Google launches hotel search site: "This could undermine OTAs"

Google has launched a full destination search site for hotel listings in a move that could seriously shake up online travel - again.

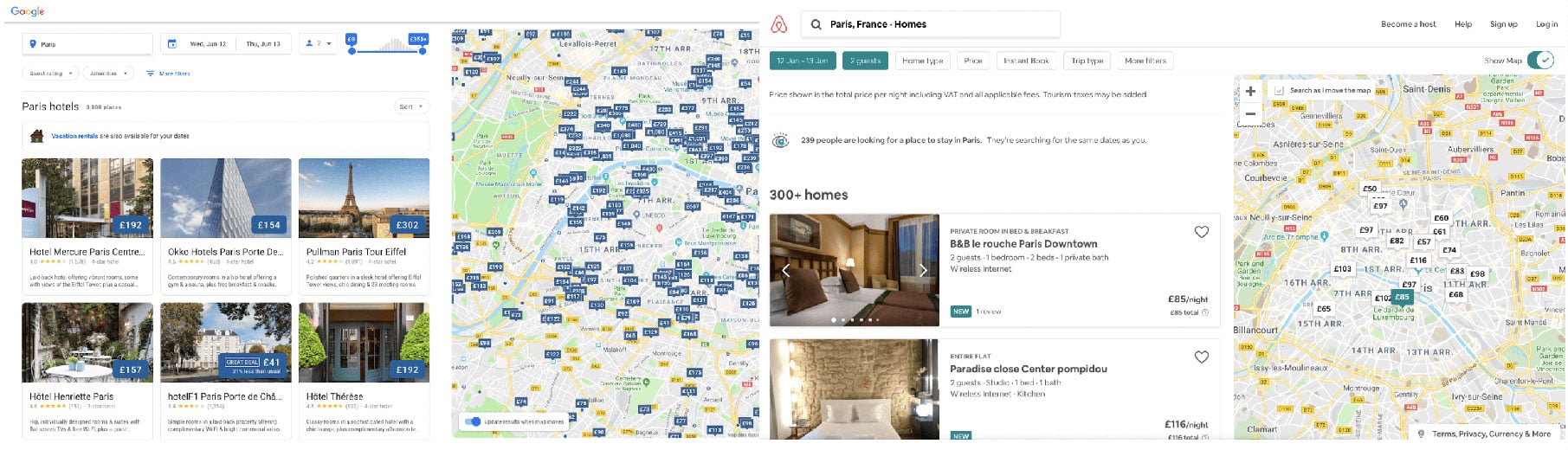

Under the innocuous title "There's still time to plan your perfect spring break trip," Google's Richard Holden published an article late last week that showcased a range of new features from the search giants. Amongst updates to Google Flights and the 'nearby hotels' feature on Google Maps was a glimpse of 'google.com/hotels.' A closer look revealed a full-scale hotel search site with definite similarities to Airbnb's clean, uncluttered, map-based interface.

So, what has actually changed? Well, Google has consolidated various elements of its hotel search experience in one platform. There are several new ways to filter results, including 'deals' determined by Google based on current and historic pricing data. The user experience still isn't perfect and the process of actually comparing like-for-like pricing can still be frustrating. But while the hotel search experience in itself isn't vastly different to what Google have been experimenting with in recent months in both their organic and Maps search, these new features and the simple fact that Google now has a dedicated site for hotel bookings could signal a watershed moment for online travel.

It looks like Google is making a play to own the lion's share of the user booking journey within their own sphere of influence. It's no wonder that Expedia and Booking Holdings spent $10.6 billion on brand advertising in 2018. If they weren't already, hotels need to be taking very seriously the power of Google over their customers, their competitors, and their distribution partners. But there's opportunity here too. Let's take a look at what this update really means.

Seizing the opportunity of Google Hotel Ads

If there's one thing that's clear as a result of the update, it's that Google wants to be the place where people decide what hotel they want to go to and how much they're going to pay for it. The search platform aggregates a huge amount of content from both organic and paid sources: photos, reviews, business listings, prices, room descriptions, map data, and more. It's a clear play to own the territory previously presided over by the major OTAs, suggests Triptease's Chief Product Officer Alasdair Snow.

"Google's changes bring their search experience much closer to the core historic utility of an OTA: the ability to compare and contrast hotels and use tools like maps and reviews to refine a hotel search down to a shortlist of possible options," says Alasdair.

"With this functionality now present and prominently positioned inside the world's number-one search engine, you can expect a lot more of this guest activity to take place within Google itself rather than on OTA sites. This puts Google in an amazing position to make itself the central hub where all guest research and decision making will take place.

"And, as long as Google continues to allow hoteliers to own the guest relationship when participating in this experience - and we don't see that changing! - this is a huge and timely opportunity for hoteliers that they should seize with both hands."

If Google continues to become the destination of choice for guests searching for hotels and comparing prices, hotels should be looking to make the absolute most of that by getting their direct price in the mix when they are likely to win the booking. That means bidding when you have the best price and when the guest's previous searches indicate they're a good match for your hotel; it also means not bidding when you're being undercut by an OTA.

