Voluntary chains vs. Corporate soft brand chains: Which branding strategy offers hotel owners more value?

Summary of the research study.

Introduction

In the modern hotel industry, the hotel owners can choose from different branding options: Independence (non-affiliation), traditional franchise, and soft brand that includes voluntary chains and corporate soft brand chains.

Voluntary chains such as Leading Hotels of the World and Preferred Hotels & Resorts include small independent properties with a collection branding that operate as its own and do not have other brands alongside the soft brand (Powell, 2017). The corporate soft brand chains such as Ascend, Curio, Autograph, and Luxury collections are proposed by international hotel companies (Marriott, Hilton, Choice) that have multiple other brands operating alongside the soft brand.

For the hotel owners who value independence and do not wish to enter into the traditional franchise agreement, affiliation with the soft brand could be a good alternative. The soft brand offers the best of two worlds - independence and brand support. When choosing the soft brand, the hotel owner needs to know whether an affiliation with a voluntary chain or corporate soft brand offers more value. Although relevant, this issue has not been studied in extant pieces of literature.

Thus, the purpose of this study is to identify through research of value propositions if a hotel owner will receive more value from affiliation with a voluntary chain or corporate soft brand chain and how individual value propositions of these brands compare to one another.

The results of this study apply to hotel owners and hotel brands. Hotel owners could refer to this study when making branding decisions. Hotel brands could refer to this study to analyze and identify improvement strategies of their value propositions to the hotel owners.

Literature Review

When reviewing the literature, I had three goals. First, I wanted to find the answers to these important questions:

- Is there a value of affiliation with the brand?

- What are the advantages and disadvantages of staying independent?

- What are the pros and cons of different affiliation models available on the market?

Detailed answers to these questions are published here.

While reviewing the literature and answering these questions, I also was looking for a gap in the research of different brand affiliation strategies. I found that the literature reviewed had limited differentiation of the value propositions of the soft brand's two main types: Voluntary chains and corporate soft brand chains.

The last goal was to see which research methodology used in the reviewed literature would be the most applicable to my thesis.

Much previous literature focused on researching the performance of branded and unbranded hotels, comparing two branding strategies: non-affiliation and traditional franchise. Various researches showed mixed KPI, and market value results for branded vs. unbranded hotels. Neither strategy had a clear advantage.

When comparing branded and unbranded hotels, researchers used key performance indicators (ADR, Occ, RevPAR, NOI) and the Market Value of the asset to identify which strategy is better for the hotel owner. Hence, I decided to use these KPIs for my research.

When I was reviewing various benefits of brand affiliation, I found different value elements that come from the affiliation with the brand, such as sales and marketing support, loyalty programs, etc. I used these elements to create a value of affiliation measurement scale.

Methodology

To examine the differences in value for the hotel owner of these two branding strategies, this study used three approaches:

- Compared key performance indicators of hotels affiliated with voluntary chains and corporate soft brand chains using t-Test.

- Compared the net operating income and market value of the hypothetical hotel affiliated with voluntary chain versus hypothetical hotel affiliated with the corporate soft brand chain using the Direct Capitalization valuation method.

- Compared various value components of the seven representatives of voluntary and corporate soft brand chains using a value of affiliation measurement scale.

