The Corona virus may not be the biggest threat to the hospitality industry

The travel industry has come to a halt with the COVID-19 virus causing a third of the world’s population to stay home and forcing the majority of the world to practice social distancing. The virus is (hopefully) a short-term threat to what has been a vibrant and growing industry over the last decade. But the virus is far from the only invisible threat to the travel industry. There are several long-term key threats to both travelers and travel providers related to technology. The technology story of the last decade in travel is one of fragmentation and consolidation.

Failures of fragmentation

The fragmentation is caused by a growing number of travel sellers at both the global and local level. While new business models for travel retail have sprung up, the more traditional have not necessarily gone away. For example, Hopper and Groupon have both become prominent travel sellers, while still not surpassing GDS (global distribution system), which has been around for decades. Hotels therefore need a mix of channels and partners to maintain high levels of occupancy and average daily rates (ADR). Hotels therefore need technology providers that can provide a large enough ecosystem of channels to choose from, in order to tap into emerging source markets frequented by guests, while also exploring source markets from new channels. For technology providers such as channel managers, or a switch, keeping up with a growing number of channels to integrate with can be a real challenge. Every new and growing source market along with new and innovative travel sellers create opportunities for new connectivity providers to enter the market. New entrants are able to get a foothold building on strong local markets where they can visit with hotel customers and provide a high level of personalized support. This phenomenon is similar to that of the battle between big box stores and small local grocers. The big box stores can provide reliability, a diverse assortment and low prices. The local grocer can provide personalized support and a local / unique product.

While new technology providers enter market, it’s surprisingly rare for the less profitable and successful ones to fully fail and exit the market. The reason? Switching technology providers can be painful. Integrations and mapping take considerable work and switching a provider means redoing that work all over again; while there might be numerous benefits, these may not make up for the cost of switching. Thus with legacy providers remaining in the market and intermittent opportunistic entrants, the hospitality technology market has become saturated and fragmented. Hoteliers relying on numerous providers are therefore exposed to significant risks for both themselves and well as their guests. The most significant risk lies in the exposure of guest data. One of the large multinational hotel chains based out of the US disclosed yet another data breach recently that may impact over 5 million guests. If a hotels distribution technology is spread over numerous vendors, managing those vendors and their security involves significant time, organization and cost. Another chain of mid-scale hotels based out of the US was exposed to this risk by its connectivity provider’s failure to safeguard guest data. In this case, there was clearly a lack of focus on security. This example highlights the importance of creating close partnerships with technology and connectivity providers and managing the relationship with a supply chain management mindset. The relationship needs to be symbiotic where both parties thrive and remain profitable. A profitable and innovating partner is much more likely to invest in security measures that keep data protected. Hoteliers would be wise to look at the above two indicators when choosing a connectivity partner.

Consolidation comes with risk

While there’s risk in fragmentation and relying on numerous small connectivity partners, it doesn’t mean that all of the larger players are a safe bet either. As in many other industries, Chinese capital rich technology companies are growing fast via acquisition rather than innovation. But with a growing prominence, comes increased scrutiny. Hoteliers and government officials alike are questioning the safety of both business and guest data stored in China based servers.

Given the increased mutual distrust between the governments of the US and China, the world’s top 2 GDPs, it was only a matter of time before that distrust split over into the corporate world. The risks associated with relying on Chinese technology providers have been recognized by the highest level of government. Earlier this year, the Trump administration ordered a China-based information technology company to sell its stake in a US-based technology provider.

Also, this is not something that is only related to the travel and hospitality industry. The top departments of the US government have endorsed cutting off China Telecom from serving the US market because of legal and security risks. "The Executive Branch agencies identified substantial and unacceptable national security and law enforcement risks associated with China Telecom's operations, which render the FCC authorizations inconsistent with the public interest," the Justice Department of US said in a statement. Another notable dispute is that between Huawei and the U.S. government. At the center of the dispute is the issue of exposing millions of U.S. (as well as European citizens) to data theft and privacy intrusion by the Chinese government and its affiliated entities. One in five North American-based corporations on the CNBC Global CFO Council says Chinese companies have stolen their intellectual property within the last year.

Hoteliers might thus want to have their connectivity providers provide maximum assurances on data privacy and safe harbor protection.

Partnering for protection

While options might seem plentiful for distribution technology providers, the risks outlined above show that the field of viable and secure options may be fewer than at first sight.

