Commercial Real Estate Valuation in the COVID-19 Era

The COVID-19 Crisis is being benchmarked with the Global Financial Crisis of 2007-08. In this article, we explore implications of the crisis on valuation of commercial real estate (hotels and beyond).

When COVID-19 struck, the markets reacted. Since the beginning of 2020, REIT returns have nosedived: -60% in retail and hotel sectors, and -30% in residential sector which is usually considered to be a safe asset. In sum: Stock markets are brutal, often anonymous and powerful when it comes to pricing assets. Commercial Real Estate (CRE) is a different ball-game altogether. CRE experiences much fewer transactions with price movements estimated through valuation.

Unlike stock market participants, CRE appraisers - professionals who estimate the market value of assets - are answerable to conflicting interests, prone to litigation risk and sensitive about their reputation with their clients. Their clients (owners, investors, lenders, etc.) need the CRE assets appraised even when the appraisers are faced such predicaments as COVID-19. The current situation has caught several appraisers off-guard.

In this article, we will address some key issues related to the valuation of CRE assets in light of the COVID-19 crisis. The aim is to provide some relevant data, insights and opinions to, at least, spur a constructive dialogue and lead to an informed wayfinding.

Does the "long run" phenomenon matter?

Although fundamentally different, like other financial assets, real estate assets are valued as if they implied series of cash flows in perpetuity. Although unlike stocks, CRE will physically depreciate, their owners keep aside some budget for ongoing capital expenditure to mitigate the effects of depreciation and rendering them akin to perpetual assets. However, if in the long run, asset values revert to their (inflation adjusted) mean, do episodes like COVID-19 really matter in valuation? Well, Keynes' famed statement "in the long run, we are all dead" leads to the predicament.

