The Recovery Period Time for Hospitality Sector

As we all know, the COVID-19 pandemic has severely affected the world economy. No industry can escape the disruption of COVID-19, hotel sector being the most and deeply affected. Many hotels are shutting their doors since March 2020 and where we can see the dramatic declined in RevPAR. Mckinsey & Company research 2020 claimed that the recovery to 2019 level could be by 2024 or later.

Some countries such as China, adapted aggressive measures and managed to contain the virus exceptionally well, whilst keeping confirmed cases low. China's COVID-19 lockdown is over, travel is restarting. The country's experience as consumer confidence in travel rises can help hospitality businesses to pick up as of present, all travel is domestic; international borders in China remain closed.

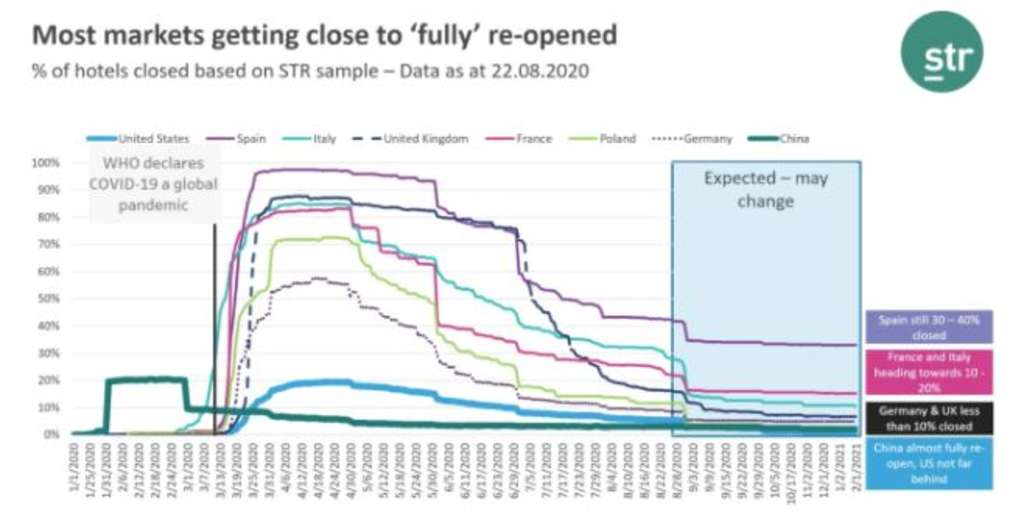

As clearly shown in the graph below, you can see that almost all the hotels in China is fully re-opened, while less than 10% of hotels still remain closed in Germany and UK. In September 2020, STR report shown that china bounced back strongly and reach over 60% occupancy.

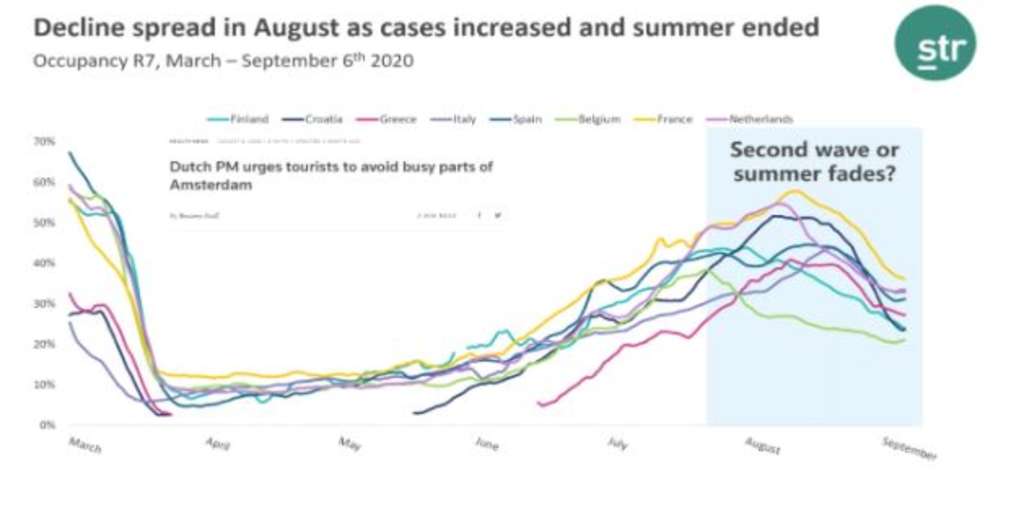

Europe is recovering to approximately 40% occupancy. However, in the middle of August 2020, there is a similar trend among European countries where we can see a decline in performance due to both second wave and the end of summer. Belgium is the first country that shown a drop in occupancy in early August.

