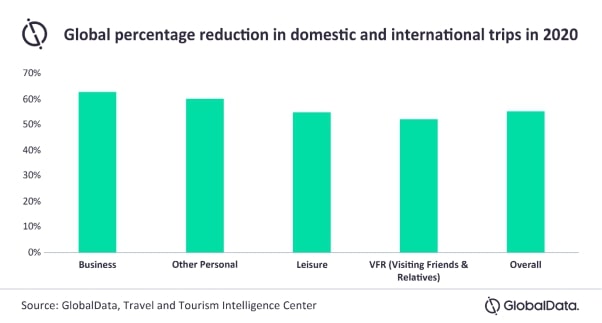

Consolidation In Business Travel Could Become A Necessity Amid A 63% Fall Of Trips In 2020, Says GlobalData

The COVID-19 pandemic has had a devastating effect on the business travel industry. The international sector was by far the worst affected, facing a 75% drop in total trips. Domestic business tourism also suffered, dropping by 56% (63% decrease overall in 2020). As a result, the global business travel industry has lost billions in client revenue, creating an overcrowded marketplace among business travel agencies. To survive the pandemic, some firms will need to consider mergers and acquisitions (M&A) to consolidate competition, drive revenue, and develop operational efficiency, says GlobalData, a leading data and analytics company.

The reduction in traveler demand has resulted in an overcrowded marketplace where business travel agencies are fighting for survival. These companies now have some tough decisions regarding their futures, and consolidation may be the most sustainable option for survival. We may see some Small and Medium Size Enterprises (SMEs) merge to give themselves more purchasing power in the industry. Alternatively, some major players could start to merge to reduce overheads and increase sales and revenue.

Craig Bradley, Associate Travel Tourism Analyst at GlobalData, comments: “Consolidation often occurs so a business can become a leader within an industry. When a company purchases or merges with another company, it reduces the number of competitors and enlarges its client base. However, in the current climate, revenue, efficiency, and cost reduction are the key motivators for M&A. The increase in overall revenue will give merged business travel firms more influence in the industry, allowing them to control pricing, take on niche markets and generate more leverage with its suppliers.”

As organizations have scaled, so have business travel agencies. Corporate clients, once worth millions in revenue, are worth a fraction of the value now. Many industry commentators have argued that this is just a momentary shift. However, many business travel clients have adapted to the pandemic by becoming more efficient and innovative, developing new ways to communicate, likely leading to a reduction in travel demand for the long-term.

Bradley adds: “Communication technologies such as Zoom, Microsoft Teams and Citrix have helped companies maintain employee engagement, collaboration, and partnerships throughout the pandemic, resulting in many companies questioning their corporate travel budgets. According to a recent GlobalData poll, 43% of respondents said their company’s corporate travel budgets would ‘reduce significantly’ in the next 12 months, suggesting that businesses will continue using communication technologies and carefully consider the necessity of using precious capital for flights and other travel expenses.”

For more information

Analysts available for comment. Please contact the GlobalData Press Office: [email protected]

EMEA & Americas: +44 (0)207 936 6400

Asia-Pacific: +91 40 6616 6809

- Quotes provided by Craig Bradley, Associate Travel and Tourism Analyst at GlobalData

- Data taken from GlobalData’s Tourism Demands and Flows Database

About GlobalData

4,000 of the world's largest companies, including over 70% of FTSE 100 and 60% of Fortune 100 companies, make more timely and better business decisions thanks to GlobalData's unique data, expert analysis and innovative solutions, all in one platform. GlobalData's mission is to help our clients decode the future to be more successful and innovative across a range of industries, including the healthcare, consumer, retail, financial, technology and professional services sectors.

GlobalData | LinkedIn | Twitter

GlobalData Press Office

+44 207 832 4399

GlobalData Plc