Top 5 Trends for Destination Marketers for the Rest of 2022

As we emerge from the pandemic, destinations marketing organizations (DMOs) are in a unique role to build back better as travel returns. Despite many additional challenges in Q2, including skyrocketing inflation, rising fuel prices, and continued staffing shortages, enthusiasm for travel endured, pointing towards strong recovery. Not only did travel demand remain steady with moderate increases, travelers also went farther out this quarter.

With these emerging trends, destinations have a strong opportunity to play a central role in recovery, capturing pent up demand while providing a sustainable and inclusive experience for travelers. To give DMOs a better look at the most relevant trends for destinations, we have pulled together the most important insights for the rest of 2022 from our latest data and research including the Q2 Traveler Insights Report, Inclusive Travel Insights Report, and Sustainable Travel Study.

1. Travel demand endures, despite rising costs

After a strong Q1 with a 25% increase quarter-over-quarter in searches globally, search volumes held steady in Q2, indicating a sustained interest in travel despite headwinds. Lodging bookings also saw moderate growth during Q2, and 10 of the top 25 destinations saw double-digit growth in hotel demand.

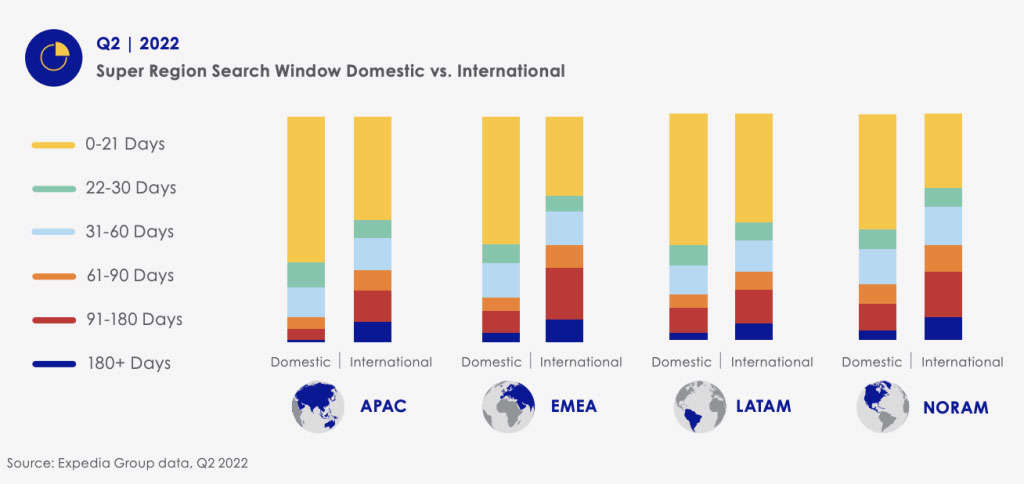

While last quarter showed growth in people booking further out, in Q2, travelers were booking in the short- to mid-term. The largest increase in searches was during the 61- to 90-day period, with an increase of 15%. This short- to mid-term search trend was consistent for international travel. The continued easing of travel restrictions and testing requirements contributed to a double-digit quarter-over-quarter lift in international searches globally in the 0- to 90-day window. This indicates that even though travelers have reverted to planning for the near term, they are still considering international trips.

Although there are rising concerns around inflation and rising fuel prices, travelers are still actively looking to visit destinations and book travel, especially in the short- to mid-term. This presents a strong opportunity for destination marketers to invest in their advertising strategy in order to capture pent up demand.

2. Family travel is on the rise

Families are very impactful for business when it comes to travel, as they spend 25% more per booking than other travelers. During the pandemic, the proportion of families traveling internationally declined compared to other traveler groups. However, Q2 data shows that international family travel has recovered to pre-pandemic levels, and now accounts for the same proportion of travelers as in 2019, or about 15%.

Additionally, families are looking to book vacation rentals. According to Q2 Vrbo data, families are 3x more likely to book a vacation rental than other traveler groups, and in turn, spend more per night than average. Visit Mesa took advantage of this trend by running a campaign on Vrbo targeting family travelers. Looking to encourage road trips to the destination, the campaign focused on Mesa’s unique vacation rental offers to target the valuable Vrbo audience. In the end, the campaign helped generate an average length of stay of 8.5 nights.