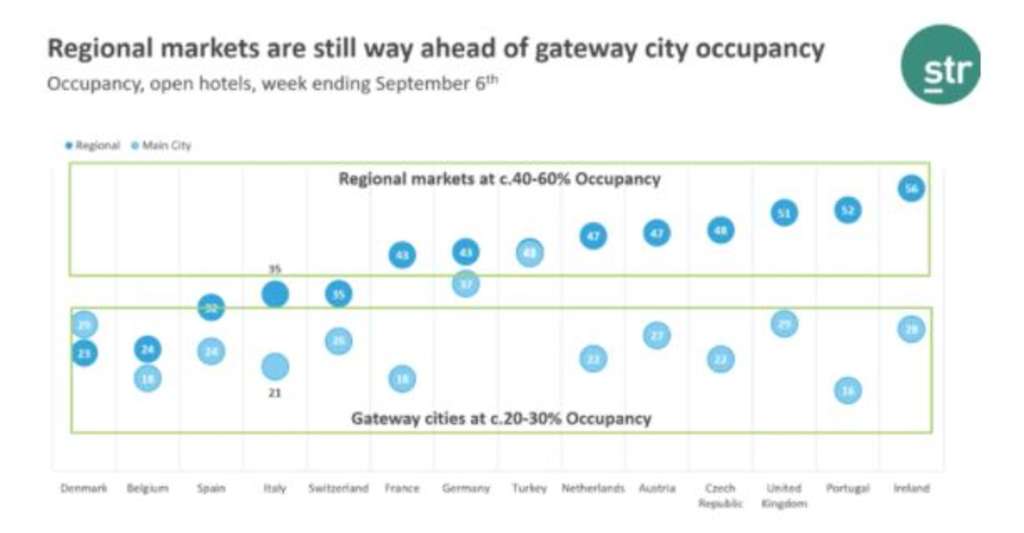

Examples of the reasons are that confirmed cases are increasing, and the Dutch Prime Minister warned tourists to avoid busy parts in Amsterdam. Germany issued travel warning for parts of Croatia. Some part of Greece and Italy are added to UK's travel quarantine list. Nevertheless, average occupancy across regional markets are operating at circa 40-60% and gateway cities are operating at circa 20-30% (shown in the chart below).

Confidence in the hotel market has been decimated with London being the hardest hit. According to STR report, the actual occupancy in UK is 46% in the week commencing August 31st 2020. The south of UK such as London are below 30% occupancy. For RevPar, London also stays behind regional UK in the short term. A further point put forward by STR is anticipated that there will be some recovery in Q42020 for London to catch up with Regional UK and stabilise around 30-40% level.

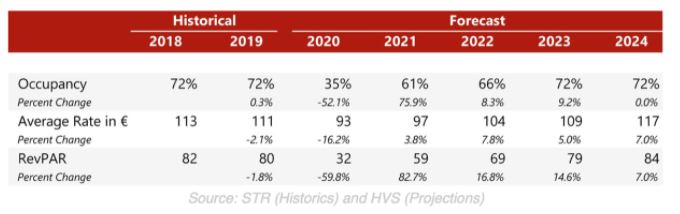

Overall, historical performance by STR and the key performance indicator projections in Europe by HVS and shown in the table below is anticipated that there will be a noticeable recovery from 2021. Occupancy, ADR and RevPAR will be back to pre-Vovid19 level by 2024.

European Hotel Sector should be recovered its 2019 level performance by 2024

Russell Kett, Chairman of the London Office of HVS said that "These projections are generic and illustrative of how we envisage the European hotel sector recovering from the effects of the pandemic - domestic leisure business leading the way, followed by corporate demand, with international cross-border demand picking up as airlines restart and people feel more comfortable about flying, and MICE business being among the last segments to recover. Clearly, there will be some hotels which will recover faster than the average shown here, but likewise there will be some which will take longer and may never achieve their 2019 performance levels again."

He continued "Some, especially those relying on international visitors, will take longer to see satisfactory levels of business return, with those reliant on MICE business taking longer still. A vaccine will help to accelerate some of this growth but, in any event, we are positive that the hotel sector will eventually produce strong returns again and remain attractive to investors who recognise their longer-term earnings potential."

In conclusion, the world can learn from China where its recovery rate is very fast without having any cure. We expected that business/leisure demand will pick up slowly in the rest of the world. The new norm for business travel will be a more mindful, thought-out way of travelling. Undeniably, domestic travel will return before international and group travels regain traction. However, the recent increase of cases across Europe raises more concern to the hotel industry. The control over people movement is still the main factor to control the virus, resulting a drop in demand. These are due to new measures, travel restrictions, decreased in consumer confidence and many more. Therefore, we are expecting the RevPAR and other key performances in many other markets to recover most likely in earliest 2023/2024.

Korosh Farazad

Founder and Chairman of Farazad Group of Companies

Farazad Group Ltd.