Keeping lights on during the current COVID crisis!

Resilience is the watchword during a sharp downturn. Companies that skillfully navigate these choppy waters will have one feature in common: they will have prepared today to build resilience tomorrow, no matter which way the economic winds blow. And sometimes, those winds blow more fiercely than others.

During the Great Recession in 2008, hotels worldwide suffered double-digit drops in occupancy, RevPAR, and profit. In many cases, the drop happened in mere months, leaving hoteliers in a cut-throat pricing war. It was a horrible situation that left an indelible impression among hoteliers.

It appears that we are the cusp of another recession. It's time to get resilient. Here are six tips on what you need to do to keep the lights on over the upcoming weeks and months, no matter how vicious and lengthy it turns out to be.

#1: Get your rates right

In times of economic downturns, quite suddenly, the same number of hotels are competing for a shrinking market. Its survival mode with a singular focus: keeping the lights on with minimal long-term damage to the brand. And so, it's most important to get your rates right.

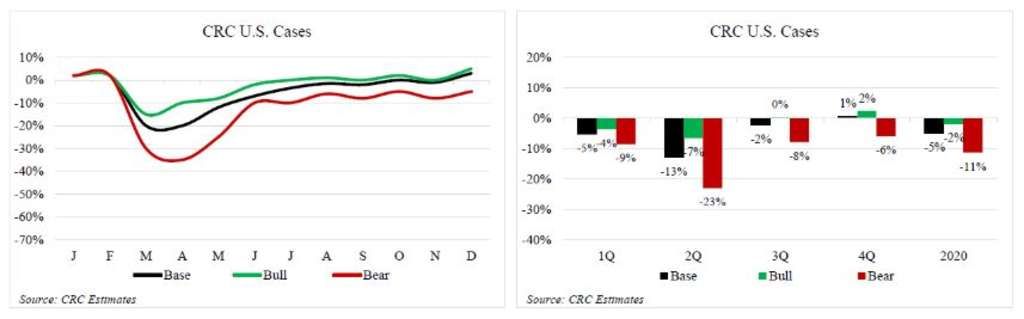

You have to be able to compete with your compset. You need to know what's happening in the market and react in near real-time with regular rate updates. The premium for attracting and booking for the guest is at an all-time high. Customers are being pelted with discounts and offers from all over the place, so you don't want to be turning away business because your rates are out of line. Overall, second quarter is going to be tough in most markets but recovery is on the horizon by third quarter, if the recovery in China and South Korea are any indication.

Only once your rates are competitive can you go on to any of the other steps here. Even the slightest pricing mistake is magnified in a recession, so your rates must be perfectly precise!

Pro tip: Don't panic and lower your rates during these early days of the downturn. Downturns don't last forever, and it can be hard to restore your rates once conditions improve. Let the data do the talking and make pricing decisions intentionally.

#2: Know your guests well

When you think about competing, you can compete on price. That's a given but you also need to be guest-centric in your approach.

A key component of getting your rates right is knowing your guests. The last thing you want to do is to follow your comp set off a discounting cliff, and unnecessarily drop your prices. Remember that everyone can compete on price without much effort. But you should compete on value, services and amenities – especially during a recession. Each hotel has its own guest mix and those that have a detailed understanding of that mix can pinpoint the right rate strategy for each channel, segment, and geography.

The more you know about your guests the better you can target them. With sufficient guest data to micro-segment your audience, you can personalize offers and stimulate demand with targeted deals. The result is an intelligent and focused discounting strategy oriented around geography, segment, length-of-stay, and other parameters.

Also, given the global nature of hospitality, you must be attuned to the status of the local economies that drive significant chunks of your business. Downturns can flare up anywhere, and as we know now, anytime! You must be hyper-vigilant and know your guest so you can foresee any local economic headwinds that might dampen demand from popular outbound markets.

Pro tip: Encourage your staff to be guest whisperers. Insights derived from direct experience help build accurate guest profiles. Also, don't hesitate to ask! Many guests are willing to share, especially if it benefits their own experience.

#3: Choose your channels carefully

A deeper understanding of your guests allows you to identify new sources of demand.

Often, you'll find unexpected sources of demand from regional or other domestic markets in slightly different cycles than yours.

You can also look at what you know about your best guests – who they are, where they come from, what types of trips they do – and then look for overlaps between those characteristics and new distribution channels. The goal is to look far and wide for ways to get your hotel in front of the best guests. In a recession, you need to be doubly sure that you are investing your distribution dollars in channels that can reliably bring you profitable revenue.

There are a few ways to identify this demand. One is to simply do your research; ask colleagues, read trade publications, and search the Internet. Another is to ask account managers at your OTAs for their input into the latest demand trends. And if you have a channel manager, those account reps are excellent resources for pointing you to the latest channels in specific markets. Here is an nice article on selecting 5 ways to choose the best channels for your hotel.

The final option is to use technology, such as Smart Distribution, to help you find new, profitable sources of demand. The tool analyzes the channel mix of hotels in your compset to identify any gaps in your own distribution. By looking at how other hotels successfully capture demand, it recommends new distribution paths for your hotel's inventory.

