Top 5 Trends Hotels Can Leverage for a Successful End of 2022

Although we’ve now surpassed the two-year mark since the start of the pandemic, the past few months have brought on a unique set of challenges, including rising inflation, sky-high fuel prices, and sustained operational and staffing shortages in the travel and hospitality industry. The good news however is that our data shows many positive trends for the travel industry, including an increase in long-haul travel, higher hotel average daily rates, and lower cancellation rates.

To give hoteliers a better look at the most relevant hotel trends, we’ve pulled together the top insights for the rest of 2022 with our latest data and research from the Q2 Traveler Insights Report, Inclusive Travel Insights Report, and Sustainable Travel Study.

1. Hotel demand is strong, despite rising costs

Q2 continued the momentum from Q1 with strong demand growth, resulting in the highest lodging bookings in Expedia Group’s history. Total gross bookings were up by double digits year-over-year in Q2 as travel demand continued to increase.

On top of strong lodging demand, Q2 showed an increase of 40% in stayed room nights and a 9% increase in stayed average daily rates (ADRs) quarter-over-quarter.

The most popular destinations saw strong growth in hotel demand during Q2, with 10 of the top 25 global booked destinations seeing double-digit quarter-over-quarter growth. Seoul saw the highest growth, along with strong performance in other APAC destinations like Tokyo, while Rome and Paris led in EMEA. Toronto moved up the list from the 29th position to 25th, Barcelona moved from 22nd to 13th, and Chicago moved from 11th to 6th.

While vacation rentals took a strong share of bookings throughout the pandemic, hotels are now seeing an increase in booking share again. Fewer people also cancelled trips during Q2, as room night cancellation rates globally declined more than double digits compared to Q2 2019.

With this strong demand and increasing ADRs, now is the time to invest in your hotel’s advertising strategy to ensure you’re capturing the pent-up demand for travel.

2. Long-haul destinations are making a comeback

One of the promising trends we saw in the report was a significant increase in demand for long-haul flights (flights with a duration of 4+ hours) as travelers went further afield. During Q2 there was a 50% year-over-year increase in global traveler demand for long-haul flights.

This trend was even more pronounced when looking at travel from the U.S. to Europe, where we saw an increase of more than 100% year-over-year growth in traveler demand in Q2. London, Paris, and Rome were the top three European destinations for U.S. travelers.

The exceptional growth in long-haul and international travel was likely sparked by the U.S. announcement on June 10 that it was no longer requiring a negative COVID-19 test to enter the country, which caused a large increase in searches during the week of June 6.

As long-haul travel grew, families also returned to international travel. During the pandemic the proportion of families traveling internationally declined compared to other traveler groups. However, Q2 data shows that international family travel has recovered to pre-pandemic levels and now accounts for the same proportion of travelers as 2019, about 15%. With families spending 25% more per booking than other traveler groups, the return of family travel has a positive impact on the industry.

In response to the growing appetite for trips further from home, hoteliers should make sure they are strategizing about the best ways to reconnect with international travelers. Dreams Jade Resort & Spa has been able to use TravelAds Sponsored Listings to target international travelers, driving over 1.2 million impressions and a click-through rate of 3.06%. In addition to targeting international travelers, engaging families is another strong business opportunity for hoteliers to consider in their marketing efforts.