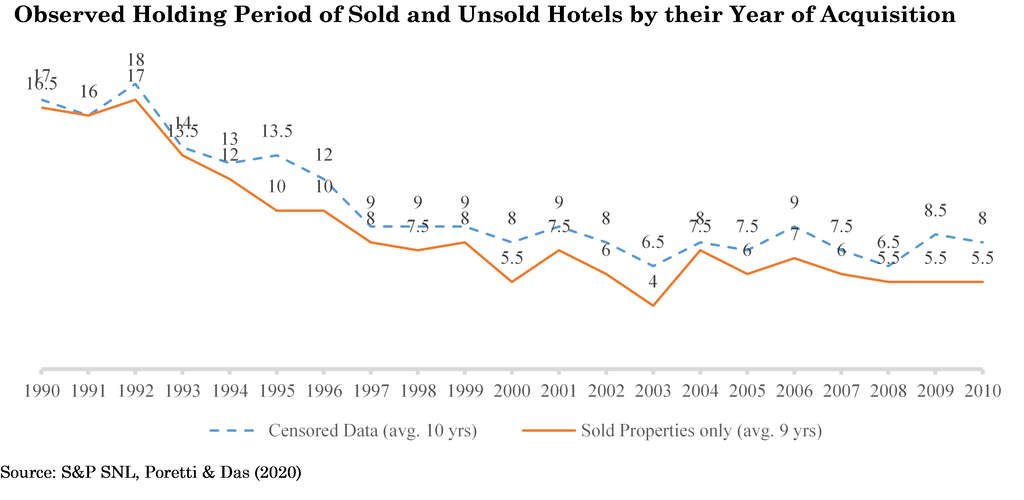

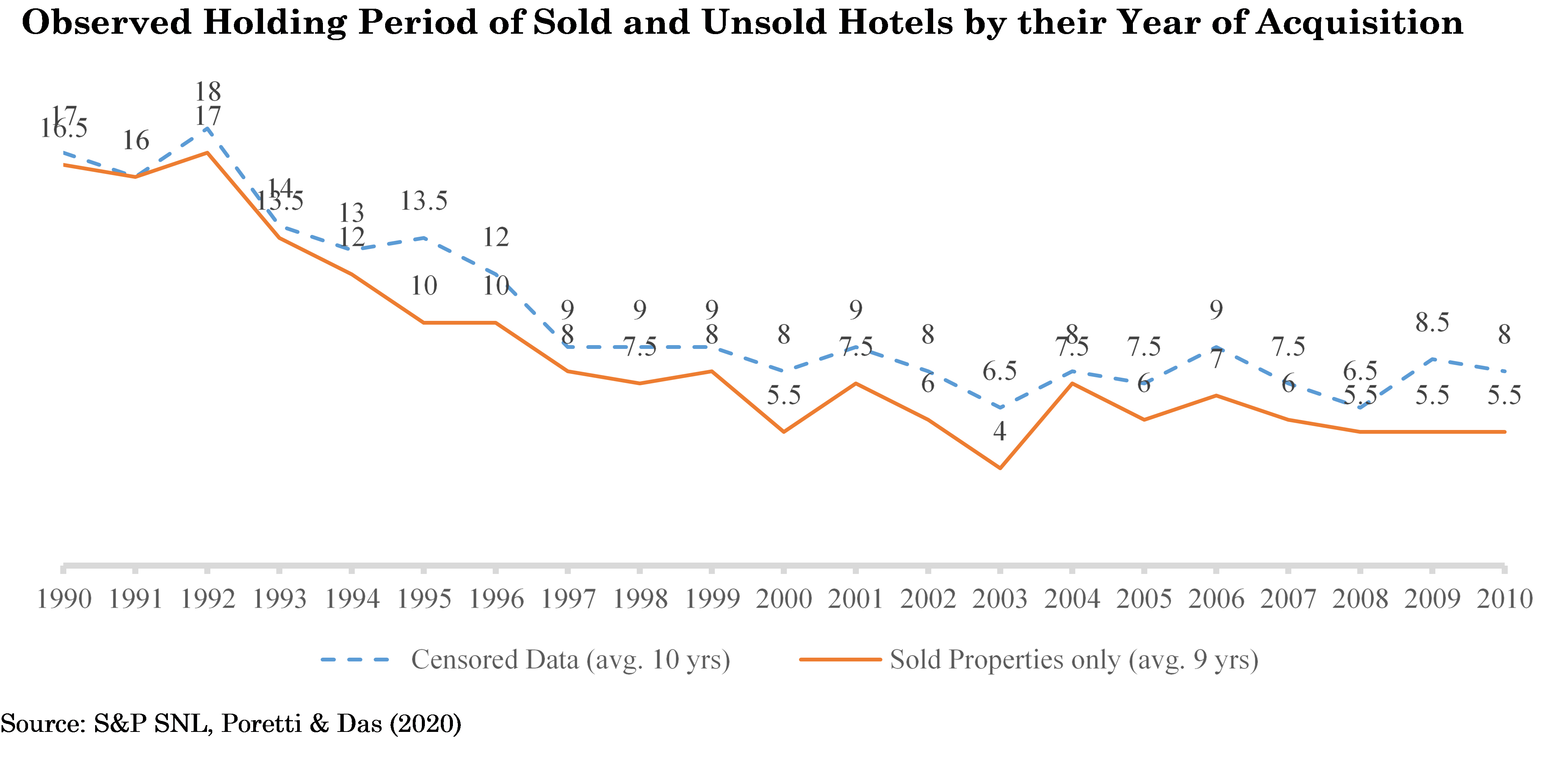

The reality is, the CRE market does care about the short run performance of an asset. Investors need a safe exit strategy and may have a target holding period. See Figure 1, for example. In recent decades, the holding periods have constantly shrunk, e.g. from 16 years in 1990 to nearly 6 or 8 years in recent years.

Although some may argue that the world's response to COVID-19 is a bit exaggerated, there should be no denial that (a) the crisis is here to stay for several months and (b) it will fundamentally change our worldview of living, traveling, shopping and working. Even if COVID-19 does not lead to a permanent regime shift (which, by the way, is probable), its impact on cash flow projections must be incorporated into any valuation.

Given the significant valuation impact of COVID-19 on CRE valuation, the next two points will shed some light on what our possible approach to valuation could be.

