Vacation Rental vs Condo-Hotel vs Hotel Financial Models

The Definitive Study of Vacation Rentals

The Vacation Rental alternative to traditional lodging continues to grow. As in any "new" industry, as the leaders establish themselves, the vacation rental financial model will begin to create rules, metrics and profit margin norms that are unique to that industry.

That time is upon us. Below please note four pro formas and how they differ.

Vacation Rentals financial models, in some cases, aren't so different from traditional hotels. In other cases they break with traditional revenue and expenditure norms by adding different revenue opportunities, hybrid housekeeping options, maintenance departments that earn revenues and "homeowners" who absorb certain substantial costs instead of the vacation rental company.

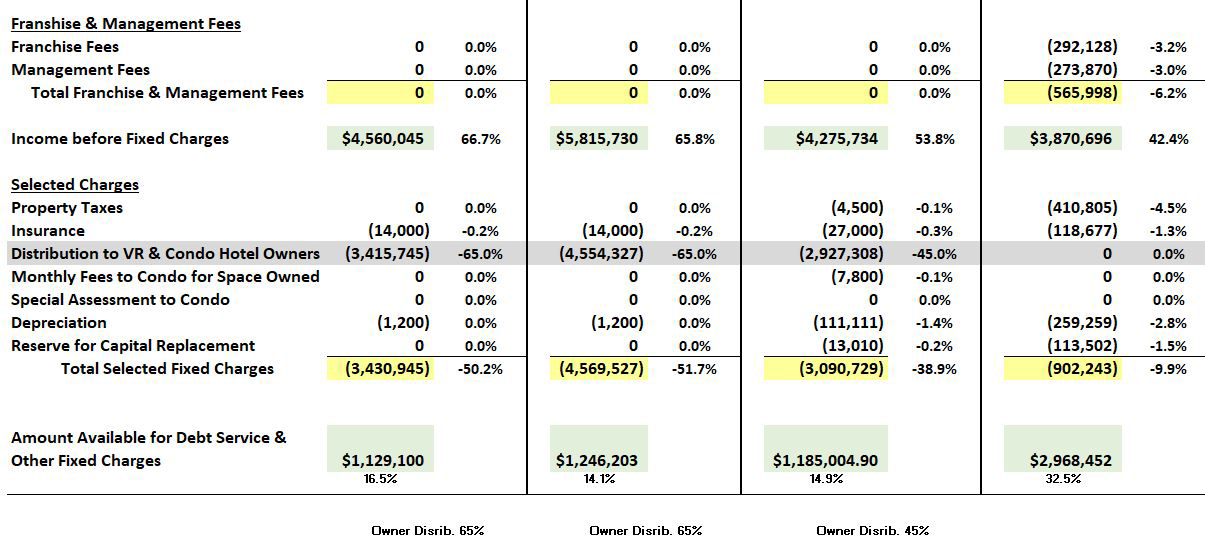

Kindly look at the 4 pro formas below that represent (1) Vacation Rental Companies that deal in condominium space, (2) Vacation Rental Companies that deal in homes, (3) Condo Hotel Programs and (4) Hotels.

Exhibit "A" represents 4 diamond properties in which occupancy, average daily rate and length of stay show variations. In essence it shows a more realistic view of how businesses of this size and caliber (75 units and 4 diamond) and typically flow through to the bottom line.

Exhibit "B" represents 4 diamond properties in which metrics mentioned are all the same. In essence it tests their flow through to the bottom line with typical metrics and expenditures in each financial model.

Exhibit "A" – Occupancy and ADR Vary

Exhibit "A" shows occupancies of 67.9%, 67.9%, 72% and 76%, average daily rates of $300, $400, $350 and $370 and average lengths of stay of 4.1, 4.8, 3.1 and 2.3 on VR condos, VR homes, Condo Hotels and Hotels, respectively.

Average Length of Stay is the "driver" on some revenues and costs that are based on reservations and not room nights occupied.

We can see that vacation rental companies can pay a 65% distribution to "unit" owners while condo hotels are distributing 45%. This can vary based on profitability.

Condo Hotels in this model earn higher Gross Reservation Revenues than VR Condos. VR Homes in many cases are big ticket "items" earning higher average daily rates.

As is typical to hotels the "Rooms Division" has a 24% cost (limited service) when comparing Cost to Sales.

Above, VR condos and homeowners are paying for towels & linens and since housekeeping cost is a profit center, it is broken out and shown separately. The Rooms Division cost, therefore is reduced by these amounts and savings from hybrid housekeeping methods.

Administrative & General is also reduced by merchant fees (credit card) because many vacation rental companies charge their guests for merchant fees.

The bottom line flow through, after distributions and other cost variations, shows vacation rentals bringing 16.5% and 14.1% to the bottom line. Condo hotels are bringing 14.9% and hotels 32.5%, all before Debt Service and Other Fixed Charges.

Exhibit "B" – Occupancy and ADR are the same

Exhibit "B" shows occupancies of 72%, average daily rates of $300 and average lengths of stay of 4.1, 4.8, 3.1 and 2.3 on vacation rental condos, vacation rental homes, Condo Hotels and Hotels, respectively.

We can see that vacation rental companies can pay a 65% distribution to "unit" owners while condo hotels are distributing 45%. This can vary based on profitability.

Hotels in this model, despite sharing the same occupancy and ADR, earn higher Gross Reservation Revenues because they have no Owner Occupancy (when an owner in a vacation rental or condo hotel stays in his home or condo).

The bottom line flow through, after distributions and other variations, shows vacation rentals bringing 16.0% and 15.8% to the bottom line. Condo hotels are bringing 14.6% and hotels 31.7%, all before Debt Service and Other Fixed Charges.

Final Observation

Hotels and Condo Hotels typically invest more in revenue management and as a result earn higher Gross Reservation Revenues. If that gap narrows than the 65% distribution by vacation rentals compared to the 45% distribution paid by condo hotels will have even more impact.

In both cases, unit owner distributions are calculated on Gross Reservation Revenues.

Vacation rental companies do not have the burden that condo hotel programs have of buying space in the condo. Those additional costs mean that the maximum they can pay and also make a reasonable profit (4 diamond) is 45%.

Hotels bring more to the bottom line but they also carry substantially higher debt because of the initial cost of the hotel and having the burden of maintenance and refurbishment of the hotel.

Which is best? You decide!

The Definitive Study of Vacation Rentals is being finalized before being published. It will be available on Amazon shortly. If you would like a copy of some great chapters write me a note and I'll be pleased to get it out to you. Simply email me at[email protected].

Richard B Evans

President of Revenue Report Card LLC

(954) 290 - 3567