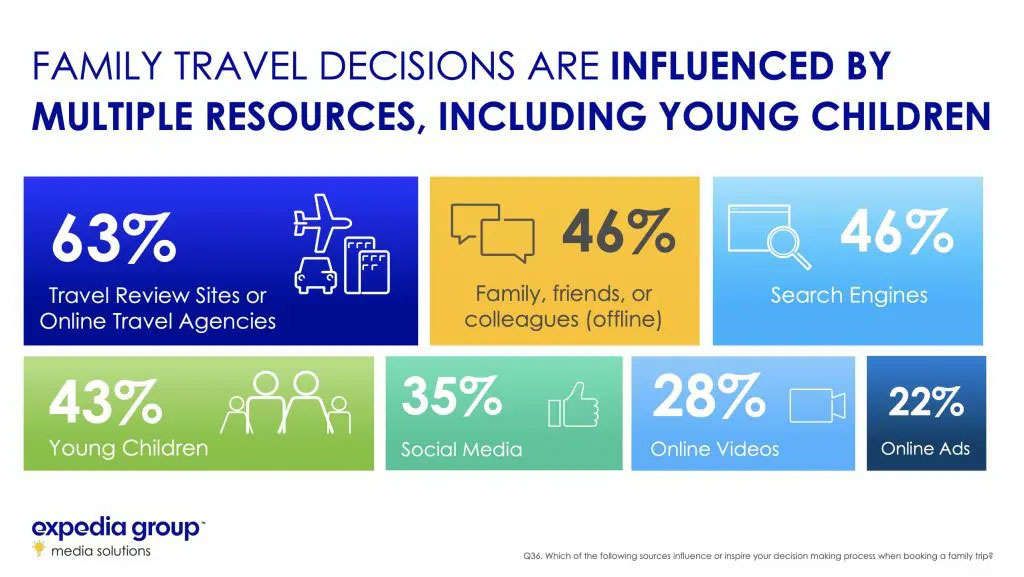

As family travel returns, destinations should consider the best ways to reach and target this valuable segment to draw in lucrative business. It’s also important to consider the collaborative nature of family travel planning, and the role Gen Alpha play in influencing how and where their family travels.

3. Long-haul destinations are making a comeback

Just as families are returning to international travel, there is a wider trend of travelers going further afield. One promising trend is the significant increase in demand for long-haul flights (flights with a duration of 4+ hours). During Q2, we saw a 50% year-over-year increase in demand for long-haul flights.

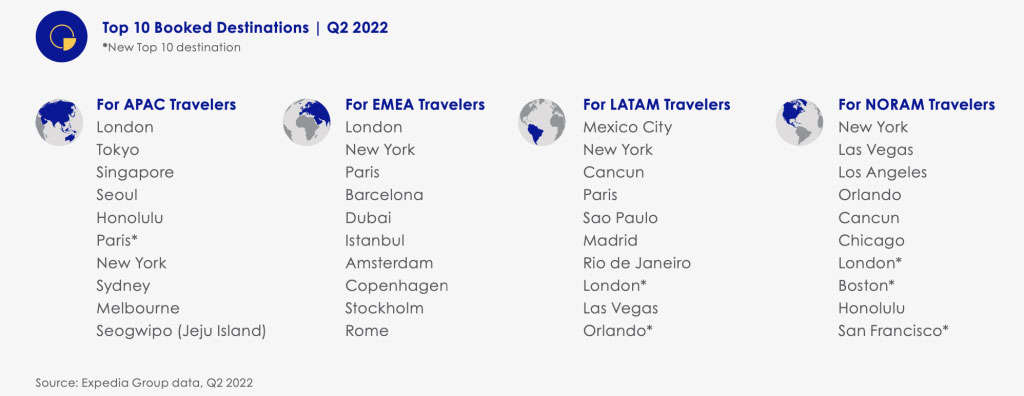

Further showing the rise in long-haul flights, Q2 delivered an increase of over 100% year-over-year growth in demand for flights from the U.S. to Europe. London, Paris, and Rome account for the top 3 European destinations for U.S. travelers during Q2. London, for one, is taking advantage of this explosion of U.S. traveler interest in visiting Europe. The London & Partners DMO recently launched the first episode of four in the “Dawn Till Dusk” campaign, which showcases the unique experiences that London has to offer, targeting U.S. travelers looking for a creative cultural experience.