Taking cue from public market equivalents

COVID-19 is not going to be yet another small blip on the timeline waiting to be lost in oblivion. A positive aspect of COVID-19 is that it has, hopefully, rescued us from our fatalistic denial toward imminent global emergencies, in terms of health, pollution and climate change. We would agree that similar unprecedented crises may happen again, even if humanity finds a permanent solution to the current health crisis. A wider acceptance of the global realities spurred by the current crisis itself is sufficient to let the after-effects persist through the next few years.

Fortunately, CRE have comparable stock market equivalents to take cue from. For some reason, the stock markets seem to have responded to the crisis: It appears that the fears of long term cash flow impacts have already been priced into stock returns. Yes, the stock markets may not have very long memories, but they incorporate the short or medium term developments quite efficiently.

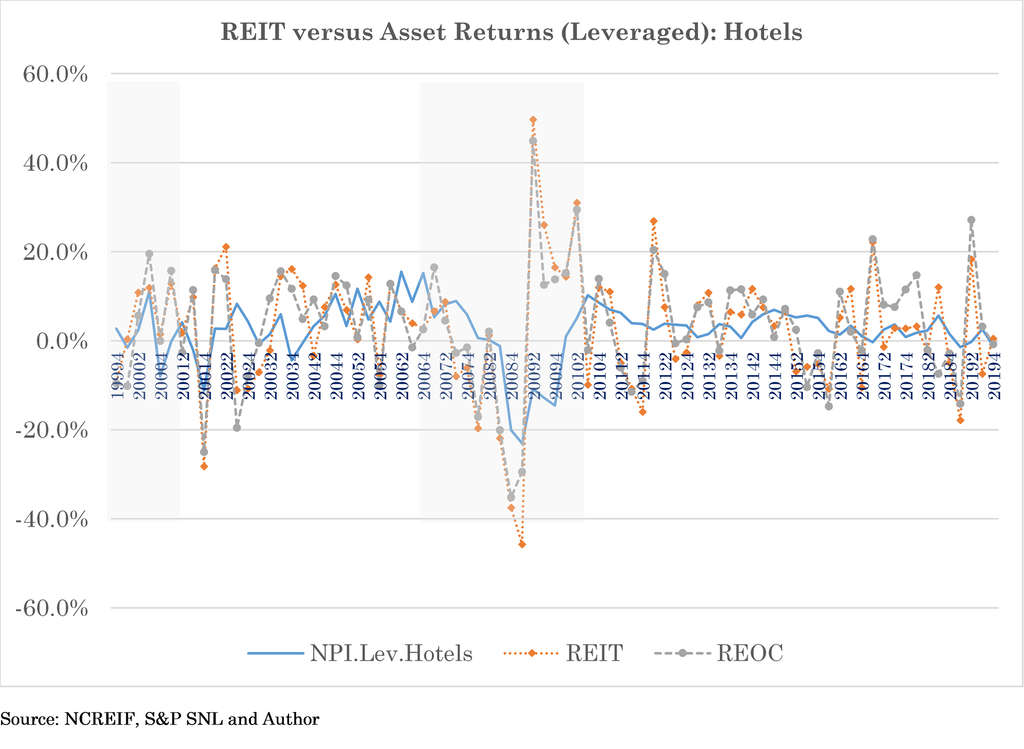

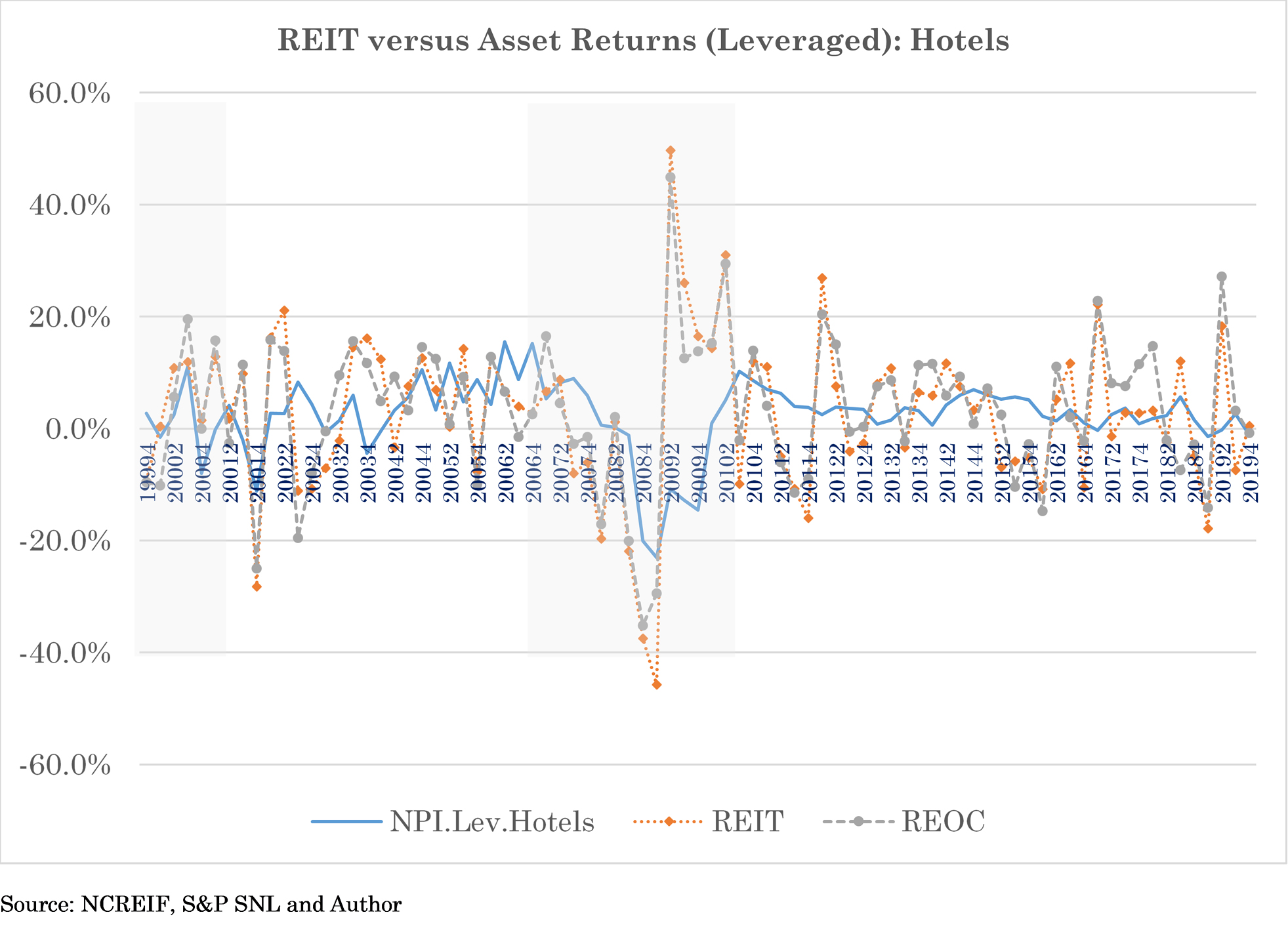

NCREIF property index (NPI) serves as a good proxy for the performance of CRE. However, for behavioral reasons (e.g. "anchoring bias"), the appraisal based NCREIF indices of CRE performance are accused of being backward looking and artificially "smooth." Fortunately, several influential studies have shown significant association between the CRE returns (NPI.Lev) and lagged stock market equivalents.

See Figure 2, where we present the hotel sector return trends, for example. Indices of REITs (e.g. Host Hotels) and REOCs (e.g. Marriott) tend to be highly and contemporaneously correlated. They are also "spiky", in that the stock market may lead to drastic changes in returns. Note that these (REIT and REOC) indices are based on actual, transaction-based stock prices. The NPI.Lev reflects return on hotel properties based on their appraised value (Lev refers to "leveraged return", the return calculated after the lenders' cash flow is already accounted for). The NPI index is smooth, but is significantly associated with lagged values of REIT returns. Regression analysis suggests that REIT performance from the last 8 quarters (two years) are significantly associated with the NPI index. Beyond a lag of two years, the association tends to diminish. The 12th(3 year) lag, in our analysis, has actually a disciplining effect (i.e. a significantly negative coefficient).

