The Smart Hotelier’s Guide to 2013 Digital Marketing Budget Planning

Having just passed the mid-year mark, now is a good time to reflect on how events in 2012 have made a significant impact on hoteliers and how they should plan their digital marketing budgets for next year. The emergence of SoLoMo (the convergence of social, local and mobile); tablets as a distinct marketing and distribution category; new social media platforms such as Google+ and Pinterest; and ongoing Google algorithm updates that have made many hotel websites obsolete are just some of the topics that have made headlines so far this year.

This is also the perfect time to review your business goals and objectives. What did you achieve in 2012 that you would like to continue and even improve upon next year? What business goals did you not achieve? Were you often distracted by the 'next big thing' and, as a result, did you lose sight of hotel digital marketing fundamentals such as keeping your property's SEO strategy up to date?

This article provides guidance on how to structure your budget in 2013. Next year's digital marketing budget should focus on driving direct online bookings and achieving serious ROIs via structuring your initiatives in three main categories: "Core" Digital Marketing Initiatives; "Business-Need" Digital Marketing Initiatives; and Capital Investments, Strategy and Operations, including website re-designs and enhancements, day-to-day website operations, campaign management and professional development.

This Year's Good News and Not So Good News

To start with the good news, travel demand is up. This year the hospitality industry has been enjoying a period of growth in all three key performance metrics. In Q2, 2012, the U.S. hotel industry's occupancy increased 3.1 percent to 65.1 percent, average daily rate rose 4.7 percent to US$106.41 and revenue per available room was up 7.9 percent to US$69.32 (STR). Industry experts anticipate a continuation of these trends in the second half of 2012, though probably at a somewhat slower pace.

So what's the bad news?

At a time when online travel demand is growing and hoteliers should have more control than ever over their online channel distribution strategies, and be capable of extracting maximum online revenues from local, state and regional opportunities, we are seeing the opposite.

Independent hotels are overly OTA-dependent.

Independent hotels have traditionally been easy prey for the OTAs due to lack of focus in and understanding of the economics and cost-effectiveness of the direct online channel, as well as ignorance of basic online distribution rules such as rate parity, and weak negotiating power with the OTAs. Last year, for example, more than 76 percent of online bookings for non-branded hotels came from the OTAs and just 24 percent came from the hotels' own websites (STR, HSMAI Foundation).

This isn't to say hoteliers are not in a position to put up a fight. Rising travel demand means that OTAs' merchant commissions are already shrinking due to push back from major hotel brands and the industry as a whole. Hoteliers have realized that flash sales sites and last-minute discounters are bad for business and lead to severe price and brand erosion and loss in business in other channels. Contracts with the OTAs are up for renewal this year and the major hotel brands should be pushing for commissions below 15 percent. Independent hoteliers should not pay merchant commissions above 20 percent. Will hoteliers finally put a stop to this extraordinary leak in revenues to the OTAs and third parties?

Independent hoteliers must budget for a major expansion in their direct online channel efforts through the rest of 2012 and in 2013 if they want to decrease their over-dependence on the OTAs and the bottom-line killing flash sales sites such as Groupon, Living Social, etc., and last-minute discounters such as HotelTonight.com.

Branded hotels are overly brand-dependent.

Major hotel brands are doing a good job of brand building and online marketing at global and national levels, but simply do not have the bandwidth to cover regional, state and local markets. Branded and franchised hotels that are over-reliant on their brands' online marketing efforts are missing out on serious incremental online revenues from local, state and regional initiatives. For example, HeBS Digital has a number of very pro-active franchised hotel clients, which consistently enjoy higher revenues from their vanity websites than from Brand.com.

Hoteliers – branded or independent – must focus on the direct online channel. This means employing best practices in the online distribution channel and increasing direct online revenues via hotel website re-designs and enhancements; allocating funds to SEO, SEM, re-targeting, mobile marketing, etc.; and utilizing the OTAs only as part of a balanced distribution strategy.

Continuing reliance on tired and obsolete advertising formats.