KPIs

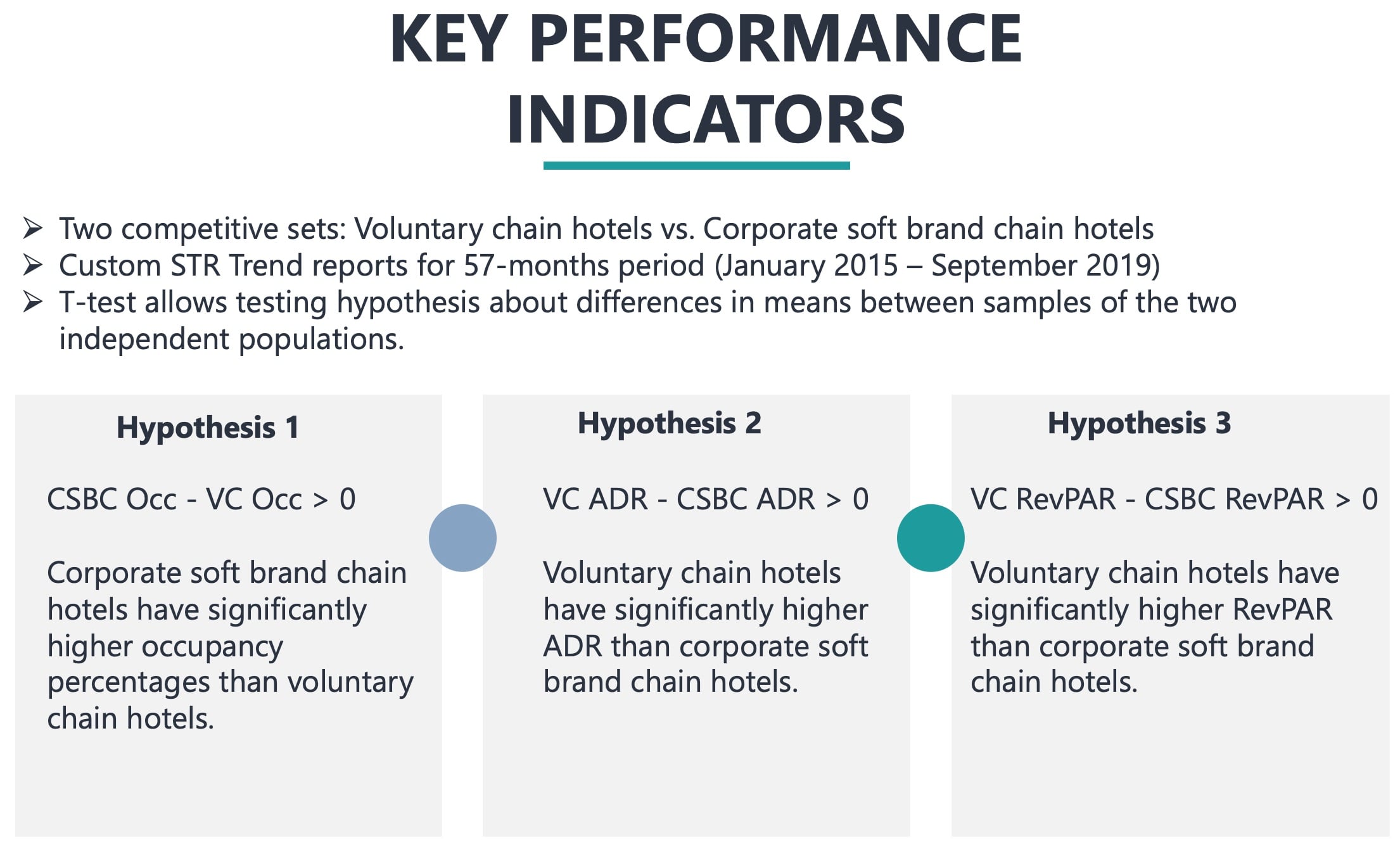

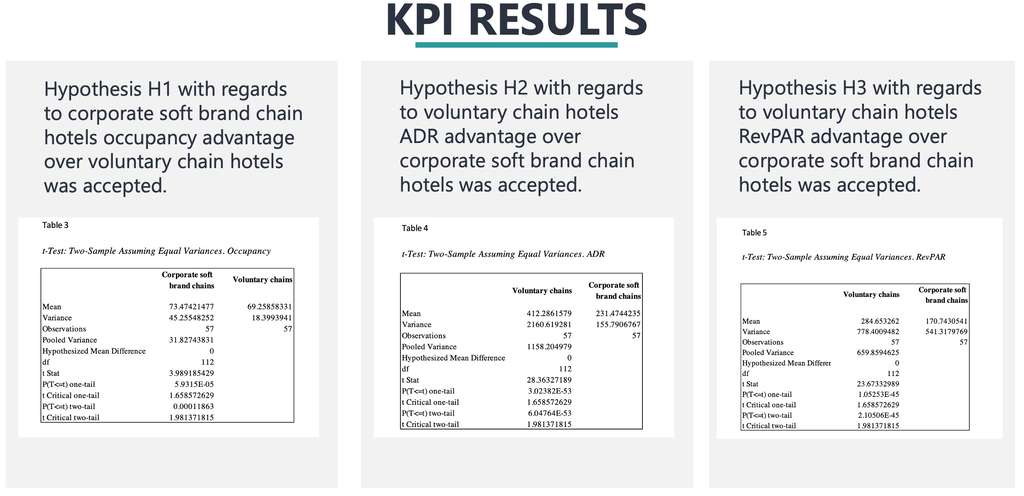

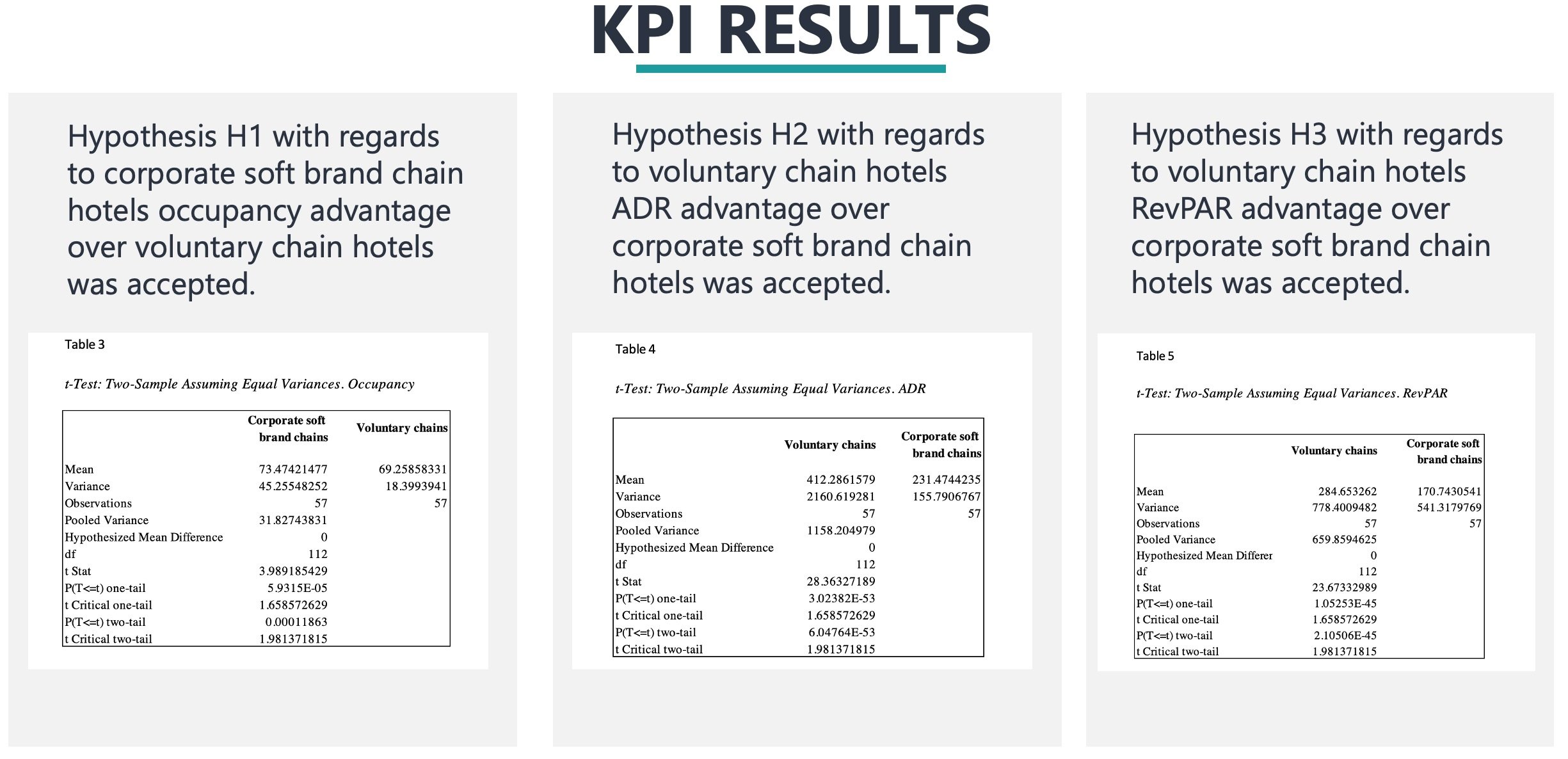

STR Global supplied two custom 6-year trend reports (January 2013 - September 2019). For this study, data of the 57 months of operation was used, from January 2015 until September 2019. The first competitive set consisted of hotels across the United States that operated under corporate soft brands (Luxury Collection, Ascend Collection, Autograph Collection, and Curio Collection). The second competitive set consisted of hotels across the United States that operated under voluntary chain brands (Leading Hotels of the World, Preferred Hotels & Resorts, Small Luxury Hotels of the World). The total number of rooms in each competitive set was 3,893.

The competitive sets consisted of hotels that operated in luxury, upper-upscale, and upscale segments. In the competitive set, every hotel was confirmed by STR to operate for 57 months under the specific corporate soft brand or voluntary chain brand from January 2015 until September 2019.

Corporate soft brand chains (CSBC) are part of the large hotel companies such as Marriott, Hilton, Choice, and benefit from strong distribution and marketing systems. Voluntary chains (VC) also provide hotel owners with distribution and marketing services; however, due to the smaller size and reach of voluntary chains, the impact on member hotels' occupancy (Occ) could be lower than the effect of the corporate soft brand chains.

On the contrary, most hotels affiliated with voluntary chains are positioned in luxury and upper-upscale classes, when a large number of properties affiliated with corporate soft brand chains operate not only in luxury and upper-upscale but also in the upscale segment.

Thus, this study proposed the following hypotheses:

H1: CSBC Occ - VC Occ > 0: Corporate soft brand chain hotels have significantly higher occupancy percentages than voluntary chain hotels.