Hoteliers have started to take note and are focusing on partners that can provide scale, innovation and high levels of security. We are thus seeing increased attention and interest in our DHISCO product. DHISCO has emerged as an attractive option for hoteliers seeking reliable distribution with primarily U.S. based servers and an operation adhering to U.S. and international security laws/standards. DHISCO is a 25-year-old SAAS business spun off from Dallas based Pegasus Solutions in 2014 and brought by RateGain in 2018.Coincidentally, DHISCO was one of the original innovators of electronic hospitality distribution and played a prominent role in shaping the history of distribution. After staying out of the spotlight for nearly two decades, DHISCO is now becoming the obvious choice for hoteliers seeking both innovation and security. Unlike many of the competitors that have grown through acquisitions, DHISCO has been infused with innovation through its partnership with its parent company RateGain. One of the more significant examples of this innovation is the collaboration on Smart Distribution, which is poised to bring long awaited efficiencies and flexibility to hospitality distribution.

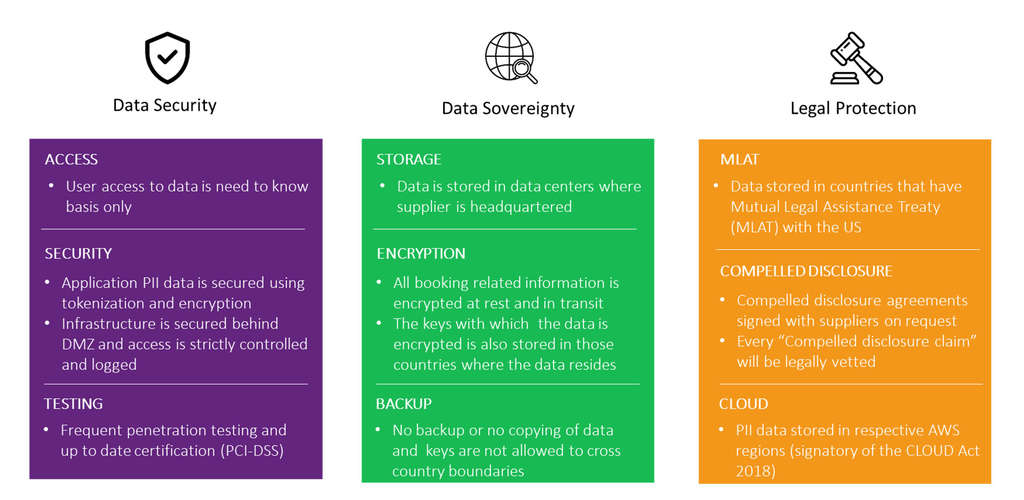

A number our clients have been asking about DHISCO’s data security, data sovereignty, internal and 3rd party access to the client’s data that passes through DHISCO’s switch DHISCO’s switch connects demand partners - OTAs such as Booking.com or Hotwire.com to suppliers such as IHG, Marriott. The switch transfers ARI (availability, rate & inventory) as well as the booking data (credit card, name, email etc.) between the suppliers and demand partners. The DHISCO switch stores the above data in a hybrid set of data centers namely AWS (in multiple regions across the world) and in a private datacenter - Aligned Energy Data Center - Dallas. Even though our clients are talking about data security, what they are really worried about is “compelled disclosure” whereby a government or provincial authority forces a company to provide access to data stored within that government’s geographical jurisdiction. This most probably has become the top concern considering the recent events mentioned above.

In addition, in order to stay ahead of unwarranted compelled disclosure events, DHISCO have instituted customer friendly policies. The below diagram explains how we safeguard your data across multiple pillars.

With the travel industry at a stand-still, hoteliers are taking the opportunity to revisit their technology partnerships to be in a strong competitive position when the market rebounds and travelers take to the skies, roads and hotel beds. The last thing the industry and hoteliers need right now, is the loss of trust when travelers return. There is no amount of disinfectant that can keep guest data safe if data security is compromised.

To know more about how we can assist you with data security and sovereignty, you can reach out to me or write to [email protected]

About RateGain

RateGain Travel Technologies Limited is a global provider of AI-powered SaaS solutions for travel and hospitality that works with 3,200+ customers and 700+ partners in 100+ countries helping them accelerate revenue generation through acquisition, retention, and wallet share expansion. RateGain today is one of the world's largest processors of electronic transactions, price points, and travel intent data helping revenue management, distribution and marketing teams across hotels, airlines, meta-search companies, package providers, car rentals, travel management companies, cruises and ferries drive better outcomes for their business. Founded in 2004 and headquartered in India, today RateGain works with 26 of the Top 30 Hotel Chains, 25 of the Top 30 Online Travel Agents, 3 of the Top 4 Airlines, and all the top car rentals, including 16 Global Fortune 500 companies in unlocking new revenue every day. For more information, please visit www.rategain.com.