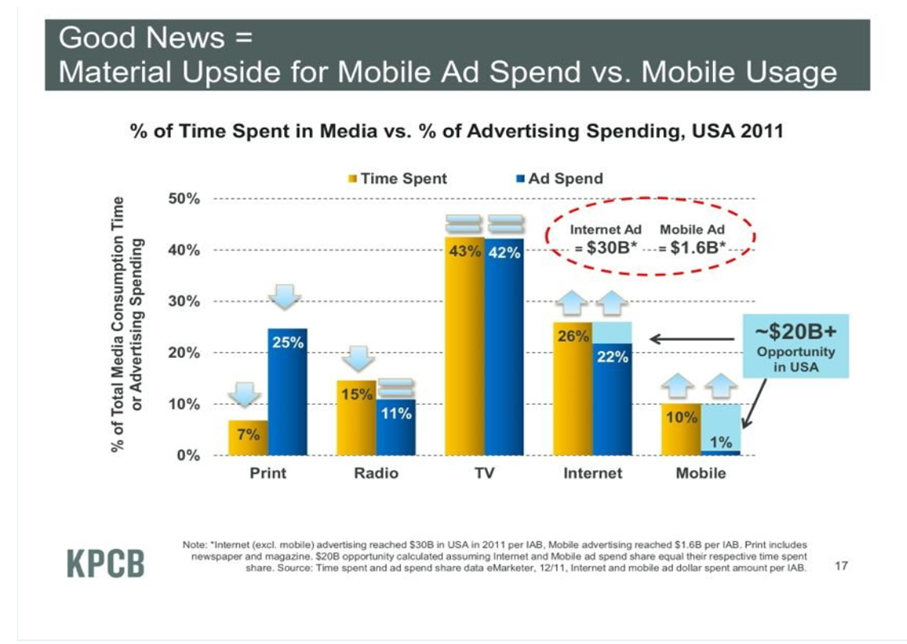

Another important concern is that many hoteliers continue to rely on offline advertising media, especially print media. Last year advertisers in the U.S. over-spent by more than $20 billion in print-media advertising while under-spending by more than $20 billion in Internet and mobile media.

Inertia from the past and lack of understanding that the travel consumers have migrated to the online, social and mobile channels are the main reasons for some hoteliers to continue to rely on offline advertising formats. Recently Starwood announced that the brand would be spending 75% of its marketing dollars in the digital space.

How Are Your Peers Allocating Their Budgets?

In the HeBS Digital's Sixth Annual Benchmark Survey on Hotel Digital Marketing Budget Planning and Best Practices, nearly one-third of respondents planned to spend as much as 49 percent of their advertising and marketing budgets on digital marketing initiatives (including website design and optimization). For the third year in a row, 'economic constraints' continue to negatively affect digital marketing budgets more than any other reason (e.g. last year's budget, what peers are doing, property renovations and non-marketing constraints).

The Benchmark Survey shows that hoteliers are going back to the basics and putting budget dollars into core initiatives that produce the best results and the highest ROIs. Here are the top five initiatives your peers consider of highest priority, based on how hoteliers answered to the question "Of your total Internet marketing budget, where did you spend your money?"

- 33.0% Website re-design/design

- 27.2% SEO

- 26.0% SEM (paid search)

- 24.3% Email Marketing

- 15.7% Display Advertising (banners)

Naturally, "fixing" the hotel website remains of paramount importance to hoteliers. Anything you do online today – from social media to banner advertising to email marketing – leads back to the hotel website. The results in favor of SEO and SEM show that hoteliers are paying attention to the importance of search engines for revenue generation, and how changes in the search engine algorithms affect their SEO strategies, and therefore we see an increase in budgets dedicated to SEO and Local Search.

What about all of the "hot" initiatives like social media and mobile? Hoteliers are ranking those in the top 10 initiatives they have spent their marketing dollars on, immediately after the five "core" initiatives mentioned above:

- 15.6% Mobile Marketing

- 14.0% Local Search/Linking

- 13.4% Social Media

- 12.3% Retargeting/Remarketing Advertising

- 12.0% Online Video

The Benchmark Survey results are supported by the overall growth in digital marketing spending by U.S. advertisers as a whole. According to a recent study published by eMarketer, US online spending will grow 23.3% in 2012 to reach $39.5 billion by the end of the year. The greatest increases in ad spending are for social media, email, and search marketing. Mobile is also seeing an increase in spend. Spending on traditional direct marketing such as direct mail, TV and radio will remain flat (eMarketer).