If the past is a good reflection of the future, we should expect that the plummeting REIT (or REOC) stock prices will exert a negative pressure on CRE valuation for the next several quarters. If the crisis persists longer, CRE values will see a substantial drop in values for the next few years. These years will be a substantial part of the investors' holding period that will bolster discounting effect.

The next pertinent question to ask is how to interpret the drop in prices into CRE values.

1. Adjustment to valuation metrics

CRE valuation has two key inputs: (1) how much cash flow an asset is expected to generate in the future and (2) how risky are the cash flows. So long as the macroeconomic swings are modest, the data follows a fixed "regime", making cash flow forecasting easier. The risk metrics (e.g. discount rate, capitalization rate, etc.) are determined by adding some premium to the exogenous risk-free rate. The risk-metrics, therefore, are reflective of the "uncertainty" in cash flow whereas the cash flow estimates are about their expected "levels".

In March 2020, the NCREIF Valuation Committee published a COVID-19 bulletin outlining some standards for addressing the predicament. The overall tone recommended the wise "wait and watch" approach. However, a key takeaway was to avoid adjusting risk-metrics and focus on adjusting the cash flow metrics (occupancy rate, rental growth, percent rent, etc.). These are good first steps. If the guidelines serve as "standards" and are applied across the board, the valuations will be "defendable." Besides, just focusing on the risk-metrics will not lead to drastic changes in valuation from the previous quarter. The CRE community, anyway, has made its peace with the "smoothed" indices.