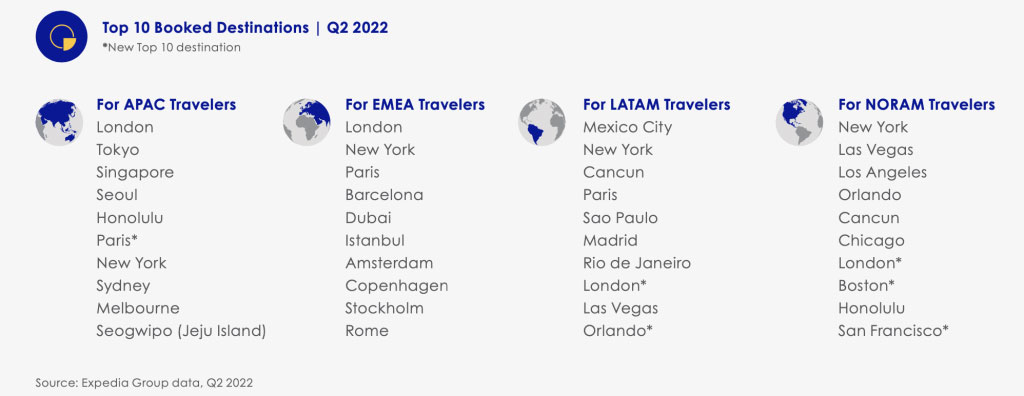

Looking at the top 10 booked destinations, two European cities, London and Paris, had strong showings across regions in Q2. On the global top 10 list of booked destinations in Q2, London took the No. 3 spot and Paris took the No. 7 spot.

Even though travelers have reverted to planning for the near term, they are going farther from home and still considering international trips. Destination marketers should start strategizing for ways to reach international travelers again, including leveraging search window and destination insights, sophisticated targeting, and ensuring international audiences are part of the targeting mix.

4. Consumers are looking for inclusive representation and local community engagement

Our newly released Inclusive Travel Insights Report shows that consumers are paying attention to how inclusive travel providers are, and they want to see accessibility and diversity incorporated into travel advertising. In fact, 78% of consumers said they have made a travel choice based on promotions or ads they felt represented them through messaging or visuals.

One DMO that succeeds in inclusive marketing is Visit Panamá, which partnered with us to develop a campaign that represents all travelers. It features a new video series called “The Next Turn,” which connects inspiration, planning, and booking to offer a shoppable travel experience. One episode features Amar, a blind traveler, who experiences Panamá through his sense of hearing, smell, taste, and touch, showcasing how travelers with different abilities can immerse themselves in the amazing experiences Panamá offers.

Consumers are also looking to engage with local communities and cultures, as 64% said they are interested in learning more about travel options that support local cultures and communities. Tourism Malaysia knows the importance of promoting its local culture, which is why it worked with us to create a Travel Spotlight landing page. The campaign shows travelers how they can experience Malaysian culture by visiting historical sites such as Georgetown, Penang, observing a different way of life by seeing the traditional longhouses housing communities in Sarawak, or visiting the indigenous communities of Kadazan and Dusuns.