Building Your 2013 Digital Marketing Plan & Budget: Three Main Criteria

What line items should you include in your 2013 hotel digital marketing budget in order to drive as many revenues as possible through the direct online channel?

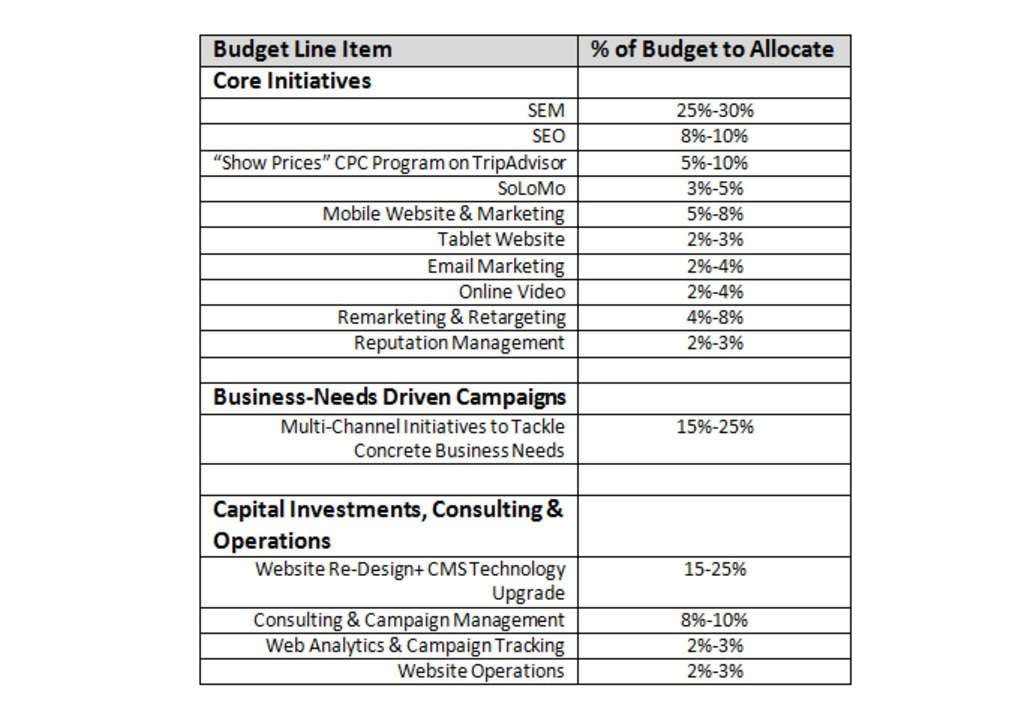

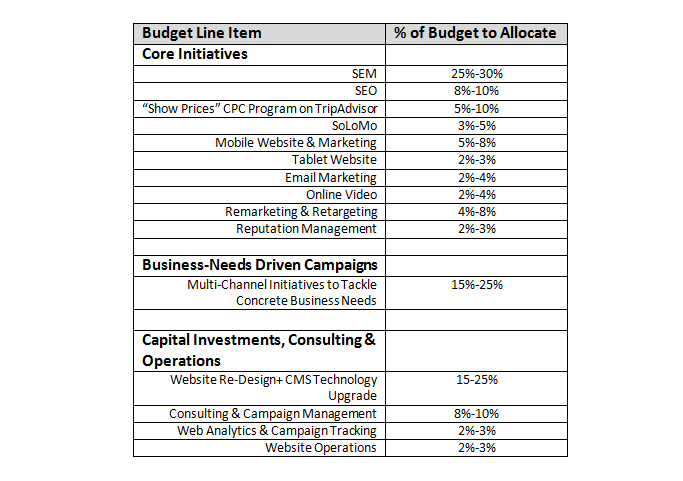

Your 2013 budget should take a three-silo approach and include:

- The Core Digital Marketing Campaigns: This portion of the budget should include tried and true initiatives that have been proven to drive high ROIs. Whether they are monthly or year-round initiatives, such as SEM on Google and Bing/Yahoo, the "Show Prices" CPC program on TripAdvisor, or ad hoc initiatives such as a tablet website, these items must be included in your 2013 budget.