H2: VC ADR - CSBC ADR > 0: Voluntary chain hotels have significantly higher ADR than corporate soft brand chain hotels.

H3: VC RevPAR - CSBC RevPAR > 0: Voluntary chain hotels have significantly higher RevPAR than corporate soft brand chain hotels.

To accept or reject the hypotheses, ADR, Occ, and RevPAR were compared using t-Test. T-Test allows testing hypothesis about differences in means between samples of the two independent populations.

NOI and Market Value

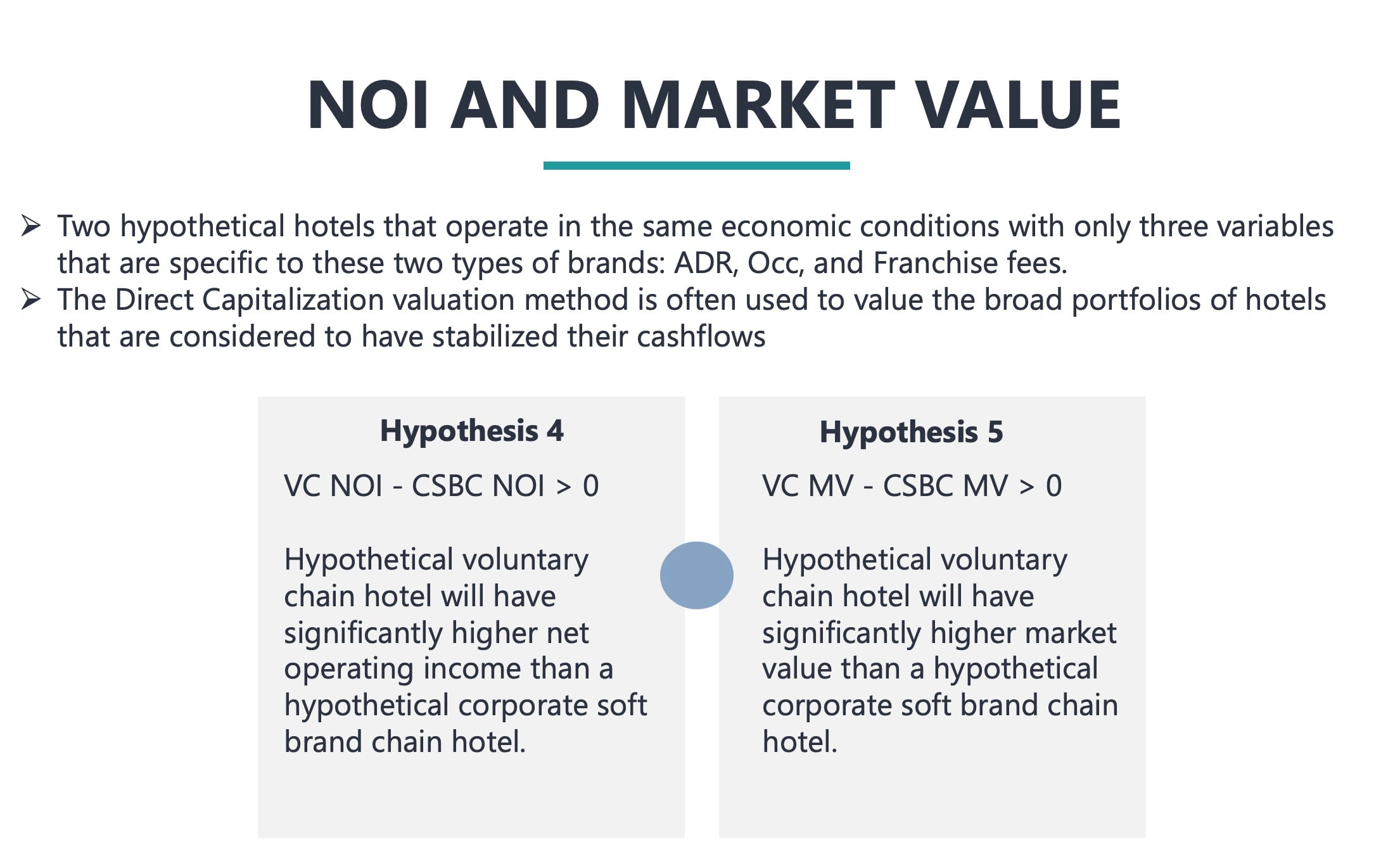

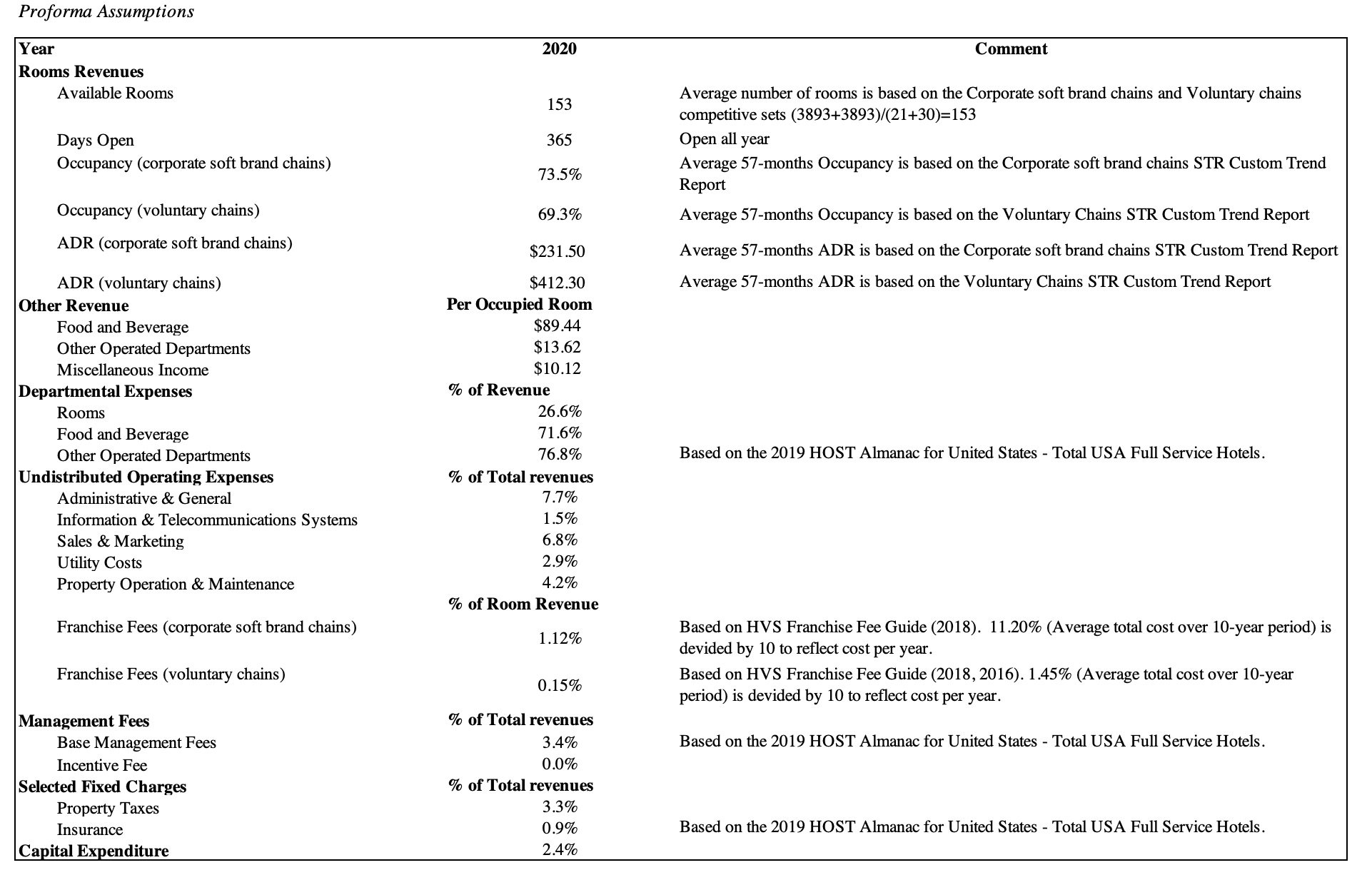

The second part of the research aimed to compare NOI and Market Value of the hypothetical voluntary chain and corporate soft brand hotel that operates in the same economic conditions with only three variables that are specific to these two types of brands: ADR, Occ, and Franchise fees.

