What Changes To European Online Hotel Distribution Mean For Direct Bookings

On the surface, a recently released study by D-EDGE that deep-dives into European hotel distribution trends for the years 2014 to 2018 shows what you might already suspect. The OTAs dominate the channel mix with Booking Holdings at the top while average reservation values continue to march at the pace of inflation. Length of stay (LoS) has diminished slightly while long-lead-time reservations have frustratingly high cancelation rates.

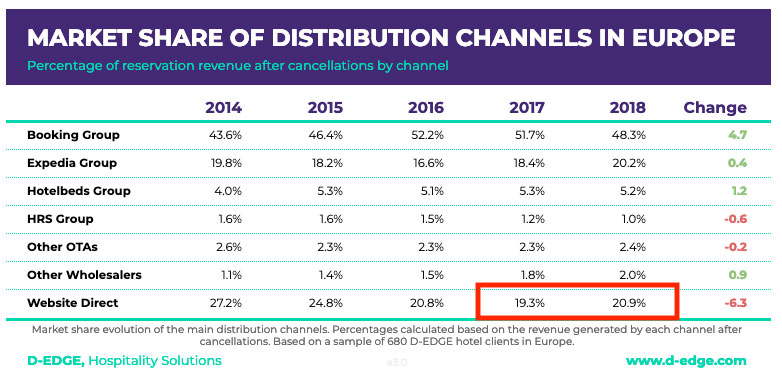

A nascent trend, though, is that the much-vaunted direct bookings appear to be making a comeback. Although too early to say definitively, we appear to be just beyond the market share nadir, with direct brand.com bookings seeing a steady decline from 27.2% to 19.3% over the course of 2014 to 2017 followed by a recovery to 20.9% in 2018. Moreover, the numbers point to most of this gain being taken out of Booking Holdings' piece of the pie which fell back below half of total reservation revenues (after cancellations) to 48.3% in 2018 from 51.7% in the previous year.

Still, though, much work is needed before we can be steadfastly optimistic. While the last year may indicate a forthcoming rebound, when reservation revenue indexes are compared for the entirety of this measured timeframe, website bookings are still far behind the OTAs for cumulative growth and below the global average.

Interestingly, the revenue indexes were tabulated for before as well as after cancelations, revealing that direct bookings have the lowest cancelation rate of any channel, sitting at under half that of the average for all. While cancelations are a growing problem for the entire industry, guests appear to be much more satisfied and committed when dealing directly with the hotel.

Not only that, but customers have the greatest average reservation values of all channels analyzed, and this has persisted for the entire breadth of the study. So, not only are direct bookings less like to drop out, but they continue to represent the largest per-individual income when compared to reservations made through the OTAs or other wholesalers.

Circling back to LoS, the marketplace average now sits at 2.3 days for 2018 with barely significant differences between each measured channel. Although they are doing better than some OTAs and reservation services, direct bookings aren't the leader by a long shot. The inference here is that, in tandem with spreading the good word about the benefits of booking direct and delivering better customer satisfaction in these reservations, our branded websites still aren't doing enough to entice guests to increase their time with us. And to echo the study, fighting back against this diminishing LoS is important because longer stays mean reduced operating costs.

I remain optimistic as this study shows that hotels can be successful in the vast digital landscape if they offer guests superior content and service through their owned online presences. Still, though, direct bookings are one part of a healthy channel mix and you would be wise to see which ones deliver the best results for your specific property.