What Is Shaping The Future Of The Hospitality Industry?

INTRODUCTION

There is something that we can all agree upon and this is the vast and unforeseen impact the COVID-19 sanitary crisis has had on all our lives.

The hospitality, travel and tourism sectors have been hit hard but we can't ignore the impact on society. Consumer behaviour and eventually consumer spending have been, and will continue to be altered and business plans need to adapt to these new circumstances.

In this latest report from Horwath HTL Spain, we take a closer look at how hospitality companies will need to realign their businesses to deal with the current needs and desires of the market and offer some suggestions which we consider will be fundamental for hotel developers and investors to bear in mind when planning new hotel projects.

We consider whether these changes will be permanent or just temporary. Whatever the final outcome, those businesses willing to consider alternative scenarios and re-consider their planning strategies will be better prepared for the "New Future".

What is shaping the future of the Hospitality Industry?

Introduction

The coronavirus pandemic will remain in our collective memory for generations to come due to its devastating impact at different levels on the global economy. With continuing government assistance and the support of financial institutions, commerce will continue to push forward and get beyond the crisis. Overcoming economic crises is not a new thing. Where there's a will, there's a way.

However, there is another important element that all companies, in particular those linked to the service sector, will need to manage as business and commerce deal with the post-COVID world - the social aspect. We must all now adapt to new rules, standards and values which have and will continue to influence our social behaviour, and hence our behaviour as consumers, especially as consumers of travel and tourism services.

The closure of boundaries, lockdown measures and travel restrictions have forced the hospitality sector to live through its worst results in recent history. Financial loss and hotel closures have been all too commonplace, creating a level of uncertainty that most have never experienced.

But we must force ourselves to look ahead and get ready to confront the new environment that is emerging. It won't be easy nor swift, but the industry has often shown its resilience and capacity to rebound from unexpected scenarios and is blessed with a solid backbone. The question that arises now is how to adapt to the factors that are shaping the future of the hospitality industry.

The social impact is clear to us all and has forced changes in the way we live. Daily routines such as working practices, shopping habits and even interpersonal relationships have been altered, influencing and changing our behaviour. The hospitality industry will need to bear these new trends in mind if it is to experience a renaissance and continue to thrive. Projects under development will also need to reconsider their planning and business models and adjust to the new needs and demands of consumers.

This article analyses how the pandemic has changed some consumer behaviours and attitudes and how these may affect the world of hospitality in the future. Of course, consumer behaviour is always in a state of flux, but we need to stop and reflect on whether we are living through a period of permanent or only temporary change. We also need to resist the temptation to believe that things will go back to "normal".

"Never look back, unless you are planning to go that way." Henry David Thoreau

Evolving consumer behaviour & habits

Lockdowns, the inability to travel, teleworking, social distancing, strict health and safety measures; these are all factors that have influenced our behaviour, interaction with others and our way of viewing life.

We have classified seven different categories of changing consumer behaviours that we believe will also have an impact on hospitality, as well as on travel and tourism in general, and that are worth considering as we all look for ways to respond to the market and position ourselves for success.

1. Health and Safety

Consumers will pay more attention to the different security, hygiene and health procedures that establishments are implementing. Google searches related to health terms in the last year have increased considerably, reaching peaks in March 2020 and January 2021. In order to gain the confidence of consumers, firms will need to be both transparent and reliable.

2. Wellness

The United Nations has emphasized the importance of mental health and wellbeing, particularly given the extreme scenarios of isolation and loneliness derived from lockdowns. Many of us will be placing special emphasis on our wellness and wellbeing, such as in-house exercise and sports, fresh and organic food, nutrition, self-care, regular medical checks etc.

3. Consumption & Spending

Many consumers will be prioritising expenditure on basic products and will focus on leisure goods due to decreased purchasing power as a consequence of a rise in unemployment. Consumers will opt for better quality products or known brands. There will also be more pre-planning and less spontaneous purchasing.

4. Digitalization

Online webinars and meetings as well as usage of platforms for teleworking are now fundamental components of our working habits. Home delivery services, contactless payments, medical appointments through videoconference, online purchasing or even the development of a "COVID Radar App" all point towards an accelerated era of digitalization.