I assumed that 57-months average Occ and ADR (data from custom trend reports) of corporate soft brand chains competitive set and voluntary chains competitive set are equal to Occ and ADR of a stabilized hotel. I also assumed that future cash flows would grow at a constant rate over time.

The Direct Capitalization valuation method is often used to value the broad portfolios of hotels that are considered to have stabilized their cashflows. Since average Occ and ADR are derived from competitive sets that consist of a group of hotels, usage of the Direct Capitalization method and assumption of stabilized performance indicators are appropriate for this study.

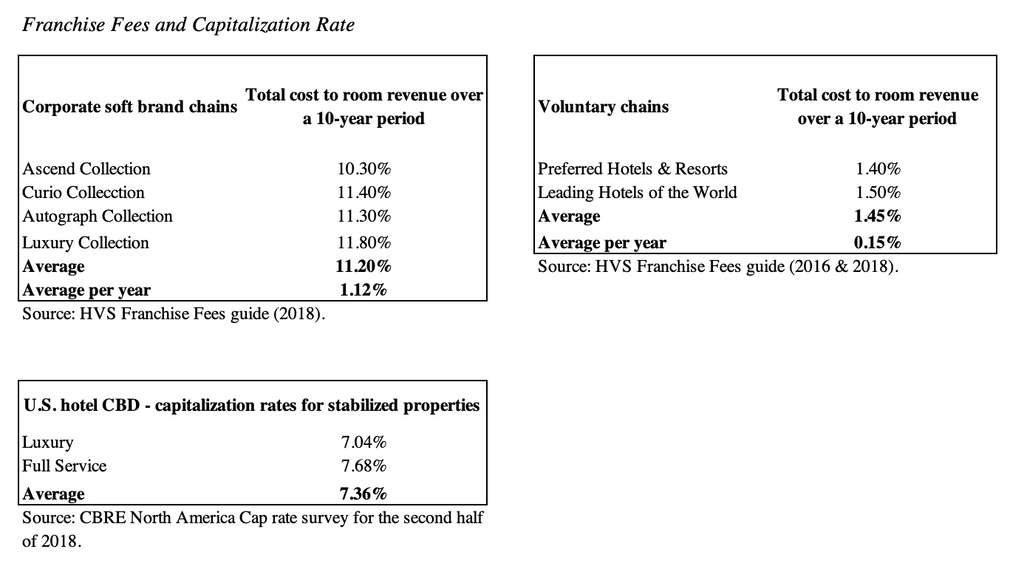

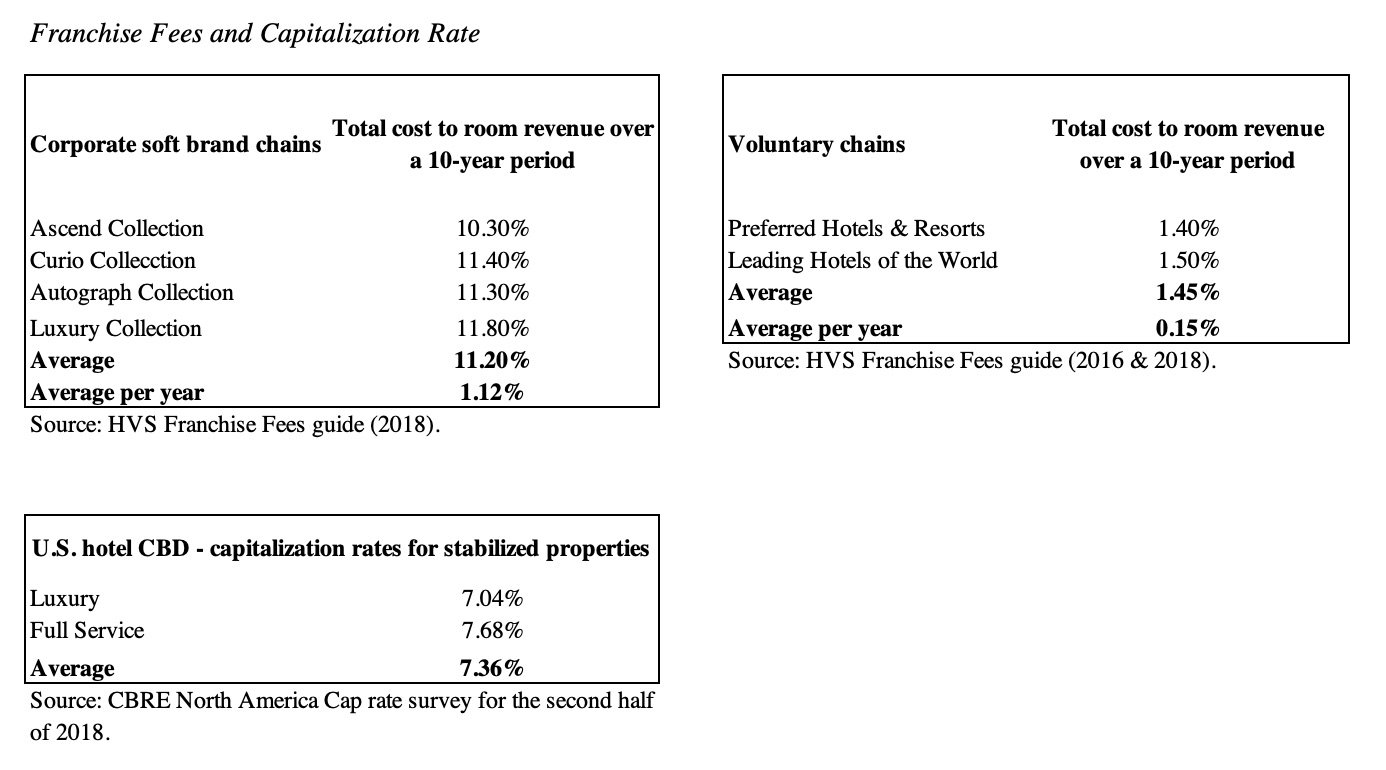

Due to substantially lower franchise fees that voluntary chains charge compared to corporate soft brand chains (Russell & Kim, 2018), net operating income and asset value could be higher for the hypothetical hotel affiliated with voluntary chain compared to hotel affiliated with corporate soft brand chain.

