“Outlook for Hotels in Europe and UK for 2020”

There is no doubt that Europe is overwhelmed with the second wave of the COVID-19 pandemic since end of September. We can see a sharp increase in cases across the continent, especially in the United Kingdom, France, Spain, Germany, Netherlands and other European countries. The governments of each European country are responding and imposing stronger restrictions to control the second wave of this global pandemic.

On 27th October 2020, there were 367 coronavirus deaths and almost 23,000 new cases in UK. It is recorded as the highest death toll since May 2020, pressuring prime minister, Boris Johnson to implement tougher restrictions. The strict lockdown created a huge impact to all industries around the world, mainly hospitality businesses. According to PWC, the European hotels could take up to four years to return to business level in 2019 - even if an effective coronavirus vaccine, anticipated sometime in 2021, leads to a return of travellers. The hotels in UK has been hit hard by this, the UK occupancy averaged 51% in August, climbing to 58% in September, but has tumbled to about 50% in October. A case study of Whitbread, the owner of Premier Inn, experienced a loss of £725m in the first half of its financial year to 31 August 2020. The revenues dropped from £1.084bn to £250.8m and informed that bookings had reduced since regional lockdowns were enforced in October 2020. In addition, Whitbread plans to cut nearly 6,500 jobs after Boris Johnson announced new restrictions on the injured hospitality industry, comprising a 10pm curfew on all pubs that could last 6 months. The job axes represent one in five of the total staff.

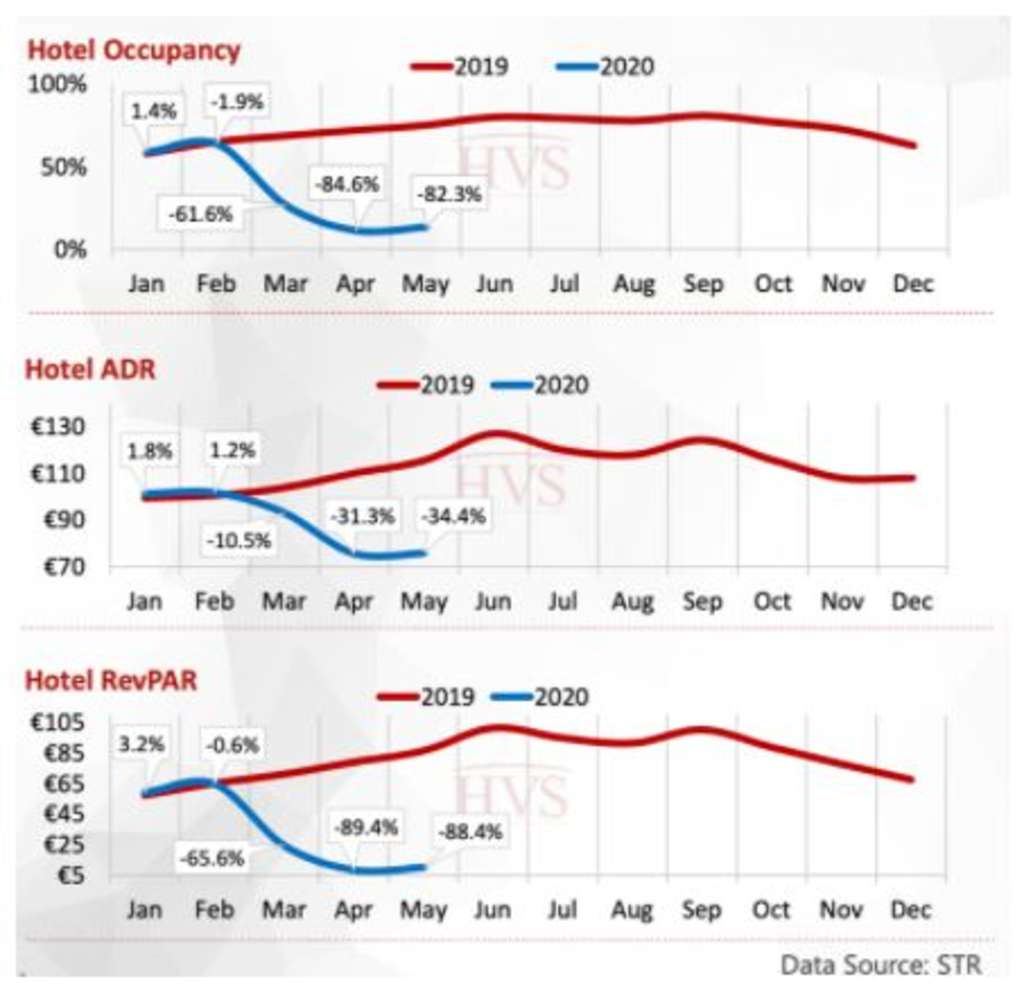

The graph below illustrated the Key performance indicators (Occupancy, ADR and RevPar) of European Hotels in 2019 and 2020. The outlook for hotels in Europe and UK shown a similar trend. The KPI level dramatically plunged back in March after the continent initial lockdown and will remain depressed until travel and other restrictions eased, vaccine will be the key for individual comfortability level to travel and staying at hotels again.

Moreover, the hotel supply growth is expected to be lower and lengthier. The reasons are as follow:

- COVID-19 market condition causing delayed - the new projects at the early stage are on hold indefinitely, postponed or even cancelled.

- Sourcing bank financing for new development in the next few years will be difficult as lenders become more conservative with their underwriting.

- Some properties may close and not re-opening, leading in a negative supply growth.

- Projects under construction that are close to opening are likely to finish, although at a slower pace.

Angus Johnston, UK Real Estate Lead, at PricewaterhouseCoopers said that "The forecast is another example of the short-term impacts and structural changes being wrought by COVID-19 on the real estate industry. With no end in sight to the collapse of international business travel, city centre operators will inevitably struggle. Longer term, whilst iconic properties will no doubt recover, the future viability of many locations must be in doubt if both international travel and corporate events fail to bounce back. Hotel owners may therefore need to consider how to repurpose or divest any non-core existing assets." In the bleakest outlook since benchmarking began in the 1970's, hotel occupancy rates in 2021 are forecast to be 55% across the UK and could take four years to return to pre-pandemic levels.

Alex Campbell, Partner at Fieldfisher said that "there will be a point of recovery for the sector, and Governments can help with the recovery of the market by introducing measures that encourage the renewal of tourism initiatives. The business and personal leisure travel market will return only once both employers and individuals feel that it is safe to do so again from a health perspective. As the global lockdown concludes, people will be less interested in spending money on material possessions and instead are likely to spend on holidays, travel and experiences. The medium-term prospects of the hotel and leisure sector are therefore, good". Therefore, travel and hotel industries are likely to come back strongly post-COVID19 as people and economies depend on it. Nevertheless, in the short term, people will spend less money to do non-essential travel and more on domestic travel compared to international travel.

In conclusion, the deep financial crisis caused by COVID-19 led to dramatic changes in hotel sector with declines in key performance indicators, the closure of many hotels and the furloughing of many hotel employees, resulting in job losses and redundancies throughout the sector. Experts are anticipating hotels in Europe and UK potentially be able to achieve a full recovery by 2024. Those hotels that are relying on international visitors, will take longer to see acceptable levels of pre-COVID business return. Overall, hotel sector will ultimately bounce back and produce strong returns and remain attractive to long-term investors.

Korosh Farazad

Founder and Chairman of Farazad Group of Companies

Farazad Group Ltd.