Are Hotels a Hedge Against Inflation in the Modern Era?

- Inflation affects hotel returns through pricing, substitution effects and interest rates.

- Most hotels’ returns are not sensitive to low-to-moderate inflation.

- Luxury hotels have the most promise as inflation hedges.

- Dollar strengthening appears to help luxury returns as well.

In December 2021, the U.S. Consumer Price Index (CPI) exceeded its 2020 level by more than 7%, the highest rate since the 1980s, according to the St. Louis Federal Reserve. This dramatic upswing has rekindled debates over the effects of high inflation.

Due to the uniquely short lease periods, measured in days rather than months or years, hotels have been debated as a hedge against inflation. In theory, hotel managers could rapidly adjust prices to account for any short-term variations in inflation. Can hotels use this approach to hedge against inflation?

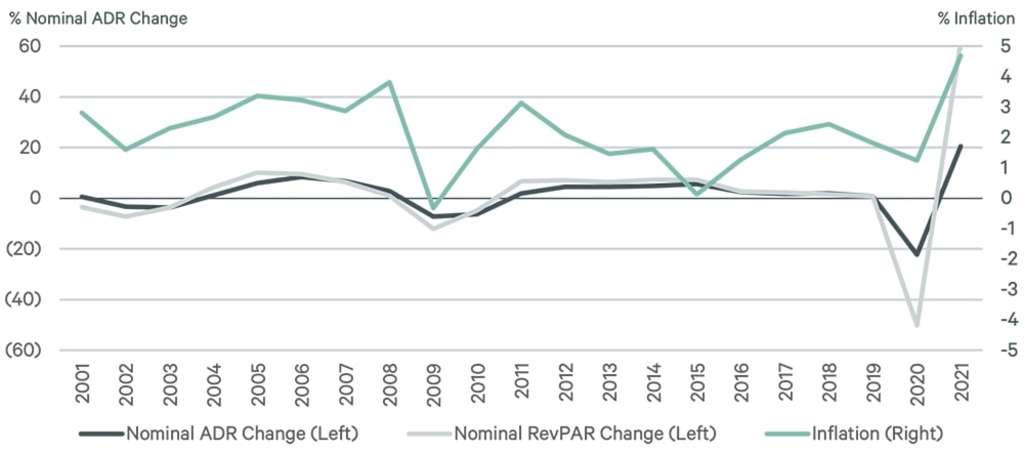

Figure 1 illustrates the rough, positive relationship between inflation and nominal average daily rate (ADR) and revenue per available room (RevPAR) since 2000. The different scales of the series understate the extent of the ADR swings, which are much larger than inflation. While deflation is a rare and short-lived occurrence, decreases to ADR can be significant and protracted. In 2015, inflation slowed to a standstill while ADR and RevPAR experienced large gains. Afterward, inflation increased while ADR and RevPAR shrank. This trend continued until the shock of the COVID-19 pandemic in 2020.

Figure 1: ADR and Inflation Mostly Move Together

A close link between inflation and nominal rates would indicate a good ability to price to inflation. The correlation coefficient of ρ=0.54 between ADR and inflation and ρ=0.55 between RevPAR and inflation suggests that there is a moderately positive relationship.

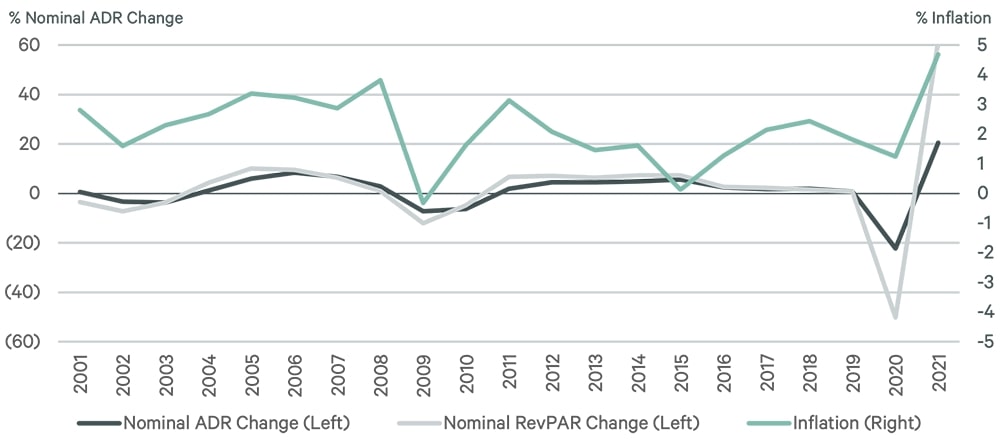

When looking at real returns, i.e., nominal returns less inflation, there is a strong association with real GDP growth. Figure 2 illustrates this relationship. The correlation between these variables is higher than between inflation and ADR, with ρ=0.70. In aggregate, it appears that hotels are generally resilient to inflation. ADR changes mimic broader price changes, and the pattern of returns mimics the real economy.