- Business-Need Driven Marketing Campaigns: This part of the budget should be based on concrete business needs for the property, not advertising driven. Taking into account factors such as seasonality, area events that tend to bring business to your hotel, or customer segment need areas (such as meeting or group planning, family travel or weddings), you can never be 100% prepared in advance for what your business needs will be. In Q1 2013, will you need more weekend bookings? Once summer arrives, will family travelers be a target segment? Once you are able to determine your business needs, only then should you launch a multi-channel marketing campaign to achieve your goals for that quarter.

Also important to note – with the rapid changes in our industry, one cannot always prepare for the new initiatives that may need to be placed into the budget at any moment.

- Capital Investments, Consulting & Operations: The line items in this part of the budget include those that are necessary to keep your website "healthy," such as website re-designs, enhancements and technology upgrades as well as initiatives that don't produce direct revenue yet are essential to the success of your property, such as consulting, analytics and hosting. Scrimping on these initiatives can jeopardize the performance of all other budget line items.

The Core Digital Marketing Campaigns & Initiatives

Search Engine Marketing (SEM):

Recommended share of the 2013 hotel digital marketing budget: 25%-30%.

There are certain digital marketing initiatives which are proven winners, no matter what the state of the industry is or what the latest trends are. An example of one of these fundamentals is SEM. The search engines still rule distribution and are still the key driver of direct online hotel distribution. This includes mobile SEM, which must link to special mobile landing pages on your mobile website.

With the search engines maintaining such an important role in the direct online channel, search engine marketing (SEM) continues to be the most efficient means of delivering a targeted marketing message via the online channel, in terms of both traffic generation and revenue production. By following industry best practices and optimizing your campaigns on a consistent basis, you can ensure that your SEM campaigns continue to drive high ROIs.

Search Engine Optimization (SEO): 8%-10%

The recent Google Panda updates (Panda 3.9 just launched) have raised the bar for hotel websites, demanding not only deep and relevant content on the hotel website but also unique and engaging copy. The Google Venice update had a heavy impact on the localization of search. In summary, it means that Google will try its 'best' to serve you localized results based on your location, whether or not your search query is geo-targeted (i.e. you could type in 'hotel' and Google bases search results off of your location).

Hoteliers are also challenged to keep their hotel website consistently updated with fresh content as this significantly affects SEO. This means that budget dollars need to be allocated to keeping the website current or investing in a tool such as the HeBS Digital CMS Premium which allows hoteliers to add and edit both textual and visual content on a 24/7 basis, publish/un-publish new special offers, create packages and promotions, control the featured special promo tile on the home page, manage the photo selection on the website, and automatically push new specials and promotions to the hotel social media profiles and mobile website.

Case Study: Search Engine Revenues

In spite of all the new and trendy digital marketing initiatives and formats that overwhelm hoteliers nowadays, the good old search engines generated the most revenues for HeBS Digital's client portfolio consisting of thousands of hotel properties.

Here is the search engine (Google, Bing and Yahoo) year-to-date contribution as percentage from the total website revenues, as of July 2012:

- SEO revenues: 32.7%

- SEM revenues: 22.9%

A robust content strategy, supported by adequate technology and marketing funds, can make all the difference and allow the hotel to maximize its revenues from the search engines.

"Show Prices" CPC Program on TripAdvisor: 5%-10%

Take advantage of the ability to dramatically increase your visibility on TripAdvisor, the largest travel website in the world. Adding a property listing in the "Show Prices" functionality on the hotel pages on TripAdvisor serves a dual role: on one hand it brings highly qualified online travel consumers directly to the property's booking engine, and on the other hand this listing levels the playing field with the OTAs and provides a direct booking option to the site's users.

SoLoMo: 3%-4%

Bring SoLoMo (social, local and mobile) initiatives to the forefront of your hotel's targeted digital marketing strategy. The convergence of these three content and marketing platforms allows the hotel to deliver more personalized, relevant content to existing guests and customers in real time like never before.

