Will Talks of Vaccine Contribute to Higher RevPAR for Hotels?

The breaking news on the successful trails of COVID-19 vaccine has boosted hotel companies' stock price and valuations. However, hotel owners still need to focus on cash reserves in this unprecedented pandemic crisis.

On 9 November 2020, U.S. based Pfizer and Germany based BioNTech vaccine maker said its coronavirus vaccine is 94% effective in over-65s at preventing COVID-19. A week later Massachusetts-based biotech company Moderna also revealed similar positive result that it is nearly 95% effective from trials of their own vaccine. And most recent data released on 23 November 2020, the coronavirus vaccine developed by the University of Oxford AstraZeneca is highly effective at preventing people developing COVID-19 symptoms up to 90% efficacy.

It will take some time for vaccines to become readily available, but analysts are anticipating that the impact of these new vaccines will kick in significantly early next summer of 2021 and life should be back to normal sooner than later by next winter.

Lee Fong, Asia Pacific research director at Jones Lang LaSalle, said a potential vaccine offers hope against the uncertainty that has been disturbing economies and real estate markets. He claimed that 'investors are expecting the retail property market in Europe and U.S. to benefit most from the vaccine, followed by office and hospitality sectors. He added 'more decision-makers, whether occupiers or investors, to move forward with plans that may have been put on hold, supporting a pick-up in real estate activity'. This means that the real estate industry will gradually return to normalcy to 2019 market. The businesses are slowly recovering, where people are expecting to return to a travel environment.

The sector that could see gains in vaccine is property and commercial real estate. This sector has been dramatically hit hard by the Covid-19 where people have to work from home under government guidance and regulations. But the idea of a viable vaccine has raised the perspective of people returning to work in offices in the city centres.

Another sector is hotels, on the following day of the announcement of Vaccine from Pfizer and BioNtech, on the 10th November 2020 at 10 am GMT. 6 hotel Companies, among the world's largest jumped up showed*:

- Accor on Euronext Paris stock exchange trading at €28.89 ($34.27), an increase of 23.57% from the previous day's low.

- Hilton on the New York Stock Exchange trading at $104.19, an increase of 12.23%; Hyatt Hotels Corporation on the New York Stock Exchange trading at $67.53, an increase of 19.82%.

- InterContinental Hotel Group on the New York Stock Exchange trading at $61.09, an increase of 10.71%.

- Marriott International on the NASDAQ stock exchange trading at $118.30, an increase of 13.87%.

- Wyndham Hotels & Resorts on the NASDAQ stock exchange trading at $55.12, an increase of 6.68%.

The question is when will hotel performances recover to pre-COVID level?

The recovery times between markets and individual properties are expected to vary. Some hotels will recover faster than others, once a vaccine is readily available and rolled out. This is an unprecedented crisis, with no historical data to benchmark against and predict outcomes. The future of this challenging time is unknown. There are many factors that affect RevPar of the hotels (as follows):

- When will people feel comfortable to travel and explore places again?

- What budget are they willing to spend on accommodation during holidays?

- Where will travellers choose to go on holiday?

- What is the hotels strategy to attract existing and new guests? And many many more…

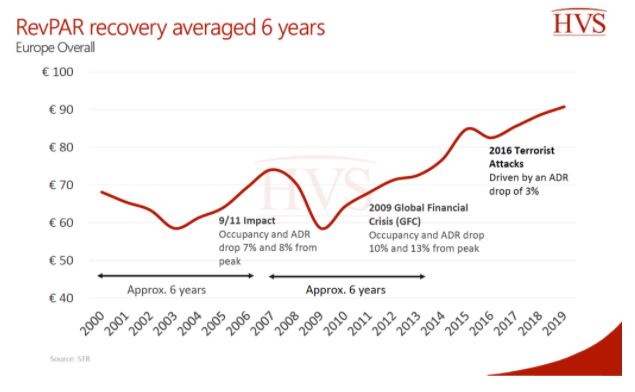

Nevertheless, according to HVS research in June 2020, they claimed that RevPAR recovery in Europe usually takes approximately 6 years after the major events. For instance, 9/11 impact in 2001, Global Financial crisis in 2008 as shown in the graph below.

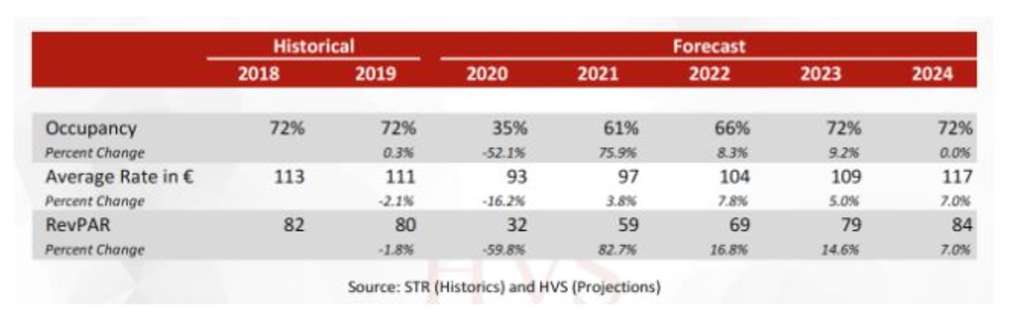

Another point raised by HVS - hotel sector within Europe should rebuilt its RevPAR 2019 performance by 2023/2024, as shown in the table below.

In conclusion, there is no doubt that the ongoing vaccine news will boost traveller's confidence and gradually increase hotel companies share price. Yet, some analysts are forecasting that the hotel assets within Europe will re-establish its RevPAR 2019 performance by early 2024. Some hotels might take longer time to restore to RevPAR rates pre-COVID market. Some might struggle to re-open to align with government restrictions and unfortunately, some might never recover at all. The hotels that do open their door again have to ensure that profitability is sustained, and cashflow remains positive.

*Source: Hotel news now 10th November 2020

Korosh Farazad

Founder and Chairman of Farazad Group of Companies

Farazad Group Ltd.