Future-Proofing UK Hotels

Malcolm Kerr, Managing Director of Horwath HTL UK has been talking to prominent executives and advisors to get their perspective on the major challenges facing owners and how they are preparing for an uncertain future.

Hotel owners and operators broaden product offerings, reduce head-count and optimise efficiency to build-in long-term resilience.

As the UK emerges from COVID-19 lockdown and the realities of Brexit come into focus, hotel industry stakeholders are being forced to make major changes to their businesses to remain relevant and return to profitability.

Industry pundits have been speculating for months on the future of travel and tourism and the pending doom or coming revitalisation of the hotel sector.

Optimists are adamant that global economic growth will ensure that the travel industry rebounds strongly and that tourism receipts will soon surpass those pre-pandemic. Pessimists on the other hand point to international commitments to reduce carbon emissions, the adoption of remote working and the risk of future disruptions when proposing that major sectors of the industry will never recover.

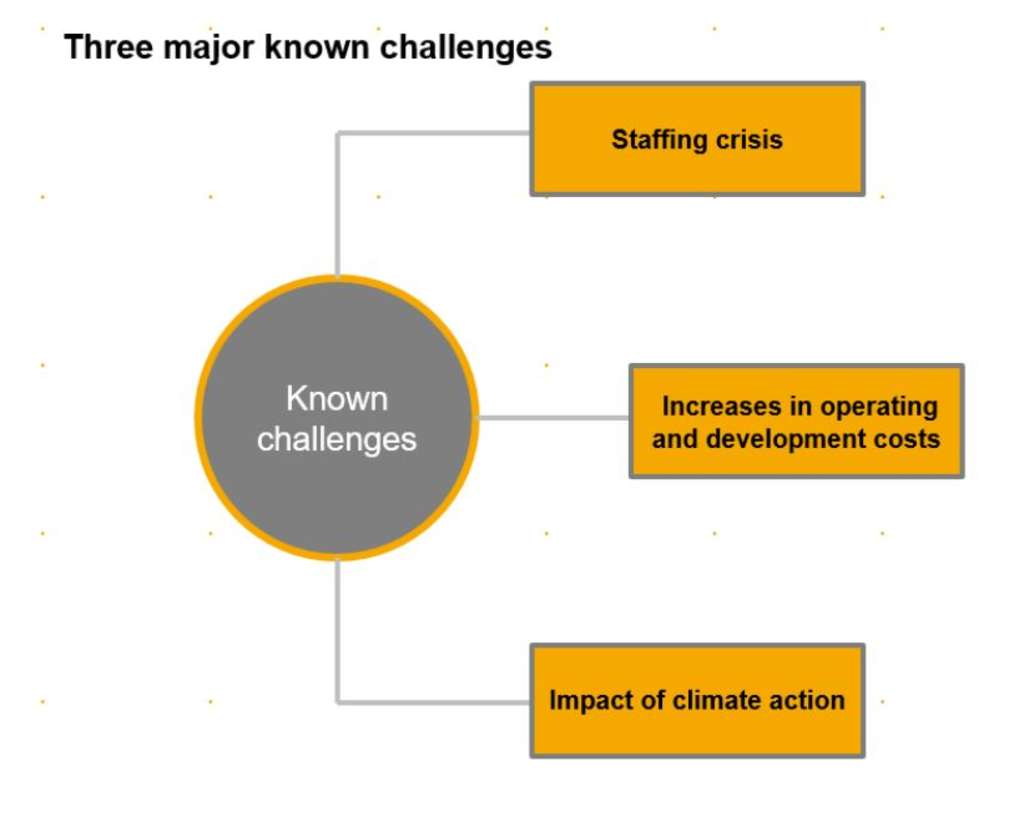

In reality, it is still too early to accurately forecast what will happen over the coming months and years. Savvy owners and investors must instead focus on the known and immediate challenges to ensure that they are best placed to navigate the vagaries of the pandemic and to compete effectively, whatever the future may hold.

We are at the early stages of a staffing crisis across hospitality

Chris Mumford, founder of Cervus Leadership Consulting, notes that “There has been a clear uptick in hiring at line-staff and department head level as hotels reopen, although this is recruiting of roles that already existed pre-pandemic and had been vacated during the crisis.”

Unsurprisingly, employers are having to pay significantly more (anecdotal evidence suggest around +20%) to secure experienced people, with hiring surges tied to the ever changing ‘roadmap’ for venue re-opening.