Local search generates 3-5 percent of total website revenues across HeBS Digital's client portfolio. Consumers perform more than 3 billion local searches every month (Google). Google, Bing and Yahoo have placed much more emphasis on their local search business profiles, meaning that hoteliers have had to pay much more attention to the ongoing management and enhancement of these profiles or their websites would plummet in the search engine rankings. Continuously optimizing these profiles as well as enhancing your property's listing on the main data providers is vital to your hotel's SEO strategy and must take precedent next year in your budget.

Local content is also the foundation of mobile content for the search engines, making it extremely important to any hotelier's mobile website and SEO strategy.

Mobile Website and Mobile Marketing: 7%-8%

The mobile channel has already become a real travel planning and hotel distribution channel, especially for drive-in and last-minute travel markets. The U.S. hospitality industry is experiencing staggering growth rates in leisure and unmanaged business travel bookings via the mobile channel:

2010: $99 million

2011: $753 million

2012: $1,368 million

2013: $2,155 million (PhoCusWright)

HeBS Digital's own data shows that having a hotel mobile website generates incremental revenue through mobile and voice reservations which, without a well-optimized property mobile site with rich content, would have easily gone to the competition or the OTAs.

The question of whether a hotel or a travel supplier needs a mobile website has already been categorically answered: Mobile sites generate serious incremental bookings. The mobile web adheres to different rules than the conventional desktop Internet. Mobile users have even shorter attention spans and less time to browse than traditional desktop users. The mobile web features a number of limiting factors such as slower speeds, yet-to-be-perfected mobile browsers, smaller displays, multi-step booking and more.

The biggest mistake hoteliers make is not having a mobile site at all. Accessing a "conventional" website via a mobile device, even the iPhone (320 x 480 pixels), often results in an undesirable user experience (the inability to find information needed) and a predictable outcome (abandoned website visits and reservations). Today's hyperactive travel consumers rely on mobile sites that download quickly, provide short and concise textual content, minimalistic visual content and easy-to-use booking engines.

Content quality is the biggest "must-have" for a mobile site. The Google Panda algorithm updates favor mobile websites with rich visual and textual content that is fresh, engaging and optimized for the search engines.

Having a hotel mobile website – even if developed according to industry's best practices – is only the beginning. Just like with the mobile website, the mobile Web abides by different rules that require mobile Web-specific marketing initiatives.

Here are the top mobile marketing initiatives hoteliers should focus on in 2013 and beyond: mobile SEO, mobile SEM (paid search), mobile link building to the mobile site from mobile directories and sites, and local content optimization. Mobile search engines favor and predominantly serve local content; therefore, hoteliers need to optimize their local content and listings on the search engines, main data providers, and local business directories.

Tablet Website Enhancement: 3%-5%

More and more consumers are using tablets to plan and purchase travel, and hoteliers must deliver a customized, user-friendly experience on these devices. One in five Americans will use a tablet by the end of 2012 – and of this growing population, more than half reported shopping on their tablets once a week and 12 percent shopped daily (eMarketer).

Search engines and many major media sites consider tablets as a separate, distinct device category, characterized with its own unique user behavior and best practices for user experience and content delivery. According to Google's company data, 7 percent of all searches already come from tablets versus 14 percent from mobile devices and 79 percent via desktops (Q1, 2012).

Put it in your budget to either enhance your desktop website for the touch-screen tablet environment or build a tablet-only version of the property's website, in addition to the desktop and mobile sites, all managed via a single digital content depository-enabled CMS.

Email Marketing: 2%-3%

The grand-daddy of all digital marketing formats, email marketing generates 3-5 percent of total website revenues across HeBS Digital's client portfolio. Email marketing is still an essential component of the hotelier's direct online channel strategy, and an easy and affordable way to send messages to your key customer segments. Email marketing campaigns still generate significant ROIs for hoteliers, making this initiative a crucial line item in almost every hotelier's budget.

Smarten up your email marketing strategy by introducing reservation recovery email initiative, and increase your opt-in list by implementing a modal acquisition capability on the website.

