Hotel Market Beat 2022 - Europe

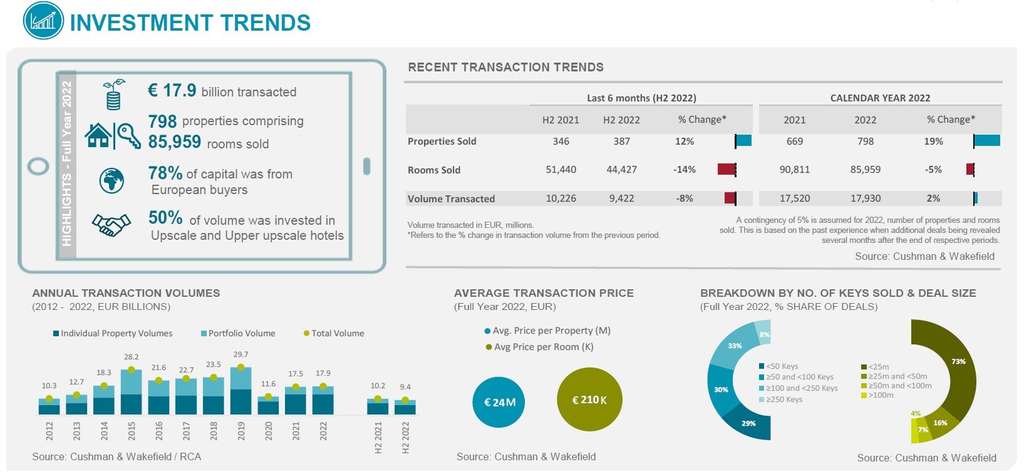

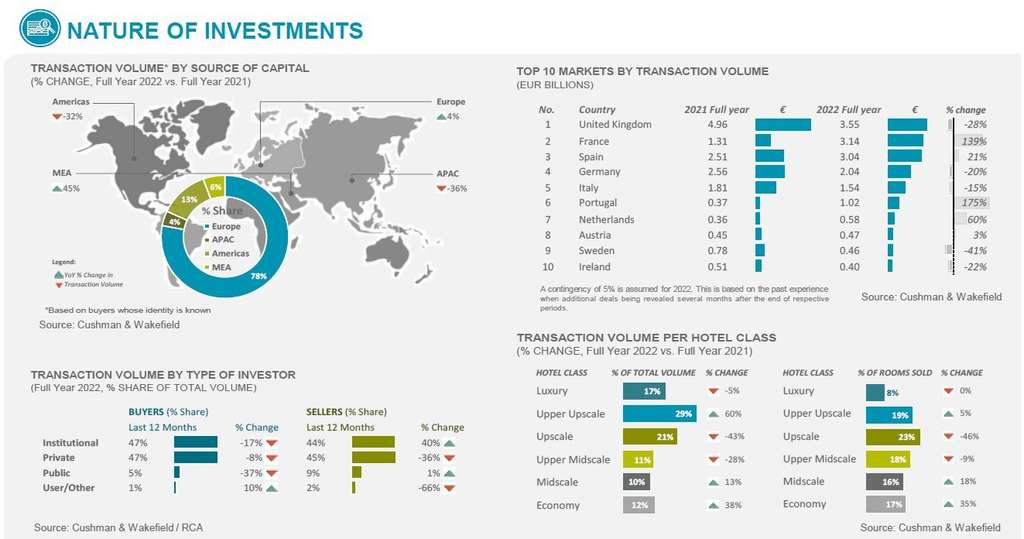

While most markets across Europe experienced a robust hotel performance recovery, the transaction activity recorded only a modest growth in 2022 hampered by the raised cost of financing, economic and geopolitical concerns. Nevertheless, nearly 800 hotels were sold in 2022 worth €18 billion, 2% more than in 2021. The UK remained the most active hotel investment market, although its lead over other markets has narrowed with the rise of France and Spain, ranked the second and third respectively.

A tale of two halves in 2022

Underpinned by the strong performance recovery and the wall of capital, the hotel transaction activity in Europe started with a healthy rebound in the first half of the year reaching €8.5 billion, 17% more than in 2021. Typically, deal flow is notably stronger in the second half of the year, but in 2022 it was stalled by the rising financing costs as well as increased geopolitical and economic concerns. Consequently, the transaction volume only reached €9.4 billion during H2 2022, 8% below the level achieved during the same period in the prior year.