3. Travelers are looking to book trips in the near- to mid-future

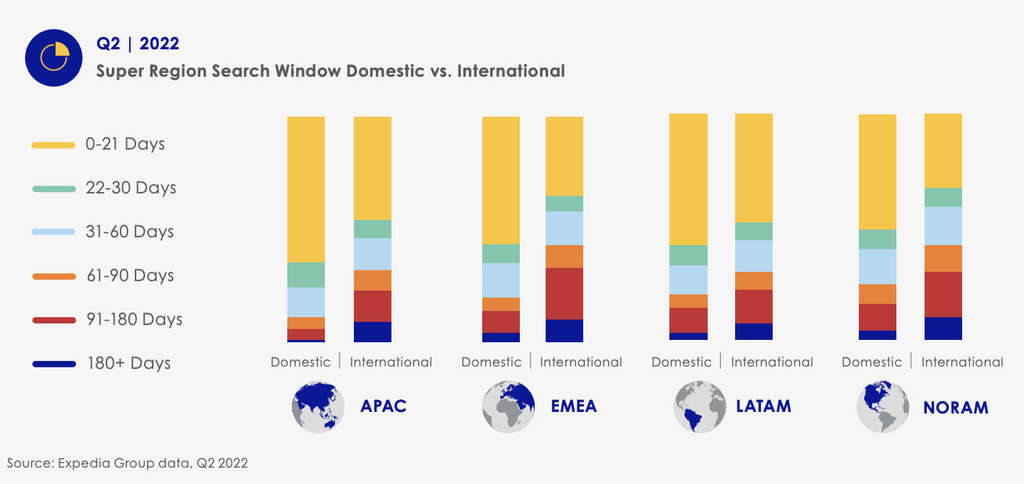

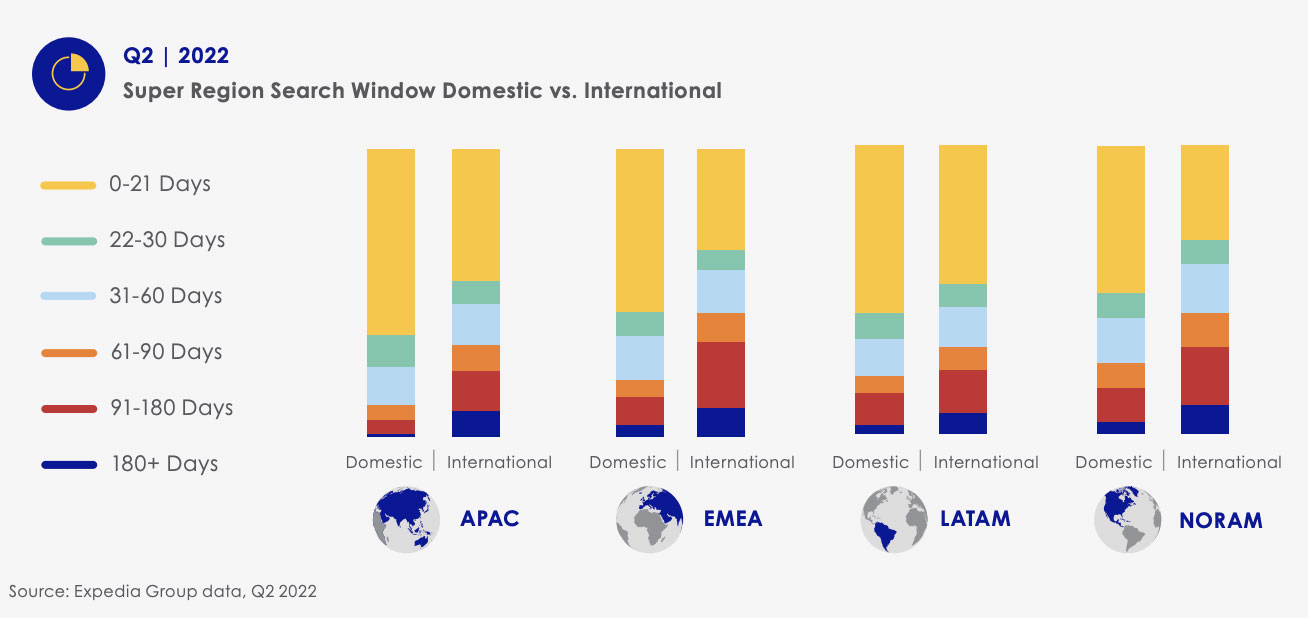

Last quarter we saw a major increase in travelers booking further out, which was likely due to planning for mid-year trips that included summer travel in the Northern Hemisphere. However, this quarter we saw larger growth in short- to mid- term planning. The 0- to 90-day search window saw growth, increasing more than 5% quarter-over-quarter, and the 61- to 90-day window saw the largest growth at 15%.

Regionally, EMEA and NORAM saw the strongest growth in the 0- to 90-day search window, driven in part by the spring and summer travel season. In APAC and LATAM, the 61- to 180-day search window saw strong gains quarter-over-quarter with 30% and 20% growth, respectively.

These findings are in line with data from the April 2022 Expedia Group survey conducted by Wakefield Research, which found that 53% of consumers feel comfortable booking travel less than one month in advance. Those with travel plans in the next 12 months are comfortable booking within three months of their trip on average, which aligns with trends seen in our first-party data.

This short- to mid-term search window is important for hoteliers to keep in mind for targeting travelers when planning campaigns and allocating their advertising dollars. One way that hoteliers can focus on efficiently targeting near-term travelers is by using TravelAds Sponsored Listings. For example, MiraMe Athens was able to use TravelAds to focus on a highly competitive CPC strategy and tailored ad copy to target a 0- to 2-week travel window.