Thus, this study proposed the following hypotheses:

H4: VC NOI - CSBC NOI > 0: Hypothetical voluntary chain hotel will have significantly higher net operating income than a hypothetical corporate soft brand chain hotel.

H5: VC MV - CSBC MV > 0: Hypothetical voluntary chain hotel will have significantly higher market value than a hypothetical corporate soft brand chain hotel.

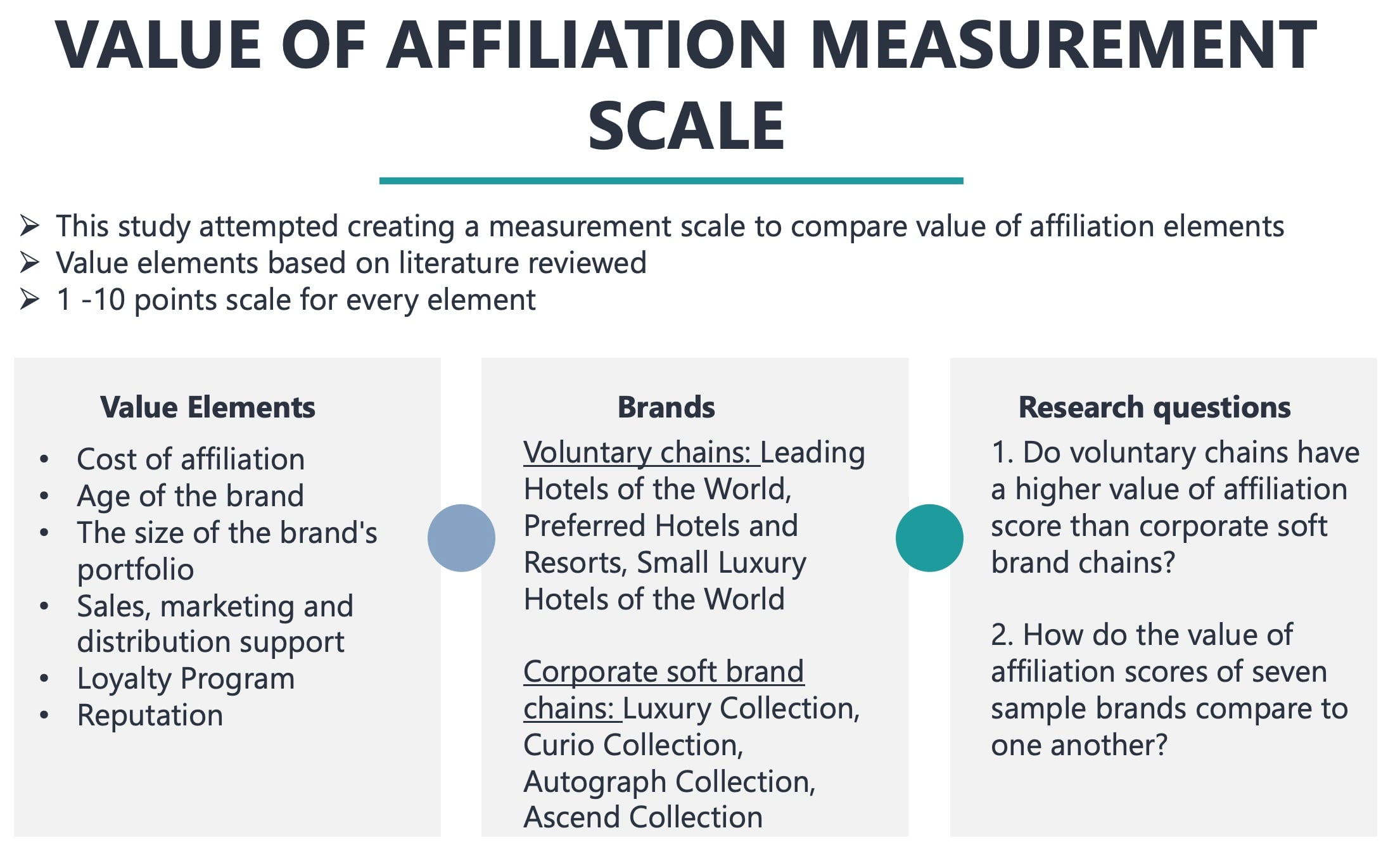

Value of Affiliation Measurement Scale

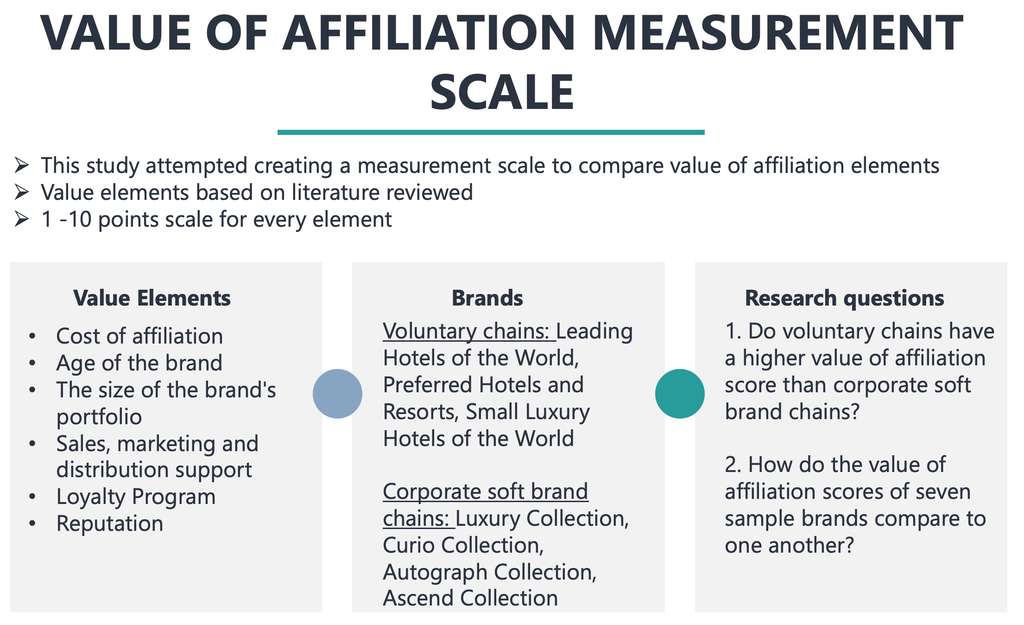

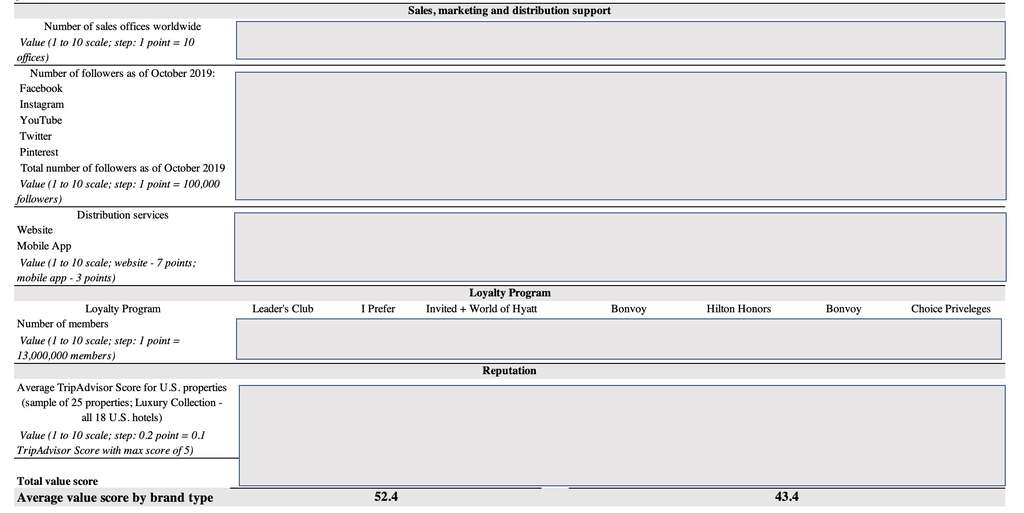

The measurement scale that allows comparing various value elements of the brand affiliation does not exist to this date. I attempted creating such a measurement scale to compare the value elements of three voluntary chains and four corporate soft brand chains.

Value elements were based on the literature reviewed and included:

- Cost of affiliation

- Age of the brand

- The size of the brand's portfolio

- Sales, marketing, and distribution support

- Loyalty Program

- Reputation

Voluntary chains used for the comparison: Leading Hotels of the World, Preferred Hotels and Resorts, Small Luxury Hotels of the World.

Corporate soft brand chains used for the comparison: Luxury Collection, Curio Collection, Autograph Collection, Ascend Collection. These are the same brands that were analyzed in the previous two parts of the study.

The following research questions were defined:

- Do voluntary chains have a higher value of affiliation score than corporate soft brand chains?

- How do the value of affiliation scores of seven sample brands compare to one another? (results are excluded from this summary due to confidentiality reasons)

Results

KPIs

T-tests results showed support for hypotheses H1, H2, and H3 at a significance level of 5%.

NOI and Market Value