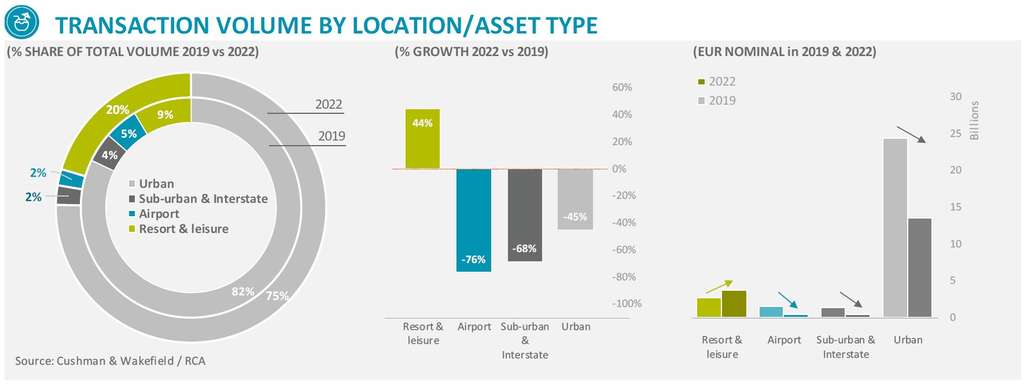

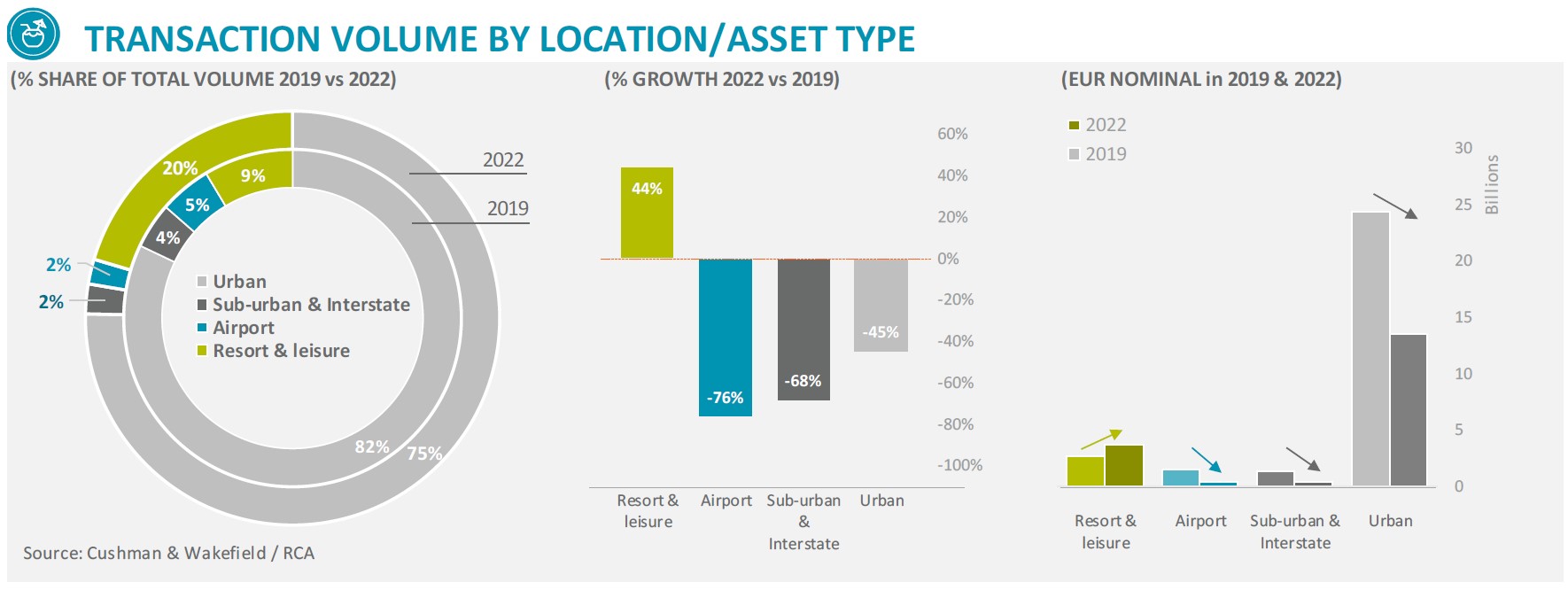

Overall, 798 hotels with 86,000 rooms changed hands in 2022 at average price of €210,000 per room. Most of the capital (78%) was sourced from within Europe followed by Americas. Investment from Middle East recorded the strongest growth, up by 45% compared to 2021. In terms of hotel class, the most capital was invested in Upper Upscale hotels (29%) while most rooms were sold within Upscale class (23%). Economy hotels recorded the strongest growth in terms of room sold (up by 35%). This confirmed the rising focus on hotels that are less exposed to inflationary pressures as they benefit from lower labour and other operating expenses such as energy and F&B supplies. Alongside this, and in a slight contradiction, resorts continued to be popular among investors underpinned by the strong recovery of leisure demand, long-term growth potential and naturally constrained supply growth. Overall, resorts accounted for 20% of total transaction volume in 2022 compared to 9% in 2019. The total volume invested in resorts across Europe reached nearly €3.7 billion, 44% more than in 2019. Not surprisingly, airport hotels recorded the most significant decline, down by nearly 76% compared to 2019.

In terms of deal sizes, while there were several big-ticket deals and portfolio transactions in 2022, the liquidity appears to be stronger at the lower end of the spectrum, with most deals being below €25 million, accounting for 73% of deals in 2022. This is driven by a lower requirement for debt and more flexibility in decision making when it comes to smaller deals.