Accelerator is another strong way for hotels to increase their visibility and to help reach short-term travelers because it allows partners to create campaigns just days in advance of check-in to help fill their rooms.

4. Inclusivity is top of mind for consumers when searching and booking travel

Our Inclusive Travel Insights Report shows that consumers are both paying attention to how inclusive travel providers are and want to see accessibility and diversity incorporated into travel options and advertising. In fact, 92% of consumers think it’s important for travel providers to meet the accessibility needs of all travelers.

Consumers are also willing to pay more for travel providers that are actively committed to creating an inclusive environment. We found that 7 in 10 consumers would choose a destination, lodging, or transportation option that is more inclusive for all types of travelers, even if it’s more expensive.

Not only are consumers looking for inclusive travel options, they also want representation incorporated in advertising and marketing efforts: 78% of survey respondents said they’ve made a travel choice based on promotions or ads they felt represented them.

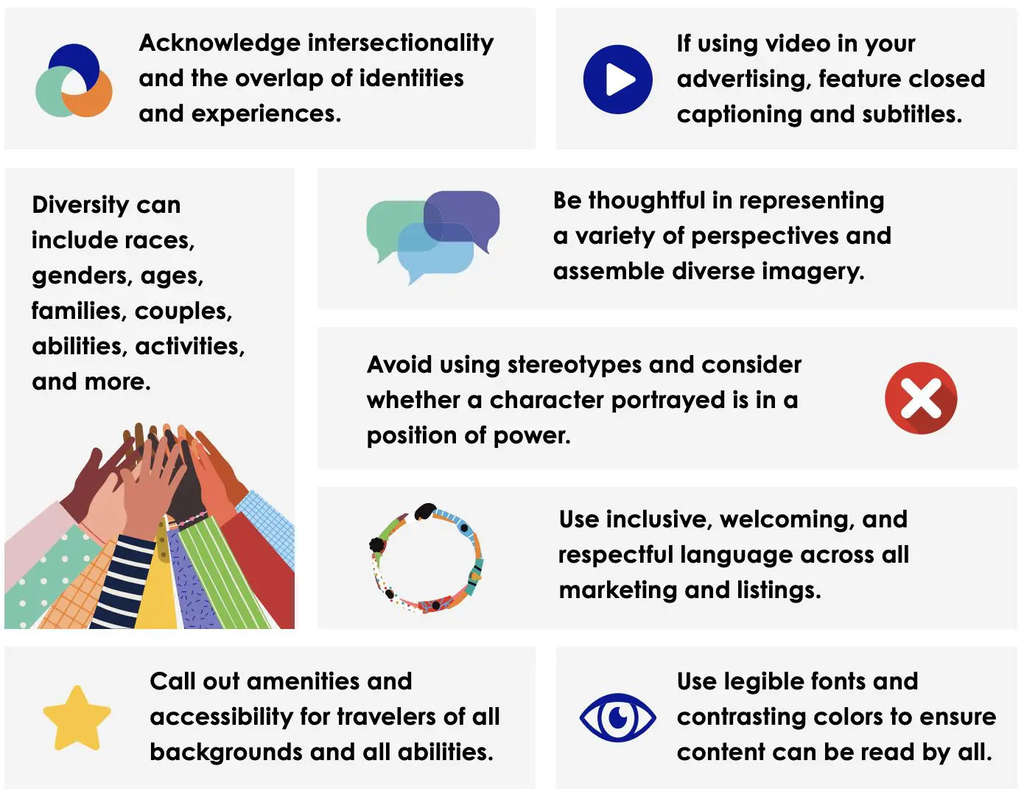

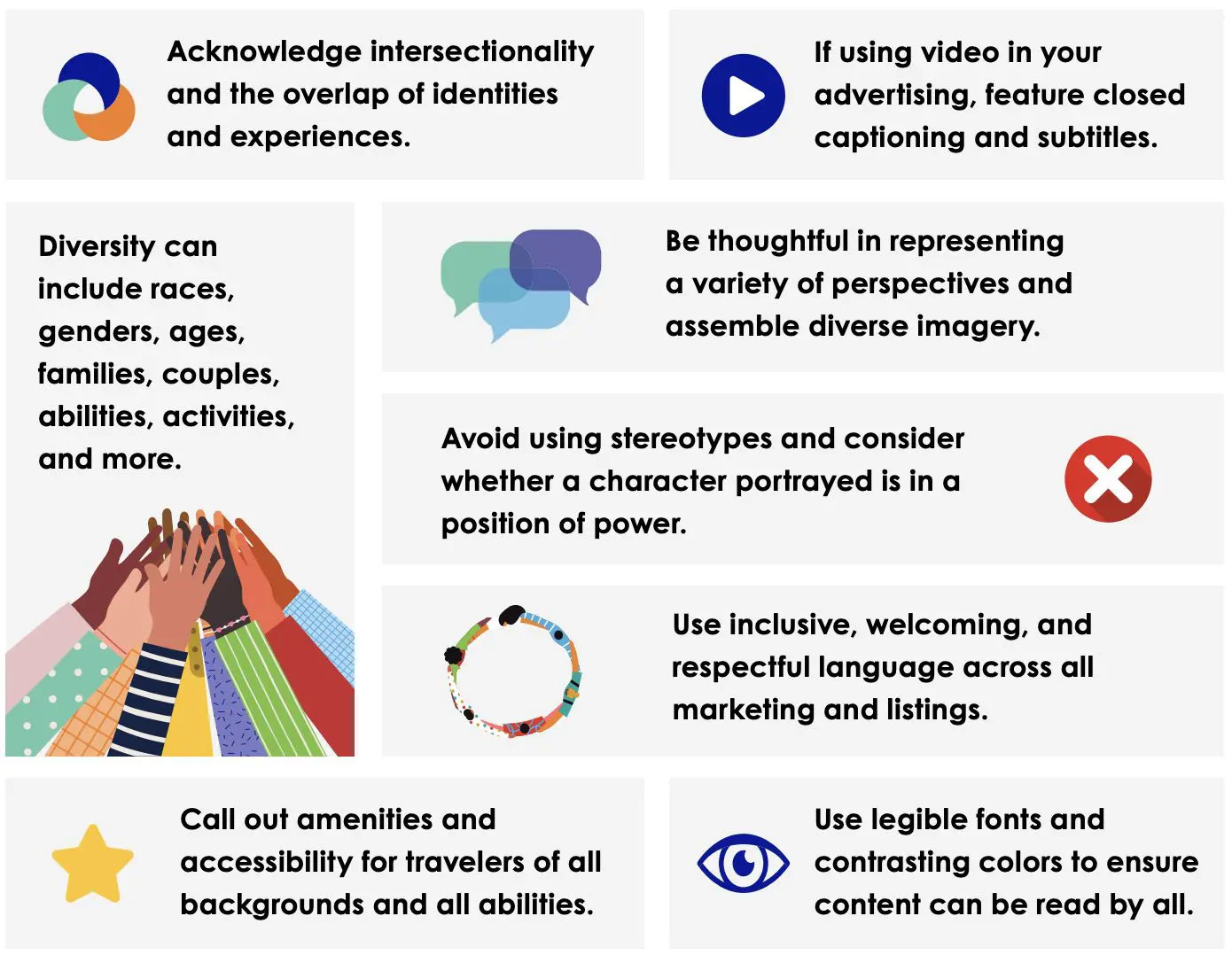

Hoteliers need to ensure they are providing accessible and inclusive experiences for every traveler and are incorporating inclusivity into their marketing efforts. Some of the key things to keep in mind for representative and inclusive advertising are highlighted below.

Download the Inclusive Travel Report.

5. Consumers are looking for sustainable travel options—and will pay more for them