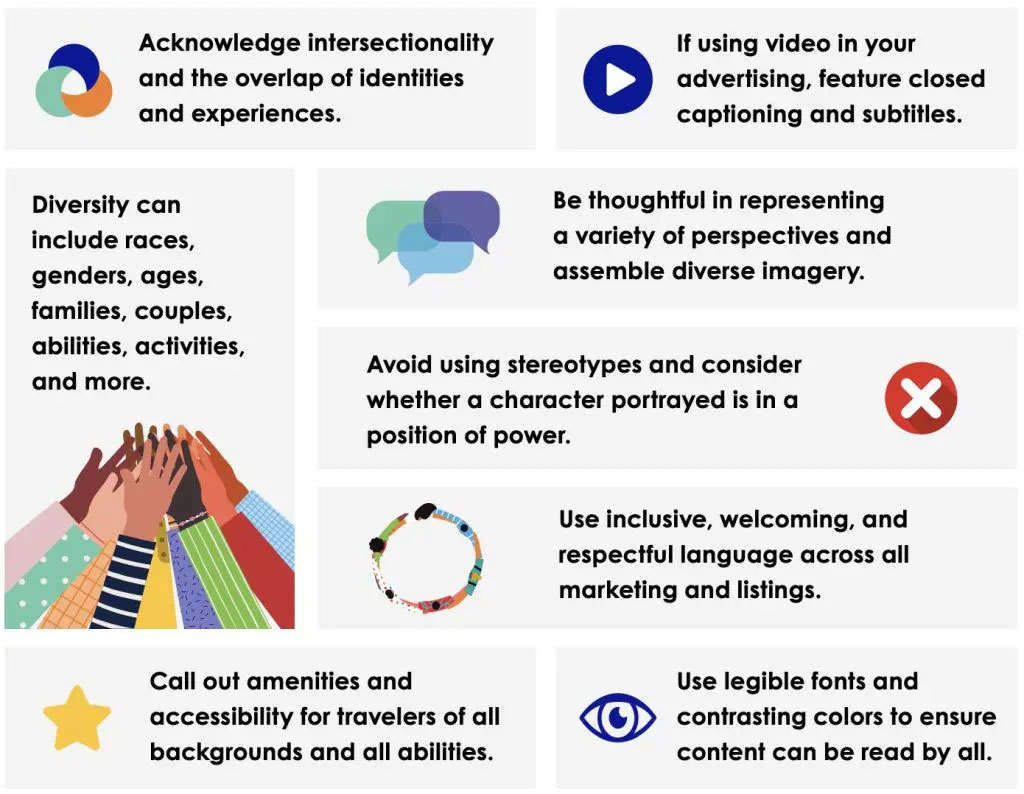

Destinations should make sure they are creating inclusive environments for travelers, and think about the best ways to highlight accessibility, diversity, and cultural experiences in their marketing efforts. Below are some specific things to keep in mind when it comes to advertising.

Download the Inclusive Travel Report.

5. Consumers are looking for sustainable travel options, and will pay more for them

As shared in our Sustainable Travel Study, sustainability is another key element consumers are paying attention to when making travel decisions, with 90% saying they look for sustainable travel options when traveling, and 7 in 10 saying they have avoided a travel destination or transportation option due to skepticism that the commitment to sustainable practices was real. This means that it’s essential for destinations to be authentic and transparent when it comes to their sustainability efforts.

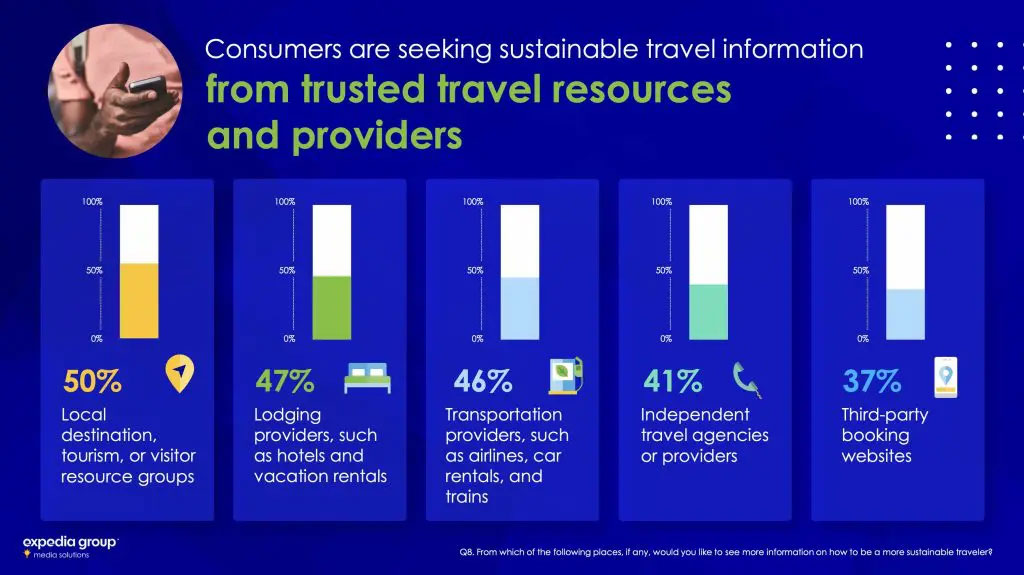

Consumers want sustainable options, and they are willing to pay more for them. In fact, 74% of consumers would choose a destination, lodging, or transportation option that is committed to supporting the local community and culture, even if it’s more expensive. And they are turning to destinations, more than any other resource, for information. Half of consumers want to see sustainable travel information from local destination, tourism, or visitor resource groups.

One example of a DMO that has leveraged sustainable travel in their campaigns is Hawaii Tourism Oceania, who partnered with us to encourage travelers to take more fulfilling trips. The messaging in this campaign was key, centered on rewarding travel and “Malama Hawaii,” which means “to give back.” The campaign’s landing page expanded on Malama with a video and how the relationship between people and place grows stronger every time you give back, whether it’s to the land, the ocean, the wildlife, the forest, or the community.

Download the Sustainable Travel Study.

For more insights into the latest traveler behavior and intent, download our Q2 Traveler Insights Report and subscribe to our blog for updates. If you’re interested in learning more about how our team can leverage these insights to help develop campaigns for your brand, contact us.