ESG Real Estate: did the message of COP-26 backfire?

90% of buildings are at risk of stranding no matter what pledges are made at the UN climate summit in Glasgow. With tightening climate laws and banks and pension funds cutting investment, who will control these “brown” buildings in the future?

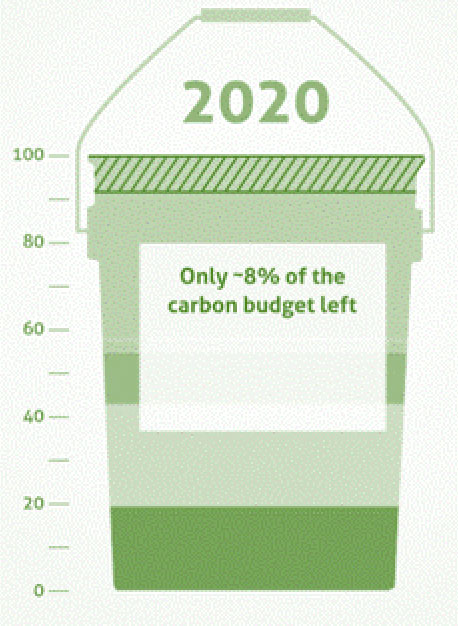

In a world shaken by a pandemic, and a fast-closing window of opportunity to avoid climate catastrophe, the pivotal COP-26 UN climate conference kicked off in Glasgow and the stakes could not have been higher. Basically, Paris set the destination - limiting warming well below two degrees (ideally 1.5) - but Glasgow is the last chance to make it a reality. The clock is ticking, and to have a chance of limiting the rise, the world needs to halve greenhouse gas emissions in the next eight years.

This is a gigantic task that we only will be able to do if governments attending COP-26 create a level playing field for those taking action and come up with bold, time-bound and front-loaded plans to transform their economies to reach so called net zero emissions.

This is a gigantic task that we only will be able to do if governments attending COP-26 create a level playing field for those taking action and come up with bold, time-bound and front-loaded plans to transform their economies to reach so called net zero emissions.

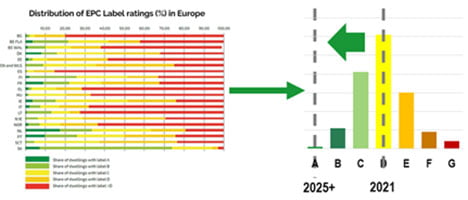

COP-26 is expected to significantly ramp up climate responsibility in the real estate sector, and investment projects will need to prioritise the creation of environmentally friendly buildings and fully sustainable communities that will go far beyond minimum energy efficiency standards (MEES) with EPC “A” levels expected as a minimum. Those which do not may ultimately be left behind and diminish in value.

Lenders also are increasingly factoring in net zero environmental and sustainability considerations. For example, ABN Amro - which has a balance sheet of EUR185 billion in outstanding loans for residential and commercial properties - intends to have an “A” weighted average energy label of its entire portfolio by 2030. This measure alone will have immediate impact with other banks and funds expected to follow suit after COP-26.

Lenders also are increasingly factoring in net zero environmental and sustainability considerations. For example, ABN Amro - which has a balance sheet of EUR185 billion in outstanding loans for residential and commercial properties - intends to have an “A” weighted average energy label of its entire portfolio by 2030. This measure alone will have immediate impact with other banks and funds expected to follow suit after COP-26.

Leaders in the real estate sector are beginning to recognise that they must act now - in ten years' time it may not be financially viable for refurbishments to take place to achieve net zero. But although most are worried about the dreaded “brown discount”, few are embedding ESG principles in their day-to-day operations, let alone in their mid to long-term planning.

In the two year build up to COP-26 most of us feel overwhelmed by the tsunami of information on how to reduce emissions and adapt to tighter regulation. For many years the issue of sustainability was part of any business consideration only to a limited extent. But all of a sudden we are surrounded on a daily basis by the problems related to climate change, pollution, plastic waste, biodiversity loss, economic inequality, water scarcity – enough to make even the most passionate sustainability activists, even myself, want to pull the covers over their heads or look away from time to time. Nonetheless environmental concerns are pressing and we have to find a way to motivate us.

Already as far back as in 2003, 48% of people felt overwhelmed by environmental messages all around them, so it comes as no surprise that we not only feel overwhelmed, but also a little guilty because we might feel that we should be doing more to help the planet. At the same time, we might have a sense of futility that we are never going to be able to do enough.

A 2018 study by Princeton University concluded that if people feel guilty they are in fact less likely to make an effort to take steps to improve climate change, and that, in fact, guilt-based environmental appeals run the risk of backfiring. The research findings suggest that people are better motivated to take action if the climate message harnesses the power of positive emotions, like pride, achievability and attainment.

How do we move forward from here?

So how can carbon emissions from the built environment be controlled and how can we obtain positive buy-in from all stakeholders to drive industry wide action now?

The key focus needs to be on creating the right levers to encourage innovative design and planning, align stakeholder interests, drive down carbon emissions and create viable, resilient and future proof buildings.

To achieve that there needs to be a concerted move towards standard measurement and disclosure of whole-life cycle carbon assessments (LCA) of every building, small or large, to inform and encourage more carbon and cost efficient construction, renovation and operations and to create a level playing field for all. Standardised LCA will play a key role in aligning the interests of real estate owners, financiers, developers and consumers and provide a mechanism to tackle upfront carbon emissions from the entire built environment. LCA can be done quickly and cheaply, prompts immediate action, and measures the net zero status of each stage of a building’s life cycle, providing the relevant stakeholders with confidence that the ratings they achieve are accurate, and that they can be directly compared with peers and compliance standards.

Understandably, heads are still spinning but the market requires fairness and to that we need to stop relying on “green” certification standards for the purposes of benchmarking. 99% of these standards are proven to be still essentially un-sustainable - they ultimately consume resources at a rate that is destructive to maintain - only a lower rate. These certifications are too lenient and we need LCA benchmarking to kickstart the build sector into immediate and meaningful action.

Understandably, heads are still spinning but the market requires fairness and to that we need to stop relying on “green” certification standards for the purposes of benchmarking. 99% of these standards are proven to be still essentially un-sustainable - they ultimately consume resources at a rate that is destructive to maintain - only a lower rate. These certifications are too lenient and we need LCA benchmarking to kickstart the build sector into immediate and meaningful action.

Doing so will act as a safeguard against the inevitable rising sustainability standards, both in terms of regulations as well as consumer expectations. Furthermore, factoring in physical resilience against extreme weather patterns, or cost disruptions in fuel or electricity, etc, is increasingly recognised as an important element within the underwrite risk-mitigation envelope. High-performance, net-zero buildings provide that kind of resilience.

ESG may appear at first glance as an nuisance, an additional cost and as unfeasible. Ultimately, however, it's about creating significant value, resilience and competitiveness and about reducing the risk of devaluation and stranding.