The Winners and Losers in the Pandemic? It Came Down to This.

Location ... location ... location. It’s a constant refrain in real estate and, by extension, the hotel industry. The turn of phrase took on a whole new meaning in the wake of the COVID-19 pandemic. Depending on orientation, some hotels thrived, some survived, some shuttered and some didn’t survive.

Asset type also had consequence. Full-service hotels situated in downtown locations with ample meeting space and F&B outlets were a victim of circumstance and did not fare well on a profitability continuum. Meanwhile, hotels in secondary or tertiary markets, so-called drive-to markets, or properties within resort destinations had a better chance to stay afloat or succeed. With commercial and international business choked off and a reliance on domestic leisure travel, hotels that catered or skewed more heavily toward that segment were spared the pandemic’s full wrath; in fact, some markets in 2021 performed better than they did over the same time frame in 2019, according to HotStats data.

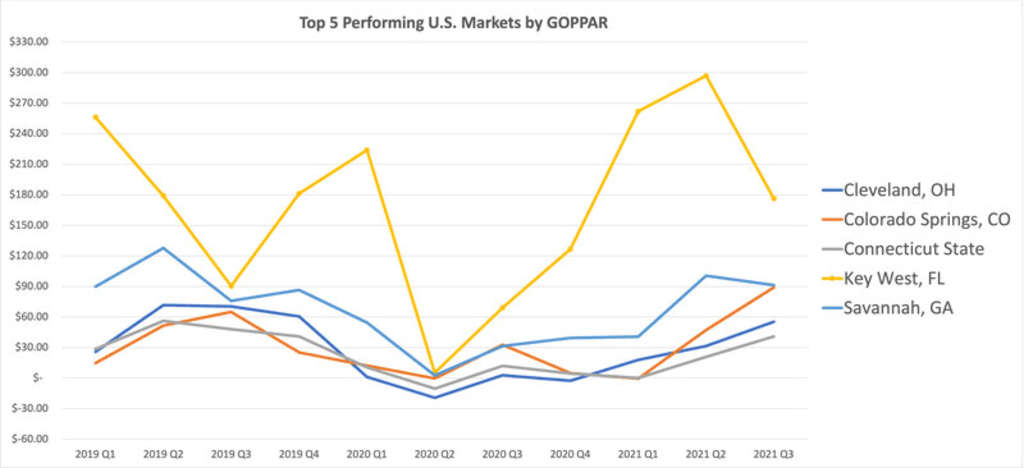

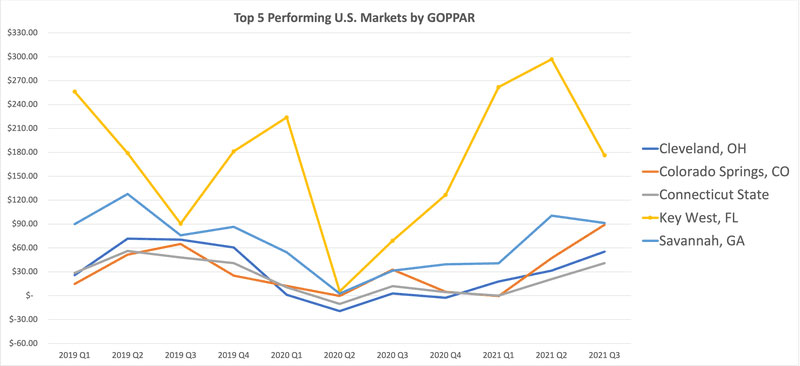

Consider Key West, Fla., the state’s southernmost point known for conch, Hemingway, key lime pie, nightlife and myriad water activities. Prior to the pandemic, the island city, which historically produces its best results in winter months as a haven for snowbirds, performed favorably in the first quarter of 2019, recording gross operating profit per available room (GOPPAR) of $256.24. For the year, Key West’s GOPPAR was $175.23, placing them well higher than the total U.S. GOPPAR of $89.14.

It’s no surprise that Key West GOPPAR plummeted in Q2 2020, recorded at just $5.39, 97% lower than the Q2 2019 level. The city clawed back, however, and by Q1 2021, its GOPPAR of $261.92 eclipsed Q1 2019 by $5. It’s a remarkable turnaround, one that carried through the entire year and, rather incredibly, could be described as gangbusters. Both Q2 and Q3 2021 exceeded their 2019 comps by $118 and $86, respectively—illustrating how a resort destination not only survived but thrived during a global pandemic. It’s no surprise, then, that JLL has called the Florida Keys “the best hotel investment market in the world.”

Similar resort-specific destinations across the U.S. performed admirably during the pandemic. Colorado Springs, home to the iconic Broadmoor, had a splashy Q3, with GOPPAR reaching $88.95, $24 higher than Q3 2019 and the highest for any quarter since 2018.

The Georgia city of Savannah benefits from its coastal location and tourist/leisure demand drivers, from architecture and history to food and climate. It, too, has outperformed its pre-pandemic performance: In Q3 2021, it recorded GOPPAR of $91.28, $15.41 higher than at the same time in 2019.

No one could have predicted the pernicious impact of the pandemic. Certainly, some hotels have the serendipity of location and asset type and those with a business mix that skewed more toward leisure came out on top. Others, with a business mix that catered toward corporate or convention business, struggled to stay afloat.

New strains of COVID are not making it easy on the hotel industry. Just when we thought we were out of the woods and into the clear, a new wave of infection is introduced and communities hunker down or people become more wary of movement—individuals and companies, alike. Any cap on travel is negative for the hotel industry. The bright side is that despite a global pandemic, travel continues to be sacrosanct; it’s not an experience that people are ready to give up on and the data illustrate it.

As the calendar turns, the hotel industry is looking to a brighter 2022, but remains in a precarious position. Markets like Key West could be in for another blockbuster year—that may not portend well for the collective hospitality industry.

David Eisen

Director of Hotel Intelligence and Customer Solutions for HotStats

HotStats Limited