“It seems pretty clear that there will be critical staff shortages over the coming year” states Mumford, “however, it will not be until more hospitality businesses fully re-open and the furlough scheme is rolled-back that the true extent of the problems will become clear.”

The pending shortage of workers in hospitality is significantly worsened by Brexit. Many EU nationals have already left the UK, including some who may be still receiving furlough payments. Others, at all levels of operations, have taken up opportunities outside the hospitality industry.

This concern is being born out at the property level. Managers are being forced to make significant changes to operations to balance inconsistent demand, rising costs and limited staff availability – while still meeting guest expectations.

Beverly Payne, General Manager of The Conrad St. James, London found the challenges of ramping up operations and opening new food and beverage (F&B) outlets (such as The Pem by Sally Abé) exasperated by some furloughed staff choosing to pursue other careers, remaining in their own countries or being tempted to move to other higher paid roles.

“We are having to look closely at the value and productivity and flexibility of every role.”, explains Payne, “In parallel with increases in average employee costs, staff will need to show a high level of flexibility, both in scheduling and ability to multi-task. Ultimately, the staffing budget will be shared by fewer, more productive, full-time employees In the short-term this is very difficult to achieve while maintaining our required service standards”, Payne continues. “Team members returning from furlough understandably need a lot of support, mentoring and training to get back up to speed.

“Going forward, new technologies are helping to streamline operations (as well as supporting on-line training) but in a luxury property such as ours, human interaction is a critical part of the experience.” Payne adds.

While the industry continues to lobby government (via UK Hospitality and others) to expand the Shortage Occupation List – and generally reduce constraints on the employment of EU nationals in the hospitality sector, people costs will inevitably continue to increase above the general rate of inflation over the coming years.

Despite full-service properties continuing to require considerably higher staffing than economy hotels, the adoption of new technologies, changing guest expectations and pressure to maximise returns from all areas of operation, will dictate that staffing ratios will not realistically return to pre COVID-19 levels.

Costs are set to rise sharply as COVID-19 support is removed and Brexit duties come in

Above and beyond the rises in labour costs, hoteliers must prepare to absorb significant increases in hotel operating and development costs as COVID-19- support measures are wound back and the realities of Brexit become clear.

As Caroline Fleet, Partner at Crowe UK explains, “As well as the risk of higher customs duty tariffs being applied to imports from the EU, there are also practical issues such as the time spent to clear customs, adding to additional time and costs in the supply chain. Coupled with this, as businesses reopen, government are looking to reduce financial support to the sector over a fairly short horizon. The reduced 5% VAT rate will cease from 30 September 2021 and be replaced with a rate of 12.5% until 31 March 2021, the furlough schemes for employees is due to end from 30 September 2021 and the business rates exemption ends in 30 June 2021 with a discount applied till March 2022. Hoteliers will therefore quickly find themselves with significantly more costs on their books.”

Whether out of necessity or caution, owners and operators must do everything they can to control overhead costs, optimise worker efficiency and tech solutions.

Sustainability is central to the future hotel development and operations

Added to the mix of ‘knowns’, governments worldwide have committed to significant reductions to carbon emissions, introducing legislation which imposes ever more stringent limits on, and measurement of, the environmental impact of businesses and consumer behaviour.

Already around a third of FTSE 100 companies have joined the UN’s “Race to Zero” campaign to reach net zero carbon emissions over the next 10-20 years. Such companies already track carbon emissions of suppliers and have typically pledged to eliminate unessential business travel.

To secure business from such key corporate clients, accommodation providers will have to demonstrate compliance with best-in-market environmental practices.

Hotel development is a lengthy process and developers must ensure that they are well ahead of the curve at the planning stage to ensure the final product is relevant and marketable at opening.

Similarly, in operating properties, owners need to prioritise capital improvements which increase efficiency and meet ever tightening regulations, while taking full advantage of capital allowances available from HMRC

“With the ‘super deduction’ capital allowances available for companies, in place from April 2021 to March 2023, businesses are clearly reassessing the timing and nature of their capital expenditure programs to ensure that they obtain the full benefit of this opportunity”, says Fleet “For qualifying new plant and machinery such as furniture and kitchen equipment, a super deduction of 130% is available, and for fixtures and fittings an accelerated allowance of 50% is available”. Unlike other measures there is also no cap on the level of spend.”