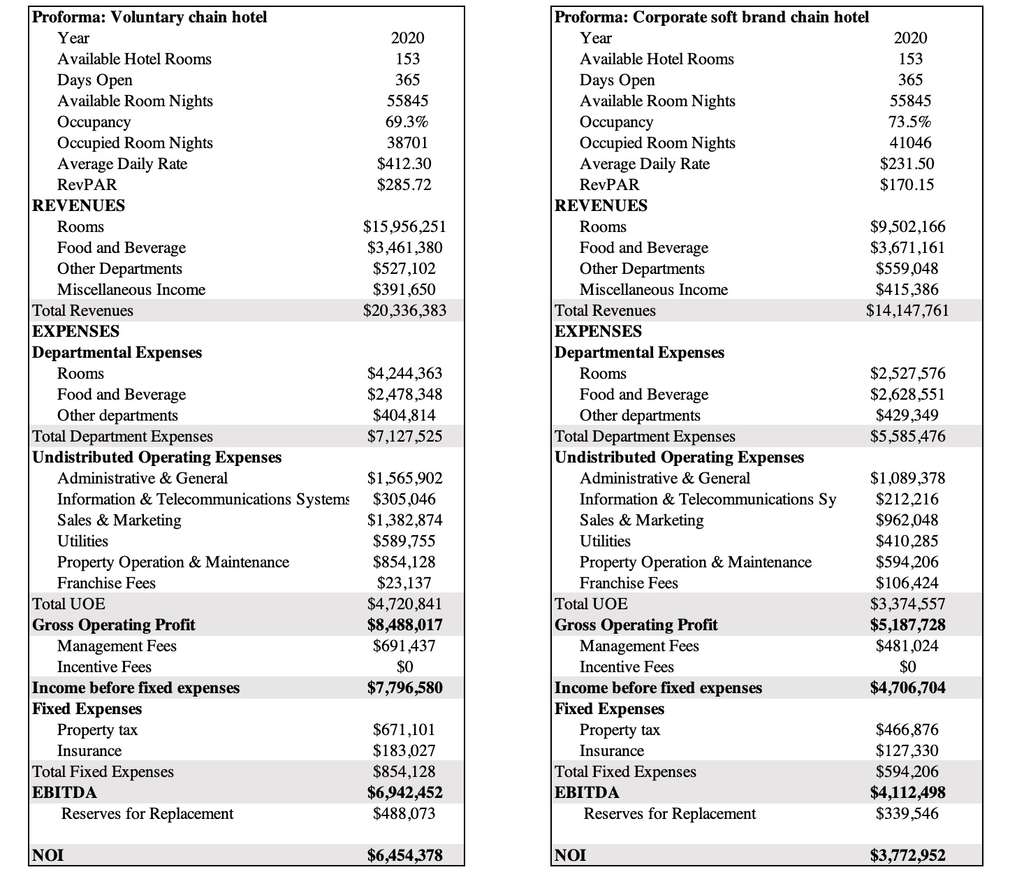

To demonstrate that the net operating income (NOI) of the hypothetical voluntary chain hotel (VC) would be higher than the NOI of the hypothetical corporate soft brand chain hotel (CSBC), two proformas were created. Both proformas are based on the same data and percentages except ADR, Occ, and Franchise fees which were specific to the branding type.

Proformas were based on the assumptions presented below.

The result showed support for the H4 hypothesis. The projected 2020 annual NOI of the voluntary chain hotel was $2,681,427 greater than the NOI of the corporate soft brand chain property.

To demonstrate that the property market value (MV) of the voluntary chain hotel (VC) would be higher than the market value (MV) of the corporate soft brand chain hotel (CSBC), the following formula of the Direct Capitalization valuation method was used:

MV (2019) = NOI (2020) / Capitalization Rate

The result showed support for the H5 hypothesis. The voluntary chain hotel's market value was $36,432,426 greater than the market value of the corporate soft brand chain property.

Value of Affiliation Measurement Scale

Results showed that the voluntary chains received a 9 points higher value score than the corporate soft brand chains.

Due to confidentiality reasons, value scores of individual brands are hidden and excluded from this summary.

The contribution proportions of different value elements demonstrated that for the voluntary chains majority of value was derived from sales, marketing, and distribution support (33%), low cost of affiliation (28%), and brand reputation (17%).

For the corporate soft brand chains, the majority of value was derived from sales, marketing, and distribution support (43%), brand reputation (20%), and loyalty programs (17%).