5. Remote Working

The sanitary crisis has forced many businesses to implement telework as part of their new procedures. In most cases remote working has been efficient and productive both for the employee and the employer. On the positive side, employees believe some of the benefits of teleworking include, but are not limited to, reduced stress; work-life balance optimization; flexible time schedules; and commuting time savings. Employers have also noticed better productivity, reduced costs associated with physical offices, decreased staff absenteeism and better use of technologies. As teleworking has proven to be successful it looks like many organizations will maintain this concept as a definite or hybrid alternative for workers.

6. Tourism &Travel

According to a survey undertaken by Booking.com, travel restrictions during this crisis have led to new ways of looking at travel and tourism by consumers. Some of the emerging trends when considering travel activities include: "greener" destinations, trips closer to home leading to an increased use of private transport, the possibility of working remotely and rural tourism.

7. Sustainability

Before the pandemic, sustainability was already a key topic addressed by individuals, companies and worldwide organizations such as the United Nations. Consumer behaviour will be more orientated towards reduced and conscious consumption and minimal waste. Sustainable products, responsible brands, eco-friendly policies, ecological products and environmental concerns will gain greater interest in the future.

Consequences for consumer spending

Changes in consumer behaviour will eventually lead to variations in consumer spending patterns. Consumers will now spend more time comparing and will take responsible decisions and assess what impact the product or service purchased will have globally.

Citizens have stayed longer at home which has resulted in an increase in the use of the internet and therefore an intensification of transactions made through online shopping. Accessibility, exclusive promotions, delivery service, competitive prices, the ability to compare and high availability are all aspects that attract the consumer. Everything indicates that this mode of consumption and spending will be increasingly common in the future.

Once the economic subsidies introduced by governments such as the various furlough schemes come to an end, consumption is expected to be hit negatively.

The WTTC January 2021 forecast predicts two possible scenarios regarding unemployment - the optimistic one, where as many as 111 million jobs could be regained (still 17% below 2019); or the most conservative outcome, predicting a return of 84 million jobs (25% below 2019, accounting for 82 million fewer jobs).

Unemployment will remain high, disposable income will be lower and consumers will be more price sensitive, opting for economic options and will cut spending not related to basic products and services.

The Ernst & Young Consumer Price Index Report analyses the five different consumer profiles that are expected to arise post-COVID. They have classified these profiles according to the expected level of expenditure compared to the pre-crisis era. 9% of those surveyed would buy more than before, 13% will face spending cuts, 22% would be classified as "moderate consumers" spending less, 25% will spend more only if necessary and 31% who are expected to be the ones less affected by the pandemic will be spending the same.

When referring to tourism and travel, spending will be impacted in different ways and this will be very dependent on the speed at which vaccinations are administered by the different countries.

The main conclusions derived from TripAdvisor's Traveler Sentiment Journey Survey are as follows:

- Nearly half (47%) of all respondents globally say they are planning to travel internationally in 2021

- More than three quarters (77%) of travelers surveyed say they will be more likely to travel internationally if they receive the vaccine, rising to 86% for travel domestically

- More than a quarter (26%) of respondents globally say that in order to ensure safe travel they will only travel to destinations that require visitors to be vaccinated before travel

- Nearly half (45%) of respondents planning at least two domestic trips in 2021

- A majority of consumers surveyed (64%) also report a desire to purchase more from local retail in 2021

Adaptability of the hotel industry

Hotel Operations

Given this extraordinary episode, it is compulsory for the hospitality industry to adapt. Now is the moment for hotel owners and operators to demonstrate the resilience of the sector and its capacity to adjust to the realities of the market and integrate the new rules and regulations. It is not just a matter of being politically correct; it is the moment to prove the industry's potential to think outside the box.

The table below identifies some of the new procedures and standards that hotels will need to adopt at least in the short and medium term.

Planning

Planning is key in any business, but in the current scenario, rigorous, efficient and continuous planning will be more determinant than ever. Operating departments will establish new SOPs, action plans will be fundamental for all divisions, business models will be reconfigured and contingency plans will need to be carefully analysed.