“Adaptation, conversion and renovation of existing properties should be first priority in development considerations from a sustainability perspective since the embodied carbon and energy inherent in existing structures makes this the recommended approach of the future, while also making greatest economic sense.” says leading hotel architect, Dexter Moren of Dexter Moren Associates.

Moren considers that “There has been significant progress in recent years in the quality and efficiency of modular MEP helping to make retrofitting of older buildings increasingly feasible. For example, as the pandemic has brought air quality and purity into sharp focus, the latest split-type air-conditioning systems can deliver more efficient and personal air-quality control than older central air management systems, while saving on both space and costs.”

Gerard Nolan, Co-founder of C1 Capital Partner agrees that “There is still value in conversion of low-grade office to hospitality/office mix”, but adds “investors and banks have been cautious and in many cases re-development of redundant inefficient structures will prove the most viable option.”

C1 is leading the redevelopment of Boundary House, on Jewry Street near Liverpool Street. existing 45,000 sq ft office building will be demolished and will be replaced with a 300 key “lifestyle” hotel and serviced office mixed use scheme.

“As the (Boundary House) planning and construction programme will take 2 to 3 years, our vision is that the pandemic will be over when the ribbon is cut” says Nolan.

Learning lessons from limited service operations

Broadly speaking, long-stay and budget accommodation properties have performed better through the pandemic than full-service upmarket hotels, particularly in metropolitan environments. Already honed to minimise staff to guest ratios they have they been able to continue operations (where permitted) with a minimal cost base, while adjusting quickly to short-term changes in demand.

As Nolan notes “The construction efficiency and operating margin offered by economy hotels and other limited service accommodation makes them hard to beat in potential ROI.”

While there is no suggestion of abandoning investments in luxurious full-service hotels just yet, owners recognise that lessons can be learned from the structural efficiencies of limited service operations.

The pandemic experience has given owners and operators the opportunity to look at their hotel cost structures from a zero-base, adding back only critical and profit generating services. For many, the cost reductions and related product amendments will stay in place long-term.

Liutauras Vaitkevicius MIH, Managing Director of The Zetter Group, notes that “Reduced frequency of housekeeping, which became standard practice throughout the industry in compliance with distancing measures, will remain an option for our guests going forward. This also ties in with our ongoing efforts to reduce waste and continue with our mission to deliver sustainability”.

The viability of labour and space demanding F&B operations in many hotels is understandably under intense scrutiny.

“The economics of operating a full 3-meal an in-house restaurant 7 days a week does not currently make sense in any of our properties” says Vaitkevicius, “so going forward we will continue cherry-picking on key dates to ensuring our programming and service offering is matching demand trends from largely local customer base. I am confident that, as we start seeing the return of both international and business travel, we will be well placed to meet guests’ needs while continuing to build our brand, product and service proposition to keep consumers interested and engaged”, he added.

Blurring the lines between hotels and alternative accommodation

Careful analysis of alternative uses and positioning on a property by property basis is critical. Major groups are keen to showcase their flexibility to owners introducing more and more brands and derivatives to meet particular property and location attributes.

“There is absolutely a blurring of the lines between traditional hotel and alternative accommodation types. We are seeing more and more hybrid models every day” Says Philip Lassman, VP Development, Northern Europe for Accor.

Indeed, over the past two years Accor has been progressively introducing a “Living” derivative for each of its main brands, offering studios and apartment products with co-living elements for long stay guests in addition to standard rooms.

Positioning itself as “The world-leading Augmented Hospitality group” Accor is increasingly looking at properties as a collection of separate complementary elements in order to maximize revenue per square foot.

Dennis Wong, Vice President, Portfolio Strategy and Growth at Oakwood explains that his company has similarly broadened its product offering in recent years.

“Oakwood has transformed from becoming a corporate solutions provider that specialises in sourcing and leasing long-term accommodation for corporate clients to becoming a full-serviced hospitality management group. Now with a collection of brands that offers diverse accommodation choices, ranging from providing the essentials through Oakwood Apartments, delivering crafted experiences through Oakwood Studios to tailoring bespoke luxury with Oakwood Premier, we have a global portfolio of properties that combine the space and comfort of a private residence with the thoughtful services and amenities of a hotel – heightening our competitiveness with traditional hotel propertiessays Wong.

The growing interest in alternative accommodation is in part due to improved building and operational efficiencies.