Chetan Patel, VP E-commerce at Onyx Hospitality Group, suggests that combining meta with an organic Google strategy is the way for hotels to take advantage of the changes.

"Unless Google changes tack and cares only about monetization, something they do not quite have a track record for, this is a massive opportunity for the travel industry," Chetan suggests.

"At Onyx, we generate over a third of our organic traffic via the Google listings of our properties. This is huge. That traffic also converts at a significantly higher rate than traffic from other sources. If users are able to use Google to find all the information they need to decide on their accommodation, and hotel websites are a regularly viable option for finishing the reservation, this could undermine OTAs."

So, how are Google making that organic information more accessible for potential guests? And how can hoteliers make their websites the 'viable option' for completing the booking? Let's take a look at what's actually changed with Google's latest update.

The search experience

Most of what you can see on google.com/hotels has been available for a couple of months already. When we tested it searching from both a desktop and mobile in London, we were still presented with the familiar top-of-listing ads followed by the Google Hotels panel before the organic listings. Having the panel here rather than to the side of the results certainly makes it a more interruptive experience, and the prompt to enter search dates after having made a very generic query ('hotels in Paris') is a simple yet highly effective way to retain the user (and their potential for revenue generation) instead of having them immediately click out to Booking.com, Expedia or TripAdvisor.

Entering search dates takes you into the Google Hotels experience proper. As an interface, it's more than a little reminiscent of Airbnb's search result listings. You can explore results via the map, by altering your preferred price, or by filtering on a variety of different criteria - including the new 'Deals' marker, which we'll come onto in a second (or you can jump down there now).

At this stage of the search, the meta auction isn't visible - which makes sense from a user perspective. If you're yet to choose an exact location, price range or even accommodation type (the opportunity to adjust our search to vacation rentals was clearly highlighted on desktop), you don't need to know that there are five or six different prices available for every hotel. But that's not to say that price and pricing options aren't playing a role in the user experience, even at this early stage.

How is Google determining the sort order of hotels?

When we first ran our search for 'hotels in Paris' then input our dates of June 12-13 (as we would if we were planning to attend Triptease's European Direct Booking Summit), the first two hotels we saw on our results were the Hôtel Ritz Paris (rate: £1,029) and the Four Seasons Hotel George V (rate: £1,079). We then searched Barcelona and clicked on a result at random: the Barcelona City Centre hotel (rate: £79). When we then went back and refreshed our Paris search, our results had completely changed: five of the top six hotels we had to choose from had rates under £100, and two were advertised as having 'great deals'. We'd been firmly put in the low-budget, deal-hungry bucket of potential guests. As is to be expected, Google is altering how results appear to guests based on what it can learn from their search behavior.

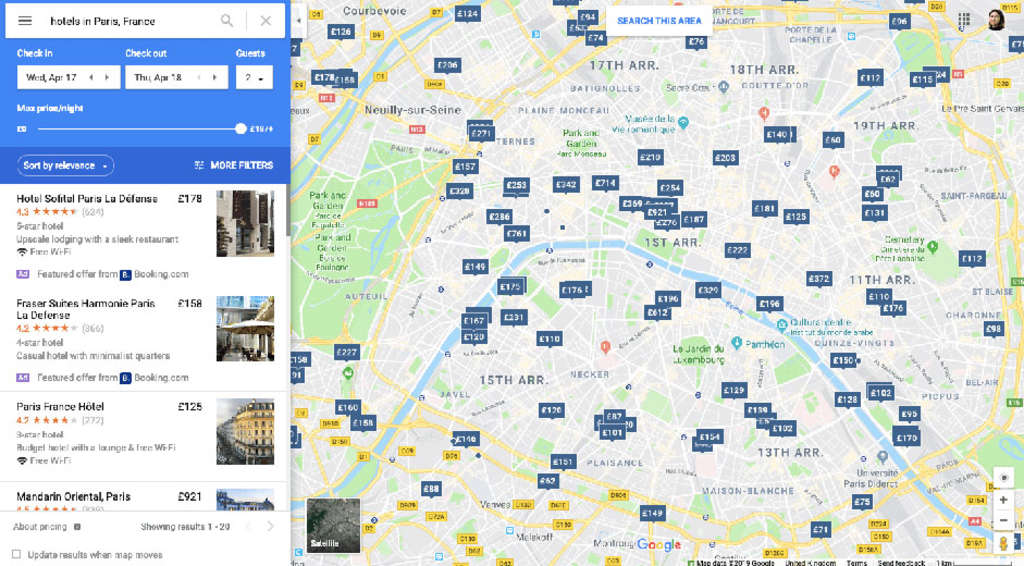

What we know less about is whether or not there is still an extent to which advertisers can promote a specific property at this stage of the search. When searching from within Google Maps, the top two results for a hotel query are often 'Featured offers' such as in the picture below.

An advertiser (in this case Booking.com) can pay to promote a property within a generic destination search, with the benefit that theirs is the only rate shown initially when the user clicks through. Mirai published a great detailed overview of this feature when it launched in the summer of 2018. It doesn't seem as though these advertisements have been migrated over to the Google Hotels site, but we'd be surprised if some form of promotion on the results page didn't become available to advertisers in the near future.