In our Sustainable Travel Study, we found that sustainability is another key element consumers are paying attention to and basing their travel decisions on—our data shows that 90% of consumers look for sustainable travel options.

Our report also showed that 65% of consumers would like to opt for environmentally friendly transportation or lodging on their next trip and over 50% of them would be willing to pay more for sustainable lodging.

Consumers are looking to hotels—47% said they want to see more information about how to be a sustainable traveler from lodging providers. With this rise of consumer focus on sustainable travel, hoteliers should ensure that they’re providing information about their sustainability efforts on their websites and in their marketing materials.

One example of a successful sustainability focused campaign is Iberostar. They created a campaign with our team that educated travelers on their Wave of Change initiative that focused on their move toward a circular economy, responsible consumption of seafood and improvement of coastal health. Our in-house creative agency developed an interactive campaign featuring a microsite with stunning imagery and curated information designed to inspire travelers to make informed decisions about how they travel. This focus on sustainable travel drove strong results for the hotel with a return on ad spend of 46:5, showing that sustainability can be positive for business.

Download the Sustainable Travel Study.

For more insights into current traveler behavior and intent, download our Q2 Traveler Insights Report and subscribe to our blog for the latest updates. If you’re interested in learning more about how our team can leverage these insights to help develop campaigns for your brand, please contact us.