Remarketing & Retargeting: 5%-10%

Online media campaigns that are not business-needs driven (more on this below) should be launched using the latest targeting capabilities, including retargeting, also known as remarketing. The Google Display Network offers the ideal symbiosis between re-targeting text ads and banner ads to target online travel consumers already familiar with your property and brand.

With these campaigns, you may target users after they leave your website. Messages are customized based on which part of the site users visited, and whether or not they made a booking. Retargeting campaigns aid in increasing brand awareness and loyalty, and move users through the purchase conversion funnel.

A recent survey by Econsultancy and Responsys showed that 70 percent of companies believe that integrating search and display had the most positive impact on their display advertising.

Online Video: 3%-4%

Short videos of your hotel and its amenities (best practices require not a single 30-minute video, but shorter 30- to 60- second videos illustrating different aspects of the hotel product: weddings, spa, entertainment, etc.) certainly influence travel bookings. It is now more affordable than ever to produce and showcase a video on your website. There are high-quality vendors available that will come to your property, provide a script, film videos, edit and provide to you in a usable format for your site.

Reputation Management: 2%-3%

In 2013, there must be room in the budget for managing the property's online reputation and presence in leading social media and review sites. Over the last few years, online customer reviews and social media have reached an unprecedented level of awareness within the hotel industry. With Google+ Local now utilizing Zagat reviews, and Bing now incorporating Yelp reviews, you are taking quite a big risk if you are not monitoring and responding to reviews.

Consider a solution such as Revinate or ReviewPro to help you manage the overwhelming amount of reviews and social media mentions you may not want to manage manually. HeBS Digital also helps clients utilize these tools effectively by providing analysis, customer intelligence, competitive benchmarking and automated reporting.

Business-Needs Driven Digital Marketing Campaigns & Initiatives

Recommended share of the 2013 hotel digital marketing budget: 15%-25%

Business-need campaigns help the property tackle business and occupancy needs that arise because of seasonality or group cancelations, weekend vs. weekday occupancy issues, as well as needs related to any key customer segment: meeting planners, wedding planners, leisure travel, corporate travelers, etc.

Multi-channel marketing campaigns are the most effective way to address such a business need, increase reach, and boost bookings & revenue for a need period. In order to effectively build traction across multiple channels, hoteliers must first identify what the business need is and then determine an online marketing goal.

Different media channels will help you achieve different goals. The question is – what are your property's goals? Once you determine your goals it's important to brainstorm a multi-channel campaign that utilizes the right online channels effectively and, most importantly, promotes one cohesive campaign message across these channels.

When strategizing a business-need campaign, take into consideration how the fundamentals can play a role in achieving success. For instance, should you launch an SEM campaign to promote this initiative? Would adding a section to the website build awareness and increase the SEO visibility of this campaign? Once you've determined the fundamentals, you can begin exploring what media channels are right for your goals and begin building your marketing plan.

A 'Business-Needs' campaign should be launched at least once per quarter. Here is an example of what a 'Business-Needs Driven' campaign might look like:

Business Issue:

Property X needs to drive leisure bookings for the upcoming month – they just realized they are only at 60 percent occupancy!

Campaign Solution:

- Search Engine Marketing (SEM): Create a campaign with a limited time offer, package or special and drive consumers directly to the property website. Include the rate and package details in the ad copy and consider geo-targeting to drive-in markets (it may be too late to capture a fly-in market).

- Search Engine Optimization (SEO): Add several search engine optimized landing pages to your site with the details of the promotion, as well as targeting the audiences most likely to convert: weekend travelers, senior citizens, family travelers, special occasions, museum goers, etc. This will increase the overall conversion rate of the campaign since all other line items in this campaign's budget will drive to these particular content pages.

- Online Media: Launch online media campaigns with the limited-time offer. Online media is a key touch point to increase the reach of your marketing campaigns, target key customer segments, and increase the effectiveness of other online marketing initiatives. Advertising on the Google Display Network allows you to target and refine your audience to show ads to the most relevant users. With display advertising you can reach key demographics based on interest, keywords, and other metrics.