Figure 2: Real Returns Correspond to Real GDP

What does history tell us?

Historical work has presented a more complex picture of hotels than just rate changes that mirror inflation. Avner Arbel and Robert H. Woods (1991)1 examined the performance of hotels between 1975 and 1989, an era of high inflation. They concluded that adjusting prices too closely to the rate of inflation decreases returns over this period, as the higher prices also lead to reduced occupancy in times of high inflation. Since inflation does not affect all prices equally, consumers often shy away from travel when faced with a higher cost of living. In more recent times, the effect of inflation on hotel returns has garnered less analysis. Three decades of relatively stable inflation pushed concerns about high rates or stagflation to the back of operators’ minds until the recent surge in consumer prices.

The question investors face now is whether conditions today will mirror those from last century, and what the response will be of contemporary hotels in the face of transitory or persistently high inflation. To see if the “hotels as hedge” theory is plausible, consider not only ADR, but also the effect on occupancy and the resulting passthrough to net operating income (NOI).

Arbel and Woods also suggest several variables to control for confounding effects that may be happening simultaneously with inflation and hotel performance, including GDP and exchange rate. Arbel and Woods also include a term that accounts for a long-run linear trend (time trend) in ADR to separate the direct effect of inflation apart from long-standing general movements in both variables.

In an analysis among property types other than hotels, EA economists Neil Blake, Matt Mowell and Jing Ren (2021) reported that inflation affects interest rates. These in turn can affect capitalization rates and thus property value. The total return on hotels, including value appreciation or depreciation, should be considered when evaluating whether hotels can be an effective hedge against inflation.

An economic model for real returns and inflation

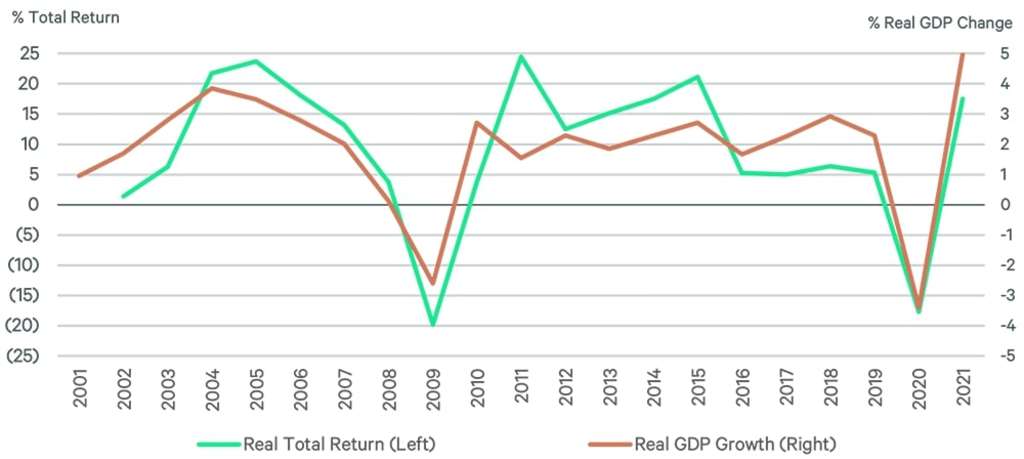

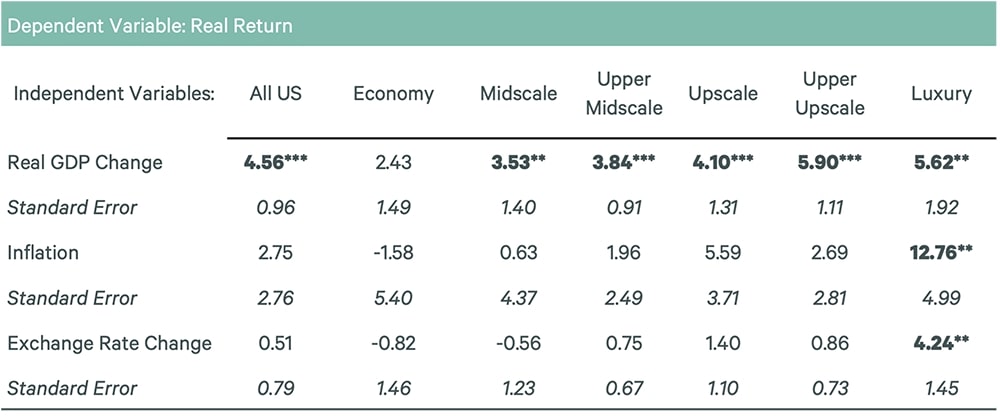

To isolate the effect of inflation among different hotels scales while controlling for various confounding factors, we estimate an econometric model for the U.S. and the six chain scales. The real rate of return, inclusive of both real NOI and real appreciation, is the dependent variable. This data comes from the EA Hotel Investment Performance series, which uses Trends®3 data to estimate NOI and combined CBRE and Real Capital Analytics (RCA) transaction data to track cap rates. EA uses growth rates in GDP, the CPI and the exchange rate as well as a time trend and lagged real return as controls. The data is from the Bureau of Labor Statistics (BLS) and the Bureau of Economic Analysis (BEA) for the period 2000 to 2021. The results of this model are tabulated in figure 3.