There's endless choice - but it's easy to tailor

The search experience on Google Hotels is tangibly designed around getting the user to what they want in as frictionless a way as possible. We've already seen that they'll adjust how results are displayed based on factors like previous search behavior, but that's pretty much expected practice of ecommerce in 2019 (though it's something hotels struggle to achieve on an individual basis). What's more notable is how phenomenally easy it is to narrow down your choice to two or three properties in just a few clicks.

Starting with our generic search - just location and dates - we began by filtering our price point down to £145 and under. One click. Then, we upped our minimum guest rating (based on aggregated Google, TripAdvisor and OTA reviews) to 4+. Another click. Next, we selected a couple of amenities - free wifi and a bar. Lastly, we opted to filter on 'Just deals'. In no time at all, we were down to seven properties to choose from.

We tried to replicate the search on Booking.com and reached an almost identical number of results - six hotels. One property appeared in both sets of filtered results (Google's and Booking.com's).

The major difference between the two experiences? Booking.com makes almost no visual distinction to suggest your results are filtered. Scrolling past the list of six takes you straight into more suggested properties. It may be subjective, but the Google experience certainly gives a stronger impression of actually producing results tailored to the user.

Scrolling through Booking.com's tailored search results - there's almost no distinction between the six filtered listings and their other suggested properties

Pricing data laid bare

So what does that mean for hotels? Well, as with almost everything Google does, there'll be proponents and detractors of this change.

In terms of the good stuff, the traffic that does end up looking at your property will be more highly-qualified as a result of the easy filtering process. It also means there's room for you to compete on organic (rather than paid) grounds with other hotels and accommodation providers in your area. While you may not be able to bid higher than the Marriott next door on PPC, you can keep yourself in the same consideration set on Google Hotels with great guest reviews, high-quality photos and well-documented amenities.

What may be a red flag for some businesses though is the 'Deals' tag and how it can be used to narrow down results. We've already seen how tightly it can constrain the set of properties under consideration. It looks like Google is calculating these 'deals' based on a combination of historic pricing data for each hotel and a market comparison of other hotels in the location, both of which it is turning outward for the user to see.

Google's 'Price evaluation' feature

There are a bunch of implications here. Firstly and perhaps most obviously, your revenue management strategy (or lack thereof) will be made visible to any searcher checking out your hotel. Secondly and perhaps most importantly, it's entirely feasible that an undercut price from an OTA will trigger that 'deal' tag, especially if it's a significant disparity - which, while it might help your hotel stay in the consideration set for price-conscious searchers, will promote the fact that the best price for your property is available elsewhere.

Going forward

Getting Google right is hard, not least because the search giant is famously cagey about its algorithms, sorting criteria and product direction. And that can make it hard for hotels to know where to turn.

"Google knows better than anyone that the key to driving revenue online is through relentless experimentation, measurement and iteration," explains Scott Stirling. Scott manages Triptease's guest acquisition and metasearch bidding technology. "This makes it hard for a hotelier to keep up to date with the sheer pace of change that Google's Hotel business is experiencing and will continue to experience."

"A year back, Google's hotel booking interface merely acted as a quick gateway to the hotel website or to OTAs via Google Hotel Ads," adds Chetan. "It has since dramatically expanded into a one-stop shop where you can locate a property on map or search, access useful information, see reviews, look at pictures, watch videos and even take virtual tours. It even shows price fluctuations. Unlike hotel and OTA websites, you also get to see pictures posted by other guests. This allows for well-rounded information-gathering that consumers need to make a decision.

"Google search and Maps are so ubiquitous that it is hard for most users not to pass them on their way for a perfect hotel," he continues. "Because Google cares as much about providing great user experience as they do about monetizing their traffic, the hotel website link and official site option on meta are properly highlighted for consumers. That is why it is significant. Google seems to be taking over the role OTAs have played in the guest journey so far, and are arguably doing a better job at it."

Google may be taking over parts of the OTAs' role, but that doesn't mean OTAs aren't wise to the opportunities presented by Google's metasearch.

"We always need to remember that Google's mission statement is 'to organize the world's information and make it universally accessible and useful,'" Scott advises. "This mission presents enormous opportunities to those able to take them. OTAs spend billions of dollars a year on metasearch. Hotels, on the other hand, get just one in 50 of their guests from meta! Hotels need a partner for guest acquisition that is able to leverage data scale like the OTAs do.

"In order to drive more direct bookings, hotels need to ensure that as Google makes the hotel world's information accessible and useful, that their direct listing is up there along with the OTAs, it is in parity, and it links the user through to a super-high converting website. Only Triptease can offer this holistic solution."

About Triptease

Triptease helps hotels to fight back against Online Travel Agents (OTAs) by increasing direct bookings and attracting more valuable guests.

Our full-funnel marketing solution uses unique price, market and customer data to help them personalize guest experiences, build direct relationships, reduce the cost of sale, and grow profits.

Established over a decade ago, Triptease is trusted by over 13,000 hotels worldwide.