- Email Marketing: Send an email newsletter to your opt-in list which is short, to the point and includes only the details of your limited time promotion.

- Travel Consumer Deal Alerts: send an online press announcement promoting the limited time offer. Travel writers and bloggers are "feasting" on pro-active travel information like this one.

- Mobile Marketing: For the right campaign, mobile marketing can effectively build traction when targeting local feeder markets, up-selling onsite accommodations such as a spa and restaurant, and increasing last-minute bookings. Launch an SMS text campaign to your mobile opt-in list with the last-minute offer. Keep in mind the immediate, hyper-local nature of mobile that allows us to reach our customers anywhere, anytime – making this an ideal way to quickly reach potential guests with your campaign.

- Social Media: Social media is an excellent channel to virally and quickly promote your campaign, increase awareness, and engage your target customer segments. It is also a powerful tool in generating buzz, capturing customer information, driving website traffic, and ultimately helping to increase any campaign's revenue. A Facebook sweepstakes, for example, will not only help promote your campaign, it will also increase your fan base and build your email and mobile opt-in list for future promotions.

- Interactive Initiatives: Initiatives such as contests and sweepstakes will generate buzz for any campaign. This type of initiative will also increase traffic to the site, encourage repeat visits, increase time spent on the hotel website, and ultimately increase bookings overall.

It is important to remember that by leaving room in the budget for these 'Business-Needs Driven Campaigns,' you are allowing for flexibility in your budget to actually launch initiatives that will drive ROI when your property needs it the most. Most of these initiatives will serve a dual purpose: they will quickly stimulate bookings and at the same time increase overall awareness of your property - ultimately resulting in results beyond the life of the campaign.

Capital Investments, Consulting & Operations

The Hotel Website:

Recommended share of the 2013 hotel digital marketing budget: 15%-25%

The explosion of the mobile and social media channels and the emergence of the new tablet channel presented a major challenge to hotel marketers: Creating and managing digital content throughout three distinct distribution and marketing channels, as well as publishing the hotel's latest special offers and promotions on the hotel's social media profiles.

Today's hotel website needs fresh content, rich media and current promotions. The hotel's special offers, promotions and packages need to be marketed across all channels, from the desktop website to the mobile site and social media. The hotel's rich media assets (hi-res photos, PDFs, graphics, videos, etc.) need to be pushed to all marketing and distribution channels, including the hotel website, social media, OTAs, GDS, etc.

It is not just about having any hotel website. Most hoteliers who should have a website already have one. The question is, what kind of a website do you need today? Today the hotel website MUST:

- Accommodate new travel purchasing behavior by the increasingly hyper-interactive travel consumers

- Employ the latest website and digital marketing technology

- Handle stringent new demands imposed by the search engines (e.g. Google Panda Update)

- Generate maximum revenues from the direct online channel

- Act as the hub of the hotel's multi-channel digital marketing efforts

Many hoteliers are mistakenly led to believe that not investing in the property's website re-design or optimization is actually saving money. Wrong! Not investing in your website is losing money and severely damaging the hotel's bottom line.

Your old and tired 1-2 year old property website cannot possibly meet the new requirements and most likely has dropped off the map, i.e. experienced deteriorating search rankings.

Case Study: Need for Website Content & Digital Marketing Asset Management System

There is a growing need for centralized website content and digital marketing asset management technology as hotel marketers are challenged to create and manage content; store and distribute the hotel digital marketing assets; and circulate special offers and packages, events and happenings, all through several distinct channels:

- own "desktop" website

- mobile website

- tablet website

- social media profiles on Facebook, Twitter, Google+

- hi-res photos to the OTAs and GDSs (optional)

Obviously, hoteliers need more than just a simple website content management system (CMS) capable of adding and editing textual and visual content. HeBS Digital's proprietary CMS Premium offers all of the above capabilities and acts as a centralized web content and digital marketing asset management system and was specifically developed to accommodate the Google Panda and "Freshness" updates by allowing hotel marketers to maintain fresh content on the hotel website.