Narrow margins at the top

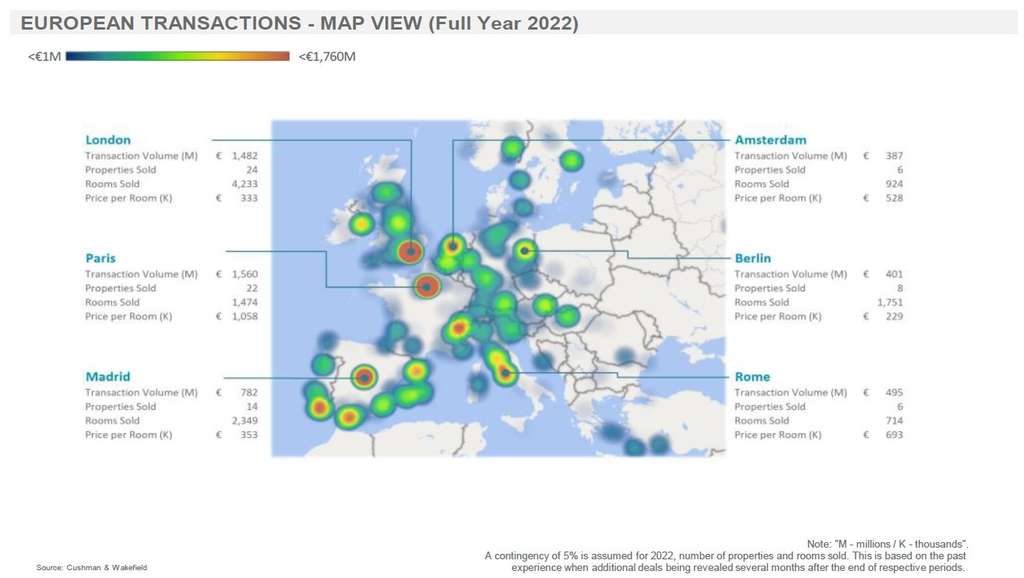

While the overall hotel transaction volume in Europe recorded only a minor increase in 2022, there were both thrivers and decliners when drilling down to the country level. Several traditionally dominant countries, such as UK and Germany, recorded a slowdown in hotel investment activity, while other markets such as France and Spain benefited from marked growth. This resulted in much less significant differences between volumes transacted within the top 5 markets. These are summarised below:

- UK – The UK remained Europe's most active hotel investment market in 2022, with 214 hotels sold worth over €3.5 billion. Nonetheless, the transaction volume experienced a 28% decline compared to 2021, because of rising costs of debt and economic instability in the UK and global markets, especially in the second half of the year. H1 was characterized by notable portfolio transactions, such as Tristan's acquisition of a majority stake in Point A Hotels and KSL's investment in Pig Hotels UK. On the other hand, the H2’s activity was driven by single asset deals, primarily in London. Examples include Whitbread’s acquisition of the 5 Strand development for Hub by Premier Inn, the disposition of Trafalgar St. James London Curio Collection by London & Regional, and the sale of The Dilly hotel by Archer Hotel Capital.