Figure 3: Results of Multivariate Regression

All chain scales’ real returns, except economy, have a strong positive relationship to GDP. Although the estimated effect for economy hotels is positive, the effect is statistically insignificant. Economy hotels might see some upside when the GDP falters as more people substitute to an affordable stay. This substitution effect may come at the expense of price inflexibility, as economy hotels also have the only negative effect on inflation. This suggests that economy hotels may not have the power to raise prices in step with inflation.

However, the inflation effect is only statistically significant in luxury hotels. In fact, luxury hotels seem to benefit directly from inflation, perhaps as an excuse to raise prices for a less price-sensitive clientele. Upper midscale and upscale hotels have large positive effects, but also too much statistical noise to assign much significance to these effects. Essentially, real returns for these chain scales are insensitive to inflation movements. If an investor is looking to offset or hedge losses from inflation-sensitive assets, only luxury hotels appear to have significant promise in this regard.

The significant positive coefficient on the U.S. exchange rate for luxury hotels also seems at odds with conventional theory. Arbel and Woods (1991) expect a negative effect of exchange rate increases as a stronger dollar means international travel becomes cheaper in relative terms. During the COVID-19 pandemic, international travel was restricted at the same time as the dollar strengthened, but the effect is still positive and significant when excluding this period. An explanation for the coefficient on exchange rates —and potentially inflation — is that these variables may be positively correlated with strength in the economy not accounted for by GDP growth alone. This analysis examines broad national U.S. aggregates, in which international travel is a relatively small part of the total lodging business, and these aggregates may be insensitive to international travel. There are several U.S. markets where international travel plays a much larger role, such as San Francisco, New York City and Miami. In these markets the effect could be lessened or reversed.

Importantly, this model considers the timeframe after the year 2000 when inflation was relatively mild. Since we expect inflation to have peaked and to be decelerating, this model likely has explanatory power. On the other hand, these results may not hold if inflation were to continue increasing in 2022 to the high levels seen in the 1970s and ‘80s. Moreover, the timeframe that the model covers lacks any significant period of simultaneous high inflation and low growth, or “stagflation.” The relationship that real returns have to inflation may look markedly different under stagflation conditions.

Conclusion

CBRE EA expects that inflation peaked in Q4 2021 with CPI growth of 6.8% year-over-year (Y-o-Y). Looking forward, EA also expects that inflation will remain elevated in the first half of 2022. CPI will grow at or above 5% Y-o-Y in Q1 and Q2 2022 before settling to long-run average levels of approximately 2% by 2023. EA also expects GDP growth to exceed 4% during all of 2022. According to the model presented in this paper, this simultaneous high level of inflation and GDP growth should mean significant returns in luxury hotels, exceeding the predictions of a model that does not consider inflation.

Increasing labor costs as a major part of inflation could be a headwind to our expectations. If the cost of hotel labor is rising comparatively faster than in previous inflationary periods, the reduction in NOI could decrease the income return and the hotel value, counteracting some of the additional total return that would normally be generated in an inflationary period with economic growth.

The inflation rates examined for this study have a moderate range from around 0-7%. These rates are still small compared with the double-digit rates of the 1970s and ‘80s. Moreover, GDP growth has generally accompanied contemporary inflation. Even the recent highs in inflation growth due to global supply chain disruptions have been caused in part by the fast pace of GDP recovery. The hotel industry has been recovering rapidly over this same period.

While much about the modern relationship between extended periods of high inflation along with poor GDP growth, or stagflation, remains unknown, some broad characterizations emerge from this analysis. During periods of low or medium inflation, most hotels see neither benefit nor harm from inflation. The returns follow the real economy. There is weak evidence that suggests that economy hotels may be less able to price to inflation, but much stronger evidence that luxury hotels are able to benefit from higher rates of inflation. Therefore, luxury hotels emerge as the most likely candidate as a hedge for inflation. In addition, the relationship between exchange rates and this top echelon of hotel demand may also be changing from historical expectations as the returns have increased in response to a strengthening dollar.

- 1Arbel, Avner, and Robert H. Woods. “Inflation and Hotels. The Cost of Following a Faulty Routine.” Cornell Hotel and Restaurant Administration Quarterly 31, no. 4 (February 1991): 66–76.

- 2Neil Blake, Matt Mowell, and Ren Jing. “Estimating the Impact of Inflation on Commercial Real Estate Returns.” CBRE Viewpoint (June 2021). https://www.cbre.com/insights/articles/estimating-the-impact-of-inflation-on-commercial-real-estate-returns

- 3Trends in the Hotel Industry is CBRE’s annual survey of hotel operating statements from thousands of hotels across the U.S. For more information, please visit https://pip.cbrehotels.com/trends.