Consulting: 8%-10%

The HeBS Digital's Sixth Annual Benchmark Survey showed that there was also an increase in budget dollars (19.9%) going toward the services of an outside Internet marketing agency, showing that hoteliers recognize the speed at which our industry progresses and the need to work with dedicated, experienced professionals in this area to stay on top of trends and achieve high ROIs.

Work with a full-service hotel digital marketing firm that will actively help you create and manage a budget that makes the most sense for your property. This firm should also teach you the latest trends and best practices so you can achieve high ROIs and incremental revenue growth.

Website Operations: 2%-3%

A small yet necessary budget for website hosting and maintenance needs to be included in the budget. Website maintenance may not always be planned. For instance, this year's Americans with Disabilities Act update meant that every hotel website needed to be updated to include their ADA amenities and services, including a landing page describing ADA-friendly accommodations. You may also avoid the need to pay for website updates by investing in a CMS solution that not only allows for total control over the hotel website, but also functions as a centralized digital marketing asset depository and dashboard to store, manage and distribute all of the hotel's digital marketing assets.

Analytics & Campaign Tracking: 2%-3%

There is no such thing as a free lunch. A leading analytics tool such as Adobe's Digital Marketing Suite powered by Omniture allows hoteliers to effectively measure the results of their digital marketing efforts. This in turn allows for the necessary and quick shifts in marketing funds from less effective marketing campaigns to campaigns with higher ROIs.

In summary, here is a quick snapshot of how you should allocate your 2013 digital marketing budget:

Conclusion

In 2013, the hotel's digital marketing budget should be separated into three silos. The core of the budget should focus on the fundamentals of hotel digital marketing that drive serious ROIs; there should be a budget allotted for specific business needs and unforeseen challenges; and a portion needs to be set aside for capital projects such as website re-design and enhancements, consulting and campaign management, and day-to-day website operations and professional development.

Keep in mind that while the industry is enjoying growth in all three key performance indicators, the economy still remains a factor when planning the 2013 budget. That means that the digital marketing budget must remain somewhat flexible (depending on business needs and campaign results) and that every dollar must be spent wisely, taking the dynamics of the marketplace and the industry's latest best practices into account.

Partner with a digital marketing firm that tackles its clients' challenges and celebrates successes as if they were their own. A firm that works extra hard to deliver ROI on every dollar, focuses on initiatives that drive ROI, and helps hoteliers transform their Internet presence into their hotel's most effective distribution channel.

About the Authors and HeBS Digital

Max Starkov is President & CEO and Mariana Mechoso Safer is Vice President, Marketing of HeBS Digital, the hospitality industry's leading full-service digital marketing and direct online channel strategy firm based in New York City (www.HeBSdigital.com). Margaret Mastrogiacomo, Senior Manager, Interactive Media & Creative Strategy at HeBS Digital, also contributed to this article.

HeBS Digital has pioneered many of the best practices in hotel Internet marketing, social and mobile marketing, and direct online channel distribution. The firm has won over 200 prestigious industry awards for its digital marketing and website design services, including numerous Adrian Awards, Davey Awards, W3 Awards, WebAwards, Magellan Awards, Summit International Awards, Interactive Media Awards, IAC Awards, etc.

A diverse client portfolio of top-tier major hotel brands, luxury and boutique hotel brands, resorts and casinos, hotel management companies, franchisees and independents, and CVBs are benefiting from HeBS Digital's direct online channel strategy and digital marketing expertise. Contact HeBS Digital's consultants at (212) 752-8186 or [email protected].

ABOUT NEXTGUEST

NextGuest provides hoteliers with everything they need to thrive in the digital world, with bespoke technology solutions developed to meet the needs of luxury hotel clients coupled with elegant design capabilities that bring brands to life. We marry the power of data with brand discovery to uncover unique strategies that apply to everything from website design, content marketing, CRM, and more, helping the world's top hotel brands maximize ROI as they acquire, convert, and retain guests throughout the travel planning journey. While each of our services is available on its own, the integrated technologies, marketing, and consulting offerings work together to increase digital engagement and generate revenue for hoteliers, allowing them to focus on what matters most — serving their guests. www.nextguest.com | [email protected]

Mariana Safer

SVP Global Marketing

NextGuest merged with Cendyn