- France - The French market experienced the strongest growth of transaction activity among the top-5 countries in Europe, leading to an annual volume totalling €3.1 billion in 2022 (+139% on 2021). This was primarily driven by the strong attractiveness of Parisian hotel investment market (65% of the total volume). Especially, the second half of the year was characterized by several high-profile transactions in prime locations achieving a price at over €1 million per room. Examples of these high value deals include the sale of Soho House Paris, Hôtel Royal Saint Honoré, and Locke Paris.

- Spain – With an estimated volume of €3.0 billion in 2022 (+21% on 2021), Spain recorded the third-largest hotel transaction activity in Europe. The rising popularity of resorts amongst hotel investors, as well as the continued attractiveness of major gateway cities with a strong leisure appeal, contributed to this significant growth (nearly 40% above the last 10-year average). Examples of the major deals closed in 2022 include the Hotel Princesa Plaza in Madrid, the Hotel Incosol Marbella, and the 7Pines Resort in Ibiza during H1, as well as the acquisition of the 23-hotel portfolio Sareb by Fortress Investment Group and the 5-hotel Alua portfolio by Fattal Hotels in H2.

- Germany – With an estimated €2.0 billion transaction volume in 2022, Germany remains one of the largest hotel investment markets in Europe. However, compared to 2021, the country recorded about a 20% decline in hotel transaction activity, primarily due to a marked increase in debt costs. In addition, the recent spike in prime office yields in Germany has begun to also negatively impact hotel pricing and transaction activity. There was also a slowdown in forward deals due to developers battling with the increasing construction costs, supply chain disruptions and financing obstacles. Nonetheless, there were still several notable transactions closed in Germany during 2022, including the acquisition of the Sheraton Berlin Grand Esplanade by Deutsche Finance Group, the sale of A-Rosa Sylt resort in List, Motel One development site in Munich, and the dual-branded AC by Marriott & Moxy in Würzburg.

- Italy - With a total of €1.5 billion invested in hotels, the Italian transaction market experienced a decline in 2022 (-15% vs 2021), hampered primarily by the slow activity in H2. Nonetheless, investors have shown a strong appetite to buy assets in Rome, where 6 hotels were sold with a total volume reaching €495 million (+77% vs 2021). Notable transactions in the Italian capital included the acquisition of W Rome by CPP Investment Board and Hamilton-Pyramid Europe, the sale of Palazzo Marini 3&4 to Fort Partners (to be converted into a Four-Season hotel)), and the acquisition of Hotel Majestic by Boscalt Hospitality (to be converted to ultra-luxury Baccarat lifestyle hotel).

Overall, investors continued to focus on core markets in Europe with UK, Spain, France, Germany, and Italy accounting for about 74% of total transacted volume, in line with 2021 levels (75%). In terms of cities, London remains the most active hotel investment market, followed by Paris and Madrid.

Slow start but improving outlook for 2023

Looking ahead, we expect hotel transaction activity to see a slow start in H1 2023 due to the costs of borrowing remaining high and a potential mild recession in some markets. Nonetheless, investment activity is expected to gain momentum in the second half of the year, supported by the continued operating market recovery and pressures on some owners to strategically dispose of assets to deleverage or address fund redemptions. Hotels remain an effective hedge against inflation which, combined with the return of international capital and pricing consensus, should support activity within the sector. There are already several major hotel deals and portfolio sales in progress or expected to come to market soon, thus raising the prospects for a stronger transaction volume in the second half of 2023 and early 2024.

Sources: C&W, STR, UNWTO

Note: A contingency of 5% is assumed for 2022, number of properties and rooms sold. This is based on the past experience when additional deals being revealed several months after the end of respective periods.

Borivoj Vokrinek

Strategic Advisory & Head of Hospitality Research EMEA

Cushman & Wakefield