Discussion

Results of all three parts of the research showed that affiliation with the voluntary chain had more value for the hotel owner than affiliation with the corporate soft brand. Voluntary chain hotels historically had significantly higher RevPAR than corporate soft brand hotels. Based on the historical average ADR and Occ results and franchising costs, the hypothetical voluntary chain hotel would have higher NOI and market value. Voluntary chains also received a higher average total value score when different value elements of affiliation were assessed.

Results suggest that hotels affiliated with voluntary chains can achieve higher ADR than corporate soft brand hotels. The difference in ADR is the crucial factor that allows voluntary chain hotels to achieve greater RevPAR, and higher occupancy of corporate soft brand hotels does not present an advantage as lower ADR offsets it. An affiliation with a voluntary chain could potentially result in better financial performance in terms of ADR and RevPAR for the hotel owner than affiliation with a corporate soft brand chain.

The study results also suggest that the hotel owner would benefit from higher profitability and the higher sale price of the property if he or she chooses a voluntary chain as an affiliation partner versus a corporate soft brand chain. Higher ADR and lower franchise costs drive a voluntary chain's advantage over the corporate soft brand chain.

Voluntary chains have significantly lower affiliation costs than corporate soft brand chains. Voluntary chains are more experienced and recognized than corporate soft brand chains that are relatively new. Corporate soft brand chains outperform voluntary chains in the number of loyalty program members and, as a result, potentially could bring more business to the hotel and are more valuable in this regard.

Corporate soft brand chains have more sales offices worldwide than voluntary chains; however, it's hard to assess the direct impact on the particular hotel. Moreover, corporate soft brand chains are part of larger parent companies, and it's hard to estimate how much support every brand in the portfolio receives from sales offices. On the contrary, voluntary chains have to support only one brand. In this regard, support from a lower number of sales offices worldwide that voluntary chains provide could be more valuable. Quality and narrow focus could outperform quantity.

On average, voluntary chains have a more substantial number of social media followers than corporate soft brand chains. It could be because voluntary chains exist longer than corporate soft brand chains because voluntary chains have a more effective social media strategy. Voluntary chains also have slightly higher average reputation scores, but the difference is not significant.

Overall, corporate soft brand chains can bring more business to the hotel than voluntary chains because of more extensive loyalty programs and stronger sales and marketing support. These advantages over voluntary chains come at a higher cost for the owners. Hotel owners are presented with a choice to pay a higher price for potentially higher sales volumes when affiliating with corporate soft brand chains versus paying a lower price and possibly receiving less business when affiliating with a voluntary chain.

To conclude, hotel owners can achieve better results at a lower cost when affiliating with voluntary chains. Corporate soft brand chains have a more significant potential to bring business to the hotel; however, the value from the higher volume of business is offset by lower ADRs and higher costs of affiliation for the owners.

Recommendations for action

The results imply that affiliation with the voluntary chain is more valuable than affiliation with the corporate soft brand chain for hotel owners. Voluntary chains have a clear advantage over corporate soft brand chains in terms of cost of affiliation and quality of business (higher ADR).

Corporate soft brand chains have access to massive loyalty programs. Potentially it's a significant source of business. Stone (2018) stressed the importance of access to loyalty programs as its contribution to sales is substantial. For example, in 2016, 50% of room nights for Marriott came from loyalty members; for Hilton, the number was 56% (Stone, 2018). On the contrary, Skift Report (2018) posited that loyalty programs might not matter as much when compared to factors such as where the hotel property is located and how much it costs. U.S. Experiential Traveler 2018 survey conducted by Skift found that location and price were the two most important motivators for travelers when booking a hotel, beating out loyalty affiliation by more than 50 percentage points ("Skift Report", 2018). Hotel owners should question loyalty program benefits as it's not an automatic guarantee of a high volume of business.

Another great benefit of the voluntary chain is a narrow focus and better service. Corporate soft brand chains are part of large parent companies with multiple brands when a voluntary chain is one company that serves one brand. In this regard, a voluntary chain is more agile, personal, and focused on the needs of the hotel owners affiliated with the brand.

The main recommendation for the voluntary chains is to continue building upon strengths and integrate corporate soft brand's strong sides to their business models. The low initial investment and small continuous membership fee should stay. It's an excellent benefit for the hotel owner. Voluntary chains should continue building a strong social media presence. The most considerable advantage of corporate soft brand chains is access to large loyalty programs. Voluntary chains should consider either growing their loyalty programs or partnering with other loyalty programs. For example, the Small Luxury Hotels of the World increased the loyalty program benefits for the hotel owners by partnering with the World of Hyatt.