Pro tip: Monitor your cost of distribution. In a recession, every cost must be carefully controlled. You must prioritize lower-cost channels since they'll bring you more profitable revenue. A good habit to have, regardless of economic conditions!

#4: Get creative with packages and promotions

In a recession, consumers aren't just looking for the lowest prices – they are looking for value. You have to get creative! It's all about how to use your fixed costs (amenities like valet, F&B, and spa) to your advantage. Build packages that appeal to your core demographics and give your property an advantage when the competition heats up.

Start by putting together creative vacation packages that appeal to your core guest demographics. In a recession, where travelers have lower budgets for airfare or are eliminating vacations altogether, create a "simple splurge" staycation package that pampers guests without breaking the bank and target it to drive markets. These are going to be easier targets than faraway guests facing steep airfares or when flying as a whole has been reduced dramatically.

Two other strategies to build creative packages and promotions:

- Partnerships. Look to your local community for value-adds. You aren't the only one suffering. Partnerships allow you to offer more value, amenities and/or services, which keeps you competitive and distinguishes your property from others.

- Influencers. Influencers can be great partners for creative, micro-targeted campaigns. In a downturn, you'll probably have some extra rooms to spare...might as well fill them with those who market your property!

Pro tip: Past guests are especially valuable as they already have a relationship with your brand. Engage them with exclusive incentives, such as F&B credits, double points or "stay 3 nights, pay for 2." Experiment early and often and double down on what works!

#5: Analyze your data more often

The final step is to analyze your data more often during the downturn. Conditions change quickly and unexpectedly. Those who identify opportunities in different geographies, channels and guest segments will gobble them up first, leaving everyone else fighting for scraps.

Your data will help you zoom in on your segment sweet spots. Which guest segments seem to be resilient in the face of the headwinds? What are the characteristics of are there any defining characteristics of your best customers?

In addition to your internal systems, another helpful source of data is your OTA account manager. With deep visibility into global points-of-sale, they should be able to help you identify promising opportunities, such as geographies or segments ideally suited to your hotel, as well as potential opaque deals that help hit your break-even revenue number without sacrificing price position or brand perception.

Pro tip: Challenging economic conditions should be treated as crises. Create a "War Room" and hold frequent meetings that bring sales, marketing, revenue, and operations together. Put the data front-and-center and foster a collaborative mindset that unites everyone in the fight for survival.

# 6 Don't lose sight of your tech stack

When there's a recession raging, "we'll get to it next quarter" won't fly; it will be too late and those hotels who have the right technology in place will leapfrog the underprepared. With the right tools in your toolbox, you can master the strategies we covered here. Unfortunately, hospitality technology investment lags other industries, leading to less-than-resilient hotels with glaring productivity and profitability gaps.

And – here's something that's especially scary – hotels that get left behind may be at a permanent disadvantage after the next recession. Hospitality technology was in a very different place in 2008; we've gone leaps and bounds beyond where we were then. Those hotels with complete tech stacks will likely capture market share, develop stronger relationships with guests, and develop permanent advantages.

A few tools that make up a resilient tech stack include:

- Rate shoppers keep your rates aligned intelligently and fluidly with your comp set.

- Business intelligence tools help you understand your business in real-time. The sooner you integrate data-driven decision making into your hotel's workflows, the better!

- Staff collaboration tools so that your staff can more efficiently communicate with each other, as well as guests. You'll save money and do more with less – a necessity to survive in a downturn.

- CRM gives you a centralized view into your guest and enables smarter segmentation for more targeted marketing. Those that market well to their existing databases experience less revenue erosion than those that rely more on mass marketing and third-party distribution.

Instead of completely ignoring any technology investment decision during these times, scope out the technologies you want to invest in to drive stronger bonds with past guests. Decide on what you need to invest in for your tech stack today and avoid those regrets tomorrow when the market recovers. Your hotel will be positioned to not just survive but thrive, no matter what happens!

By keeping the six tips highlighted top of mind along with some preparation, patience, and fortitude, you may find that you've not just survived but also thrived! And, of course, these steps will embed resilience in your operation to carry you through the long haul.

About RateGain

RateGain Travel Technologies Limited is a global provider of AI-powered SaaS solutions for travel and hospitality that works with 3,200+ customers and 700+ partners in 100+ countries helping them accelerate revenue generation through acquisition, retention, and wallet share expansion. RateGain today is one of the world's largest processors of electronic transactions, price points, and travel intent data helping revenue management, distribution and marketing teams across hotels, airlines, meta-search companies, package providers, car rentals, travel management companies, cruises and ferries drive better outcomes for their business. Founded in 2004 and headquartered in India, today RateGain works with 26 of the Top 30 Hotel Chains, 25 of the Top 30 Online Travel Agents, 3 of the Top 4 Airlines, and all the top car rentals, including 16 Global Fortune 500 companies in unlocking new revenue every day. For more information, please visit www.rategain.com.

Ankit Chaturvedi

AVP-Marketing

+91 9654502760

RateGain Technologies Limited