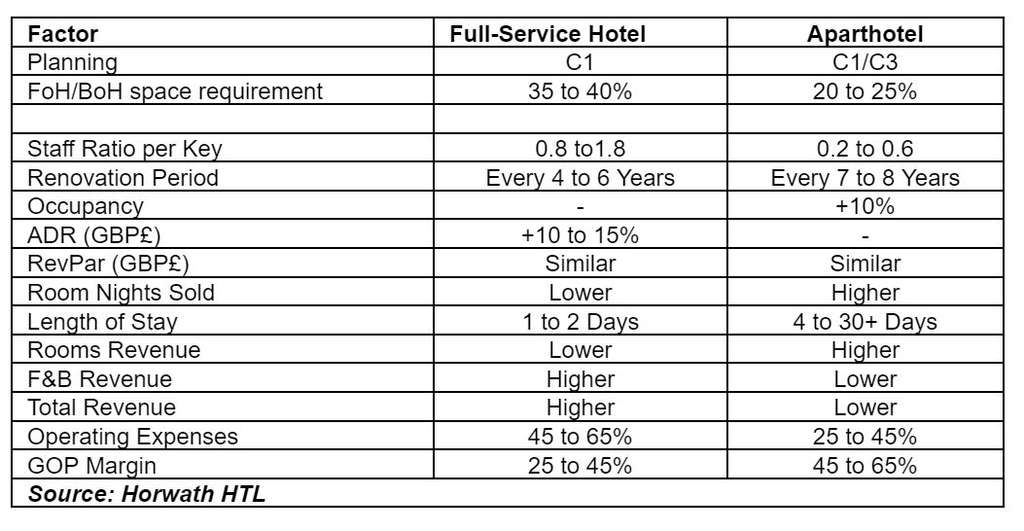

Andrew Reitmaier, Director, Horwath HTL UK has reviewed operations and completed buyer due diligence for a vast range of hotels and alternative accommodation properties in the UK and overseas.

“Despite typically achieving lower average daily rates versus hotels of a similar quality – higher, more stable occupancy and lower operating expenses allow aparthotels to consistently deliver a better GOP margin and profit per square foot” says Reitmaier.

The table below sets out an indicative comparison, from our experience at Horwath HTL, of key operating performance variances between a full-service hotel and an aparthotel.

“When you add the efficiencies gained from reducing front and back-of-house space and curating and limiting the services offered, the investment proposition becomes increasingly attractive, turning over far more of the building to income producing rooms, to achieve a higher return on investment”, says Ken Moore, Interim Managing Director, Synergy Global Housing.

Tailoring operator and brand agreements

As a significant proportion of hotels re-open with limited services and facing rising overhead costs, management and franchise agreements are inevitably coming under close scrutiny.

Simon Allison, chairman and CEO of HOFTEL (a global association of hotel property investors) notes that “Over the past 18 months operators have allowed numerous concessions to owners to preserve cashflow and meet local legal requirements. These have included the closure of outlets, reduced staffing and services, deferment of property improvement works, use of F, F&E reserve for operational expenses, fee concessions and deferrals to name a few.

“As the legal restrictions fall away, operators may struggle to justify re-instatement of standards and fees to pre-Covid levels particularly given significant reduction of their central group resources”, adds Allison.

Owners with experience of alternative management structures have seen relative strength and weakness laid bare through the pandemic and are keenly aware of the value of negotiating management and franchise agreements; seeing scope to amend and refine management and brand agreements to ensure they are fully aligned to product and service changes, operator resources and owner’s objectives going forward.

Conclusions

Despite the unprecedented challenges of 2020 and 2021 hotel owners and operators remain confident in the future of the industry.

The tight labour market, rising costs and environmental regulations dictate that hoteliers must learn to build and operate more efficiently than ever before.

Careful planning and close collaboration between owners, operators and lenders in the months ahead will be vital in order to complete and establish a sustainable platform for growth.

Thanks to

Chris Mumford, Cervus Leadership Consulting

Philip Lassman, VP Development, Northern Europe, Accor

Simon Allison, Chairman, HOFTEL

Gerard Nolan, GNP and C1 Capital Partners

Beverly Payne, General Manager, Conrad St James

Liutauras Vaitkevicius MIH, Managing Director, The Zetter Group

Dexter Moren, Founder, Dexter Moren Associates

Caroline Fleet, Partner / Head of Real Estate, Crowe UK

Related Insights:

Recovery Mode: Hospitality And Travel Predictions For 2021 And Beyond | Crowe Global