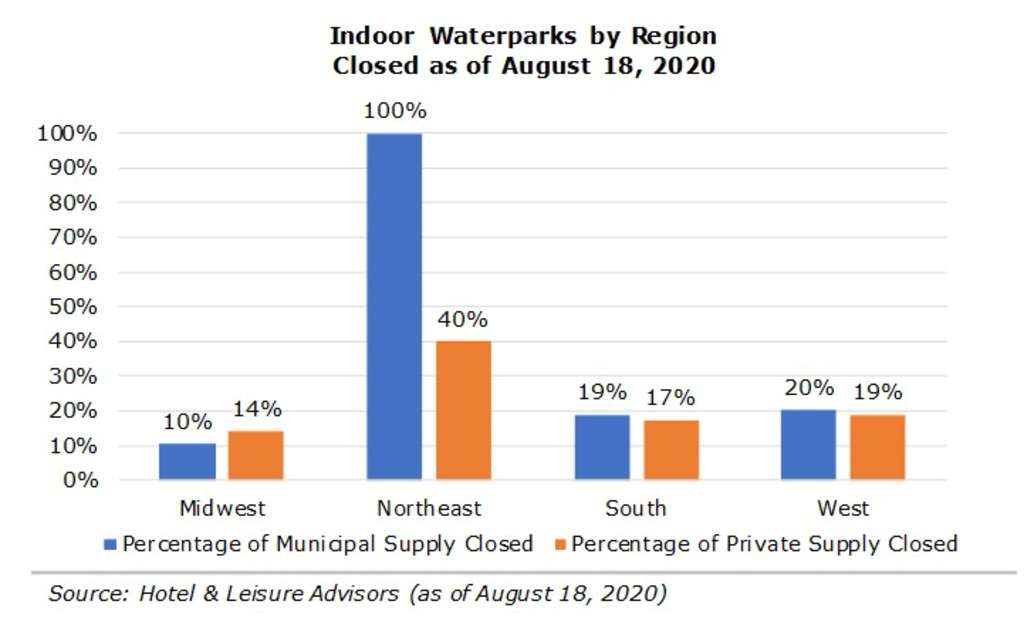

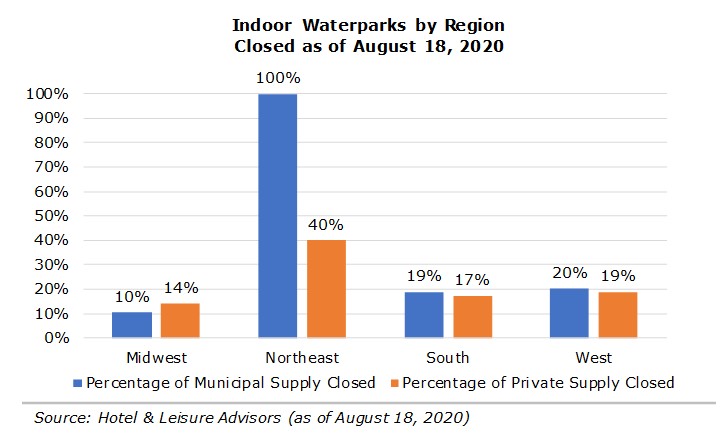

The following graph indicates the location of the indoor standalone and resort waterparks and the percentage that are closed by region.

Conclusion: The $2.9 billion in lost revenue and 57.5 million in lost attendance translates to reduced profits for owners and operators, possible permanent closures, reduced employment, and the loss of a leisure time activity for millions of families. However, the waterpark industry is dynamic and resilient. Though the road to recovery won't be easy, operators will refocus their marketing and operational strategies to adjust to the new normal going forward, hopefully setting the industry up for a robust recovery.

The authors wish to acknowledge Michael Weber for his assistance with the article.