Hotel Design

The physical concept of hotels must be re-thought. Cleanliness, sanitizing, reduction of non-essential elements (cushions, decorative elements, newspapers/magazines) and the redesign of common areas to respect social distancing and capacities are all key aspects to consider when evaluating how rooms and public areas need to be adapted.

Health & Safety

Health and safety measures will be without doubt, the area where hotels will need to focus their efforts. According to the Study on Monitoring Sentiment for Intra-European Travel from the European Travel Commission "2/3 Europeans feel much safer and relaxed to enjoy their trip when strict health and safety protocols are in place". In response to this, we have seen how some companies have introduced exclusive campaigns aiming to safeguard their client's stay. In fact, some properties even offer 24/7 medical care services, extended insurance policies or free PCR tests. Some campaigns implemented by hotels are listed below:

Sales & Marketing Strategies

The Study on Monitoring Sentiment for Intra-European Travel from the European Travel Commission pointed out that almost a 45% of those surveyed intend to plan their next trip online via travel review websites (18%), destination websites or social media (12.7%) and the hotel's websites (11.8%). This is reinforced by EMEA consumer research performed by SAS, a leader in marketing analytics, that identified that 70% of new digital customers plan to keep using digital services after lockdown. "The sectors and businesses that manage to retain these customers in the long-term can expect the highest dividends".

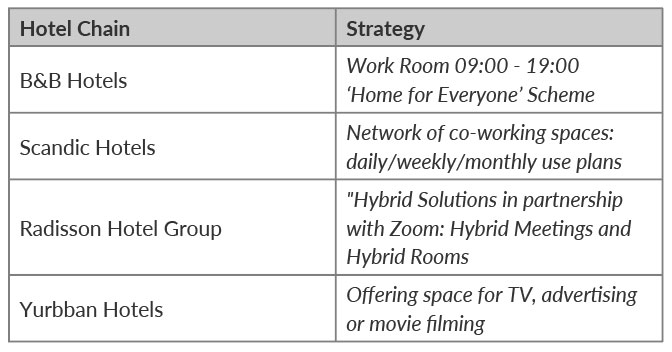

Another way of increasing visibility as well as returns is by reinventing the spaces of the hotel with new strategies. Hotel chains have become creative in their approaches to attract new clients and have incorporated new ways of business into their action plans. Some of these business model strategies include day room rentals, conversion of spaces into co-working areas, offering the facilities for TV and film shooting and even rental of spaces to schools for education purposes.

People Management

While it is important to focus on consumer comfort and safety, we cannot disregard the other essential human factor of this industry - staff. Millions of hotel staff members have been forced to put their careers on hold and it will be challenging for them to return to service, both physically and psychologically. After isolation and limited socialisation, dealing with customers face-to-face and teamwork routines will be challenging.

Hotels will have to invest money and resources by organizing training sessions, supplying appropriate Personal Protective Equipment, providing meticulous information and guaranteeing a safe working environment. Comprehension, flexibility, adaptability and empathy are also key in facilitating a fluent return to work.

Hotel Planning & Development

Many hotel developers are wondering how to proceed with their projects and manage the risks that affect the planning of any new business. Solvency and liquidity, future cashflow projections and uncertainty about the markets of the future are the main factors affecting all new hospitality investments. However, those who decide to embark on new projects or who are already in the planning phase, cannot ignore the repercussions this pandemic has had socially and thus the impact on future hotel development.

Developers, financiers and investors will need to take into consideration six fundamental pillars that will enable them to stay ahead of changes in demand and create value added products. Those capable of adapting their hotel concepts and business plans to the "New Normal" will be also be anticipating the "New Future".

What changes are here to stay?

We are all aware that consumers have had to adapt to new routines and procedures in their lives at a social, personal and labour level. However, we must ask ourselves whether the changes that have occurred due to the pandemic will be temporary or permanent. It is said that it takes between three weeks and eight months to transform a behaviour into a habit. In this case, whether these customs become habits will depend on external variables. Factors such as social conduct, culture, geography, investment in science, regional politics or international cooperation will shape consumer behaviour. This is why companies in the hotel sector need to be vigilant and ready to adapt when less expected.

The diagram above identifies the extent to which we believe these new behaviours and strategies will persist over time taking into consideration past trends and future needs.