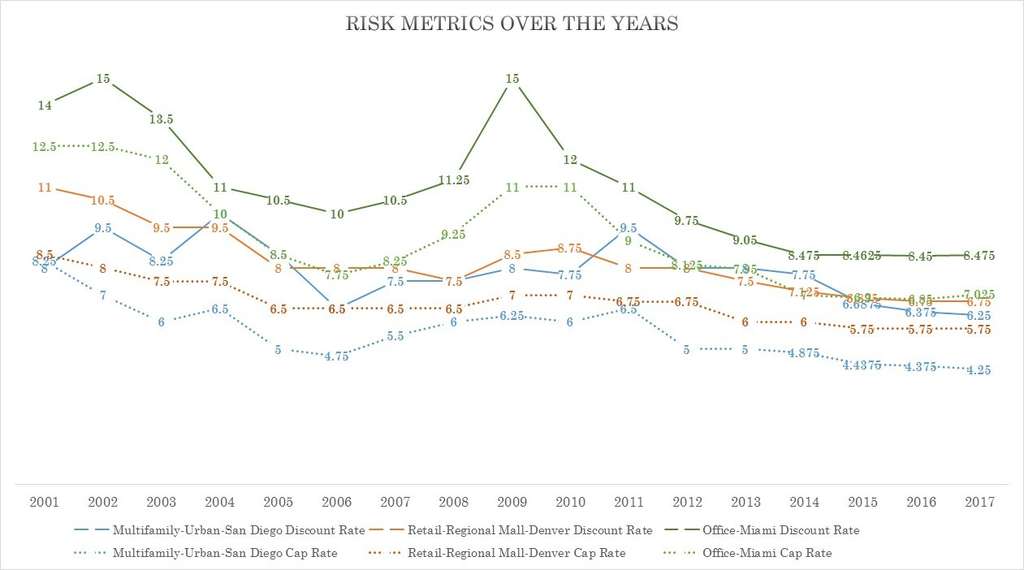

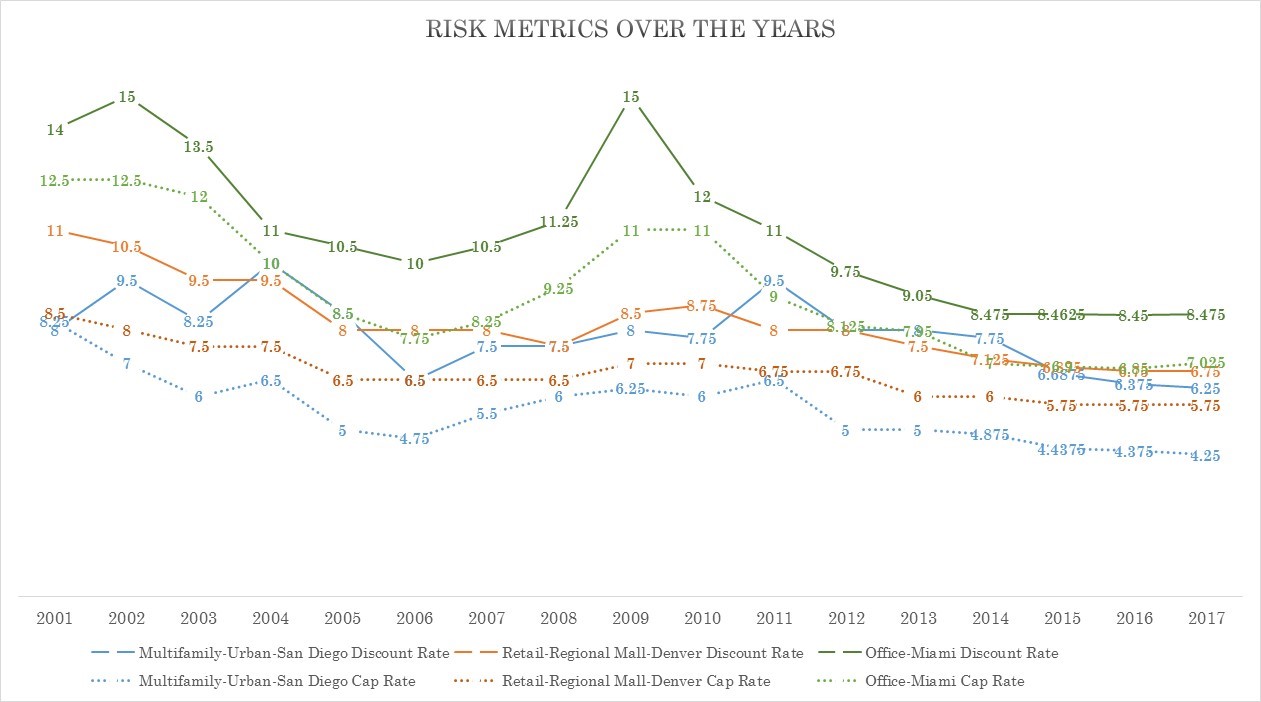

However, recent history tells us a different story. For illustration, we randomly selected some CRE markets with different levels of risk metrics and plotted their trends as shown in Figure 3. During crisis periods, risk metrics tend to spike up. For example, during the GFC, the discount rate of Miami offices went up by nearly 400 bps. The pattern suggests a stronger correction in discount rates than in cap rates. The Integra Realty Resources (IRR) data suggests that the spread of terminal (going-out cap) rate with respect to the going-in cap rate witnesses a substantial rise of 25 to 75 bps compared to its conventional values. After all, risk metrics and cash flows provide different sets of information to valuation models. Adjusting only one may, again, lead to smoothing errors in valuation.

End Note

Every crisis is different; every asset is unique. Therefore, applying a blanket adjustment technique to all assets will not be wise. Besides, the dust of the COVID-19 crisis still needs to settle before we can come up with a more definitive take on its valuation implications. The stakeholders (appraisers, clients, and investors) must take any valuations done today with a pinch of salt. In coming months, we should expect retrospective revisions to the valuations done today.

In these testing times, we realize how ineffective the emerging valuation techniques (e.g. machine learning-based automated valuation methods) are during crises. We also realize how important human argumentation, subjectivity and a resulting consensus are to the real estate industry.

Stay safe!

Glossary

- REIT: Real Estate Investment Trust, a company which owns and operates real estate assets and enjoys a special tax treatment.

- REOC: Real Estate Operating Company which did not opt for the REIT status.

- NCREIF: National Council of Real Estate Investment Fiduciaries. A consortium of commercial property owners which pool their data for creating real estate performance indices and benchmarks.

- NPI.Lev: NCREIF Property Index after accounting for payout to lenders.

EHL Hospitality Business School

Communications Department

+41 21 785 1354

EHL