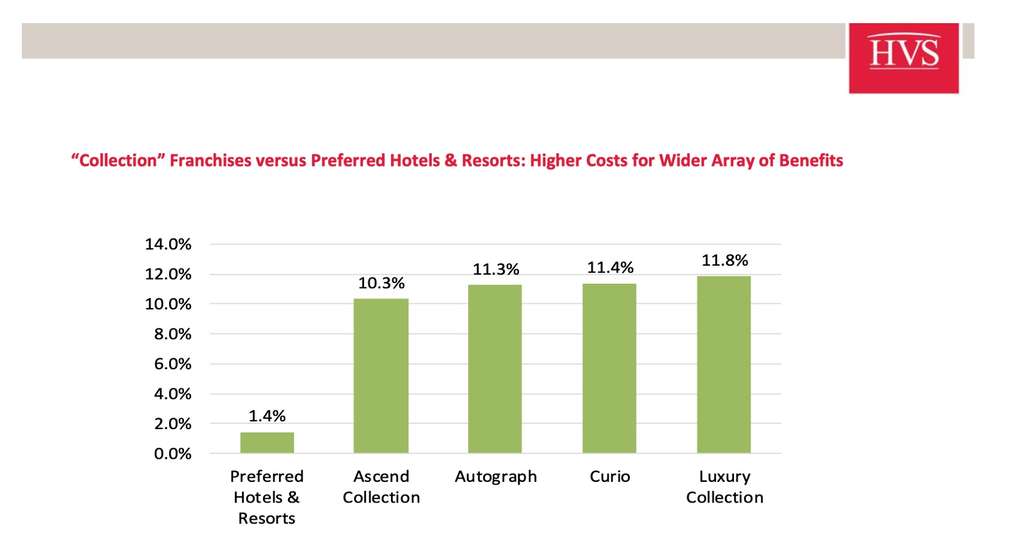

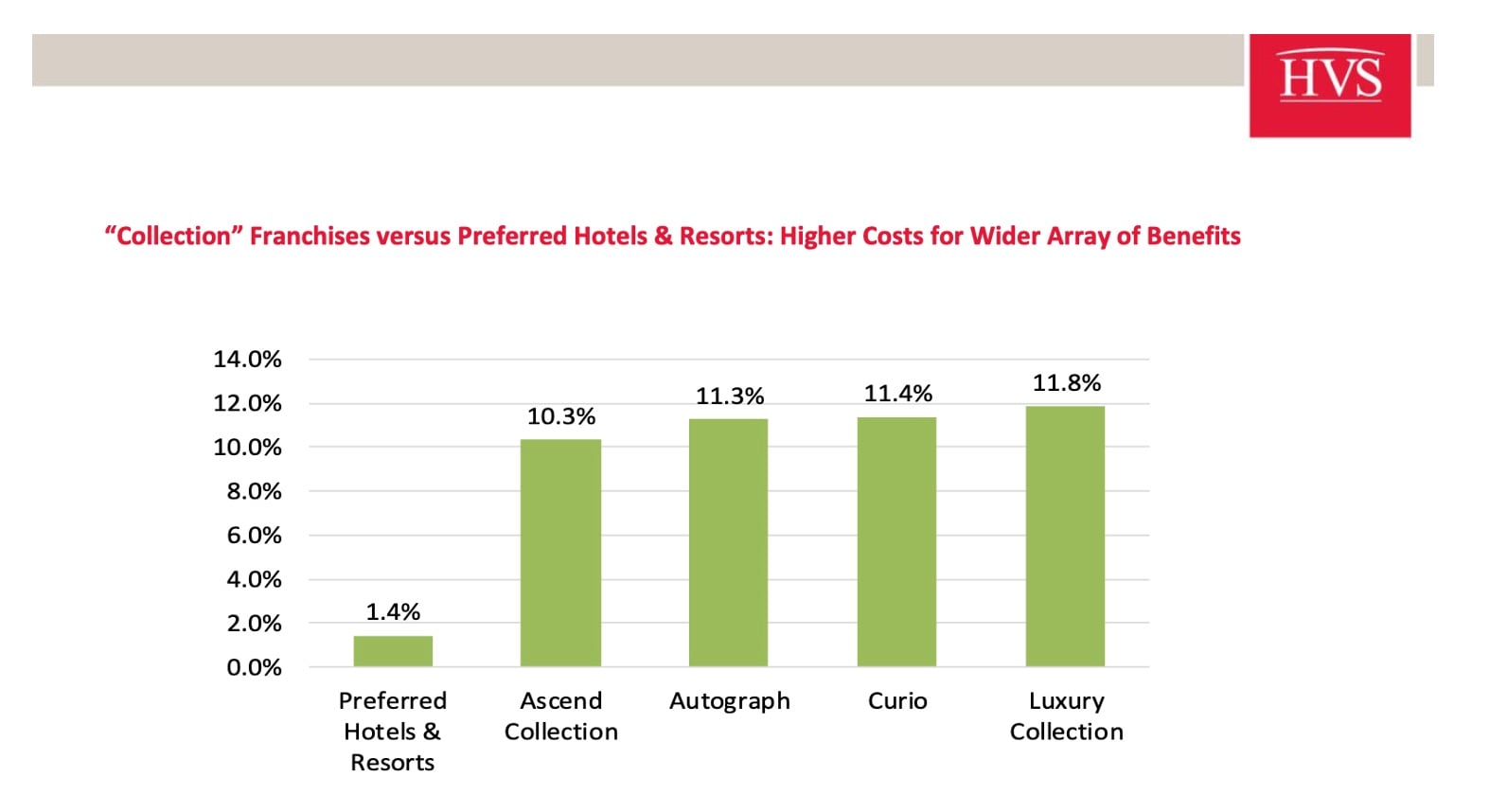

Corporate soft brand chains have a lower value for the hotel owners than voluntary chains. Mostly because of high initial investment and high ongoing fees. According to the 2018 HVS Franchise Fee Guide, over ten years hotel affiliated with voluntary chain Preferred Hotels and Resorts would pay 1.4% of total room revenue in franchise fees. The hotel affiliated with a corporate soft brand chain would pay, on average,11.20% in franchise fees (average of four brands: Autograph Collection, Curio Collection, Luxury Collection, and Ascend Collection).

If corporate soft brand chains want to compete with voluntary chains successfully, fees should be re-considered. Corporate soft brand chains charge only from 1% to 2% lower fees than other brands within the same parent company (Russell & Kim, 2018). Such high fees do a poor differentiation of corporate soft brands from the traditional franchise for the hotel owner. Hotel owner receives more independence by affiliation with a corporate soft brand chain; however, fees are almost the same as for association with a conventional brand under the franchise agreement. Moreover, there are brand recognition difficulties as consumers are not well familiar with soft brand collections (Stone, 2018). Thus, the hotel owner pays high fees for the brand that is new and is not well-known to the consumer.

Corporate soft brand chains benefit from the sales support of a parent company; however, it's not clear for hotel owners how much support a particular brand within a large parent company receives. For example, Marriott has 82 sales offices worldwide, as well as 30 brands under its umbrella, including soft brand chains. It's not clear how much sales and marketing support effort is focused on the Luxury Collection, for example. Corporate soft brand chains need to market their value proposition to the hotel owners more clearly, especially when they charge much higher affiliation fees than voluntary chains.

Limitations

Limitations of this study require future research on this topic. The overall assumption that key performance indicators (ADR, Occ, and RevPAR) are only driven by brand affiliation is the most significant limitation of this study. The results are only applicable to hotel owners and brands that operate in the U.S. market.

When building the competitive sets, local competitive conditions, and hotel characteristics were not considered. Thus, the matched-pair approach introduced by Carvell et al. (2016) would be a more precise method to use for future research.

The discounted cash flow valuation method that considers variation in cash flows would be a good alternative method to use for future research.

The value of affiliation measurement scale could be improved by adding more brands, including all affiliation fees, taking the degree of individual importance of every value element into account, and adding other value elements.

A comparison of individual voluntary chains to reveal the value of affiliation with a particular voluntary chain in terms of ADR, Occ, and RevPAR is recommended for future research.

References

Carvell, S. A., Canina, L., & Sturman, M. C. (2016). A comparison of the performance of brand-affiliated and unaffiliated hotel properties. Cornell Hospitality Quarterly, 57(2), 193-201. doi: 10.1177/1938965516631014

Powell, L. (2017). Soft Brand Launches and the Threat to Luxury Hotel Collections. Retrieved from https://skift.com/2017/11/07/soft-brand-launches-and-the-threat-to-luxury-hotel-collections/

Russell, K., & Kim, B. (2018). Hotel Franchise Fee Guide - USA. HVS. Retrieved from https://www.hvs.com/article/8552-2018-United-States-Hotel-Franchise-Fee-Guide/

Skift Report (2018). Soft Brands - Weighing the Risks, Rewards, and Realities. Retrieved from https://skift.com/insight/skift-insights-deck-soft-brands-weighing-the-risks-rewards-and-realities/

Stone, R. (2018). A deep dive into operating and branding strategies for hotel owners. Skift Research. Retrieved from https://research.skift.com/report/a-deep-dive-into-operating-branding-strategies-for-hotel-owners/

Credits

Dr. Demian Hodari, Associate Professor of Strategic Management at the Ecole hôtelière de Lausanne.

Dr. Prashant Das, Associate Professor of Real Estate Finance at the Ecole hôteliere de Lausanne.

Dr. Steffen Raub, Full Professor of Organizational Behavior at the Ecole hôteliere de Lausanne.

Dr. Laura Zizka, Assistant Professor at the Ecole hôteliere de Lausanne.

Hakan Ozakbas, Director of Business Performance, Americas & Asia Pacific at The Leading Hotels of the World.