The top section identifies those consumer behaviours that have been either introduced, altered or reinforced as a consequence of the pandemic. Whether these are maintained during time will depend mostly on the impact they have on our daily routines and future expectations. Those activities that have a positive impact on our lives such as purchasing value-based products (for instance, health-related) or shopping online (reducing time consumption) will last longer.

On the other hand, domestic tourism will be replaced by international travel as soon as restrictions are lifted and quarantines are not mandatory. Also, even though some businesses will allow staff to permanently work from home, it seems that a combined solution of teleworking and office-based work will be the most sustainable.

Business-related trends are shown on the lower section of the diagram. The majority of these have emerged as a consequence of this crisis, but were already present in the market and are now expected to be consolidated.

- Space conversion: Accor in 2019 entered a partnership with the co-working company Wojo and operates various co-working spaces.

- Diversification: In the last ten years, the number of branded residences as reported by Savills has increased by 170% with presence in over 60 countries around the world. Non-hotel brands have noticed the potential and are entering this market.

- Digitalization: Consumers and particularly younger generations are becoming digitalized. Guests are becoming more demanding and expect hotels to fulfil their desires which they consider basic needs. Existing hotels under development already envisioned a technological transformation was necessary.

- Health & Wellness: As per the last GWI - Global Wellness Tourism Economy report, wellness tourism already accounts for 16.8% of total global tourism revenue. Wellness tourism was a €527 billion market 2017 and is projected to reach €758 billion by 2022. Clearly, consumers are increasing their focus on all aspects of their wellbeing and the hotel industry is reacting positively to this trend. Some brands have even incorporated Health & Wellness programmes to attract this segment such as The Mandarin Oriental Hotel Group ("Wellness on the Road"), Rosewood Hotels & Resorts ("Journey to Resilience") or Hilton Hotels & Resorts ("Five Feet to Fitness").

The changes we have seen over the last 12 months have only served to reinforce the idea that some trends we were already observing in the hotel industry were and will be necessary to stay aligned with the reality of social needs. Perhaps what we are experiencing is just the future knocking at our door - are we ready for it?

Summary & Conclusions

Sometimes we learn most from drastic situations as we are obliged to adapt to unknown scenarios. This pandemic has forced the hotel industry to boost creativity and innovation and remain competitive. It has also tested the ability of owners and operators to differentiate. Simple things such as shifting from a Bed & Breakfast concept to Room & Breakfast appear innovative but are simply the result of resource optimization.

Consumers are now processing new habits and customs which may become part of our lives indefinitely. Whether we will go back to normality or not depends on how we define normality. Is washing our hands every time we enter a hotel room normal? Will "B-leisure" travelling now be more common as a consequence of an increase in the popularity of remote working? Is access to wellness facilities at hotels now indispensable? Will greeting and escorting guests upon arrival be permanently substituted by online check-in and electronic devices?

The hotel industry must become aware of the changes in consumer behaviour. This will also impact how, why, when and where they decide to spend their money. The lifting of travel restrictions and the administration of the vaccine is not enough for people to travel again. Confidence, security and comfort will be key to revive tourism and hotels will need to contribute to generating peace of mind. Transparency with sanitary procedures, strict health and safety regulations and reconditioning of common areas are just some measures hotels will need to deal with for the long term.

Some trends that we have already seen in the hotel business have now become a source of competitive advantage. Those new hotel projects that do not consider digitalization, health & wellness features, sustainable procedures or diversified products will lag behind other more visionary leaders. It is not a matter of trends; it is a question of evolution. This is not an overnight change; industry knowledge and an appropriate market study is fundamental.

Success for a new hotel development has often been defined as "Location, Location, Location". Perhaps we should now add, for existing and new hotel projects, "Planning, Planning, Planning"? As confirmed by McKinsey & Company, during the pandemic there has been a noticeable increase in the number of firms implementing scenario-based planning to react swiftly to changing economic conditions.

Those hotel companies characterised by a culture of adaptability and a positive attitude towards change will show resilience and lead by example.

As Charles Darwin stated once: "It is not the strongest of the species that survives, nor the most intelligent. It is the one that is most adaptable to change."